Emerging Market Links + The Week Ahead (September 15, 2025)

The Asset among other media sources are noting signs of life in Chinese and Asean IPO markets: China IPO market shows signs of recovery, bolstering VC/PE activity 🗃️; Tech talk reignites US investors’ interest in Chinese equities 🗃️; China healthcare firms raise US$10.6 billion YTD 🗃️; and Asean IPO comeback – robust pipeline, liquidity-fuelled SGX 🗃️.

However, a recent Bamboo Works podcast (China’s state-driven stocks, and its corporate wars abroad 17:19 Minutes) gave a reality check about the Chinese stock rally by noting that Chinese really have no other place to put their money right now (and the stock market appears to be giving a return…) plus there is some stock speculation centred around government policy (which can go in all different directions).

Finally and as mentioned Sunday, the Taoist temple in my neighbourhood had their annual 3 day festival (for the god’s birthday) which also corresponded to an extra long Malaysia Day (today) weekend. This year, the temple did not do the mutilation or piercing ritual (as with the trances, they are something to see…); but at the 3:51 Minute mark in my video, they remove the piercings from some (I think mostly Thai) devotees who walked from a temple in Brickfields (a few kilometres away):

One year (2013) for (I think) a particularly special anniversary, some went all out with the piercing ritual with my whole playlist of videos through the years uploaded here:

However, I remember this bike enthusiast though did not get very far with his bike walking in the procession around the neighborhood:

$ = behind a paywall

-

🌐 Emerging Market Stock Picks (August 2025) Partially $

-

🤖 DeepSeek Analysis

-

🇹🇼 Taiwan – Minth Group

-

🇮🇩 Indonesia – Bank Negara Indonesia (Persero) Tbk PT, Cisarua Mountain Dairy Tbk PT, Bank Mandiri (Persero) Tbk PT, Japfa Comfeed Indonesia Tbk PT, Charoen Pokphand Indonesia Tbk PT, Bank Rakyat Indonesia (Persero) Tbk PT, Astra Agro Lestari Tbk PT, Perusahaan Gas Negara Tbk PT, Bank Central Asia Tbk PT, Medco Energi Internasional Tbk PT, GoTo Gojek Tokopedia PT Tbk, Mitra Adiperkasa Tbk PT, Indo Tambangraya Megah Tbk PT, Astra International Tbk PT, Avia Avian Tbk PT, Bukit Asam Tbk PT, PT Trimegah Bangun Persada Tbk, Indofood Sukses Makmur Tbk PT, PP London Sumatra Indonesia Tbk PT, Telkom Indonesia (Persero) Tbk & Sarana Menara Nusantara Tbk PT

-

🇲🇾 Malaysia – IHH Healthcare Bhd & Frencken Group Ltd

-

🇸🇬 Singapore – Sheng Siong Group Ltd, GuocoLand Ltd, Singapore Telecommunications Ltd, CapitaLand Integrated Commercial Trust, SATS Ltd, Sasseur Real Estate Investment Trust, Hong Leong Asia Ltd,

Yanlord Land Group Ltd, ComfortDelGro Corporation Ltd, StarHub Ltd, Nanofilm Technologies International Ltd, AEM Holdings Ltd, CapitaLand Investment Ltd, SEA Ltd, Grand Venture Technology Ltd, City Developments Ltd, PropNex Ltd, Singapore Technologies Engineering Ltd, UOL Group Ltd, First Resources Ltd, UMS Integration Ltd, Wilmar International Ltd, ASMPT Ltd, Sembcorp Industries Ltd, Singapore Exchange Ltd, APAC Realty Ltd, IREIT Global, Mapletree Industrial Trust, Genting Singapore Ltd, United Overseas Bank Ltd, Parkway Life Real Estate Investment Trust, Venture Corporation Ltd, Suntec Real Estate Investment Trust, LendLease Global Commercial REIT, Capitaland Ascendas REIT, Oversea-Chinese Banking Corporation Ltd, Elite UK REIT, CapitaLand China Trust, Frasers Logistics & Commercial Trust, Seatrium Limited, NetLink NBN Trust, Keppel Ltd & Mooreast Holdings

-

🇹🇭 Thailand – Bangkok Chain Hospital PCL, Siam Wellness Group PCL, TQM Alpha PCL, Hana Microelectronics PCL, PTT PCL, Warrix Sport PCL, LH Hotel Leasehold Real Estate Investment Trust, Stecon Group, Srisawad Corporation PCL, Com7 PCL, Bangchak Corporation PCL, Charoen Pokphand Foods PCL, Central Plaza Hotel PCL, TIPCO Asphalt PCL, Mega Lifesciences PCL, Praram 9 Hospital PCL, Chularat Hospital PCL, Thai Beverage PCL, KCE Electronics PCL, CH Karnchang PCL, Erawan Group PCL, Indorama Ventures PCL, Osotspa PCL, Airports of Thailand PCL, CPN Retail Growth Leasehold REIT, CP ALL PCL, BGrimm Power PCL, PTT Global Chemical PCL, Master Style PCL, Bangkok Dusit Medical Services PCL, Central Pattana PCL, Berli Jucker PCL, Bangkok Expressway and Metro PCL, Ekachai Medical Care PCL, Central Retail Corporation PCL, Star Petroleum Refining PCL, Amata Corporation PCL, SVI PCL, PTT Exploration and Production PCL, Tidlor Holdings PCL, Krung Thai Bank PCL, Muangthai Capital PCL, PTT Oil & Retail Business PCL, WHA Industrial Leasehold REIT, Global Power Synergy PCL, IRPC PCL, Thai Union Group PCL, Bumrungrad Hospital PCL, Kasikornbank PCL & Minor International PCL

-

🇯🇴 Jordan – Capital Bank Of Jordan

-

🇦🇪 United Arab Emirates (UAE) – Pure Health Holding PJSC &

RAK Properties

-

🇿🇦 South Africa – Rainbow Chicken Ltd, ASP Isotopes Inc, ADvTECH Ltd, Grindrod Limited, Sabvest Capital Ltd, Premier Group, Stadio Holdings Ltd, RCL Foods & Metair Investments

-

🇵🇱 Poland – Toya SA & Dadelo SA

-

🇲🇽 Mexico & Central America – Fibra Monterrey SAPI de CV & Grupo Aeroportuario del Sureste (ASUR)

-

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Analysis: Why Asia Stocks Have Rallied This Year (Caixin) $

Asian stock markets have rallied this year, driven by a weaker U.S. dollar, the artificial intelligence (AI) boom and the region’s resilience to the trade war, with an anticipated U.S. interest rate cut expected to extend the momentum.

The MSCI Asia Pacific Index is up 18% this year through Monday, with the index hitting a record high. The index gauges the performance of large- and mid-cap stocks from five developed economies — Australia, Hong Kong, Japan, New Zealand and Singapore — and eight emerging markets — China, India, Indonesia, South Korea, Malaysia, Taiwan, Thailand and the Philippines.

🇨🇳 China IPO market shows signs of recovery, bolstering VC/PE activity (The Asset) 🗃️

New listings surge 32.9% to 109 companies, of which nearly half are A-shares

China’s initial public offering ( IPO ) market appears headed for a rebound as the number of domestic companies going public grew by a significant 32.9% in the first half of 2025 from a year ago, contributing to a nascent recovery in the country’s venture capital and private equity ( VC/PE ) sectors.

A total of 109 Chinese companies listed on both onshore and offshore exchanges in the first six months of 2025, from 82 in the same period in the previous year. Total proceeds reached approximately 121.36 billion yuan ( US$16.7 billion ), up 158.7% year-on-year and 24.7% from the previous half-year period, according to data from Zero2IPO Research. Machinery manufacturing was among the sectors with the strongest performance.

Since the China Securities Regulatory Commission ( CSRC ) announced the measures to “temporary tighten the pace of IPOs” on August 27, 2023, the A-share market has undergone two years of profound transformation. The measures have alleviated short-term liquidity pressure, curbed the trend of IPOs listing below issue price, and supported the secondary market to recover. The regulator has shifted its focus from quantity to quality, elevating the standards for companies seeking to go public.

🇨🇳 Chinese government bond yields rise to 2025 high (FT) $ 🗃️

Investors bet world’s second-largest economy can move past deflationary pressures

Yields on 30-year Chinese government bonds rose 0.08 percentage points on Wednesday to 2.21 per cent.

Ten-year yields rose 0.03 percentage points to 1.82 per cent, their highest level since just before US President Donald Trump’s “liberation day” tariff announcement in April, which prompted a move out of risk assets in China. Bond prices fall when yields rise.

🇨🇳 Analysis: How a Scrapped Tax Exemption Will Change China’s Bond Market (Caixin) $

A tax change for institutional investors in certain Chinese bonds will spur trading, reduce price distortions and discourage them from parking too much capital in the multitrillion-dollar market, analysts said.

Under the change, announced last month, institutional investors now have to pay value-added tax (VAT) on the interest they earn on newly issued Chinese sovereign, local government and financial bonds. Financial bonds are issued by policy banks, commercial lenders and other financial institutions in China.

🇨🇳 Tech talk reignites US investors’ interest in Chinese equities (The Asset) 🗃️

Despite the lingering risks, US investors are starting to be drawn to China equities, driven by technology investing opportunities and diversification trends

In a significant shift, US investors are showing their highest level of interest in Chinese equities since early 2021, according to Laura Wang, equity strategist at Morgan Stanley Asia, following a 1.5-week marketing trip across the United States.

Wang reveals in a report that over 90% of US investors she met during the trip expressed willingness to increase their exposure to Chinese equities. This marks the highest level of positive sentiment since the peak of China’s equity market in early 2021.

Their interest spans both broad index-level investments and specific thematic opportunities, particularly in high-growth sectors such as artificial intelligence ( AI ), humanoid robotics, biotech, and new consumption trends.

🇨🇳 China’s Regulator Ramps Up Push to Curb Food Delivery Subsidy War (Caixin) $

China’s market watchdog has stepped up oversight of the country’s intensifying food delivery subsidy battle, warning leading platforms to steer clear of unfair competition as a wave of cut-price campaigns rattles the industry.

At a press briefing Tuesday, Wang Qiuping, spokesperson for the State Administration for Market Regulation (SAMR), said the agency had summoned top platforms for talks and secured public pledges to rein in “malicious subsidies” and comply with the law.

🇨🇳 Natan’s Notes #11: PDD, terrible management? (Natan’s Substack)

A brief recap of Q2 numbers

During Q2 2025, PDD Holdings (NASDAQ: PDD) or Pinduoduo reported revenues of RMB 104B, right in line with expectations after several quarters of misses, and delivered EPS of RMB 22.1, a staggering 50% above consensus.

Following the release, the stock initially surged 10%, only to tumble to –3% by the end of the earnings call. This isn’t the first time it has happened: exactly one year ago, management managed to sink the stock by more than 30% in a very similar fashion.

Let’s take a closer look at the key takeaways from this quarter’s call.

🇨🇳 Pinduoduo’s AI Silence Is the Strategy (The Great Wall Street) $

Why PDD Holdings (NASDAQ: PDD) or Pinduoduo‘s AI Playbook Values Efficiency Over Hype

Lately, I’ve been asked over and over again: why isn’t Pinduoduo participating in the AI race? In this article, I’ll look at their history, how they operate, and why this silence fits the very strategy that made them so successful.

🇨🇳 Hello Group takes ‘Cyrano approach’ in bid to rekindle China’s dating interest (Bamboo Works)

The leading dating app has launched an AI-backed function that advises people on what to say to prospective dates, as it tries to return to revenue growth after five years of declines

Hello Group (NASDAQ: MOMO)’s revenue fell 2.6% in the second quarter, extending a stream of declines dating back to 2020, as it also reported a surprise quarterly loss

The leading dating app has found recent success with its overseas business, whose contribution grew to 17% of revenue in the second quarter from less than 10% a year earlier

🇨🇳 Linklogis deepens its blockchain bet to make supply chain finance great again (Bamboo Works)

The provider of digital supply chain financing services will use XRP Ledger to settle digital transactions as it continues to reel from China’s long-running real estate slump

Linklogis (HKG: 9959 / FRA: 0NY / OTCMKTS: LNKLF) will integrate its platform onto XPR Ledger’s blockchain network to settle international trade-related digital asset transactions

The supply chain financier has been active in using blockchain, with related services becoming its largest revenue source

🇨🇳 Cambricon Wins Approval for $559 Million Share Sale Amid Stock Frenzy (Caixin) $

Chinese AI chip designer Cambricon Technologies Corp (SHA: 688256) has received regulatory approval to proceed with a scaled-down private share placement, following a remarkable 500% rally in its share price over the past year.

The China Securities Regulatory Commission approved the plan, Cambricon said in a Tuesday filing to the Shanghai Stock Exchange. While pricing details were not disclosed, the market is closely watching how the company will value the offering amid its meteoric stock rise.

🇨🇳 Chinese Regions Dial Back Car Subsidies as Funds Dry Up (Caixin) $

Multiple provinces in China are reining in vehicle trade-in subsidies, dealing a blow to auto sales and casting doubt on the durability of the national stimulus program.

On Sept. 4, the Department of Commerce in Hubei province said it was cutting auto trade-in incentives to two levels — 3,000 yuan ($411) and 5,000 yuan — from a previous range of 7,000 to 15,000 yuan. The application process has also become more complex. Starting Sept. 5, buyers must obtain an eligibility voucher before purchasing a new car.

🇨🇳 Price War Batters Chinese Automakers’ Profits (Caixin) $

China’s protracted auto price war is hammering carmakers’ profits and forcing them to pivot to overseas markets in search of growth.

While BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), the country’s largest electric-vehicle (EV) maker, posted a stellar first quarter, its fortunes reversed in the second quarter. After doubling in the first three months, the company’s net profit dropped by 30% to nearly 6.4 billion yuan ($900 million yuan) in the second quarter as revenue growth slowed to 14%. Its gross profit margin narrowed by 2.4 percentage points to 16.3% in the April-June period, its lowest since the third quarter of 2022.

🇨🇳 Chery Auto IPO PHIP Update & Review (Douglas Research Insights) $

Chery Auto is getting ready to complete its IPO in the next few weeks. It is expected that Chery Auto could raise about US$1.5 -2.0 billion in this IPO.

ROE is super high at 70%+. Chery Auto has one of the highest ROEs among all the major auto companies globally.

Chery Auto has one of the best records among all the major auto companies globally in the past three years in terms of sales and net profit growth.

🇨🇳 NIO HK/ADS Placement – Slightly Better Placed, but Slightly Bigger Deal at US$1bn (Smartkarma) $

NIO Inc (NYSE: NIO) is looking to raise around US$1bn via a primary placement in Hong Kong and US.

The company had last raised around US$450m in March 2025. The deal didn’t end up doing well.

In this note, we will talk about the placement and run the deal through our ECM framework.

🇨🇳 NIO (NIO US/9866 HK): An Opportunistically Timed US$1 Billion Raise (Smartkarma) $

NIO Inc (NYSE: NIO) , a Chinese premium electric vehicle manufacturer, has launched an equity offering to raise around US$1 billion.

The raise is opportunistically timed to take advantage of the 83% QTD share price rally and comes hot on the heels of a US$513 million raise in April.

While NIO continues to target a break-even in 4Q25 and reduce its cash burn, the valuation is stretched. A history of false dawns and intensifying competition warrants caution.

🇨🇳 Black Sesame throws down the gauntlet to Qualcomm in autonomous driving race (Bamboo Works)

The startup’s internally developed C1200 series chips can substitute for the U.S. giant’s higher-end offerings, forming a key plank to its expansion strategy

Black Sesame International Holding Ltd (HKG: 2533) continued to lose money in the first half of the year amid heavy spending on marketing and product development

The company posted strong revenue gains on the growing market for autonomous driving chips, and could further expand into the robotics arena

🇨🇳 Can Proya export its story to become a global makeup artist? (Bamboo Works)

China’s leading cosmetics maker is seeking a second listing in Hong Kong, aiming to boost its overseas expansion as its top-line revenue growth slows

Proya Cosmetics (SHA: 603605) is exploring a Hong Kong IPO to complement its existing listing in Shanghai, seeking capital for its push to become a top 10 global cosmetics player

Despite its big aspirations, growth for the company’s core skincare products has slowed this year after five years of strong gains

🇨🇳 Laopu Gold (6181 HK): Technical Overhang Masks Strong Fundamentals – Gold Bulls Stay Put (Smartkarma) $

Laopu Gold Co Ltd (HKG: 6181) is down nearly 20% since June’s lock-up expiry, despite strong 1H2025 results and subsequent analyst earnings upgrades.

The stock trades at 22x FY26E, the low end of its YTD P/E range, with a PEG below 0.8x.

China’s retail gold demand in 2Q2025 has shifted toward investment products – a trend that could support Laopu’s mostly investment-driven sales.

🇨🇳 Carlyle, HongShan, EQT Among Final Contenders for Starbucks’ China Business (Caixin) $

Starbucks Corp. has shortlisted four private equity bidders for a stake in its China operations and may select a new strategic partner as soon as October, according to people familiar with the matter.

The contenders are Boyu Capital, Carlyle Group Inc., HongShan Capital Group, and a consortium formed by Primavera Capital Group and EQT Partners. Starbucks is banking on the chosen firm to help it steer through an increasingly saturated and competitive coffee market on the Chinese mainland. Once dominant, the U.S. coffee chain has seen its lead eroded by rapid expansion from local players like Luckin Coffee (OTCMKTS: LKNCY) and Cotti Coffee. The size of the stake on offer hasn’t been disclosed.

🇨🇳 Budget Retailer Miniso Bets on Homegrown IP to Fuel Global Expansion (Caixin) $

MINISO Group Holding (NYSE: MNSO), the Chinese discount lifestyle retailer known for its “efficiency-first” model, is rewriting its playbook. The company is betting big on developing its own intellectual property (IP), seeking to turn original characters into global brands as it looks beyond low-cost retailing.

At the company’s second-quarter earnings call, Chief Executive Officer Ye Guofu said Miniso has signed nine trendy toy artists and will prioritize in-house IP development over licensing deals. “In the past, we didn’t have the awareness to build our own IP,” Ye said. “Now we recognize the value. We have strengths in product design, marketing and distribution. The only missing piece is original IP.”

🇨🇳 Two Chinese Medical-Device Makers Declare Bankruptcy After Winning Bulk-Buying Bids (Caixin) $

Two Chinese medical device firms have declared bankruptcy after successfully winning bids in a government-led bulk-buying program, a first-of-its-kind event that spotlights the intense financial pain inflicted by the state’s cost-cutting measures.

The Tianjin Medical Procurement Center announced recently that two companies selected in an inter-provincial alliance for orthopedic trauma products, Changzhou Dzhang Medical Device Co. and Changzhou Kangyu Medical Device Co., have gone bankrupt and can no longer supply their contracted products.

🇨🇳 Zai Lab under pressure over clinical results and rival drugs (Bamboo Works)

Shares in the Chinese biopharma firm have been pounded by disappointing trial results for a cancer drug and sluggish sales of its existing products

The survival benefits for a new gastric cancer drug, bemarituzumab, were weaker than expected in the final analysis of a Phase Three trial

The news unsettled investors, coming after Zai Lab Limited (NASDAQ: ZLAB)’s latest quarterly earnings also missed the mark

🇨🇳 China healthcare firms raise US$10.6 billion YTD (The Asset) 🗃️

Regulatory support, drug innovation hopes drive outperformance

China’s healthcare sector is enjoying a fundraising boom. From January to early September 2025, pharmaceutical companies in the country have raised a total of US$10.6 billion through initial public offerings ( IPOs ), follow-on deals, and block share placements, exceeding the combined amount raised from 2022 to 2024, according to data from Dealogic.

Hong Kong is the primary fundraising venue for Chinese pharmaceutical companies, with 10 issuers raising US$2.1 billion in the first half of 2025.

On the primary market, the most significant deal was the US$1.3 billion dual listing of Jiangsu Hengrui Pharmaceuticals Co (SHA: 600276), which became the largest-ever healthcare IPO globally by market cap. Other notable fundraising activities on the Hong Kong Stock Exchange ( HKEX ) were the US$975 million share placement by WuXi AppTec Co (SHA: 603259 / HKG: 2359 / OTCMKTS: WUXAY) in July and that of Hansoh Pharmaceutical Group Company (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF), which raised US$500 million in August.

🇨🇳 Fosun’s Portuguese makeover moves ahead with $360 million health disposal (Bamboo Works)

The conglomerate’s sale of 40% of Luz Saúde is its latest divestment in Portugal, though it continues to own major stakes of that and other assets in the country

Fosun International (HKG: 0656 / FRA: FNI / OTCMKTS: FOSUF / FOSUY) has raised $360 million by selling 40% of its healthcare asset in Portugal, continuing its strategy of strengthening its balance sheet through asset sales

Having survived a recent debt crisis, the conglomerate re-entered the dollar-bond market last year and issued $300 million in fresh notes this month

🇨🇳 In Depth: Returning to Its Roots Pushes China’s Agricultural Bank Up the Ranks (Caixin) $

🇨🇳 Shengjing Bank (2066 HK): Revised and Final Offer Remains Light (Smartkarma) $

Shenyang SASAC increased its Shengjing Bank Co Ltd (HKG: 2066 / FRA: 6SY) offer by 21.2% from HK$1.32 to HK$1.60 per H Share, a 40.4% premium to the undisturbed price.

The revised offer has been declared final. The revised terms signal that at least one of the substantial H shareholders would not accept the previous offer.

While the revised terms should ensure the support of key shareholders, the terms remain light. Therefore, there remains a risk around the 90% minimum acceptance condition.

🇨🇳 Jilin Jiutai RCB (6122 HK): Minorities Out of Options as the Offer Opens (Smartkarma) $

On 3 July, Jilin Jiutai Rural Commercial Bank (HKG: 6122) disclosed a voluntary conditional offer and delisting proposal by Jilin Province at HK$0.70. IFA opines it is fair and reasonable.

The IFA analysis is flawed, and the offer is unattractive. Nevertheless, the offer represents the best-case scenario for minorities, as the timeline for resuming trading remains uncertain.

While the 24 October vote on the delisting proposal should pass, the satisfaction of the minimum acceptance condition (90% of independent H shares) poses a challenge.

🇨🇳 TAL Education Group: What Is The Expected Impact Of AI-Powered Content & Learning Tools? (Smartkarma) $

TAL Education Group (NYSE: TAL) reported robust financial performance for the first quarter of fiscal year 2026, showcasing significant revenue growth while managing to improve operational efficiency.

The company recorded net revenues of $575 million, marking a 38.8% increase year-over-year, with a notable rise in gross margin from 51.7% to 54.9%.

Operating income improved significantly with TAL turning a previous operating loss into a profit of $14.3 million, demonstrating enhanced operational leverage and cost management.

🇨🇳 New Oriental Education Power Shift: How Will Non-Academic Tutoring Redefine Growth? (Smartkarma) $

New Oriental Education (NYSE: EDU) reported a strong performance in the fourth quarter of its fiscal year 2025, highlighting both positive advancements and some challenges that may impact their future outlook.

The company announced an 18.7% year-over-year revenue increase, excluding contributions from its East Buy segment, primarily driven by the expansion of new business ventures.

These ventures include overseas test preparation, which grew by 15%, and adult and university student services, expanding by 17%.

🇭🇰 SUNeVision profit rises, but near-term pressures worry investors (Bamboo Works)

The Hong Kong data center operator’s revenue rose 10% in its fiscal year through June, fueled by demand from AI applications and cross-border data traffic

Sunevision Holdings Ltd (HKG: 1686)’s revenue rose 10% to HK$2.94 billion in its latest fiscal year, while its net profit rose 8% to HK$980 million

The data center operator’s shares plummeted 13.8% after it published its latest annual results, though they remain up over 50% year-to-date

🇭🇰 Hong Kong Moves to Ease Capital Rules for Banks Holding Licensed Crypto (Caixin) $

Hong Kong’s de facto central bank is proposing a softer capital regime for banks holding certain digital assets, marking a significant step toward aligning with global norms while bolstering the city’s ambitions as a digital finance hub.

The Hong Kong Monetary Authority (HKMA) on Monday issued a consultation paper on a new supervisory policy manual module, CRP-1, which sets out how crypto assets should be classified under the Basel Committee on Banking Supervision’s global capital standards set to take effect in early 2026.

🇭🇰 Sun Hung Kai Properties: A Buy On Earnings Turnaround And Potential Catalysts (Seeking Alpha) $ 🗃️

🇭🇰 uCloudlink Group: Macro Pressure And Regulatory Worries (Seeking Alpha) $ 🗃️

🇭🇰 Zijin Gold IPO Preview (Douglas Research Insights) $

Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF)

Zijin Gold is getting ready to complete its IPO in Hong Kong this year. A successful IPO of Zijin Gold could fetch as high as US$3 billion in IPO proceeds.

Zijin Gold had sales of US$3.0 billion (up 32.2% YoY) in 2024. Net margin increased from 14.2% in 2023 to 20.8% in 2024.

There has been a sharp increase in the gap between gold AISC (all-in-sustaining cost) and gold price in the past year, leading to higher profit margins of gold producers globally.

🇭🇰 Zijin Gold IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Zijin Gold suggests implied EV of US$40.4 billion and market cap of US$42.9 billion.

Our EV/EBITDA valuation multiple of 14.3x is based on a 50% premium to the comps’ valuation multiple in 2026.

We believe a 50% premium valuation to the comps’ average EV/EBITDA multiple is appropriate for Zijin Gold mainly due its higher sales growth, EBITDA margins, and ROE than the comps.

🇭🇰 Zijin Mining: Gold IPO De-Risks, Copper Upside Remains (Smartkarma) $

Dilution: The gold IPO trims attributable EBITDA by ~3% as minority interests rise.

Parent Impact: Zijin parent emerges leaner, with net debt falling by US$4bn and copper now ~70% of EBITDA.

Valuation: At ~7× EV/EBITDA, the stock offers 15–30% upside on our estimates, stretching to 25–45% at spot.

🇲🇴 Macau casino GGR at US$554 million in first seven days of September, month on track for year-on-year double-digit growth: JPM (GGRAsia)

Casino gross gaming revenue (GGR) in Macau for the first seven days of September stood at MOP4.45 billion (US$554.4 million), representing a daily average of MOP635 million, suggested brokerage JP Morgan, citing industry checks.

“As well expected, this is softer than the July and August run-rates – MOP714 million per day – due to seasonality,” wrote analysts DS Kim, Selina Li and Lindsey Qian, noting that September has historically been among the weakest months of the year in Macau in terms of GGR performance.

“But the print still suggests double-digit growth from last September’s MOP575 million per day, indicating the sequential slowdown is within normal seasonality,” the JP Morgan team added.

🇲🇴 Macau premium mass remains robust, signs of recovery in grind mass: Citi (GGRAsia)

Banking institution Citigroup says its latest monthly survey of Macau casinos indicates that the premium-mass segment “remains robust”, with signs of recovery also seen in the grind mass business.

“Perhaps because we conducted our September 2025 survey right after school started, the number of premium mass players seen fell 18 percent year-on-year,” wrote analysts George Choi and Timothy Chau in a Sunday memo.

They added: “However, the 27-percent year-on-year increase in average wager per player – a metric to measure player quality – more than offsets it, translating to a 3-percent year-on-year increase in total premium mass wager observed.”

🇲🇴 Citi ups Macau’s casino GGR forecast to US$31 billion, on the strength of shows, side bets (GGRAsia)

Macau casino gross gaming revenue (GGR) may reach MOP248.6 billion (US$31.1 billion) in full-year 2025, representing a circa 10-percent growth year-on-year, suggested Citigroup in a latest memo. Such growth is expected to be driven by an array of concerts and events hosted by the city’s casino operators, and an “increasing popularity” of baccarat side bets in the Macau market, stated the institution.

The Citi team said: “We are also raising our 2026 GGR year-on-year growth forecast from plus 5 percent to plus 7 percent, (to) MOP265.5 billion or US$33.3 billion.”

The banking institution said concerts and events were a “proven model in Macau”, and one of the “key drivers” to fuel GGR growth in the market.

🇲🇴 Melco Resorts & Entertainment: It’s All About Deleveraging (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇲🇴 Fitch downgrades SJM Holdings’ outlook, flags ‘uncertainty’ regarding deleveraging efforts (GGRAsia)

Fitch Ratings Inc says it expects SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY)’s earnings before interest, taxation, depreciation, and amortisation (EBITDA) leverage to increase to over 8.0 times in 2025, up from 7.0 times last year. Such EBITDA leverage will “gradually” fall to below 5.0 times in 2027, suggested the rating agency in a Friday report.

In the memo, Fitch said it had revised the outlook on SJM Holdings’ long-term foreign-currency issuer default rating to ‘negative’ from ‘stable’, and affirmed the firm’s rating at ‘BB-‘.

“The negative outlook reflects heightened uncertainty around SJM Holdings’ deleveraging trajectory, as recent results indicate slowing EBITDA and cash flow improvement from the Grand Lisboa Palace resort (pictured),” wrote analysts Samuel Hui, Rebecca Tang, and Tyran Kam.

🇹🇼 Himax Technologies: Display Chips Priced For Mid Cycle (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: Attractively Valued AI Cornerstone (Seeking Alpha) $⛔🗃️

🇹🇼 TSMC And The Invasion Illusion (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇹🇼 Hon Hai Precision: Look Past August Top-Line Contraction (Seeking Alpha) $ 🗃️

🇰🇷 US Tariffs on Imports from Japan Lowered to 15% but Imports from Korea Are Unchanged at 25% – Why? (Douglas Research Insights) $

One of the biggest events in Korea in the past week has been the uncertainty regarding the US tariffs on South Korea which remains unchanged at 25%.

On top of this, it was reported on 9 September that the US tariffs on Japanese goods including cars and auto parts will be lowered to 15% by 16 September.

If Lee’s approval rating falls to about 45% to 50% range, then there could be a greater urgency by the Korean government to finalize a trade deal with the US.

🇰🇷 Korean companies admit cutting corners on US visas but say they have little choice (FT) $ 🗃️

Conglomerates shaken by immigration raid on Hyundai site

South Korean companies have routinely used unsuitable visas for workers sent to the US to build multibillion-dollar advanced manufacturing sites, according to Seoul-based executives and industry groups.

🇰🇷 POSCO Holdings: Korean Steel Giant At Crisis Poised For A Turnaround (Seeking Alpha) $ 🗃️

-

🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

🇰🇷 Many Reasons To Like KT Corporation (Seeking Alpha) $ 🗃️

🇰🇷 Gaming venue at Jeju Shinhwa World rebranded as ‘LES A Casino’ (GGRAsia)

Hong Kong-listed Shin Hwa World Ltd (HKG: 0582), the promoter of Jeju Shinhwa World, a resort complex with a foreigner-only casino on South Korea’s holiday island of Jeju, has announced the rebranding of the gaming venue at the complex. The gaming venue is now branded “LES A Casino”, replacing the “Landing Casino” moniker.

That is according to a press release sent to GGRAsia on Monday.

Shin Hwa World Ltd said it had been working on the rebranding efforts since 2022, following the inauguration of a new management team and a repositioning of its brand.

In late August, the Hong Kong-listed firm reported a net loss of just below HKD244.4 million (US$31.4 million) for the first six months of 2025, compared with a HKD231.5-million loss a year earlier.

🇰🇷 Ecopro Co: Pursuing a PRS Deal Worth About 700 Billion Won Using Its Stake in Ecopro BM (Douglas Research Insights) $

Several local news outlets reported that Ecopro Co Ltd (KOSDAQ: 086520) is pursuing a plan to raise about 700 billion won through a PRS agreement using its stake in Ecopro BM Co Ltd (KOSDAQ: 247540) as collateral.

Ecopro BM currently has a market cap of 11.4 trillion won. A PRS worth 700 billion won (assuming no change in share price), represents 6.1% of Ecopro BM’s market cap.

Although Ecopro has not officially announced this PRS deal, we believe that this is a high probability (70%-80%+) that this deal will get done in the next several weeks.

🇰🇷 Tender Offer of a 9.5% Stake of Sammok S-Form By Chairman Kim (Douglas Research Insights) $

Kim Jun-nyun (chairman of (formwork for construction and civil engineering works) Sammok S-Form Co Ltd (KOSDAQ: 018310)) is conducting a tender offer of 1.4 million shares (9.52% stake) in Sammok S-Form through affiliates of the company.

We believe that this tender offer signals one step closer to Chairman Kim Jun-Nyun and related parties eventually taking the company private.

The company’s net cash is nearly 73% of its market cap. The company is trading at dirt cheap valuation (EV/EBITDA of 0.6x).

🇰🇷 DB Hitek: Treasury Shares Cancellation, EB Issue, and Employees Equity Compensation (Douglas Research Insights) $

(2 world class wafer fabrication facilities) DB HiTek Co Ltd (KRX: 000990) announced a detailed plan for its 4.16 million treasury shares utilization (9.4% of outstanding shares), including shares cancellation, issuance of exchangeable bonds, and equity compensation for its employees.

There will be 2.22 million treasury shares that will be used in the issuance of EBs. This represents 54% of the total treasury shares and 5% of outstanding shares.

The company also plans to cancel 1.486 million treasury shares (representing 35.7% of treasury shares and 3.3% of outstanding shares).

🇰🇷 Nongshim’s Thriving Collaboration with Netflix and K-Pop Demon Hunters (Douglas Research Insights) $

K-Pop Demon Hunters (KDH) started streaming on Netflix on 20 June 2025. KDH has become the most watched film on Netflix history, achieving 291.5 million views as of 11 September.

NongShim Co (KRX: 004370) has a collaboration with Netflix, releasing ramyun and snacks featuring characters from K-Pop Demon Hunters. The sale of these products (especially overseas) are likely to result in higher sales.

Nongshim has hit a big home run in this collaboration with Netflix and the K-Pop Demon Hunters film. Additional series related to KDH are highly likely.

🇰🇷 Divorce Between SK Group Chairman Chey Tae-Won and Roh So-Young Coming to an End: Impact on SK Inc (Douglas Research Insights) $

More than eight years have passed since SK Chairman Chey first filed for a divorce from this wife Roh So-young in July 2017.

This divorce case has finally reached the Supreme Court of Korea. Although the final outcome still remains unknown, it appears that this divorce case is finally coming to an end.

We also provide an NAV analysis of SK Inc (KRX: 034730 / 03473K). Our NAV valuation of SK Inc suggests implied market cap of 24.1 trillion won which is 42% higher than current levels.

🇰🇷 Nongshim Holdings: NAV Valuation Analysis (Douglas Research Insights) $

(Food products and consumer goods) Nongshim Holdings Co Ltd (KRX: 072710) is part of our top 10 picks in our latest Korea Top 10 Picks Bi-Weekly.

Despite the recent share price appreciation, Nongshim Holdings’ price remains undervalued. Our NAV analysis suggests an implied price of 161,564 won per share which is 40% higher than current levels.

Nongshim Holdings’ 32.7% stake in Nongshim (NongShim Co (KRX: 004370)) is the largest component of the value (1 trillion won) which is nearly twice as high as Nongshim Holdings’ current market cap.

🌏 Asean IPO comeback – robust pipeline, liquidity-fuelled SGX (The Asset) 🗃️

China corporates seek diversification, dual listings, emerging markets undervalued

After years of listless primary market activity and a reputation for missing out on some of the region’s sought after listings, the Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) is mounting a quiet but convincing comeback in 2025.

The headline numbers help tell the story. SGX posted its strongest financial performance since listing in 2000, with full-year profit up nearly 16% to S$609.5 million ( US$472.73 million ) and revenue growing 11.7% to S$1.3 billion. Importantly, this upturn wasn’t driven by one-off gains, but broad-based growth across equities cash trading and derivatives.

Geopolitics is lending a hand too. With US-China tensions still simmering, a handful of Chinese healthcare and biotech firms are eyeing SGX as a neutral capital-raising venue. While it is not a surge, it could be a smart pivot for companies looking beyond Hong Kong or the US.

🇮🇩 Telekomunikasi Indonesia: Favorable Takeaways From Investor Events (Seeking Alpha) $ 🗃️

🇲🇾 Genting Malaysia’s EBITDA margin to remain ‘compressed’ until 2027: Fitch (GGRAsia)

Fitch Ratings Inc says it expects earnings before interest, taxation, depreciation, and amortisation (EBITDA) margin at casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) to “remain compressed at 23 percent from 2025 to 2027”.

The rating agency said that this was due to “higher operating costs and payroll-related expenses” in the company’s United Kingdom and United States operations.

It added: “This follows labour union contract renewals in the U.S. from the second half of 2024, and higher minimum wage (levels) and contributions to national insurance in the U.K., as mandated by the government. However, increased business volumes should mitigate the impact of higher operating costs and support margins.”

🇵🇭 PLDT: Fiercer Competition And Macro Headwinds Hammer Growth And Upside (Downgrade) (Seeking Alpha) $ 🗃️

🇵🇭 DigiPlus planning to acquire land-based casino but talks stalled: report (GGRAsia)

Philippine-listed licensed online gaming operator DigiPlus Interactive (PSE: PLUS) is reportedly seeking to acquire a land-based casino in the country as part of a plan to diversify into brick-and-mortar gaming.

The Manila Standard cited an unidentified source saying DigiPlus was trying to balance its online operations with a physical gaming venue, amid ongoing regulatory uncertainties regarding the domestic online gaming segment.

The person told the media outlet that DigiPlus had already identified a target and discussions were ongoing, but such talks had recently stalled.

🇸🇬 Grab Is Digital Infrastructure For Southeast Asia (Seeking Alpha) $ 🗃️

🇸🇬 5 Mid-Sized Singapore Companies That Reported Higher Revenue and Profits (The Smart Investor)

We rounded up five candidates that reported better revenue and profits, and you can determine if they deserve a place within your buy watchlist.

PC Partner Group Ltd (HKG: 1263 / SGX: PCT / OTCMKTS: PCPPF) is a global manufacturer of computer electronics, selling its own brand of products worldwide.

Hiap Hoe Ltd (SGX: 5JK) is a real estate group with a diversified portfolio of hospitality, retail, commercial, and residential assets.

Frencken Group Ltd (SGX: E28) is a global technology solutions company serving customers in the aerospace, analytical life sciences, automotive, healthcare, and industrial sectors.

Golden Agri-Resources (SGX: E5H / FRA: 4G3 / 4G3A / OTCMKTS: GARPF / GARPY), or GAR, is an integrated agribusiness that manages an oil palm plantation of around 534,000 hectares in Indonesia as of 30 June 2025.

Banyan Tree Holdings (SGX: B58 / FRA: 1O7 / OTCMKTS: BYNEF) is a global hospitality company with an extensive portfolio spanning 93 hotels and resorts, over 140 spas and galleries, and 20 branded residences.

🇸🇬 4 Singapore Mid-Cap Stocks That Raised Their Dividends (The Smart Investor)

During the recent earnings season, we noted that several mid-cap companies managed to raise their dividends in line with profit increases.

We shine a spotlight on these four businesses and investors can decide if they wish to add them to their buy watchlists.

Tiong Woon Corporation Holding Ltd (SGX: BQM), or TWC, is an integrated heavy lift specialist and service provider to the oil and gas, petrochemical, infrastructure, and construction sectors.

ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY), or CDG, is a transport operator with a comprehensive suite of transportation solutions.

PropNex (SGX: OYY) is Singapore’s largest real estate agency and offers integrated services such as real estate brokerage, training, and consultancy.

SBS Transit (SGX: S61), or SBST, is a leading bus and rail operator in Singapore which operates around 200 bus services with a fleet of 3,400 buses.

🇸🇬 Can ST Engineering Keep Flying High After Hitting Record Levels? (The Smart Investor)

Can STE’s strong performance continue, or does turbulence lie ahead?

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering or STE has seen its share price skyrocket to fresh all-time highs last month, driven by strong demand across the defence and aerospace sectors.

Will this strong performance continue, or does turbulence lie ahead?

Why ST Engineering has rallied

Strong tailwinds underpinning key segments

Risks and challenges

Get Smart: What This Means for Investors

🇸🇬 Is Singtel Still a Buy After Its Strong 2025 Rally? (The Smart Investor)

Is there any upside left for Singtel’s share price?

Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel has witnessed a significant jump in its share price year-to-date for 2025, outpacing the broader Straits Times Index (SGX: ^STI).

With an interest rate cut expected later this month, investors are asking one important question: is there any upside left for Singtel’s share price?

Singtel’s latest business update provides some clues.

Singtel’s 2025 Rally: What’s Driving the Momentum

The Bright Spots: Where Growth Is Coming From

The Headwinds: What Investors Need to Watch

Dividend and Capital Recycling

Get Smart: Still a Buy?

🇸🇬 Looking for Reliable Singapore Blue-Chip Stocks? These 4 Definitely Make the Cut (The Smart Investor)

🇹🇭 Thailand’s new PM Anutin opposes gambling as a means to boost economy (GGRAsia)

Thailand’s new Prime Minister, Anutin Charnvirakul, says the country will have to “wait for another prime minister” should gambling be considered a means “to stimulate the economy”.

Mr Anutin said on Wednesday that he was considering a review of poker’s current legal status. On July 23, the Sports Authority of Thailand approved the classification of poker as a sport eligible for registration.

Following his election on September 5 as the country’s new prime minister, Mr Anutin vowed to hold fresh elections to select a new government.

🇮🇳 Amber Enterprises: Implication of Rs 1,200 Crore Infusion in Iljin Electronics from PE (Smartkarma) $

Amber Group’s (Amber Enterprises (NSE: AMBER / BOM: 540902)) electronics arm, ILJIN Electronics, has raised Rs 1,200 crore in its first-ever institutional fundraise, led by private equity firm ChrysCapital and supported by InCred Growth Partners.

This capital infusion accelerates ILJIN’s organic expansion & supports its strategic inorganic growth ambitions, positioning the company as key beneficiary of India’s push for self-reliance under PLI and ECMS schemes.

The fundraise is a powerful validation of Amber’s strategic pivot towards high-growth EMS sector, paving the way for sustained, multi-year growth and a potential re-rating of the consolidated entity.

🇮🇳 Vedanta’s Risky Diversification into JP Associates; Instead of Debt Reduction (Smartkarma) $

Vedanta (NSE: VEDL / BOM: 500295) recently emerged as the highest bidder in a fiercely competitive auction to acquire Jaiprakash Associates Limited (NSE: JPASSOCIAT / BOM: 532532), a key player in the Indian infrastructure sector.

With an offer of INR 17,000 crore, Vedanta secured the company’s assets under the National Company Law Tribunal (NCLT) resolution process.

While the deal presents an opportunity for Vedanta to expand its footprint in diverse sectors, several factors raise concerns about the financial sustainability and strategic risks associated with this acquisition.

🇮🇳 Kotak Mahindra Bank Placement – SMBC’s Kotak Exit to Power Yes Bank Entry (Smartkarma) $

Sumitomo Mitsui Banking Corporation (SMBC) aims to raise around US$700m via a cleanup of its 1.65% stake in Kotak Mahindra Bank (NSE: KOTAKBANK / BOM: 500247).

SMBC received RBI’s approval last month to buy a 24.99% stake in Yes Bank (YES IN). As per media reports,the cleanup is to procure funds for its Yes Bank stake.

In this note, we run the deal through our ECM framework and comment on deal dynamics.

🇮🇳 Urban Company IPO: Will India’s Home Services Giant Clean Up on the Dalal Street? (Smartkarma) $

India’s home services market, valued at INR 5,210 billion, is projected to reach INR 8,580 billion by FY2030 at a CAGR of 10–11% .

Urban Company‘s core Indian business has turned profitable, with its EBITDA for this segment improving from a 9.72% loss in FY23 to a 3.30% profit in FY25.

The company’s annual consumers grew from 4.76 million in FY2023 to 6.5 million in FY2025, while average spend rose from INR 3,786 to INR 4,079 during the same period.

🇮🇳 Dev Accelerator IPO Review: Tier 2 Focus, Backward Integrated Player (Smartkarma) $

Dev X planning to double the operational capacity in next two years.

Company is also planning to repay certain debt, while its tier-2 focus and backward integration provides them edge over its peers

Operationally, they are better than peers, evident from longer period lease and high occupancy rates

🇮🇳 Exiting the Long Position “pain Trade” on Union Bank of India; Stick with Long Position on Baroda (Smartkarma) $

We cut our losses on our long position on Union Bank of India (NSE: UNIONBANK / BOM: 532477), whilst sticking with our core conviction buy name Bank of Baroda Ltd (NSE: BANKBARODA / BOM: 532134)

UBI has a slightly higher structural credit risk profile than Baroda, in our view, with UBI’s slightly bigger share of exposure to agriculture and MSME credit

Baroda is now our sole buy in Indian banks; it has lesser credit quality headwinds than UBI for similar valuations, whilst having potential to expand returns over the medium term

🇮🇱 Elbit Systems: Growth Prospects With Limited Upside (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇹🇷 Marti: Unlocking Ride-Hailing Growth In Türkiye With Bitcoin Exposure (Seeking Alpha) $ 🗃️

-

🇹🇷 Marti Technologies Inc (NYSEAMERICAN: MRT) – Ride-hailing service + owns and operates a large fleet of e-mopeds, e-bikes & e-scooters. 🇼

🇯🇴 International General Insurance: A Great Opportunity In The Insurance Industry (Seeking Alpha) $ 🗃️

🇹🇷 Turkish stocks rally after court delays case against opposition leadership (FT) $ 🗃️

🇿🇦 Anglo American’s Strategic Journey: From Restructuring To Copper Champion (Seeking Alpha) $ 🗃️

-

🌐 Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) – World’s largest primary producer of platinum metals (platinum, palladium, rhodium, iridium, ruthenium & osmium; base metals as in copper, nickel, cobalt sulphate, sodium sulphate & chrome; & precious metals as in gold). 🇼 🏷️

🇵🇱 InPost: Long-Term Growth Story Remains Intact (Seeking Alpha) $ 🗃️

🌎 Where is the anti-incumbent wave going? (Latin America Risk Report)

It’s always possible to say that every country is different and only local conditions matter. But regional trend maps are more fun.

If you look at a map of Latin American elections from 2018 to 2023, the narrative is fairly clear. The hemisphere (also reflected globally) went through an anti-incumbent wave that provided a clear regional trend.

🌎 Millicom: Update After Q2’25 With A Change (Rating Downgrade) (Seeking Alpha) $⛔🗃️

-

🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🌎 DLocal: Back To High Growth And Take Rate Improved (Seeking Alpha) $ 🗃️

🌎 My thoughts on $DLO CEO Pedro Arnt’s interview at the Goldman Sachs technology conference (Rose’s Substack)

I spent some time listening to Pedro Arnt talk about Dlocal (NASDAQ: DLO) and it made me think about how different this company looks today. It is not just a LatAm payments story anymore. It feels more like a scaled infrastructure business that is spreading across emerging markets.

The market is messy. Too many small fintechs chasing pieces of the pie, most of them not built to last. That creates price pressure but it also creates consolidation. Scale wins here. Merchants do not want to deal with the payments, the taxes, the regulations in each country. They just want someone to handle it. $DLO is that someone.

Brazil and Mexico are back to growing after a weak 2024, but the bigger story now is outside LatAm. Africa, the Middle East, and Asia are already 25% of revenue and climbing. That makes the company less dependent on one region and smooths out the ups and downs.

🇦🇷 Argentine Bulls May Return, So Choose Your Weapon – equity, bonds, or options (TheOldEconomy Substack)

September LatAm Report: The Argentinean Edition

In today’s LatAm market review, I will discuss Argentina’s capital markets through the lens of the TFC. The Southern Cone was also the central theme in the August report. Since then, two events have unfolded: Movimiento al Socialismo (MAS) lost in Bolivia, one of the region’s leftist strongholds; and La Libertad Avanza was defeated in the Buenos Aires elections.

Almost all Argie equities are down YTD, and the BA elections amplified the pressure. Golar LNG (NYSE: GLNG), as a high-order bet on Milei’s success, was hammered last week. MercadoLibre (NASDAQ: MELI) is an exception, but its operations are scattered across the continents, so the company’s performance is not tied only to Argentina.

On the equity front, the situation is tempting. Even the fastest horse got beaten, and the banking giants Grupo Financiero Galicia Sa (NASDAQ: GGAL), Bbva Argentina (NYSE: BBAR), and Banco Macro Sa (NYSE: BMA) are interesting again. Real estate conglomerate IRSA Inversiones y Representaciones Sociedad Anónima (NYSE: IRS) is also a good proposition at the current stock price.

🇦🇷 Argentine markets slump after Milei loses badly in Buenos Aires (FT) $ 🗃️

Investors worry provincial election defeat will undermine president’s reform agenda

Dollar bonds dropped about five cents on the dollar, some of the biggest losses since before Milei secured a $20bn IMF bailout this April.

Argentina’s Merval stock index, already the worst performing market in dollar terms among almost a hundred major global bourses this year, was down nearly 10 per cent on Monday.

🇦🇷 Unlocking Value In Argentina: Why IRSA’s Assets Still Trade Below NAV (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Americas: Turning Nevada Into America’s Lithium Powerhouse (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Argentina: Playing A Lithium Bottom (Seeking Alpha) $⛔🗃️

🇦🇷 Grupo Financiero Galicia: Prepare For Volatility As Argentina Faces Political Turmoil (Seeking Alpha) $ 🗃️

🇦🇷 Galicia: The Sell-Off Created A Buying Opportunity As The Long-Term Prospects Remain Strong (Seeking Alpha) $ 🗃️

🇦🇷 Cresud Is Not Attractive Unless You Consider Farmland Is Very Undervalued (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres At Its Worst Juncture, Equity Dilution Seems Very Possible (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres Crop Solutions: Waiting For Gross Profit To Turn (Downgrade) (Seeking Alpha) $🗃️

🇦🇷 Banco Macro: Should You Buy The Dip? (Seeking Alpha) $ 🗃️

🇧🇲 Bank of N.T. Butterfield & Son Battles Slow Growth With Greater Buybacks (Seeking Alpha) $⛔🗃️

🇧🇷 TikTok Shop Brazil GMV grew close to US$50m in August (Momentum)

In May 2025, TikTok Shop officially launched in Brazil, its second market in Latin America after Mexico. Within 3 months, its monthly GMV grew 25 times from US$1 million to US$25.7 million.

In August, TikTok Shop’s Brazil GMV almost doubled from July, reaching US$46.1 million.

Momentum Works and Tabcut have been tracking TikTok Shop’s global performance. We recently jointly released TikTok Shop in the U.S. H1 2025 report, with data from Tabcut and analysis by Momentum Works.

For an overview of TikTok Shop’s overall trajectory in Southeast Asia, you can refer to the recently released Ecommerce in Southeast Asia 2025.

Brazil is another market we are closely tracking – now that the August data is out, here are a few key takeaways.

🇧🇷 Patria Investments: Strong Fundraising, Cheap Valuation, Big Upside (Seeking Alpha) $ 🗃️

-

🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇧🇷 BrasilAgro Closed Its Third Year Of Operational Challenges, And Remains Unattractive (Seeking Alpha) $ 🗃️

🇧🇷 Why Nu Holdings Stands Out Among Global Fintechs (Seeking Alpha) $ 🗃️

🇧🇷 Nu AI Private Banker! (Global Equity Briefing)

Bridging the knowledge gap between the 1% and the 99%.

Last week, I again listened to Nu Holdings (NYSE: NU)’s CEO, David Velez, interview on their YouTube channel and felt a need to write an article on one of the most important services that they are building.

Nu is building an AI-powered Private Banker!

🇧🇷 Itaú Investor Day 2025: The Bank Will Start An Unimaginable Repositioning (Seeking Alpha) $ 🗃️

🇧🇷 BRF S.A.: The Potential Merger With Marfrig Makes It Interesting (Seeking Alpha) $ 🗃️

🇰🇾 Consolidated Water: Rally Has Pulled Forward Returns (Downgrade) (Seeking Alpha) $ 🗃️

-

🇰🇾🌎 Consolidated Water Company Ltd (NASDAQ: CWCO) – Designs, builds, operates & in some cases finances seawater reverse osmosis (SWRO) desalination plants & water distribution systems in several Caribbean countries. 🏷️

🇲🇽 Mexico to slap 50% tariff on Chinese cars under US pressure (FT) $ 🗃️

World’s biggest buyer of Chinese autos seeks to preserve US free trade deal

The measure is buried in a list of tariffs proposed in a draft bill to congress on roughly 1,400 products, from textiles to steel, that will apply to all countries with which Mexico does not have a trade deal. But Chinese cars were by far the biggest import affected by the tariffs, said Gabriela Siller, chief economist at Banco Base.

🇵🇦 Copa Holdings: Take Advantage Of Mr. Market’s Confusion (Seeking Alpha) $ 🗃️

🌐 Nebius Group (NBIS): Microsoft Deal and Updated Valuation Model (MVC)

As I anticipated several times, Nebius Group NV (NASDAQ: NBIS) has finally signed its first contract with a Big Tech company.

In my list of catalysts from three months ago, I highlighted the New Jersey data center as a critical one, specifically because it would enable Nebius to land a transformational deal with a major tech corporation, whether a hyperscaler or a frontier AI lab.

That moment has arrived. Nebius just announced a $17.4–19.4B contract over five years with Microsoft to deliver dedicated capacity from its new Vineland, New Jersey data center, starting later this year.

Let’s dive into it.

🌐 Nebius Stock: Set For Hyperscaler Glory (Seeking Alpha) $ 🗃️

🌐 Nebius’ Explosive Upside Meets Mounting Fears (Seeking Alpha) $ 🗃️

🌐 Nebius Group: The Bubble That Wasn’t, Microsoft Just Proved You Wrong (Seeking Alpha) $ 🗃️

🌐 Nebius: AI Bubble Reaches Extreme Greed Stage (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Deal Changes Everything (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Deal Is A Game Changer, Don’t Quit Now (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Deal Is A Positive That’s Been Priced In (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: I Was Wrong, It Is Growing Into Something Special (Seeking Alpha) $ 🗃️

🌐 Nebius: 5 Top AI Stocks Roadmap, Year-End 2025 (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Home Run (Seeking Alpha) $ 🗃️

🌐 Nebius Jumps On The Microsoft Deal – It’s A Real Game Changer (Seeking Alpha) $ 🗃️

🌐 Nebius: Breaking Down The Microsoft Deal (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Buys In, Here’s What Comes Next (Seeking Alpha) $⛔🗃️

🌐 Nebius: Microsoft Contract Resets Multiples (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: Microsoft Deal Crushes Bear Thesis; A Bear Turns Bullish (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

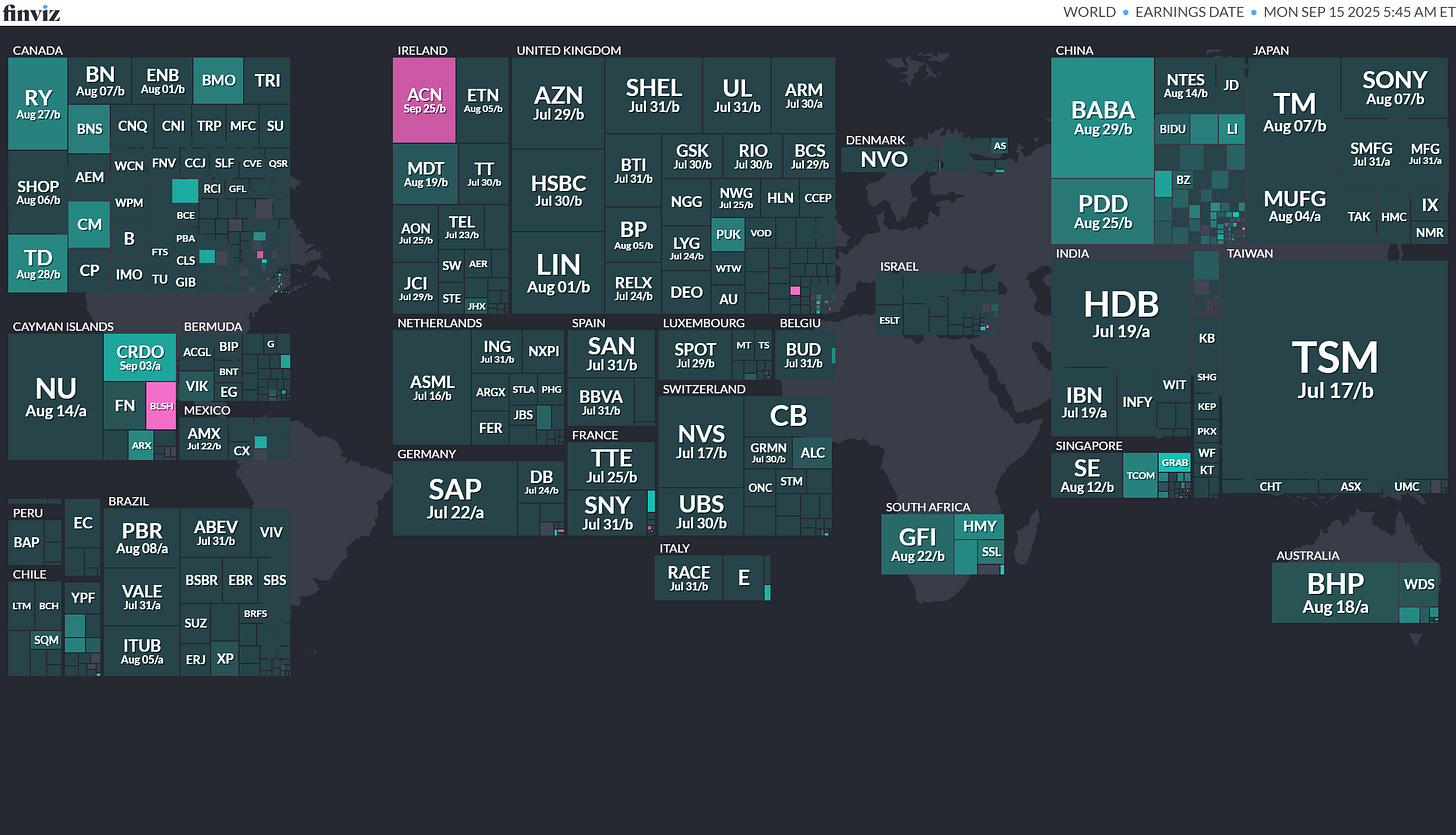

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png" width="1117" height="577" data-attrs=""src":"https://substack-post-media.s3.amazonaws.com/public/images/1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":577,"width":1117,"resizeWidth":null,"bytes":104793,"alt":null,"title":null,"type":"image/png","href":"https://www.electionguide.org/#","belowTheFold":true,"topImage":false,"internalRedirect":"https://emergingmarketskeptic.substack.com/i/173646707?img=https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png","isProcessing":false,"align":null,"offset":false" alt="" srcset="https://substackcdn.com/image/fetch/$s_!4qew!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 424w, https://substackcdn.com/image/fetch/$s_!4qew!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 848w, https://substackcdn.com/image/fetch/$s_!4qew!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 1272w, https://substackcdn.com/image/fetch/$s_!4qew!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 1456w" sizes="auto, 100vw" loading="lazy" class="sizing-normal"/>

media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png" width="1117" height="577" data-attrs=""src":"https://substack-post-media.s3.amazonaws.com/public/images/1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":577,"width":1117,"resizeWidth":null,"bytes":104793,"alt":null,"title":null,"type":"image/png","href":"https://www.electionguide.org/#","belowTheFold":true,"topImage":false,"internalRedirect":"https://emergingmarketskeptic.substack.com/i/173646707?img=https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png","isProcessing":false,"align":null,"offset":false" alt="" srcset="https://substackcdn.com/image/fetch/$s_!4qew!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 424w, https://substackcdn.com/image/fetch/$s_!4qew!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 848w, https://substackcdn.com/image/fetch/$s_!4qew!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 1272w, https://substackcdn.com/image/fetch/$s_!4qew!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ae37fb2-c774-4622-a73d-447e762884d0_1117x577.png 1456w" sizes="auto, 100vw" loading="lazy" class="sizing-normal"/>Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Rise Smart Group Holdings Ltd. RSHL American Trust Investment Services/Prime Number Capital, 1.8M Shares, $4.00-4.00, $7.2 mil, 9/16/2025 Tuesday

We are a holding company whose operating subsidiary, Rise Smart Holdings Limited, provides educational services to local students who are seeking secondary education and higher education studies in the United Kingdom (UK), Australia, Canada and New Zealand. (Incorporated in the Cayman Islands)

Our mission is to become the leading overseas studies consultancy service provider in Hong Kong. We strive to provide one-stop services that cater to students’ overseas studies needs.

We believe that the following strengths have contributed to our success and are differentiating factors that set us apart from our peers.

• Established track record: In our operating history of more than 15 years, we have focused on providing overseas studies consultancy services and built up our expertise and track record in overseas studies consultancy. We devoted substantial efforts to expanding our network of overseas education providers. We take pride in our network in successfully placing students with the overseas education providers. Through our quality of service and continued marketing efforts, we believe we have established our reputation as a reliable overseas studies consultancy services provider in Hong Kong.

• One-stop service to cater to students’ overseas studies need: We provide a one-stop service to cater to students’ overseas studies needs by offering a wide range of services to students before and after their placement to overseas education providers. In 2018, we expanded our service offerings to provide value-added services such as tutoring and visa consultation to students. We believe that by providing a one-stop service to the students we can ensure their satisfaction and eliminate the hassle of looking for other service providers.

• Established network of subagents: Since 2018, we have been establishing business relationships with subagents, which include overseas studies consultancy service providers and individuals, who refer students seeking overseas studies with overseas education providers who we have a business relationship with. Since 2021, we have been actively cooperating with subagents to enhance our market presence among students. We believe having a wide network of subagents allow us to reduce reliance on word of mouth referrals from students and parents, while enabling us to broaden the base of potential students whom we can serve and ensure a stable revenue stream.• Experienced and dedicated management and education consultants: Our management team has extensive knowledge and experience in providing overseas studies consultancy services in Hong Kong. Mr. Kin Cho Li, our Chief Executive Officer and Chairman, has approximately 15 years of experience in the overseas studies consultancy service industry. We believe our management and our education consultants understand the needs of students and their parents well to offer them suitable study programs, assist them with their applications, and offer them value-added services to cater to their individual needs. We plan to expand our presence in North America by setting up regional offices in major cities in Canada and/or the U.S.. We plan to selectively pursue mergers and acquisitions, investments, and corporations with local companies to deepen our connection with local education service providers. We will also explore the possibility of forming strategic partnerships with other overseas education consultancy service providers in Hong Kong with a strong establishment in North America to expand our service coverage in North America in a swift and effective manner. We plan to invest in our technological platform by upgrading the function and capabilities of our existing information technology system by (i) investing in the use of artificial intelligence in the recommendation of overseas education providers to students in the application process; and (ii) improving our existing data related technology in relation to student relationship management and commission management. Such improvements will increase the likelihood of our successful placement and enable our management to closely monitor and manage each student’s case to provide the best possible services to them.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: American Trust Investment Services and Prime Number Capital are the lead joint book-runners, replacing Pacific Century Securities and Revere Securities.)

(Note: Rise Smart Group Holdings Ltd. filed its F-1 on May 13, 2024. The Hong Kong-based company submitted confidential IPO documents to the SEC on Aug. 25, 2023.)

DT House Ltd. DTDT American Trust Investment Services/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/17/2025 Wednesday

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point o its range.)

Regentis Biomaterials, Ltd. RGNT ThinkEquity, 1.0M Shares, $10.00-12.00, $11.0 mil, 9/18/2025 Thursday

We are a regenerative medicine developing orthopedic hydrogel implants. (Incorporated in Israel)

We are a regenerative medicine company dedicated to developing innovative tissue repair solutions that seek to restore the health and enhance the quality of life of patients. Our current efforts are focused on orthopedic treatments using our Gelrin platform based on degradable hydrogel implants to regenerate damaged or diseased tissue. Gelrin is a unique hydrogel matrix of polyethylene glycol diacrylate (a polymer involved in tissue engineering) and denatured fibrinogen (a biologically inactivated protein that normally has a role in blood clotting).

Our lead product candidate is GelrinC, a cell-free, off-the-shelf hydrogel that is cured into an implant in the knee for the treatment of painful injuries to articular knee cartilage. GelrinC was approved as a device, with a Conformité Européene, or CE, mark in Europe, in 2017 (number 3900600CE02); we plan to identify strategic partners in Europe to bring our product to market. While we currently do not have any strategic partners in place in Europe, we plan to engage strategic partners in Europe in the future.

With GelrinC, we aim to bring to market a product for the therapy of an unmet need for the large market of cartilage injuries in the knee. Because GelrinC serves as an impenetrable barrier that stops cells from migrating away from the wound’s edges, we believe our product is the only product that helps to regenerate cartilage inwards from the edges of the cell walls. Creating new contiguous tissue is not the natural, lowest energy, alternative for cartilage cells. If such cells were left alone, they would tend to migrate and either not create new cartilage tissue or create cartilage tissue that is fibrotic (containing an excessive deposition of extracellular matrix, leading gradually to the disturbance and finally to loss of the original tissue architecture and function). By GelrinC creating such impenetrable barrier and thereby preventing the migration of the cells, the cells are forced to take a different route of creating aggregate and contiguous tissue. Unlike GelrinC, cellular products used by competing companies require a plug of two layers of which the lower layer is a mineral scaffold, which is a foreign body material that has been engineered to be inserted into the bone tissue even though the bone is often healthy. Additionally, GelrinC does not have any biological activity. As a result, we believe our product offers a simple and economic procedure, which we believe will allow patients to recover quickly with potentially long-term outcomes.

Note: Net loss and revenue are for the 12 months that ended June 30, 2024.

(Note: Regentis Biomaterials, Ltd. increased its IPO’s size to 1.0 million shares – up from 909,090 shares – and kept the price range at $10.00 to $12.00 to raise $11.0 million, according to its S-1/A filing in May 2025. Initial Filing: Regentis Biomaterials, Ltd. is offering 0.9 million shares (909.090 shares) at a price range of $10.00 to $12.00 to raise $10.0 million, according to the company’s S-1 filing dated March 11, 2025.)

Megan Holdings Ltd. MGN D. Boral Capital (ex-EF Hutton), 2.5M Shares, $4.00-6.00, $12.5 mil, 9/19/2025 Friday

We are a company principally engaged in the development, construction and maintenance of aquaculture farms and related works. (Incorporated in the Cayman Islands)

Our operations are based in Malaysia. Since our inception in 2020, we have strived to establish ourselves as a trusted and experienced provider of shrimp farm-related maintenance services in Malaysia. As of the date of this prospectus, we have been carrying out a series of upgrading and maintenance work projects for aquaculture farms, all of which are located in Tawau, Sabah, Malaysia. This constitutes 71.8%, 43.7% and 15.5% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. Besides that, we also carried out upgrading work for a pineapple plantation farm located at Kota Tinggi, Johor, Malaysia in 2022 and 2023. This constituted nil, 25.3% and 22.6% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

Complementary to our upgrading and maintenance services, we also assist customers with the design and development of new farms. As of the date of this prospectus, we are currently involved in the development and construction of a shrimp hatchery center in Semporna, Sabah, Malaysia, where we have been engaged to undertake the construction of hatchery buildings and related functional facilities. We are also assisting in the development of a 111-acre shrimp farm at Tawau, Sabah, Malaysia. The design and development of new farms comprised 22.2%, 16.4% and 61.7% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. From time to time, we also assist our customers in sourcing for building materials and machinery available for rental for use on their farms. This comprised 6.0%, 14.6% and 0.2% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

With our wide suite of services and diverse revenue streams, we are well-positioned to serve customers as a one-stop center for their aquaculture and agriculture needs.