2 Warren buffett stocks to avoid stocks and 1 person who purchased a fist 1

Most of them are always worth buying. Sometimes, even Omaha’s Oracle misses what is important.

If you need a new stock choice, you can always borrow an idea. Berkshire Hathaway‘S (BRK.A 0.55%)) (Brk.b 1.06%)) Warren buffett himself Holdings portfolio. And you have to. If you have enough time, Berkshire stocks are more than a wide range of markets than a wide range of markets due to the investment of large companies in public trading companies.

But not all Berkshire Hathaway holding is always a big purchase. Sometimes they have been evaluated too steep by new immigrants, and in other cases, they were just a clunker.

As a background, two Warren buffett stocks, which may feel good about today’s purchase, are in detail, but the name is one of the names you want to avoid until the big change is better.

Image Source: The Motley Fool.

Purchase: American Express

Many investors do not recognize credit card costumes through the destruction of other possessions and self -growth. American Express (AXP 0.55%)) It is currently the second largest stock holder of Berkshire Hathaway and accounts for 17%of its open stock portfolio. Emphasizing this strength Visa and MasterCardBut both were chosen to maintain a much smaller position.

Again, since the first position in the 1990s, it is not difficult to know what Oracle in AMEX has seen. It is not a paid broker like the master card and visa mentioned earlier. It operates the entire consumption ecosystem, as well as payment processors, as well as card issuers, and at the same time, some members will pay up to $ 900 per year to hold plastics. This privilege includes hotel accommodation and credit for riders, cash refunds for food purchases, and discounted entertainment. Some tried, but I couldn’t successfully duplicate any rivals.

Of course, the card holders of the American Exchange tend to be a bit richer than the average, so it is worth pointing out that it is amazing by most economic soft patches. As pointed out in the second quarter despite the turbulent economic background, Stephen Squeri, CEO of Stephen Squeri, “Our second quarter results continued to maintain strong driving force in the business in the last few quarters, and sales increased 9 % year -on -year to $ 17.9 billion and adjusted 17 %.”

Purchase: Kroger

Berkshire is not a major retention, and not a lot of Buffett (or others about the problem). but Croan (KR -0.08%)) Quietly, Berkshire Hathaway is one of the best stocks.

You know the company. Kroger has $ 150 billion in $ 150 billion in 2,731 stores with $ 115 billion in sales. Oh, it does not grow very quickly or not gain much profit. This year’s top -level growth is likely to lead to an operating income of less than $ 5 billion. It is just the essence of well -saturated low margin food business.

But the lack of growth firepower for Kroger complements the amazing consistency.

The unstable food business is not exactly in itself, but the company has not only gained meaningful annual profits for more than 10 years, but also doubled the conclusions. It was very helpful to maintain relevance by doing the same thing as entering the e -commerce area.

The growth of groceries is not impressive, but more importantly for investors, we have found other ways to create considerable shareholder value. For example, dividends for each quarter have increased by 250% over the last decade. For example, the number of unprecedented Kroger stocks has increased to a roughly reduced stock repurchase. In fact, reinvesting Kroger’s dividends in more stocks of more and more stocks that have been insufficient in the last 30 years would have surpassed investments. S & P 500 During this stretch.

Avoid: unitedhealth group

Finally, Buffett wanted to jump into a small position in Beleaguered Health Insurer. Unitedth group (UNH -0.37%)) A few weeks ago, you may not want to do the same yet.

But first first.

Yes, there is a drama here. Unitedhealth stocks began with the amazing tribe of one -quarter scoring estimates from April and started in May with the sudden resignation of CEO Andrew Witty. In July, the company confirmed that the US Department of Justice was investing in the Medicare claim. In the second half of the same month, the second quarter of income missed the analyst’s estimates due to the same repayment costs that bother the results in the first quarter. All of the UNH stocks fell 60% in mid -year, from peak to tropes.

As Buffett says, of course, you should be afraid when others are greedy and greedy when others are afraid. He received his advice and plead with the company’s stake in a long -established company that could overcome all the recent problems. Berkshire currently owns 5 million shares of UNH, which is worth less than $ 2 billion.

Perhaps this is one of the times when Buffett’s lead does not follow. For example, UNITEDHELTH’s Medicare business suffered similar legal issues in 2017. For example, the Pharmacy Management ARM OPTUMRX was accused by the Federal Trade Commission last year for artificially expanding insulin prices. It will also be naive that the federal government is closely investigating all aspects of the national medical industry.

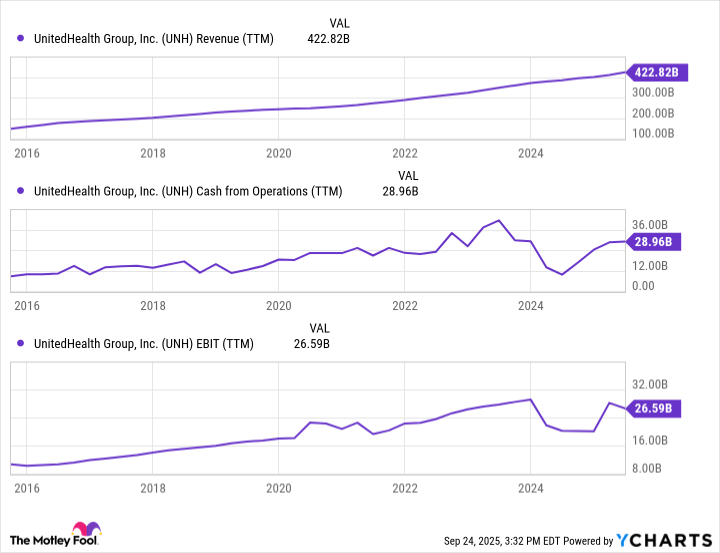

Unitedhealth continued to grow the highest line for more than 10 years, but actual operating profit and EBITDA stopped growing early last year, but recently stopped growing early last year without calculating the unexpected surge of medical expenses.

YCHARTS’s UNH Import (TTM) Data

What do you offer? The entire medical industry may be at the point where you speak, not a good way. This is not necessarily fatal to United Health, but it will undermine its value to investors. If nothing else, you can wait for the side job to settle the proverb before following Buffett with this uncertain trade.