The following is my best “magnificent seven” stock to buy now.

The “magnificent 7” stock is still one of the best purchases in the market.

“Magnificent Seven” is a term that CNBC’s JIM Cramer includes some major technology companies in the market. Cohots are configured:

- nvidia (NVDA 1.05%))

- Microsoft (MSFT 0.22%))

- apologize (AAPL 4.24%))

- Amazon (Amzn -0.23%))

- alphabet (Goog 2.44%)) (google 2.48%))

- Meta platform (Meta 0.92%))

- Tesla (tsla 2.28%))

All of these companies have reported results except NVIDIA, and investors may wonder which company looks like a solid purchase. I think all these stocks are getting more interesting every day, but I think five out of seven are purchased and two should be watched.

Image Source: Getty Image.

I am watching Apple and Tesla

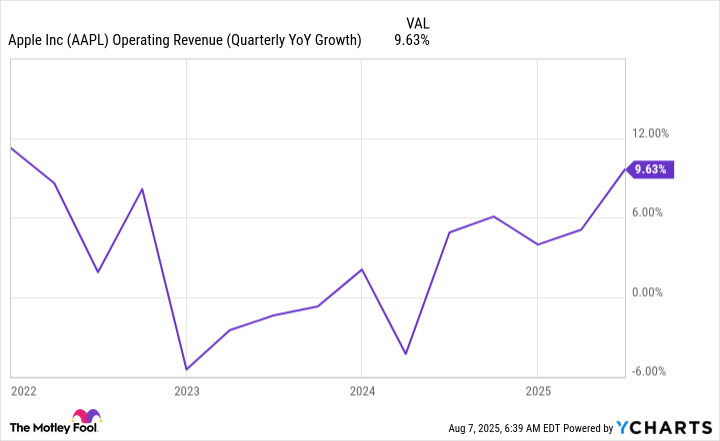

Over the past few years, many of these companies have provided explosive sales growth except Apple. Apple’s growth finally returned in the third quarter of 2025 and provided two -digit growth (round -up) for the first time since early 2022.

YCHARTS’s AAPL operating revenue (quarter growth) data

Nevertheless, there are several questions about what Apple’s next big product is behind the AI weapon race. I’m not ready to declare Apple yet, but it’s getting more interesting every quarter.

Tesla is the worst form of magnificent seven companies, and sales fall 16% year -on -year in the second quarter. In addition, when EV and regulatory credit are removed, a significant headwind appears. But Tesla’s business was not entirely about EV. Otherwise, the evaluation is meaningless. Investment in Tesla is that humanoid robots, AI, autonomous driving and Rob-taxis will eventually succeed. But now I’m waiting to improve Tesla’s situation.

I am the remaining 5 buyers

All five of the magnificent seven -year -olds seem to be promising for me because they are experiencing strong growth.

The meta platform provided a shocking Q2 report that provides 22% sales growth despite the 13% growth. This strength is expected to continue until the third quarter, with 20%sales growth.

There is no advertising business in Meta, and improvement with AI has begun to help creation and participation.

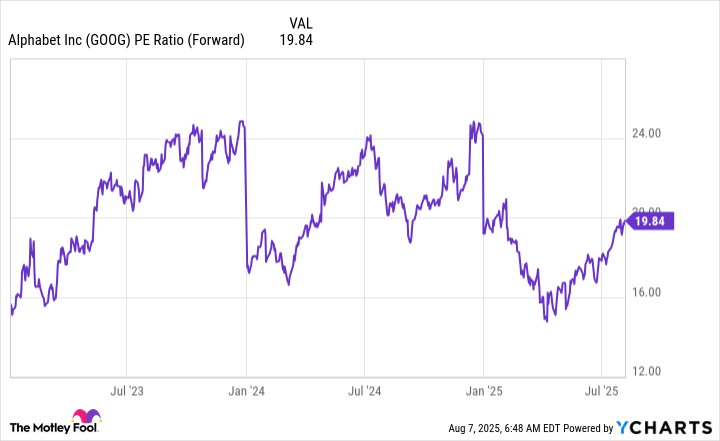

The alphabet also had a powerful advertising branch. The profits of Google search rose 12% year -on -year, showing strengths and suspicion of doubts about lifespan.

Alphabet sales increased 14% year -on -year and dilution income per week increased 22%. It is an impressive result of a company that is struggling. In addition, the alphabet is the cheapest stock in this list and is traded with 20 times gift income.

YCHARTS’s Goog PE ratio (anterior) data

All of this is combined to make the alphabet into one of the best stocks to buy.

Microsoft provided Monster Growth in the fourth quarter of 2025 (end of June 30), despite being the second largest company in the world. Revenue increased 18% year -on -year, but the biggest shock in the report was Azure. Azure is a cloud computing product of Microsoft and is a major platform for building an AI model. Azure’s revenue dropped 39%of the chin this quarter to show strong demand for computing power.

This tailwind lasts for a while and Microsoft is now made of excellent stocks.

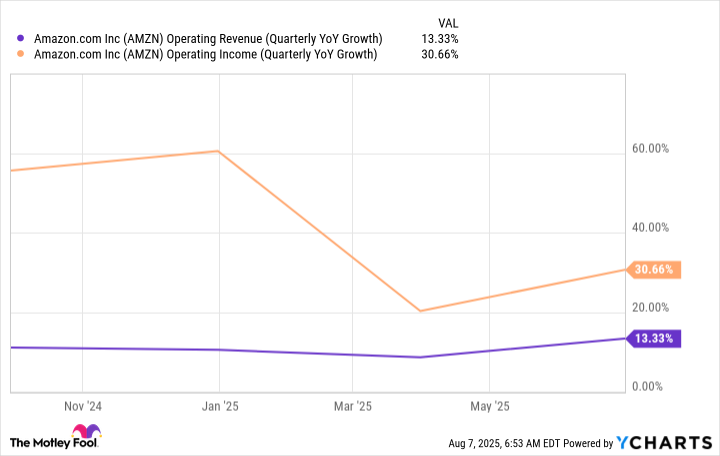

Amazon (Amzn -0.23%)) Investors responded negatively to the report, which caused the stock to sink after imports. But I don’t think they are as bad as market accidents, and long -term prospects are still positive for the company.

Amazon’s profit growth continues to grow, thanks to the strengths of high -priced businesses such as advertising and Amazon Web Services (AWS).

YCHARTS’s AMZN operating revenue (quarter growth) data

As long as this trend continues, Amazon will be a strong long -term choice. This trend, which is the fastest growing segment of Amazon and AWS, is likely to continue for the near future.

The last is NVIDIA and has not yet reported income. However, all companies related to building AI infrastructure in this list said that capital spending will increase next year due to increased data center spending. This is good for NVIDIA. NVIDIA will also offer export licenses to ship the H20 chip back to China, providing another growth tail for business.

NVIDIA expects to report the explosion income on August 27, making it a smart stock to cut stocks before that. NVIDIA may be the world’s largest company, but we expect to grow bigger as the AI build out increases.

Keithen Drury is located in alphabet, Amazon, meta platform, nvidia and Tesla. MOTLEY FOOL is located in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. MOTLEY FOOL recommends the following options: January 2026 Long $ 395 Microsoft and Tel for the short -term $ 405 Microsoft in January 2026. The MOTLEY FOOL has a public policy.