Stocks News

#19: “You can pay an annual limit in the mutual fund even if you go down the year without selling it” -Meb Faber Research

Many people do not realize this, but you can own a mutual fund, lose the fund, and still have to pay major capital gain taxes … What do you mean?! (Russell’s article.)

MorningStar has an annual report that encompasses large distribution, and generally has a fund that distributes 20 and 40% or more!

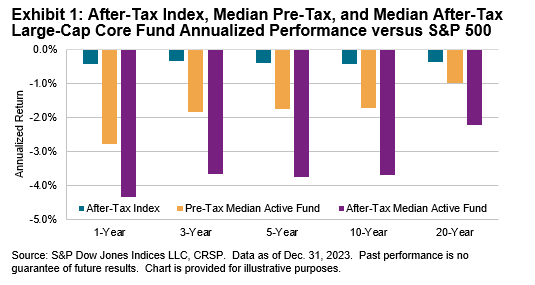

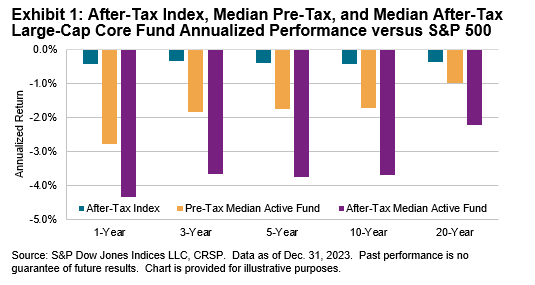

The following is a table where the table of S & P shows the investor’s tax drag. It can be argued that owning a high fee tax inefficient mutual fund in a taxable customer account is taxable.