Emerging Market Links + The Week Ahead (August 4, 2025)

I have mentioned a few times in the past how Joe Studwell’s Asian Godfathers: Money and Power in Hong Kong and Southeast Asia is an excellent read about what really happens behind the scenes in SE Asia and a must read for anyone investing in the region. And while the book is dated, nothing surprises me any more – especially about anything I hear happening in Indonesia…

Momentum’s Works Lowdown blog has added another chapter to the book by covering the recent scandals in the VC-startup ecosystem:

Scandal after scandal has rocked Indonesia’s tech ecosystem: eFishery’s founders were suspended and investigated for financial fraud; fintech lending company KoinWorks was implicated in a fraudulent lending scheme; founder of another fintech lender, Investree, fled the country amid regulator investigations; logistics startup Sicepat’s CEO allegedly diverted company funds for stock speculation; even GoTo Gojek Tokopedia Tbk PT (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF)’s founder last month faced questioning over corruption linked to a major school procurement project.

Last week, it also emerged that three prominent individuals in the ecosystem were arrested on suspicion of involvement in a ‘corruption and money laundering’ case: Donald Wihardja, CEO of MDI Ventures, the VC arm of state-owned Telkom Indonesia; Ivan Arie Sustiawan, former CEO of TaniHub; and Edison Tobing, former Finance VP of TaniHub. The case concerns a US$25 million investment made by MDI and another state-owned investment firm under Bank Rakyat Indonesia Tbk PT (IDX: BBRI / FRA: BYRA / OTCMKTS: BKRKF / BKRKY) in TaniHub between 2019 and 2023…

And:

You can find details about the case in local business outlets as well as regional tech media. However, hardly anyone in the ecosystem is surprised, after so many stories involving Indonesia’s tech ecosystem over the last 12 months…

… While entrusting 10s of millions of dollars to young, inexperienced founders sometimes lead to issues, the widespread misappropriation of funds in the Indonesian ecosystem is still mind boggling. Every case from eFishery to KoinWorks, to Sicepat and now TaniHub, MDI ventures, is seriously denting the confidence in Southeast Asia’s startup and venture capital ecosystem…

Investors in Grab Holdings Limited (NASDAQ: GRAB), Sea Limited (NYSE: SE) and any big Chinese tech players entering or active in SE Asia and/or Indonesia might want to take note of these latest scandals and how these other players might benefit or be hurt by them…

$ = behind a paywall

-

🇰🇷 Korean Stock Picks (June-July 2025) Partially $

-

Korea market/corp governance/tax updates

-

July 2025 – Kiwoom Securities, SK Inc, Doosan Fuel Cell, Yuhan, Hanwha Solutions, People & Technology, Samwha Capacitor, Haesung DS, Samsung C&T, GS Engineering & Construction Corp, Samsung Electronics, Soop Co Ltd, Daewoo Engineering & Construction Co Ltd, Hyundai Livart Furniture, Korea Aerospace Industries, Krafton, iM Financial Group, LG Energy Solution, Hanmi Pharmaceutical, HL Mando, Kia Corp, Hyundai Mobis, Shinhan Financial Group, Hana Financial Group, Samsung Heavy Industries, ST Pharm, LS Electric, OCI Holdings, Hyundai Motor, Industrial Bank of Korea, KB Financial Group, Dong-A ST, LX Hausys, CS Wind Corp, Hyundai Steel, Samsung E&A, Hyundai Glovis, Samsung Biologics, LG Innotek, PharmaResearch, Pan Ocean, HD Hyundai Electric, GC Biopharma, Hugel, Korean Reinsurance Company, Hyundai Marine & Fire Insurance, DB Insurance, Samsung Fire & Marine, Meritz Financial Group, Samsung Life Insurance, GS Retail, BGF Retail, Hyundai Engineering & Construction, Orion Corp, Samsung SDI, S-Oil, SK Hynix, Woori Financial Group, BNK Financial Group, Korean Air, DL E&C, Hyosung Heavy Industries, CJ Logistics, POSCO Holdings, Cosmecca Korea, Korea Investment Holdings, Samsung Securities, NH Investment & Securities, LX International, KEPCO, Hyundai Rotem & Tomocube

-

June 2025 (Without July Research) – Jusung Engineering, CJ ENM, Studio Dragon, JYP Entertainment, LG Electronics, SM Entertainment, HYBE, Hyundai Department Store, APR, Cosmax, F&F, Wemade, Shift Up, Cafe24, NAVER, Netmarble, HMM & DB HiTek

-

-

EM Fund Stock Picks & Country Commentaries (August 3, 2025) Partially $

-

Richard Werner’s “bank credit creation” theories, APAC equities & oil prices, Mexican industrial real estate, can South Africa Inc rally the broader JSE, Tiger Brands, Mondi, June/Q2 fund updates, etc

-

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🇨🇳 In Depth: China’s mutual fund minnows struggle to survive (Caixin) $

A sweeping regulatory overhaul of China’s $4.5 trillion mutual fund industry to lower costs for ordinary investors is driving the sector through a painful reckoning that is threatening the future of dozens of small and midsize firms.

The reforms, which began in 2023 and fully took effect this year, have dismantled the industry’s cozy high-commission relationship with securities firms, forcing asset managers to pay for services that were once subsidized and bundled into one package. This brutal new reality has led to a huge squeeze on profits, soaring costs and a struggle for survival that depends on a relentless and expensive quest to get bigger.

🇨🇳 In Depth: Will China’s push for banks to fuel tech growth pay off? (Caixin) $

China has expanded an equity investment pilot program that provides bank funding for tech companies for the third time in six months, as the government intensifies efforts to support innovation and new quality productive forces — a concept put forward by President Xi Jinping in 2023 to focus on advanced technologies.

The aim is to channel more money into funds that invest in small, fast-growing technology companies. The program could become an important source of capital for state-owned investment entities, especially local government guidance funds (LGGFs), investment vehicles run by local authorities, many of whom are struggling to find cash.

🇨🇳 In Depth: The Consumption Conundrum Dividing China’s Economists (Caixin) $

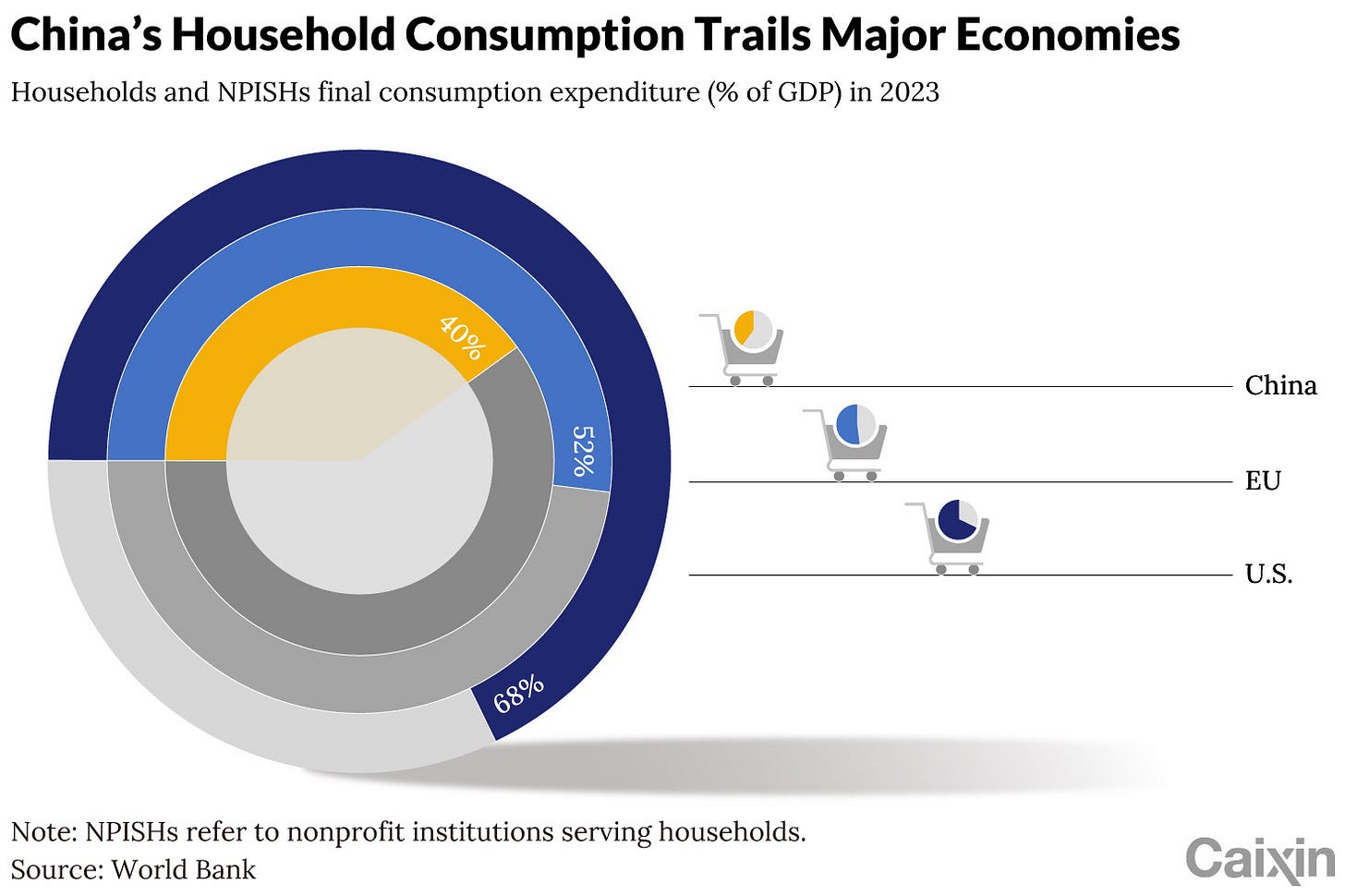

Household consumption — or rather the lack of it — has been at the center of the policymaking debate in China for several years, and top officials from President Xi Jinping down have become increasingly vocal about the need to increase domestic demand amid growing headwinds facing the world’s second-largest economy.

As the government and its advisers prepare to put together the 15th Five-Year Plan to guide the country’s economic and social development through 2030, a contentious debate has erupted over the true strength of the Chinese consumer and what policies are needed to get them to spend more.

🇨🇳 In Depth: China’s surging auto sales mask an industry in crisis (Caixin) $

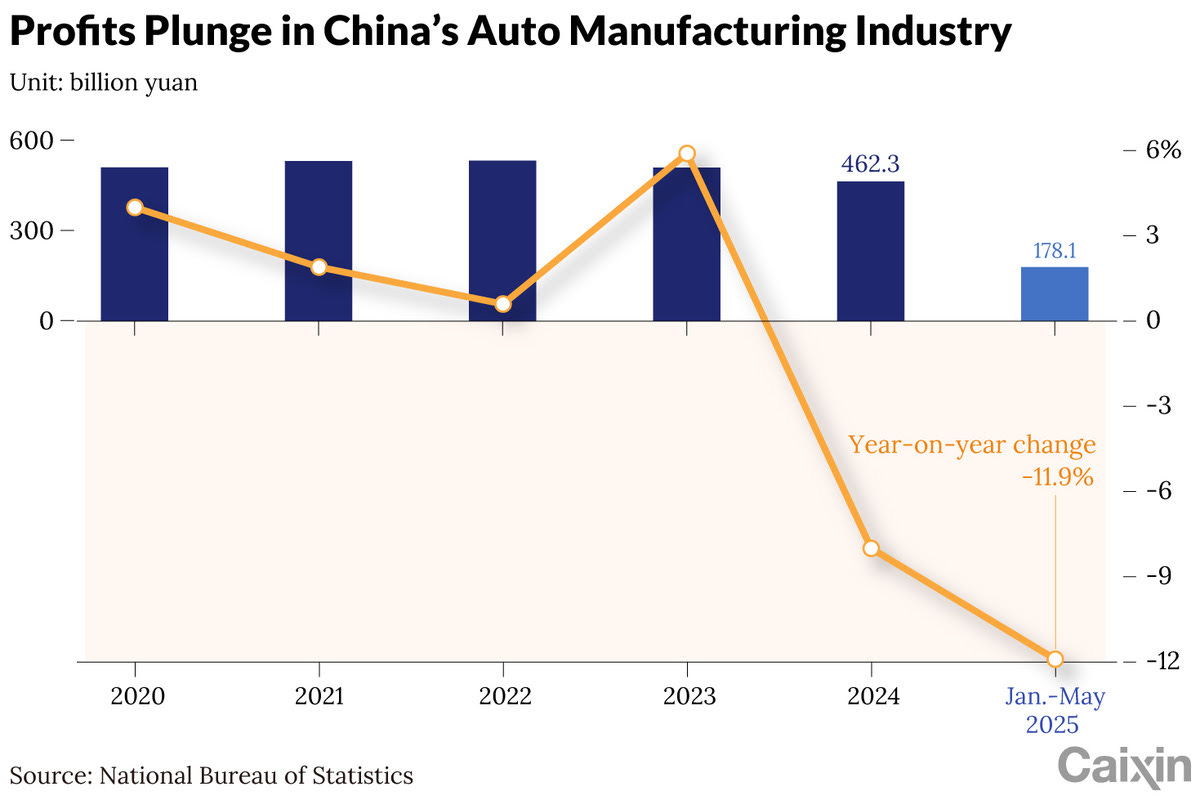

On paper, 2025 is shaping up to be another stellar year for China’s auto industry.

In the first six months of 2025, automakers in China produced 15.62 million vehicles and sold 15.65 million, with both figures jumping more than 10% year-on-year, according to figures released by the China Association of Automobile Manufacturers (CAAM) earlier this month.

But in factory floors, dealerships and corporate boardrooms across the country, the mood is far from celebratory. While consumers are snapping up ever-cheaper cars, the companies that build them are suffering. Auto manufacturers’ total profits fell 12% to 178 billion yuan ($24.8 billion) from January through May, data from the National Bureau of Statistics showed.

🇨🇳 Charts of the Day: German luxury carmakers’ China sales slump accelerates (Caixin) $

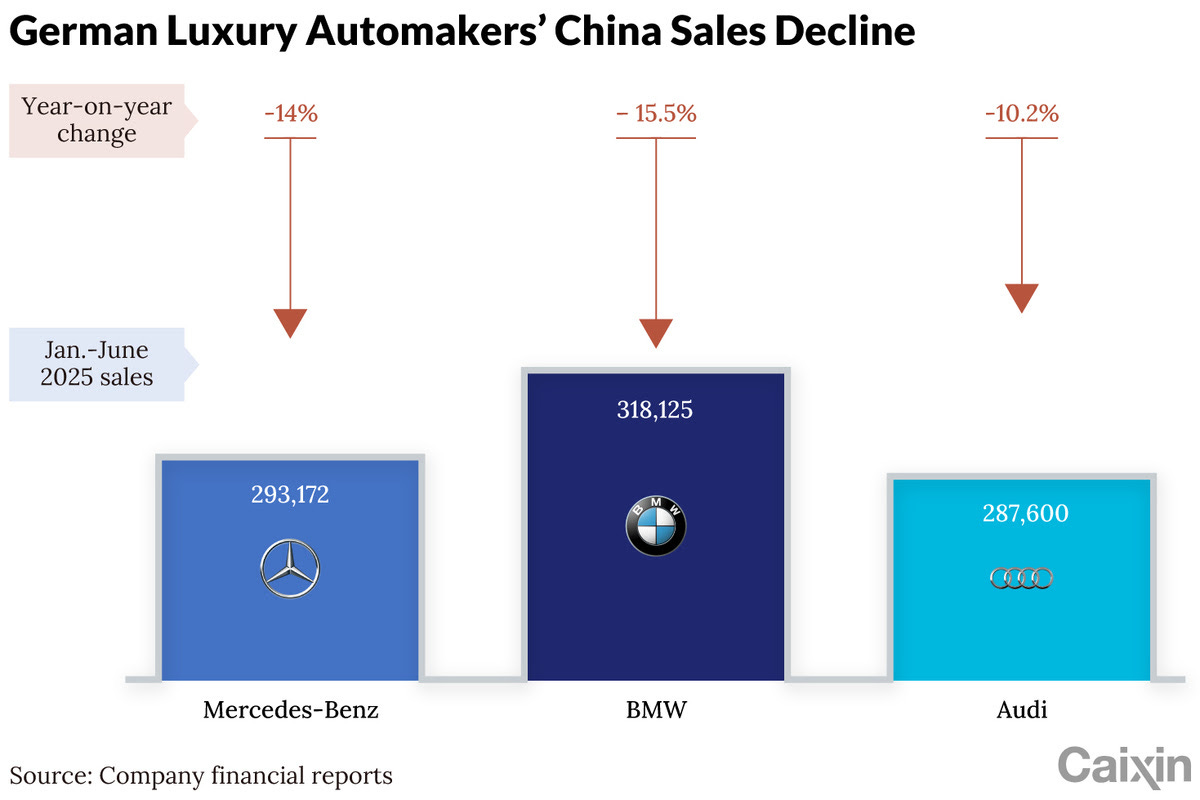

Germany’s luxury automakers saw their sales continue to decline in China during the first half of 2025, as they grapple with fierce competition from local rivals and tepid consumer demand in the world’s largest auto market.

Mercedes-Benz Group AG sold just over 293,000 cars in China, its largest single market, a 14% year-on-year drop, the company disclosed in its earnings report last week. “The market situation in the premium and luxury segment in China remained tense,” the carmaker said, noting that ongoing price competition, particularly from domestic manufacturers, is expected to keep piling pressure on foreign firms.

🇨🇳 BYD leads Chinese domination of Indonesia’s electric vehicle market (Caixin) $

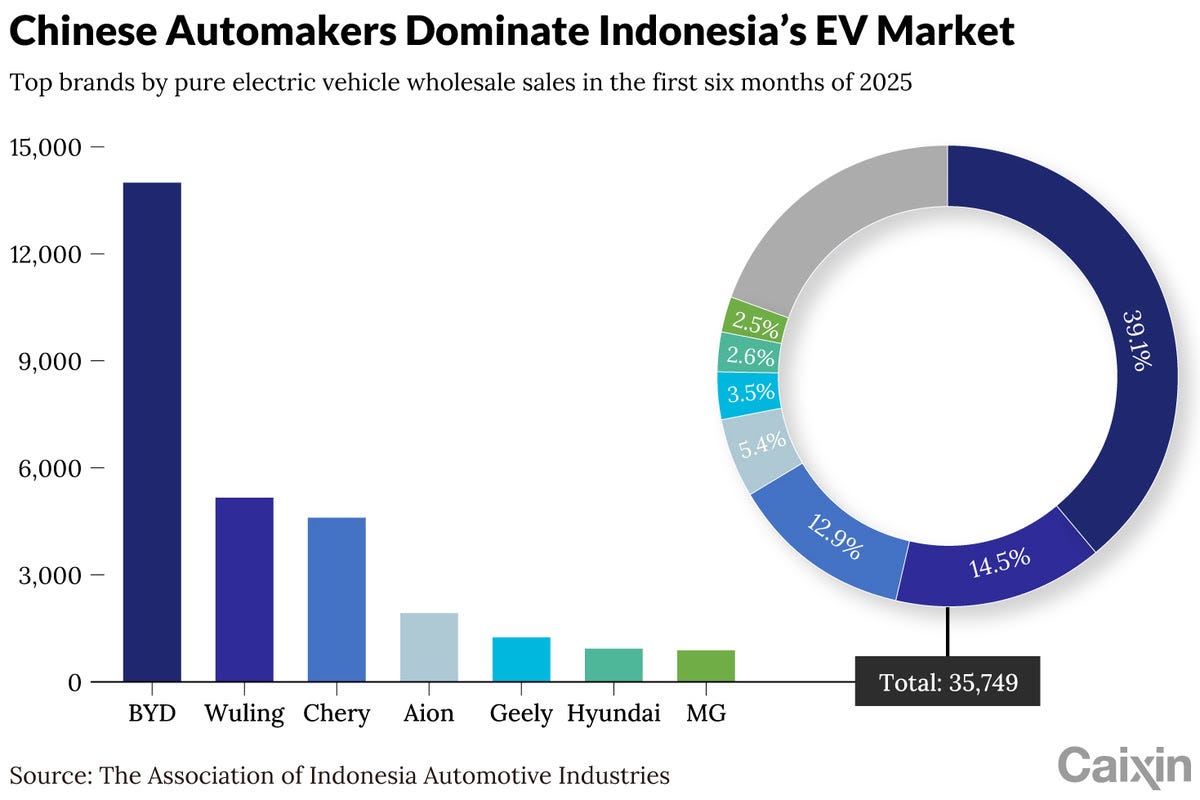

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) has pulled out in front of its fellow Chinese automakers as they cement their control over Indonesia’s fast-growing electric vehicle (EV) market, notching up more than 90% of sales in the first half of 2025.

Wholesale sales of pure EVs in Southeast Asia’s largest economy surged to 35,749 vehicles in the first half of 2025, a 267% jump from the same period last year, according to data released by The Association of Indonesia Automotive Industries.

🇨🇳 Who Paid for China’s Instant Retail War? (The Great Wall Street) $

🇨🇳 JD.com: scale economy shared (Emerging Value) $

And bargain valuation

JD.com (NASDAQ: JD / SGX: HJDD) is a bit like a little Amazon in the Chinese e-commerce landscape.

The only moat there can be is physical infrastructure. Because you cannot code it in 1 month. Who has the infrastructure?

A company called JD.

JD operates more than 1,600 warehouses, approximately 19,000 delivery stations and service outlets, and employs over 370,000in-house delivery and operation personnel. It also has over 100 warehouses outside of China.

🇨🇳 JD.com sets up Hong Kong bridgehead as real-time retail battle moves overseas (Bamboo Works)

The e-commerce giant has reportedly purchased Hong Kong grocery chain Kai Bo, aiming to bring its integrated retailing model to the city’s local market

JD.com (NASDAQ: JD / SGX: HJDD) has reportedly acquired 70% of Hong Kong’s Kai Bo supermarket chain, giving it access to the grocer’s retail network and property assets

The e-commerce giant could use the chain to extend its core Mainland instant retail business overseas, combining its supply chain strengths with Kai Bo’s local presence

🇨🇳 JD.com sets sights on Europe as it moves to buy Ceconomy in $2.4 billion deal (Caixin) $

JD.com (NASDAQ: JD / SGX: HJDD) is making its boldest push yet into the European market. On Thursday, the Chinese e commerce giant announced plans to acquire all outstanding shares in Germany’s CeconomyAG, the parent company of electronics retailers MediaMarkt and Saturn, in a cash offer valuing the deal at about 2.2 billion euros ($2.5 billion).

Through its wholly owned subsidiary Jingdong Holding Germany GmbH, JD.com is offering 4.60 euros per share, a 43% premium to Ceconomy’s three month volume weighted average price and 23% above its July 23 close, before news of the potential takeover emerged. Shares rose to 4.41 euros Thursday, up 1.26%. Upon completion, Ceconomy would be privatized and delisted.

🇨🇳 $30B MC, $27B in Net Cash + Investments — Trading at Just 6× EBITDA (Coughlin Capital) $

One of the clearest examples of embedded optionality I’ve seen in years.

I’ve spent a lot of time lately thinking about embedded optionality—those parts of a business that are either misunderstood, ignored, or not modeled at all. The kind of things that don’t show up in a screen, but end up mattering a lot more than the core operating metrics if they play out.

Baidu (NASDAQ: BIDU) is one of the clearest examples I’ve seen in years.

🇨🇳 Full Truck Alliance gets new lesson in economics (Bamboo Works)

The trucking company warned that a planned rate hike for its freight brokerage services could lead to a significant decline in that business, which could ‘adversely affect’ its profits

Full Truck Alliance (NYSE: YMM) will raise rates for its freight brokerage services as it seeks a sustainable model for the business with the winding down of government assistance

The trucking app operator’s outstanding loans to small businesses grew 25% year-on-year in the first quarter, as its non-performing loan ratio rose to 2.2%

🇨🇳 Autohome deflated by plunging ad sales, car price wars (Bamboo Works)

The car-trading services provider reported a fourth consecutive quarter of revenue decline in the second quarter, as its gross margin plunged more than 10 percentage points

Autohome (NYSE: ATHM)’s revenue fell about 6% in the second quarter, as Chinese car manufacturers and dealers slashed their advertising budgets amid a bloody price war

The company launched an international edition of its core car-trading platform in June, aiming to tap China’s growing prowess as the world’s top auto exporter

🇨🇳 Smart Share Global (EM US): Trustar Capital-Sponsored MBO a Done Deal (Smartkarma) $

Smart Share Global Ltd (NASDAQ: EM) has entered into a definitive merger agreement for a Trustar Capital-sponsored MBO at US$1.25 per ADS.

The proposal is conditional on regulatory approvals (low risk), shareholder approval (effectively done) and a maximum dissenting condition (likely to be waived).

This is a done deal. At the last close and for the end of December payment, the gross/annualised spread is 7.8%/20.1% (3.5%/8.7% including an ADS cancellation fee).

🇨🇳 Rising profit at WuXi Biologics underscores drug sector rebound (Bamboo Works)

The provider of pharmaceutical services has joined other flagship companies in the WuXi group in projecting stronger first-half earnings after a couple of lean years

Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) expects first-half revenue to rise 16% and profit to jump around 56%

The news follows upbeat earnings guidance from both WuXi XDC and WuXi AppTec, adding to evidence of a robust recovery in the drug services industry

🇨🇳 New Oriental Education: Below-Expectations Guidance Casts Shadow Over Earnings Beat (Rating Downgrade) (Seeking Alpha) $⛔🗃️

🇨🇳 Shiyue Daotian serves up tasty dividends as profits surge (Bamboo Works)

The pre-packaged rice supplier said its profit nearly doubled in the first half of the year as it increasingly focuses on premium products

Shiyue Daotian Group (HKG: 9676) said its adjusted profit rose 90% or more in the first half of the year, as it places greater emphasis on higher-margin premium products

The rice seller’s stock is more highly valued than other food companies, even after JD.com (NASDAQ: JD / SGX: HJDD) founder and Chairman Richard Liu sold down his stake earlier this year

🇨🇳 Yan Palace swoops back to profit growth (Bamboo Works)

China’s largest edible bird’s nest brand said its profit rose 20% to 35% in the first half of 2025, returning to bottom line growth despite pressure on revenue

Yan Palace (HKSE: 1497) said it expects to report its profit grew 20% to 35% increase in the first six months of 2025 despite flat to negative revenue growth

Lower selling costs, a new “intelligent” factory in Xiamen and new products are boosting margins for the maker of bird’s nest products

🇨🇳 Starbucks takes aim at Chinese rival Luckin in Manhattan coffee showdown (FT) $ 🗃️

🇨🇳 Luckin Coffee’s U.S. Invasion: A Brewing Storm for Starbucks! (Smartkarma) $

Luckin Coffee (OTCMKTS: LKNCY) reported strong financial results for the first quarter of 2025, underlining significant year-over-year growth in both revenue and profitability.

The company revealed a 41% increase in total net revenues, reaching approximately RMB 8.9 billion, mainly driven by a 42% rise in gross merchandise value (GMV) amounting to RMB 10.4 billion.

The growth in revenue was primarily fueled by expanded product sales through increased customer transactions, supported by an extensive store network.

🇨🇳 How can Luckin Coffee launch 119 new drinks in a year (Momentum Works)

When we run our coffee innovation workshops (aptly named Sip, Innovate, Repeat), our coffee-drinking participants often raise an eyebrow when they come across menu items like Orange Americano or Cheese Latte from Luckin Coffee (OTCMKTS: LKNCY).

But here are some fun facts that might change your mind — or at least make you curious enough to try one.

What sets Luckin Coffee apart is that it behaves more like a tech company than a traditional F&B brand — with structured workflows, internal benchmarks, and system-wide coordination.

This is one reason why (1) Luckin Coffee doesn’t need to be first to market with new drink ideas, and (2) it can launch more than 119 new SKUs in 2024 alone. That’s about 10 every month.

🇨🇳 Laopu Gold (6181 HK): Potential Inclusion in Both Global Indices (Smartkarma) $

Laopu Gold Co Ltd (HKG: 6181) missed global index inclusion in May following completion of full circulation. The primary placement in May then improved chances of index inclusion in August.

The stock rose nearly 60% in the 2 months following the placement and has lost more than a third of its value from the peak in the last month.

The stock could be added to both global indices with one inclusion at the end of August and one in mid-September. That could provide short-term support for the stock.

🇨🇳 China’s fading box office delivers rare profit-booster for Imax China (Bamboo Works)

After a lackluster performance last year, the big-screen movie company returned to profit growth in the first half of 2025 on the back of box office blockbuster ‘Ne Zha 2’

IMAX China Holding Inc (HKG: 1970 / FRA: IMK / OTCMKTS: IMXCF) reported its profit surged nearly 90% in the first half of the year, as its revenue rose 32%

The big-screen movie company’s revenue associated with content solutions more than doubled during the six-month period

🇨🇳 Cautious Optimism Around JOYY’s Turnaround (Seeking Alpha) $🗃️

🇨🇳 Stumbling Transsion hopes global investors overlook its fading fortunes (Bamboo Works)

The budget smartphone maker is reportedly considering a Hong Kong IPO to complement its existing listing on Shanghai’s STAR Market

Shanghai-listed Shenzhen Transsion Holdings’ (SHA: 688036) is reportedly weighing a second IPO in Hong Kong that could raise up to $1 billion

The budget smartphone maker rose to prominence by tapping the underserved African market, but its revenue began to contract last year as it faces growing competition

🇭🇰 Cosco tipped to join revamped bid for CK Hutchison’s global ports (Caixin) $

CK Hutchison Holdings (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF) is overhauling a $14.2 billion deal to sell its global portfolio of ports, inviting a major state-backed Chinese company to join the U.S.-led consortium of bidders in an effort to navigate thorny regulatory reviews.

The Hong Kong conglomerate, founded by billionaire Li Ka-shing, said in a Monday filing that its exclusivity period with a consortium led by asset-management giant BlackRock Inc. had expired. It now plans to continue negotiations by bringing in a major strategic investor from the Chinese mainland.

🇭🇰 International Housewares left out in the cold by changing retail landscape (Bamboo Works)

Hong Kong’s Dollar Tree equivalent is being undermined by locals crossing the border to shop in China, and Chinese e-commerce companies encroaching on its home turf

International Housewares Retail Co Ltd (HKG: 1373)’ net profit plunged by more than half in its latest fiscal year, as the company slashed its dividend

The fading Hong Kong houseware seller’s visionary founder appears to have lost interest in the business, making a turnaround unlikely

🇭🇰 China Citic Financial (2799 HK): Global Index Inclusion as Valuation Blows Out (Smartkarma) $

🇭🇰 HKBN (1310 HK): China Mobile Satisfies the Precondition (Smartkarma) $

The precondition for China Mobile (SHA: 600941 / HKG: 0941 / 80941 / FRA: CTM)’s HK$5.075 offer for HKBN Ltd (HKG: 1310 / FRA: 2HK / OTCMKTS: HKBNF) is satisfied. The offer is final. The offer document must be despatched by 8 August.

The HKBN CEO has commented that the China Mobile offer is not good enough, suggesting a possibility that the Board does not recommend the offer.

Nevertheless, there is a clear pathway for the offer to satisfy the 50% minimum acceptance condition and be declared unconditional. The gross/annualised spread for a 13 September payment is 1.5%/13.0%.

🇲🇴 MGM China: Bets Big on Luxury, Culture, and Growth (MileHighMonk)

MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) is a developer, owner, and operator of casino resorts in Macau, focused on offering high-end gaming, hospitality, dining, retail, and entertainment experiences. The company is a subsidiary of MGM Resorts International (NYSE: MGM), with a majority stake (56%) held by the American parent company.

MGM China’s market share grew from 9.5% in 2019 to 16% in 2024, driven by 198 new gaming tables under its 10-year concession (2023-2032) and the early adoption of smart gaming table technology. Established in 2007, the company operates two major properties: MGM Macau and MGM Cotai.

🇲🇴 SJM Holdings spending US$101mln to acquire Hengqin property it will convert to a 3-star hotel (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) confirmed on Monday implementation of a CNY724-million (US$100.9-million) acquisition previously described by a brokerage as “strategic”, for office space to be converted to a “three-star hotel” on Hengqin island. The latter is a piece of Chinese mainland territory (pictured) next door to Macau.

Monday’s update added the facility will be “not exceeding 250 rooms”.

SJM Holdings announced in December the Hengqin deal, noting the planned hotel would be “leveraging the prestigious Lisboa brand”. That is a reference to the branding used by the company for three gaming-related properties within Macau itself: the Hotel Lisboa, Grand Lisboa, and Grand Lisboa Palace.

🇲🇴 MGM China 2Q net revenues up 9pct y-o-y amid ‘record’ adjusted EBITDAR (GGRAsia)

Second-quarter net revenues at Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) rose 9.0 percent year-on-year, to US$1.11 billion, from just under US$1.02 billion in the prior-year quarter.

The information was given on Wednesday by the U.S.-based parent, MGM Resorts International (NYSE: MGM).

The parent saw its consolidated net income fall 73.8 percent year-on-year, to US$49.0 million. It said that was due to “the current quarter pre-tax impact of foreign currency transaction loss of US$208 million primarily related to U.S.-dollar denominated debt held by a foreign subsidiary.”

Nonetheless the MGM China quarterly result was amid “all-time record segment adjusted EBITDAR” for the Macau operation – MGM Macau and MGM Cotai – stated the parent, referring to earnings before interest, taxation, depreciation, amortisation and rent.

🇲🇴 Wynn Macau Ltd clinches extra US$1bln in revolving credit (GGRAsia)

Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) says its lenders have agreed to make available an additional aggregate of US$1.0 billion in senior unsecured revolving credit facilities.

The information was in a Thursday filing to the Hong Kong Stock Exchange lodged after trading hours.

The deal involves on the borrower side, Wynn Macau Ltd and a wholly-owned unit of the group, called WM Cayman Holdings Ltd II. Bank of China Ltd, Macau Branch, was identified as the agent for the revolving loan facility, which is being provided by a group of lenders.

🇲🇴 Macau July GGR best monthly figure since pandemic, at US$2.74bln (GGRAsia)

July’s casino gross gaming revenue (GGR) in Macau was the best monthly performance since January 2020, just before the onset of the Covid-19 pandemic. It rose 19.0 percent year-on-year in July, standing at nearly MOP22.13 billion (US$2.74 billion), showed data released on Friday by the city’s Gaming Inspection and Coordination Bureau.

The latest monthly tally was up 5.0 percent compared to June’s MOP21.06 billion.

🇲🇴 Analysts give big boost to Macau’s 2025 GGR forecast citing visa easing, concerts, China consumer confidence (GGRAsia)

Banking group Morgan Stanley has doubled its 2025 growth forecast for Macau casino gross gaming revenue (GGR) from 5.0 percent to 10.0 percent. It also tripled its forecast for industry 2025 year-over-year growth in earnings before interest, taxation, depreciation, and amortisation (EBITDA) to 6.0 percent, from 2.0 percent.

Seaport Research Partners has pushed its Macau GGR growth estimate to 9.0 percent year-on-year, from its previous outlook of about 7.0 percent.

🇹🇼 TSMC: The Most Important AI Play Is Still Ridiculously Cheap (Rating Upgrade) (Seeking Alpha) $⛔🗃️

🇹🇼 Taiwan Semiconductor Manufacturing Company (Part 2) (Global Outperformers)

For the first half of this Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) deep dive, I mainly focused on the broader semiconductor environment and how TSMC fits into the ecosystem. For the second half, I will focus on TSMC’s business from a financial and operational perspective, walking you through the unit economics, growth potential, risks and valuation approach behind my recent investment decision.

🇹🇼 Asian Dividend Gems: Soft World Intl (5478 TT) (Asian Dividend Stocks)

Soft-World International Corporation (TPEX: 5478) has an integrated value chain/sizeable moat for its game development, distribution, payments, content, and events in Taiwan.

The company is trading at attractive valuations. It is trading at EV/EBITDA of 3.7x, P/E of 13.4x, and P/B of 1.5x based on recent prices and LTM financials.

Net cash as a percentage of market cap is 79%. The company’s dividend yield remained steady at 6% in FY23 and FY24.

🇰🇷 Kangwon Land Inc’s 2Q net profit down 62pct y-o-y to US$44mln as costs outpace casino-sales growth (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured), a South Korean resort with the only casino in the country open to locals, reported a 62.2-percent year-on-year decline in its second-quarter net profit to KRW60.63 billion (US$43.5 million), as the rise in the group’s operational costs outpaced casino-sales growth.

That is according to unaudited results Kangwon Land Inc filed on Tuesday to the Korean Exchange, plus infomation in an earnings presentation deck.

In the second quarter, Kangwon Land Inc’s sales reached KRW360.7 billion, with the bulk of them – or KRW331.5 billion – classified as casino sales.

🇰🇷 Paradise Co’s July casino sales up by 23 percent y-o-y to US$55mln (GGRAsia)

Casino sales at Paradise Co Ltd (KOSDAQ: 034230) rose 23.0 percent year-on-year to KRW75.67 billion (US$54.6 million) in July, according to a Monday filing to the Korea Exchange. Measured sequentially, the July tally declined by 6.3 percent.

The company’s table-game sales in July were KRW71.39 billion, down 6.1 percent from June, but up 25.1 percent year-on-year.

Machine-game sales last month declined 4.2 percent year-on-year, to about KRW4.28 billion. Such tally was also down 10.1 percent sequentially.

The company is an operator in South Korea of foreigner-only casinos, including a venture at Paradise City in Incheon, done jointly with Japanese entertainment conglomerate Sega Sammy Holdings Inc.

🇰🇷 Tax Pivot in Play: Ruling Party Rethink Could Flip Market Narrative (Smartkarma) $

Jeong Cheong-rae, new ruling party boss, just called for a full reset on the tax revamp—huge. Focus is on CGT threshold for majors and top rate for dividend tax. With him stepping in, this is a clear pivot. Word is the party’s rewrite drops next week, aiming for final gov’t sign-off by month-end.

EXECUTIVE SUMMARY

Today’s selloff spooked the ruling party, prompting top lawmakers to signal tax tweak talks less than 24hrs after rollout — and they’re clearly watching the tape.

Cap gains threshold likely gets bumped to ₩3–5bn. STT hike stays. Div tax top rate may drop from 35% to 25% amid internal party push.

President Lee’s focused on pragmatism—cutting household debt and boosting corporate liquidity. Expect the tax narrative to pivot next week, sending local market sentiment in a new direction from Friday’s tape.

🇰🇷 A Disappointment in the Works for New Dividend Tax Policy in Korea? (Douglas Research Insights) $

There is a brewing disagreement among many members of the National Assembly in Korea regarding the new dividend tax policy.

A key controversial issue is dividend taxes on dividends exceeding 300 million won. There is a room for some disappointment in the works regarding tax reductions on dividends.

Instead of 25% tax rate for this dividend income bracket (exceeding 300 million won), there has been an increasing pressure by the ruling party to raise this rate to 35%.

🇰🇷 Disappointing New Korean Tax Policies (Dividends, Capital Gains, and Corporate Taxes) (Douglas Research Insights) $

The Korean government announced disappointing new tax polices for dividends, capital gains, corporate, and higher transaction taxes on securities transactions.

The new tax policies announced today is likely to have the biggest negative impact on the Korean financials with high dividend yields.

They will also likely to negatively impact other high dividend yielding stocks in Korea.

🇰🇷 Jung Chung-Rae (New Head of Ruling DPK) – Likely To Push for CGT Changes, How About Other Taxes? (Douglas Research Insights) $

Jung Chung-Rae, a four term lawmaker, has been appointed the new head of the ruling Democratic Party of Korea (DPK) in the past week.

His appointment as the head of the DPK party signals that there could be some changes to the 2025 Tax Reform Plan announced by MOSF last week.

The highest probability event is that the lower threshold for major shareholders for stock capital gains tax may NOT be lowered from 5 billion won to 1 billion won.

🇰🇷 Korea Value Up Plans Announcements by Companies in KOSPI in June and July 2025 (Douglas Research Insights) $

We provide the details of the 11 most recent companies in KOSPI that have announced their Corporate Value Up plans (June and July 2025), including their shareholder returns.

These 11 companies experienced a sharp underperformance (from one day prior to their corporate value up announcement to current) versus KOSPI in the past two months.

Among the 11 companies include Doosan Bobcat (KRX: 241560), Hana Financial Group (KRX: 086790), Kcc Corp (KRX: 002380), Orion Corp (KRX: 271560), Hanmi Semiconductor (KRX: 042700), Hanwha Aerospace (KRX: 012450), Hanwha Systems Co Ltd (KRX: 272210), Kolmar Holdings Co Ltd (KRX: 024720), Mirae Asset Securities (KRX: 006800 / 520003 / 00680K), and KDHC.

🇰🇷 Samsung Electronics: Taking Stock After The Tesla Game-Changer (Seeking Alpha) $ 🗃️

🇰🇷 Samsung 2Q25: Poor Quarter, Poor Outlook for 2H25, Management Bullish on HBM / Foundry Catch Up (Smartkarma) $

OP pre-announced, the details aren’t inspiring. Margins decline in TV, Semi. Only Smartphone is resilient. 2H25 demand outlook is weak for TV, Smartphone.

Confident tone on HBM growth, qualifications, ASP increase. Several contradictions: Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) endorses theory of HBM price pressure (how’s that positive?); HBM3E is already 80% of HBM revenue (where’s the upside?)

Consensus is revising up slowly, stock is going up sharply. This assumes a large turnaround in memory / HBM / Foundry.

🇰🇷 HK Inno.N (195940 KS): Mixed 2Q Result; Pipeline Progress to Maintain Positive Momentum (Smartkarma) $

HK Inno.N Corp (KOSDAQ: 195940) reported 2Q25 result, with double-digit revenue growth and decline in operating and net profit. Continued strong sales of prescription drug business remained the key driver.

During 2Q25, domestic outpatient prescription sales of K-CAB increased 14% YoY to KRW53B. Next major trigger for K-CAB will be the U.S. filing for both EE and NERD in 4Q25.

Recently, the company’s investigational new drug IN-115314 advances to Phase 3 trial for the treatment of atopic dermatitis in dogs. If approved, IN-115314 has blockbuster revenue potential.

🇰🇷 A Tender Offer of JTC by Affirma Capital (Douglas Research Insights) $

On 28 July, it was announced that Affirma Capital will conduct a tender offer of JTC Inc/Fukuoka (950170 KS) (JTC Inc (KOSDAQ: 950170)) which is a Japanese duty free operator listed on KOSDAQ.

This follows the exercise of a call option on all shares held by former JTC Chairman Gu Cheol-mo.

Despite some recent concerns about travelling to Japan due to Manga driven fears about earthquakes, there are some clear longer term signs that the global travelers visiting Japan are increasing.

🇰🇷 A Merger Between SK On and SK Enmove + A Massive 8 Trillion Won in Capital Raise (Douglas Research Insights) $

On 30 July, SK Innovation (KRX: 096770 / 096775) announced that it plans to merge its subsidiaries SK On and SK Enmove. The merged company will be launched on 1 November.

SK Group has announced a massive 8 trillion won capital raise plan involving this deal including paid-in capital increase of 2 trillion won for SK Innovation and SK On each.

We provide three major reasons why we are negative on this merger/capital raise.

🇰🇷 SK IE Technology – Capital Raise of 300 Billion Won (Douglas Research Insights) $

SK IE Technology Co Ltd (KRX: 361610) announced that it plans to raise 300 billion won through a third party paid-in capital allocation.

SK IE Technology plans to issue 10.5 million new shares (14.7% of outstanding shares). Expected price of capital raise is 28,600 won (2.1% lower than current price).

We have a Negative View of SK IE Technology as well its plans to raise capital worth 300 billion won.

🇰🇷 LG CNS: End of Lockup for 67.5% of Outstanding Shares on 5 August (Douglas Research Insights) $

There will be an end of lock up of 67.5% of LG CNS Co Ltd (KRX: 064400)‘s shares starting 5 August (6 months post IPO).

The shares subject to the release are those held by the largest shareholder LG Corp (KRX: 003550 / 003555) and Crystal Korea (Macquarie).

We would emphasize on positive developments on LG CNS (solid operating results and stablecoin rollout in Korea) which could be bigger factors than potential selling by the second largest shareholder.

🇰🇷 NH Investment & Securities – Capital Raise of 650 Billion Won (Douglas Research Insights) $

NH Investment & Securities (KRX: 005940 / 005945) announced that it plans to raise 650 billion won through a third party paid-in capital allocation.

Expected price of the capital raise is 20,150 won. Nonghyup Financial Group is expected to fund this capital raise.

We believe there is likely to be some net selling of the Korean securities companies in the next several months due to disappointing new tax policies (especially for dividends).

🇰🇷 Boston Dynamics – Rights Offering of 1.2 Trillion Won Expected; Potential IPO in 2027/2028 in NASDAQ (Douglas Research Insights) $

There has been an increasing probability that Boston Dynamics (BD) announces a fourth rights offering capital raise worth about 1.2 trillion won (US$870 million) in the next several weeks.

All the Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) related entities are expected to increase their ownership stakes in Boston Dynamics whereas it is expected to decline for Softbank post the capital raise.

The current valuation estimates of Boston Dynamics (post capital raise) vary widely from about 4 trillion won to 10 trillion won.

🇰🇷 Samyang Comtech IPO Book Building Results Analysis (Douglas Research Insights) $

(Defense manufacturer producing composite materials) Samyang Comtech completed solid book building results. The IPO price has been finalized at 7,700 won per share, which was at the high end of the IPO price range.

A 48.4% of the total IPO shares are under various lock-up periods lasting from 15 days to 6 months. This is a bullish signal.

Our valuation analysis suggests target price of 13,187 won, which represents a 71% upside from IPO price. Given the excellent upside, we have a Positive view of this IPO.

🇰🇭 Border casino Star Vegas sees net revenue dip 31pct q-o-q amid Cambodia-Thailand frontier clash (GGRAsia)

Net revenue at DNA Star Vegas, a Cambodia casino at Poipet near the frontier with Thailand, fell 31.4 percent sequentially in the three months to June 30, at AUD4.31 million (US$2.81 million).

Property level earnings before interest, taxation, depreciation and amortisation (EBITDA) went down 48.9 percent quarter-on-quarter, to AUD1.78 million.

Both performances were “following a border dispute in the region,” said the property’s promoter, Australian Securities Exchange-listed Donaco International Ltd (ASX: DNA), in a Wednesday filing.

🇰🇭 🇻🇳 Donaco’s shareholders nod proposal for full buyout of firm (GGRAsia)

Stockholders in border-casino operator Donaco International Ltd (ASX: DNA) approved on Monday a proposal that will see one of its investors – a Hong Kong-based investment fund – acquire 100 percent of Donaco’s shares.

In the announcement, Donaco said 98.11 percent of votes cast by Donaco shareholders “were in favour of the scheme”; and 77.50 percent of Donaco shareholders present and voting – in person or by proxy, attorney or corporate representative – “voted in favour of the scheme”.

Australia-listed Donaco runs the DNA Star Vegas resort at Poipet, on Cambodia’s border with Thailand; and the Aristo International Hotel (pictured in a file photo) at Lao Cai, in Vietnam, near that country’s border with China.

🇮🇩 Our thoughts on the scandals in Indonesia’s VC-startup ecosystem (Momentum Works)

Scandal after scandal has rocked Indonesia’s tech ecosystem: eFishery’s founders were suspended and investigated for financial fraud; fintech lending company KoinWorks was implicated in a fraudulent lending scheme; founder of another fintech lender, Investree, fled the country amid regulator investigations; logistics startup Sicepat’s CEO allegedly diverted company funds for stock speculation; even GoTo Gojek Tokopedia Tbk PT (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF)’s founder last month faced questioning over corruption linked to a major school procurement project.

Last week, it also emerged that three prominent individuals in the ecosystem were arrested on suspicion of involvement in a ‘corruption and money laundering’ case: Donald Wihardja, CEO of MDI Ventures, the VC arm of state-owned Telkom Indonesia; Ivan Arie Sustiawan, former CEO of TaniHub; and Edison Tobing, former Finance VP of TaniHub. The case concerns a US$25 million investment made by MDI and another state-owned investment firm under Bank Rakyat Indonesia Tbk PT (IDX: BBRI / FRA: BYRA / OTCMKTS: BKRKF / BKRKY) in TaniHub between 2019 and 2023.

You can find details about the case in local business outlets as well as regional tech media. However, hardly anyone in the ecosystem is surprised, after so many stories involving Indonesia’s tech ecosystem over the last 12 months.

Some thoughts:

🇲🇾 Westports Holdings (WPRTS MK): A Steady Pricing Growth Led Story (Smartkarma) $

Westports Holdings Bhd (KLSE: WPRTS), along with MMC Port Holdings Berhad (2436494D MK), are the two largest container port terminal operators in Malaysia.

With a stranglehold on Port Klang, where it holds a 75% market share, the company will be the beneficiary of significant tariff hikes of 30% over the next 1.5 years.

Despite the recent rally, the stock trades at 18x/15x FY25e/26e earnings and a dividend yield of 4%. Following the pricing-led growth, the company is embarking on an expansion plan post-2028.

🇵🇭 President Marcos won’t ‘act in haste’ about online gambling: spokesperson (GGRAsia)

Philippine leader Ferdinand Marcos Jr (pictured in a file photo) would not “act in haste” regarding the future of licensed domestic online gambling, said Claire Castro, a spokesperson for his office.

According to Friday reports on a media briefing covering the topic, Ms Castro stated: “the President cannot act in haste here”.

Some lawmakers want tighter regulation, while others are calling for a ban.

“It (online gambling) should be studied because in reality, the revenues provided by the licensees of online gambling provide assistance to the citizens” of the Philippines, she added.

Ms Castro’s comments about the President not wanting to act in haste, were reported by the Philippine National News Agency.

🇸🇬 Kenon Holdings: A Risky Play On Israeli Energy Shortages (Seeking Alpha) $🗃️

🇸🇬 Grab: Southeast Asia’s SuperApp Destined For Growth (Seeking Alpha) $⛔🗃️

🇸🇬 Grab Q2 Earnings Update! (Global Equity Briefing)

Accelerating GMV growth and Exploding Loan Portfolio!

Grab Holdings Limited (NASDAQ: GRAB) is not just “Uber of Southeast Asia”, it is much more!

The company is on a path to achieving something that Uber failed at, and that is becoming a Super App.

Combining financial services with a thriving ecosystem of services such as mobility, delivery, and travel is a great recipe for sustained long-term growth.

Q2 2025 demonstrated why Grab has become one of the favorite stocks of the retail investing community.

🇸🇬 Genting Singapore: At the Heart of Asia’s Integrated Resort Boom (MileHighMonk)

Founded in 1984, Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) has cemented its reputation as a premier developer and operator of integrated resorts, with a focus on leisure, hospitality, and gaming. Its flagship property, Resorts World Sentosa (RWS), is a landmark S$6.59 billion development situated on Singapore’s Sentosa Island. Since its phased opening in 2010, RWS has evolved into a 50-hectare, all-encompassing destination that draws millions of visitors each year.

RWS is home to Universal Studios Singapore, Southeast Asia’s first Universal Studios theme park; the S.E.A. Aquarium, one of the world’s largest oceanariums with over 100,000 marine creatures; the Adventure Cove Waterpark; and one of Singapore’s only two legal casinos. The resort also features over 1,600 hotel rooms, high-end retail boutiques, and a wide array of dining options, offering a holistic entertainment experience for both tourists and locals.

🇸🇬 4 Companies That Hiked Their Dividends by Double-Digit Percentages (The Smart Investor)

🇸🇬 4 Singapore Blue-Chip Stocks Lagging the Straits Times Index: Can They Play Catch-Up? (The Smart Investor)

🇸🇬 Searching for Reliable Singapore Dividend Stocks? Here Are 4 That Could Fit Snugly in an Income Investor’s Portfolio (The Smart Investor)

🇸🇬 3 Singapore Companies Reporting Higher Profits: Should They Be on Your Buy Watch List? (The Smart Investor)

The earnings season is in full swing, and we shine the spotlight on three companies that announced higher profits.

🇸🇬 5 Singapore Stocks Whose Share Prices Surged 13% or More in a Month: Are They Screaming Buys? (The Smart Investor)

These five stocks saw their share prices leap higher, but are they worthy of being included in your investment portfolio?

Here are five stocks that saw their share prices jump 13% or more within just a month, and we review them to see if they deserve a place in your buy watchlist.

Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF) is a conglomerate with four key divisions – healthcare, leisure, property, and investments.

City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY), or CDL, is a real estate company with a network spanning 168 locations in 29 countries.

SBS Transit (SGX: S61) is a leading bus and rail operator in Singapore and operates around 200 bus services with a fleet of 3,400 buses.

Hotel Properties Ltd (SGX: H15), or HPL, is an owner and operator of hotels with strong hospitality brand names such as Four Seasons, COMO, IHG, and Six Senses.

Sing Holdings Ltd (SGX: 5IC) is a property development and investment group with an established track record of developing a wide range of properties from landed houses and condominiums to commercial and industrial buildings.

🇸🇬 Digging the Singapore IPO Scene: How Have Recent New Listings Fared and Can We See More in the Future? (The Smart Investor)

We look at the evolving IPO scene and whether SGX can attract more listings in the months ahead.

Info-Tech Systems (SGX: ITS) became the first Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) or SGX mainboard listing in two years, back in June 2025.

Next, NTT DC REIT (SGX: NTDU) became the largest REIT IPO on the SGX in a decade, drawing in anchor investors such as the Government Investment Corporation (GIC).

The momentum has spilled over into SGX’s second board, Catalist, with Lum Chang Creations (SGX: LCC) making its debut on 21 July.

Optimism has seeped into the local market with the Monetary Authority of Singapore’s (MAS) announcement of a S$1.1 billion injection into small and mid-sized companies to boost trading liquidity and valuations.

Performance of recent IPOs

A pipeline of listing aspirants

Potential spin-offs

Get Smart: The spark to set off a virtuous cycle

🇹🇭 🇸🇬 Thai SDRs Open an Attractive Doorway to Asian Growth (The Smart Investor)

Tap into Thailand’s dynamic economy with SGX SDRs, which give you easy access to three high-growth Thai stocks.

Through Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY)’s Thai Singapore Depository Receipts (SDRs), investors can gain exposure to promising Thai stocks without needing to buy them on the Stock Exchange of Thailand (SET).

Here are three Thai SDRs delivering impressive financial performance in 2025.

🇹🇭 Hidden Champions of Thailand (Asian Century Stocks) $

Top 25 companies of Thailand.

Thailand is a medium-sized country in Southeast Asia, dependent on tourism, manufacturing and the export of agricultural goods.

It’s been one of the worst-performing stock markets over the past year, partly due to weak credit growth that’s led to persistent selling of local equities.

In this post, I run through a number of screens, and then propose 25 Thai companies with “hidden champion” characteristics, i.e. monopoly-like businesses with strong competitive advantages.

🇹🇭 Thai authorities need to build wide public support for casinos for any chance of success with legalisation effort: law firm (GGRAsia)

Any further pursuit of casino legalisation in Thailand should involve “robust public engagement” and “comprehensive regulatory frameworks” to have a chance of success. That is according to Panisa Suwanmatajarn, a managing partner at Bangkok-based law firm The Legal Co, Ltd.

She stated in an opinion paper: “Although the legislation possessed sound economic rationale, its social and political foundations proved insufficiently robust to withstand public scrutiny and political volatility.”

On July 9, Thailand’s House of Representatives voted by a large majority to approve a cabinet-requested withdrawal of the Entertainment Complex Bill that had aimed to legalise casino-resort business in that country.

🇮🇳 Infosys: Rating Downgrade As The Path To Recovery Got Murkier (Seeking Alpha) $⛔🗃️

🇮🇳 HDFC Bank (“HDFCB”): Separating the Wheat from the Chaff (Smartkarma) $

The stress periods are the times when the mettle of the best gets tested. We are in such a period and HDFC Bank (NYSE: HDB) has remained unscathed.

Even Bajaj Finance Limited (NSE: BAJFINANCE / BOM: 500034), which is also rated gold-standard in underwriting and risk management, noted issues with asset quality in the current environment, however, HDFCB’s asset quality has remained pristine.

HDFCB’s retail NPA ex-Agri has been steady at 0.82%. While HDFCB’s competitors have provided a cautious outlook, especially in unsecured loans, HDFCB has provided a stable outlook on asset quality.

🇮🇳 The Beat Ideas: GIPCL’s Strategic Shift – A New Dawn for Gujarat’s Energy Sector (Smartkarma) $

Gujarat Industries Power Company Ltd (NSE: GIPCL / BOM: 517300) is executing a 2,375 MW renewable energy park at Khavda, marking a major shift from thermal to green energy.

This transition is expected to improve EBITDA margins through lower operating costs and recurring O&M income.

The shift enhances long-term visibility and positions GIPCL as a key player in Gujarat’s clean energy future, boosting investor confidence.

🇮🇳 Business Breakdown: Sharda Motors – The Shift from Pass-Through Revenue to Product-Led Profitability (Smartkarma) $

Sharda Motor Industries Ltd (NSE: SHARDAMOTR / BOM: 535602) has phased out catalytic converter trading and commissioned a new plant, marking a shift toward high-margin through change in mix and exports.

These developments support margin expansion, strengthen supply capabilities, and align with the company’s focus on engineering-led growth.

Sharda Motors is evolving into a high-margin, technology-driven manufacturer with strong OEM linkages and export ambition, improving visibility on long-term value creation.

🇮🇳 Business Breakdown: Pokarna Limited, A Niche Quartz Player Facing Challenge Due to US Tariff (Smartkarma) $

Pokarna Ltd (NSE: POKARNA / BOM: 532486) is India’s leading quartz exporter, leveraging italian Bretonstone technology to deliver industry-leading margins, growth in Natural Quartz segment.

Company is doing major capex worth Rs. 440Crs, that will add an additional 500Cr in topline once fully operational.

The company is facing demand challenges due to the US 25% Tariff since more than 80% revenue is coming from the US.

🇮🇳 Sambhv Steel: Anchor Lock-In Opens, Bet on Capacity Expansion, Debt Reduction & Value Addition (Smartkarma) $

In Sambhv Steel Tubes Ltd (NSE: SAMBHV / BOM: 544430), the anchor investor lock-in expiry ends brought expected selling pressure, testing the stock’s resilience and investor conviction in its fundamentals.

The company posted record Q1 revenue and profit, driven by strong volumes and margin expansion from its strategic value-added product focus.

Management guides for sustained 12-13% EBITDA margins, backed by aggressive brownfield and greenfield expansions to capture future market demand.

🇮🇳 NSDL – New Management, Revised Strategy — The Battle for Market Share Continues (Smartkarma) $

This insight describes about National Securities Depository Limited (NSDL)‘s complete overhaul in top management team over the last 12 months.

The mandate for new team is to arrest the market share loss with new age/ discount brokers. The revised strategy seems to be working.

The IPO provides investors a front-row seat opportunity to witness this turnaround.

🇮🇳 M&B Engineering Ltd. IPO Analysis (Smartkarma) $

M&B Engineering, a leader in the PEB space, launched a INR 650 crore IPO with a price band of INR 366-385, opening July 30, 2025.

The company will use the INR 275 crore fresh issue proceeds for capital expenditure to expand manufacturing facilities, upgrade technology, and repay certain borrowings.

Growth is fueled by 60% capacity expansion by FY28 and a booming PEB market; valuation appears reasonable given its high PAT CAGR of 53%.

🇱🇰 Launch of City of Dreams Sri Lanka casino resort to be ‘transformative’ for South Asia: local partner (GGRAsia)

The activation of the different elements would “unlock its full potential as a transformative development in South Asia and be a catalyst in creating tourism demand”.

The comments were from Krishan Balendra, chairperson of John Keells Holdings PLC (CSE: JKH), the local partner in the development, and were outlined in that group’s results for the April to June period. City of Dreams Sri Lanka (pictured in a file photo), in the capital Colombo, has been described as a US$1.2-billion venture.

Global casino operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) has invested US$125 million to fit out the casino, the local partner affirmed. Melco Resorts was awarded a licence to run a gaming venue in Sri Lanka valid for a “term of 20 years effective from 1 April 2024”, according to previous information from the casino group.

🇱🇰 City of Dreams Sri Lanka opens, eyes customers in India (GGRAsia)

Speaking in a press briefing on Saturday, Mr Ho said that Sri Lanka could be to India what Macau is to China in terms of a gaming market.

“Macau is by far the biggest gaming market in the world. Colombo is the closest destination to India, and an integrated resort like this gives the city a lot of potential,” he stated, as cited by a number of local media outlets.

In other comments cited recently, Mr Balendra suggested City of Dreams Sri Lanka could benefit from the rise of inbound tourism from the country’s main tourism feeder market, India.

🇮🇱 Teva’s Big Pharma Comeback: Why I Think The Market Is Still Missing The Upside (Seeking Alpha) $⛔🗃️

🇮🇱 Mobileye: Core Business Continues To Exhibit Strength (Seeking Alpha) $⛔🗃️

🇮🇱 Mobileye Q2: The Turnaround Begins (Seeking Alpha) $⛔🗃️

🇮🇱 Tel Aviv Stock Exchange: A Play On An Appealing Stock Market (Seeking Alpha) $⛔🗃️

🇭🇺 ✈️ Wizz Air is Cleared for Takeoff (Natan’s Substack)

For those unfamiliar with Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2):

It’s a Hungarian fast-growing ultra-low-cost airline and the market leader in Central and Eastern Europe, a region undergoing strong economic expansion.

The company operates a fleet of 236 Airbus aircraft, almost entirely made up of the highly efficient A321neo model.

The main risks to this investment thesis include:

Engine issues lasting longer than expected, although the latest quarterly update offered encouraging signs.

A sharp increase in oil prices, raising costs for the unhedged portion of fuel expenses.

Repeated delays in Wizz Air’s fleet expansion plans, which have already been pushed back multiple times for different reasons.

The company’s high level of debt, which while potentially magnifying equity returns, also significantly increases financial risk.

🇱🇹 (MDARA) MÁDARA Cosmetics: The Craftsman’s Dilemma in Industrial Beauty (Silba)

Why being good isn’t good enough when your competitors need only be big

AS MADARA Cosmetics (OMXR: MDARA) had spent years building what couldn’t be bought: authenticity. Every decision, from staying in Latvia when labour was cheaper elsewhere, to using local ingredients when imports might be easier, reinforced who they were. The constraints that almost killed them in 2006 had become their greatest assets.

When they announced the IPO in 2017, sceptics wondered who would invest in a Latvian cosmetics company. The Nasdaq Baltic First North wasn’t exactly where global beauty brands typically listed.

But 700 investors disagreed, oversubscribing the offering by 2.6 times. It wasn’t validation of MÁDARA alone, it was proof that Baltic companies could build globally competitive brands without abandoning their roots.

🇵🇱 Asseco Poland S.A. – Overview & Highlights (The Small Cap Strategist)

25% Expected EBITDA, 30% Hurdle Rate, With A Massive Bet By Constellation Software (CSU).

Asseco Poland SA (WSE: ACP / LON: 0LQG / OTCMKTS: ASOZF) is a leading European software company and a major player in the Vertical Market Software (VMS) industry. The company develops and implements highly specialized, proprietary software solutions for niche sectors. Its business model is strategically diversified across key segments, including Solutions for Finance (its largest contributor at 31% of sales), Solutions for Public Institutions, and Enterprise Resource Planning (ERP) Solutions.

Geographically, Asseco has a dominant presence in its home market of Poland and operates extensively across Central and Eastern Europe. Through its Formula Systems segment, it also holds significant market positions in Israel and North America. The company’s revenue is largely driven by its proprietary software and related services, which generate nearly 60% of their income from recurring sources, ensuring stable and predictable cash flows.

🇵🇱 Why I Sold Auto Partner (The Wolf of Harcourt Street)

Auto Partner SA (WSE: APR / FRA: 6KF) Q1 2025 Earnings Update

This week, I sold my full position in Auto Partner (APR.WA), which represented a 3.5% portfolio weighting at the time of sale. In this article, I’ll walk through the rationale behind this decision. Before diving in, let’s first review Auto Partner’s Q1 2025 earnings, released on 22 May 2025.

My original thesis was based on three expectations:

Sustained high-teens revenue growth for the next 3 to 5 years

Stable or improving margins with operating leverage

Efficient scaling through existing infrastructure

However, several developments have since undermined this thesis:

🌎 MercadoLibre, Inc. (Exceed Invest)

Quick Insights

Narrative:

We forecast continued strong growth for MercadoLibre (NASDAQ: MELI) over the next 1-3 years, albeit with a slight deceleration in percentage growth rates as the base becomes larger. Gross Merchandise Volume (GMV) will be driven by increasing e-commerce penetration, expansion of product categories, and improvements in the fulfillment network. Total Payment Volume (TPV) through Mercado Pago will likely outpace GMV growth, fueled by the accelerating adoption of off-platform payments, credit offerings, and digital financial services.

Revenue growth will be supported by both GMV expansion and an increasing take rate from value-added services like advertising and financial products. Critically, we anticipate Adjusted EBITDA Margin expansion as MELI leverages its scale, optimizes logistics costs, and benefits from the higher-margin nature of its fintech and advertising segments. Investment in technology and infrastructure will remain significant, but operating leverage should start to become more apparent, leading to improved profitability.

🌎 DLocal: A Great Bet On Emerging Markets And FinTech (Seeking Alpha) $⛔🗃️

🌎 Ternium: Market Begins To Recognize Value, But Full Repricing Remains (Seeking Alpha) $⛔🗃️

-

🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🇦🇷 Loma Negra: When Fundamentals And Stock Price Tell Different Stories (Seeking Alpha) $⛔🗃️

🇧🇷 Vale Q2: Better Than Expected (Seeking Alpha) $🗃️

🇧🇷 Vale: Undervalued Iron Giant Ready For The Next Cycle (Seeking Alpha) $🗃️

-

🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Petrobras: Big Yield, Bigger Bargain (Seeking Alpha) $🗃️

🇧🇷 Banco Bradesco Deepens Its Recovery, But The Market Still Waits (Seeking Alpha) $⛔🗃️

🇧🇷 Banco Santander Brasil Is Moving Carefully In Brazil’s Credit Cycle (Seeking Alpha) $🗃️

🇧🇷 Banco Santander Q2: Just A Little Better Than The Last Result (Seeking Alpha) $⛔🗃️

🇧🇷 Bradesco Q2: Great Results And Recommendation Reiterated (Seeking Alpha) $⛔🗃️

🇧🇷 Telefônica Brasil: Valuation Remains Attractive Despite The Rally (Seeking Alpha) $⛔🗃️

🇧🇷 Braskem: 3 Key Reasons To Remain Bearish (Seeking Alpha) $ 🗃️

🇧🇷 Inter: Don’t Chase The Stock Here (Seeking Alpha) $⛔🗃️

-

🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 WEG Q2: Despite The Momentum, Valuation Is Attractive (Seeking Alpha) $⛔🗃️

-

🇧🇷 WEG SA (BVMF: WEGE3) – Operates worldwide in the electric engineering, power & automation technology areas. Electric motors, generators, transformers, drives & coatings. 🇼 🏷️

🇧🇷 Embraer: The Brazilian Stock Most Affected By The 50% Tariffs May Surprise (Seeking Alpha) $ 🗃️

🇨🇱 LATAM: The Unseen Turnaround In Latin America’s Aviation Market (Seeking Alpha) $⛔🗃️

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇲🇽 Trump tariffs are ‘unsustainable’, says Mexico’s auto sector chief (FT) $ 🗃️

🇲🇽 FEMSA: A Solid Refuge In Consumer Staples (Seeking Alpha) $⛔🗃️

🇲🇽 Grupo Financiero Banorte: Attractive Valuation For An Industry Leader (Seeking Alpha) $⛔🗃️

🇲🇽 Solid Margins, Bold Moves: Cemex Is Playing The Long Game (Seeking Alpha) $⛔🗃️

🇲🇽 Grupo Bimbo: Undervalued, Cash-Generating, And Ignored (Seeking Alpha) $⛔🗃️

🇵🇦 Bladex: Strong Growth In Fee Income Aids Dividend Safety And Future Growth (Seeking Alpha) $⛔🗃️

-

🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🇵🇪 Cementos Pacasmayo Is Seeing Cyclical Growth And Its Dividend Yield Might Reach 13% (Seeking Alpha) $⛔🗃️

🌐 Nebius Q2 Preview: Get Your Cash Ready And Hold The Line To Strike (Seeking Alpha) $⛔🗃️

🌐 Nebius Q2 Preview: ARR In Focus (Seeking Alpha) $⛔🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

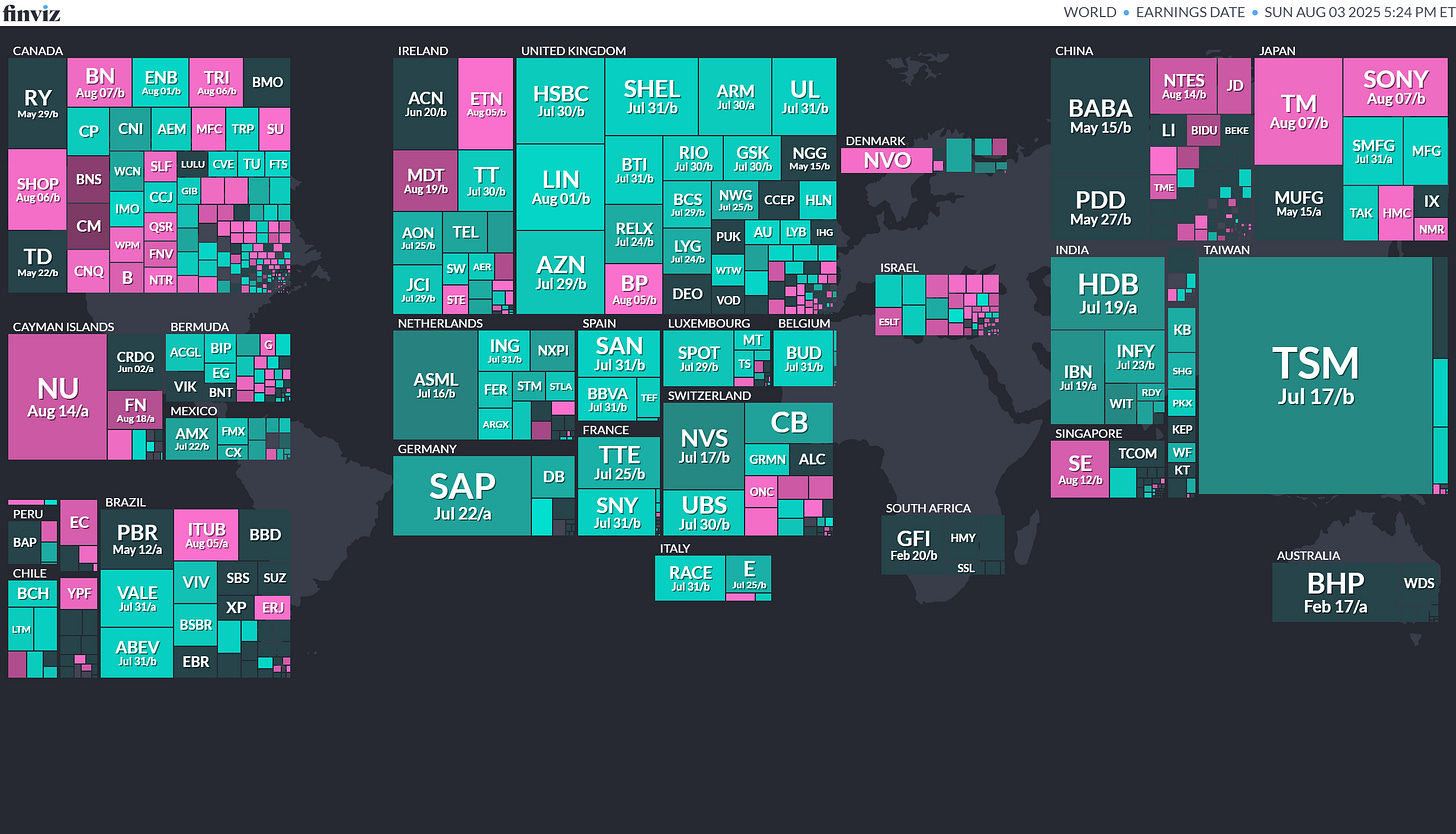

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

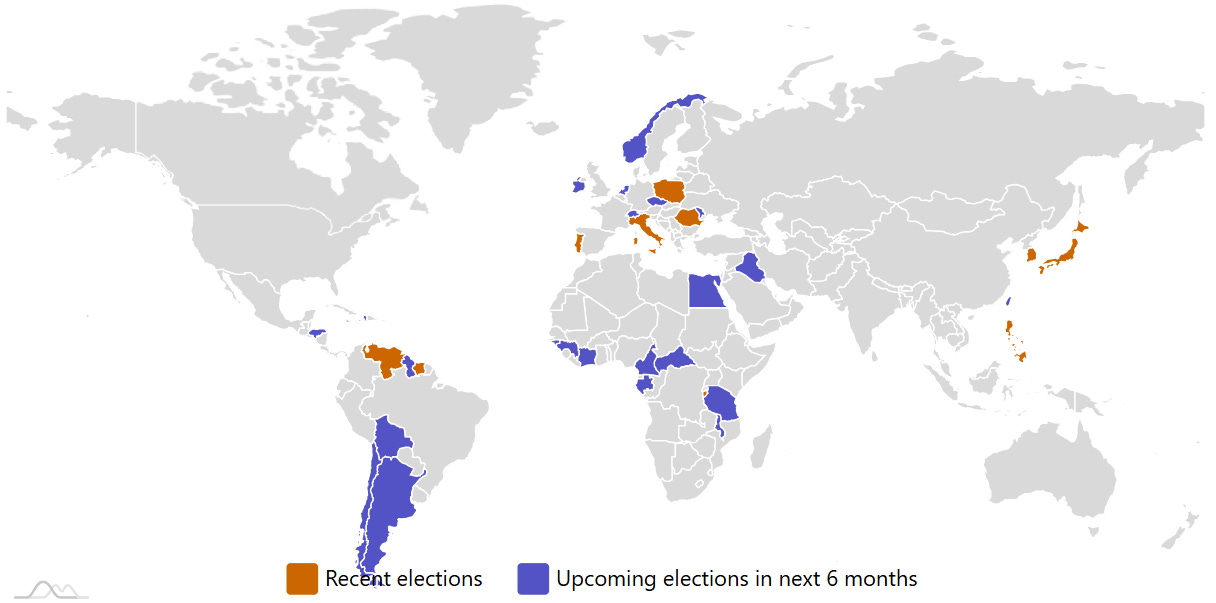

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

BUUU Group Limited BUUU Dominari Securities/Pacific Century Securities/Revere Securities, 1.5M Shares, $4.00-6.00, $ 7.5 mil, 8/11/2025 Week of

(Incorporated in the British Virgin Islands)

Established in 2017, we have rapidly grown into a premier Meetings, Incentives, Conferences, and Exhibitions (“MICE”) solutions provider based in Hong Kong. Our comprehensive marketing service portfolio is designed to meet the diverse needs of our clients, spanning across two core areas: (i) event management and (ii) stage production.

(a) Event management services

In the realm of event management, our operating subsidiary, BU Creation, excels as creative planners and meticulous executors. We curate and manage a wide spectrum of events, including cultural, artistic, recreational, and corporate promotions. Our approach is deeply collaborative, and we work closely with our clients to bring their visions to life. From the initial concept to the final execution, we ensure every detail is aligned with our clients’ objectives, delivering events that resonate and captivate audiences. In addition, we have collaborated with event production houses to co-host various remarkable events in Hong Kong. Notable examples include the S2O Songkran Music Festival Hong Kong, the Spartan Race Hong Kong, and the Grade 10 Asia Card Show Hong Kong.

Under our event management services, BU Creation directly engages in (i) design and planning, (ii) project management, and (iii) on-site supervision.

Our revenue derived from event management services represents approximately 77.9% and 77.5%, and 80.5% and 72.2% of our total revenue for the six months ended December 31, 2024. and December 31, 2023, and the years ended June 30, 2024, and June 30, 2023, respectively.

(b) Stage production services

Our expertise in stage production lies in our ability to transform spaces into immersive experiences. Our operating subsidiary, BU Workshop, meticulously coordinates with suppliers to integrate advanced lighting, visual and audio systems, stage performance elements and venue decorations. Our goal is to create environments that not only engage but also leave a lasting impression, elevating the impact of every event we manage.

Under our stage production services, BU Workshop directly manages the entire production process, from stage management and technical direction to the fabrication and installation of set elements. The lighting and visual and audio systems involved are sourced from its suppliers.

Our revenue derived from stage production services represents approximately 22.1% and 22.5%, and 19.5% and 27.8% of our total revenue for the six months ended December 31, 2024, and December 31, 2023, and the years ended June 30, 2024, and June 30, 023, respectively.

Our diverse clientele includes public institutions, marketing and public relations firms, real estate corporations, and a number of established brands. This broad customer base reflects our ability to deliver customized solutions that meet the high standards of various sectors.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: BUUU Group Limited is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, if priced at the $5.00 mid-point of its range, according to its SEC filings.)

Nasus Pharma Ltd. NSRX Laidlaw & Company (UK)/Craft Capital Management, 1.3M Shares, $8.00-10.00, $11.3 mil, 8/18/2025 Week of

(Incorporated in Israel)

We are a clinical-stage specialty pharmaceutical company focused primarily on the development of intranasal drugs to treat severe allergies and emergency medical conditions such as anaphylaxis. Intranasal administration is especially suitable for medical emergencies when prompt drug administration is critical, since the nose is lined up with a very rich vascular bed enabling quick drug absorption.

We are developing NS002, an intranasal powder epinephrine nasal spray to treat Type 1 severe allergies and anaphylaxis. We plan to conduct two Phase 2 trials of NS002.

We are also developing NS001, an intranasal naloxone powder nasal spray to treat opioid overdose. We intend to search for partnership opportunities to continue developing this product.

Note: Net loss and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Nasus Pharma Ltd. increased its IPO’s size – to 1.25 million shares – up from 1.0 million shares initially – and cut the price range to $8.00 to $10.00 – down from $10.00 to $12.00 originally – to raise $11.25 million, if priced at the $9.00 mid-point of its new range. Background: Nasus Pharma filed its F-1 for its small-cap IPO on July 8, 2025, and disclosed the terms – 1 million shares at a price range of $10.00 to $12.00 – to raise $11.0 million, if priced at the mid-point of its range.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (August 4, 2025) was also published on our website under the Newsletter category.