Reasons for the role of Starbucks in my portfolio -Is there a better investment in income and growth?

After five years, I have been chasing where I thought.

In June 2020, I was happy to invest in one of my favorite consumer brands: coffee giant Starbucks (SBUX -0.36%)). However, after poor performance, S & P 500 For these five years, with a wide range of margins, I have been in my portfolio to reconsider its role.

I believed that STARBUCKS stocks would provide my portfolio with a harmony of growth and income. For growth, I was optimistic that the company’s business would quickly rebound and unlock much higher income in China. It didn’t happen. It’s time to shake the white flag here because we are looking for strategic options for China’s business.

https://www.youtube.com/watch?v=56ci0tjooq0

Starbucks was not disappointed with regard to income. Dividend payments are increasing every year and have been working for 14 years. And at the time of this article, the dividend yield is nearly 3%, which is closer to the highest place.

Therefore, we cannot actually complain about the dividend income of Starbucks stocks. But growth was lacking. Returning to the beginning of the epidemic, Starbucks average an annual growth rate (CAGR) on average for profit. This is often not enough to promote the market performance of marketing markets. Question: Can you find similar dividend payments that provide better growth? There are actually several options.

1. Academy sports and outdoor

There are only 300 sporting goods retailers Academy sports (ASO 1.77%)) Easy to overlook. But if the management had that way, the company could have a better growth than Starbucks here.

Perhaps the biggest way for Academy Sports to lead profit growth is to open a new store. We hope to open up to 25 regions this year. We have already opened eight by the end of the second quarter of 2025. Past guidelines suggest that the company plans to open about 150 additional locations by the end of 2028.

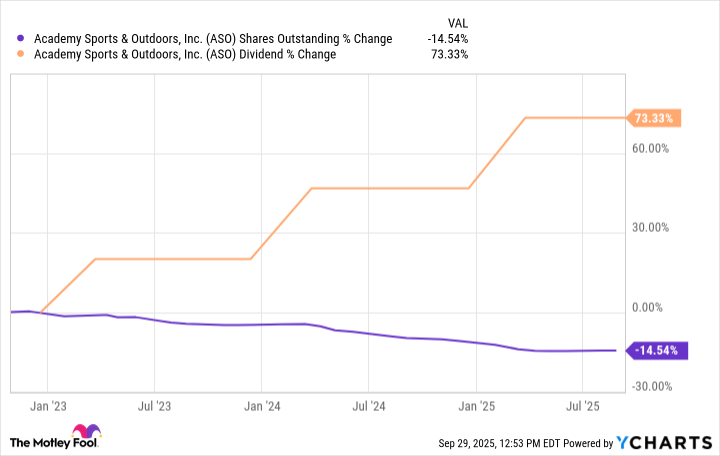

This new store opening can allow academy sports to provide two -digit growth rate in the next few years. Executives are well -known for systematically returning cash to shareholders. It purchased stocks, and dividends by quarter have grown at a good speed in recent years.

ASO shares the unprecedented data of YCHARTS.

Academy Sports, which has a dividend yield of only 1%, does not attract income investors today. However, long -term people hope to ride the company’s growth plan with much higher income on time, which can lead to higher dividend income.

2. Gold arch

Restaurant chain Golden arch (Ako -0.30%)) I own the right to McDonald’s The brands in 21 countries in Latin America and Caribbeans allow you to own and operate the franchise location and operate lower franchises for other operators. With more than 2,400 areas, this is the largest independent McDonald’s franchise.

The difference in exchange rates is masking two -digit sales growth of Arcos Dorados. In the second quarter of 2025, the company reported 3% year -on -year growth. However, adjusting currency fluctuations increased by 15%. This includes the same store sales growth and contributions to new restaurants.

Arcos Dorados shares with 3.5% dividend yields are more attractive than Starbucks stocks with imported investment. The company also paid a small part of income by dividends, leaving enough space for future growth.

About one -third of the location of Arcos Dorados is lowered. And like McDonald’s itself, Arcos Dorados generates some profits from franchises through rental income. It owns nearly 500 lands and buildings. The real estate class for business can make more powerful investments than other restaurant companies.

3. Would you like to stick to Starbucks?

Through investment experience, I learned how to sell stocks only after spending a lot of time to think about it. Therefore, we think that we sell Starbucks stocks, grow faster and buy alternatives that still provide imports, while this is not a completed deal. In fact, I have a reason to continue to hold Starbucks stocks.

It’s been a year since Starbucks hired a new CEO Brian Niccol and is still trying to revitalize the brand. It begins by regaining the more attractive coffee house atmosphere. The company announced that it would close hundreds of places that did not fit the vision.

Niccol’s plan offers an expensive price tag of about $ 1 billion. But the expectation of the investor is now low, and as the difficult decisions are repaid, Starbucks can start to pop out.

At this time, I think it is low because NICCOL has a good reputation as an operator because the risk of Starbucks stock is still the best consumer brand. Academy sports and Arcos Dorados are on my radar that potentially fill the role of my portfolio filled with Starbucks. But there’s no reason to hurry to make this decision today, so now I will continue to hold Starbucks stocks.

Jon Quast is taking place in academy sports, outdoor and Starbucks. MOTLEY FOOL is recommended and recommended. MOTLEY FOOL is recommended for academy sports and outdoors. The MOTLEY FOOL has a public policy.