Ether Lee rose to $ 10,000: chart flash parabola signal

Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

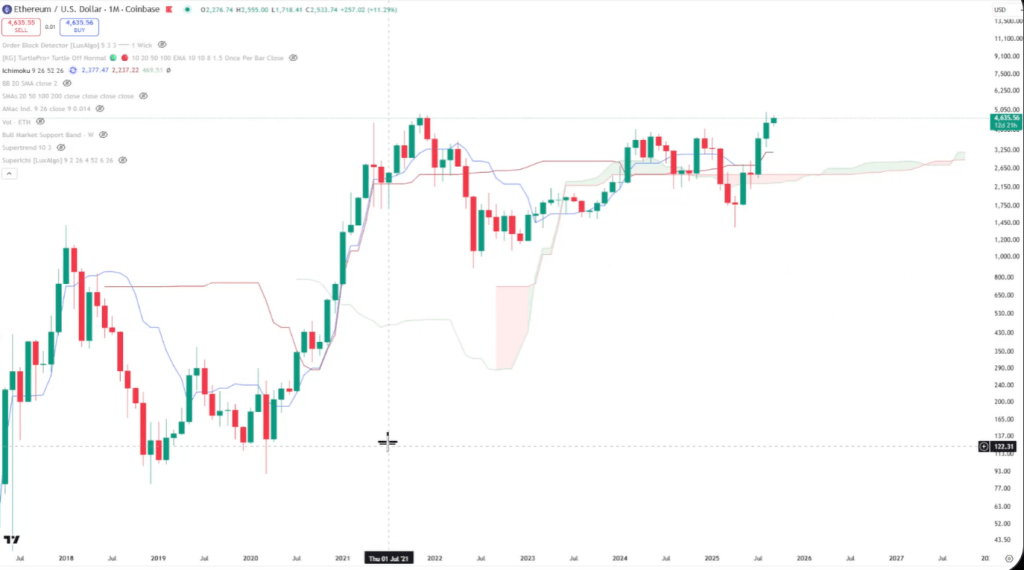

According to a multi -period analysis of Trader CantoneSe Cat (@cantonmeow), Ethereum is a decisive stage that can be used in five qualification areas.

Ether Lee is ready to break down the highest high.

In the video released today, the analyst has arranged the late cycle resistance clusters, and currently shows the joining of technical signals every month, weekly, daily, daily and intravenous charts, and prefers some high goals that can meet 1.272, 1.414, and 1.618 potential. This FIB level will be placed at $ 7,752, $ 9,883 and $ 14,011, respectively.

In the monthly chart, the analyst focuses on his case on log scale Fibonacci structure and volatility. He spent several months in ETH for several months around a 0.886 retreat, nearly $ 4,000. In the previous attempt, the same area of repeatedly recovering the market, “Last month, we investigated the persuasive,” he said.

Related reading

He pointed out the idea that the previous tower was being thinner since the peak in November 2021, which has already been stabbed on the wick. At the same time, the monthly bollinger band is expanding, while the price is rising impulsively with the top Bollinger band. “I prefer some of them that can achieve higher goals,” he said. He emphasized the sequencing and emphasized:

The second pillar of the strong paper is the fusion of the Ichimoku profile across cycles, especially Tenkan-Sen and Kijun-Sen. “If you converge Tenkan and Kijin together and price goes up with him, this fusion is called katana,” he explained. Historically, he said, “This triggers a big movement.” And now, the price is more than Katana, “Katana has raised the price.” About the current structure: “We are also advantageous for Ether Leeum because we build a Katana here and the price is rising impulsively.”

During the weekly period, the Cantonese cat has been developed through the three -cycle template defined as the “cycle fluid zone” that plays the ETH forward. Each previous cycle saw the deviation above and below before the continuous movement when the zone was recaptured. He deploys the current integration directly to the blueprint. After breaking the “$ 4,000 liquidity level,” ETH said, “Side … He said that he could test but not needed.

Low period signal

The lower period is already in line with the result from his point of view. In the daily chart, he emphasizes the “Adam and Eve Continuation Pattern” overlapped in the classic cup and handle. Here, the handle is not a big volume.

The price measured on the recovery of logs was rejected at 0.786 and found support at 0.5, and now we are trying to penetrate 0.6. He is also trying to return our way. He also points to a short -term floor sequence. If two or three of these kinds of wicks pop out like that, it’s usually pretty good.

Related reading

In the 12 -hour chart, he reads the structure as a re -number in the Wyckoff Sense, referred to the “round floor”, the reinforced secondary test (ST is higher than the VCLX ”, and refer to the appearance of the” Creek “overhead, which is ready to keep the price. Integration sideways…

He argues that relative robbery diagnosis strengthens ethical stories. Ether Lee’s market sharing gauge (ETH.D) said, “We have been broken above Ichimoku Cloud at the intensity.” “We tested the cloud for about four weeks, and Tenkan could be waiting for“ support ”in front of the next bridge, and he regained the 20 -month moving average on the basis of monthly volatility. And we simply sent a back test for a month, ”he added.” This means that we want to continue to perform more than the rest of the Cryptocurrency market for Ether Leeum for predictable future. “

ETH external width indicators also pay risks in his framework. TOTAL3 Index (TOTAL CRYPTO Market Cap, excluding Bitcoin and Ethereum), is to try to form a high -quality high in the monthly “cup and handle” structure in the monthly “cup and handle” structure, “Monthly” Cup and Handle “structure. The “Other” Index (Market Cap except TOP 10 Coins) is punched at 0.786 level every week. The next level has been punched up to 0.86.

He pointed out the linear 0.886 brake out that failed in the previous attempt, emphasizing the distinction between logs and linear recovery. “If we look up at the linear linear and look at 0.886 with style, we will do very well and follow the footsteps of the ether room.” His conclusion is not clear. “I’m optimistic for Ether Lee. I am optimistic for Altcoin. In general, I am optimistic in the Cryptocurrency market space.”

ETH was traded at $ 4,565 in the press time.

DALL.E, major images made with charts on TradingView.com