Why is the stablecoin giants tether, Circle develop a blockchain?

Tethers and circles are targeted for high throughput for ultra -high speed payments.

Control competition for payment infrastructure is accelerated, and the Tether and Circle -like publishers, such as Tether and Circle, are no longer satisfied with relying only on Ethereum, Solana or other general purpose blockchains. Instead, they have built a dedicated blockchain to strengthen the token into a global financial system.

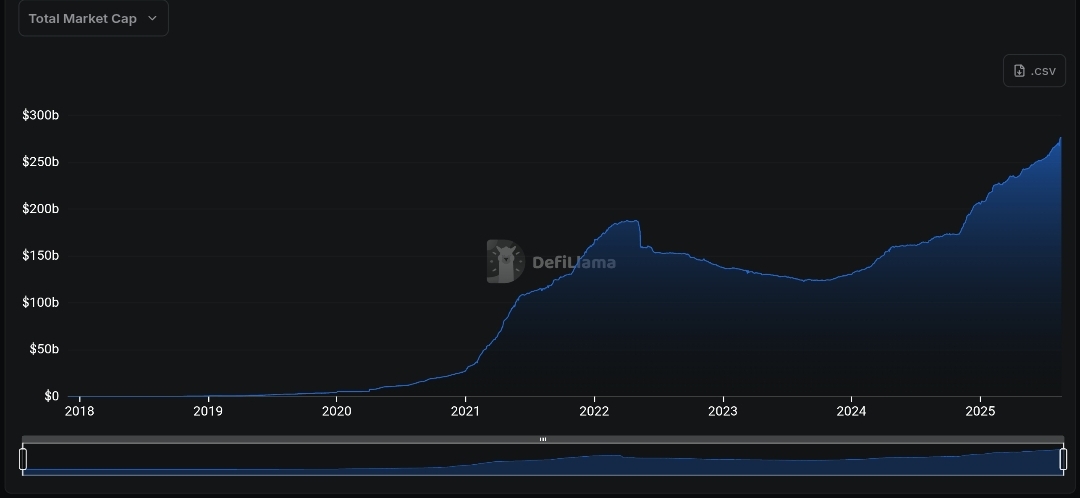

According to Defillama, the total Stablecoin market cap has risen to more than $ 250 billion in 2025 and has risen sharply from about $ 140 billion last year. This includes $ 150 billion in tethers and $ 60 billion in Circle.

Source: Defillama

However, as the volume increases, pains such as unpredictable gas rates, crowded networks and low -cost high -cost money, such as dependence on blockchains optimized for defect guess, rather than money movement. This increased the trend of the publisher’s trend and started a dedicated chain.

From stability to arc: stablecoin-native blockchain is formed

The most notable example is the new layer 1 network centered on the largest stabilization device, the USDT of Tether. The Stable announced in July raised $ 28 million in the first “Stablechain” that USDT is used as a default gas token.

Unlike Ether Lee or Solana, which prioritizes programming possibilities and comprehensive possibilities, stable is optimized only for payment. Founder Joshua Harding argued that a general purpose blockchain forced users to pay high fees with volatile tokens, have long confirmed time, or depend on managers.

Stable is aimed at solving this free of charge at the protocol level, which is free of charge, a dollar, and a predictable cost.

Tethers, executives think that the timing is perfect. Paolo Ardoino, CEO of Tether and CTO of Bitfinex, recently pointed out the US genius law.

Through this framework, banks and institutions can begin to adopt USDT for settlement according to size, and blockchains made for the same purpose as stable are deployed as infrastructure layers.

Stable is not alone. Recently, CIRCLE announced ARC, a dedicated USDC blockchain. The EVM compatible chain announced in August is designed to provide the Enterprise -class foundation for the Stablecoin Payments, FX and Capital Markets applications.

ARC uses USDC as a default gas token and is completely integrated with the existing platform of Circle while maintaining interoperability with other partner block chains. This positioning makes the network a high -performance regulatory alignment settlement class.

The plasma supported by Bitfinex raised $ 24 million earlier this year to build its own stabilization chain. STRIPE, meanwhile, unveiled TEMPO, a paradigm support STABLECOIN network.

Tokensing players are also chain of Converge and ondo Finance with Ethena, and DINARI joins with tokenized stock L1 work in Avalanche.

Why is the stablecoin publisher built his own settlement rail?

It represents the desire for control and positioning as much as the pivot of the publisher’s blockchain. Running a dedicated layer -1 allows the issuer to mix compliance with protocols, integrate foreign exchange functions, and ensure predictable fees.

It also opens a new business model. Instead of paying other people’s networks, the publisher can issue his gas tokens and operate an independent commission market to capture the settlement margin.

The regulatory level is equally important. The L1, which is built for the purpose, can include KYC inspection, regulations and customized governance in the protocol level, which is increasingly attractive as policymakers in the US, Europe and Asia. Accelerate digital asset regulations.

But these changes raise questions about existing chains. Coinbase’s analysts recently pointed out that Circle’s arc and stripe tempo aims to explicitly go to Solana’s high -level and low -level payments, which are the corner of the dominant market.

In contrast, Ether Leeum is expected to remain an institutional anchor in the short term, and is supported by the power of powerful institutional users.

Nevertheless, analysts warn that replacing trust in the existing blockchain will take more than the primitive throughput.