Microstrategy is a market rebound and acquires $ 22.1 million more from BTC.

The company, known as Microstrategy, currently has more than 640,000 BTCs.

NASDAQ, the world’s largest company, said last week that it purchased 196 Bitcoin (BTC) for $ 22.1 million.

According to the submission of the US Securities and Exchange Commission (SEC) on Monday, this acquisition, which was raised through stocks, funded through stock sales, and funds through stock sales, brought 640,031 BTC to 640,031 BTC through stocks and preferred stocks. This release has rebounded more than $ 112,000 in Bitcoin, increasing MSTR stocks in the initial transaction.

From the pioneer to the main stay: Strategy as the best company owner of Bitcoin

This submission shows how the company continues to connect corporate property with digital assets, while also exploring investor investigation and market volatility.

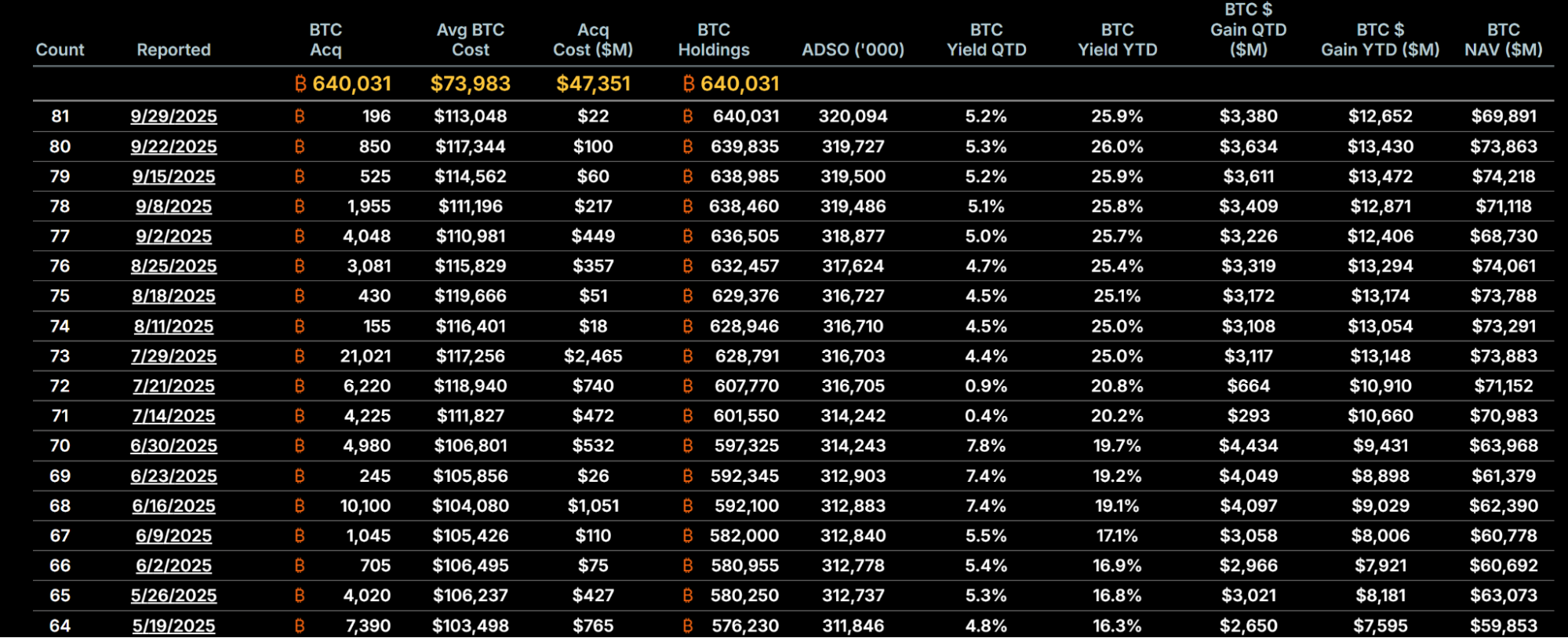

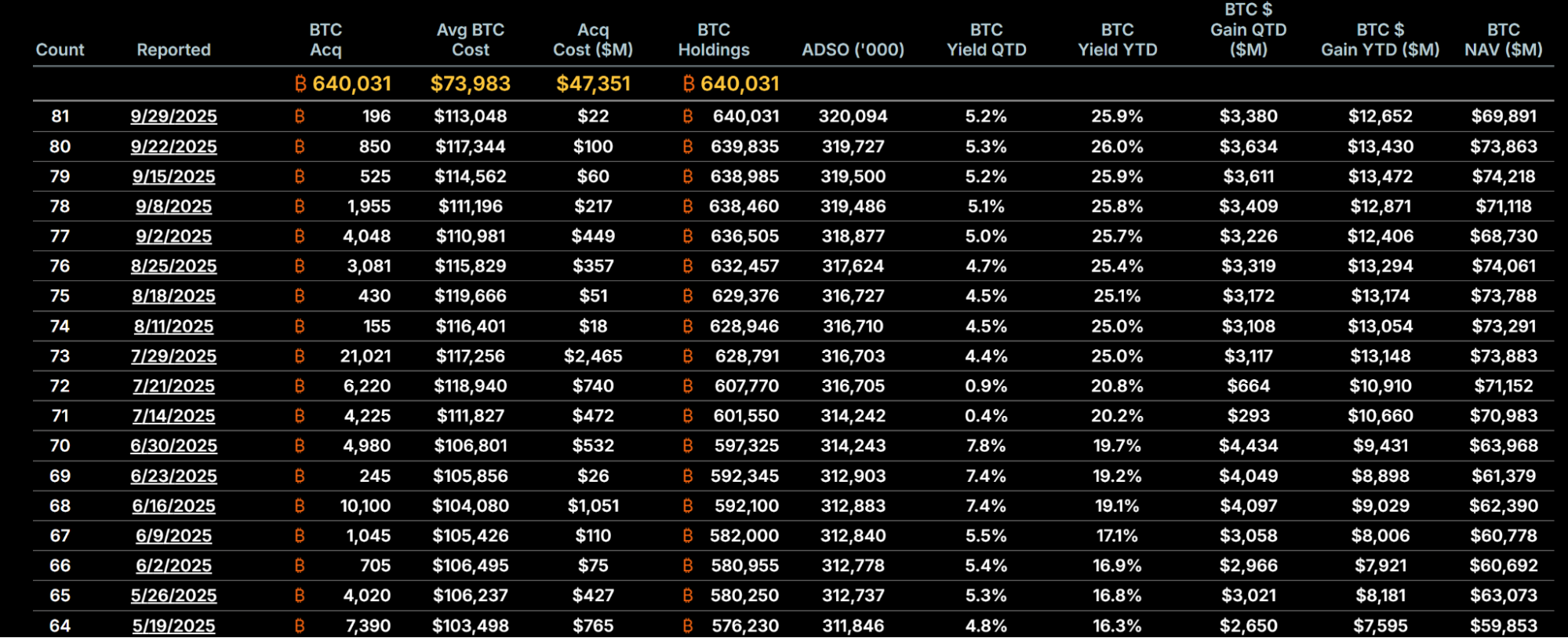

- 196 BTC was added: I bought $ 113,048 for $ 22.1m per coin between September 22 and 28.

- 640,031 BTC total: Now we have more than 3% of Bitcoin’s 21m supply in net proceeds.

- We paid $ 128m for stock sales and preferred stocks.

- When Bitcoin passed $ 112K, the MSTR rose from the pre -market.

- Saylor’s Note: Michael Saylor suggested X and wrote, “I always stacked it.”

The latest purchase of strategy will be added to a long acquisition line that defines the balance of the balance table after 2020. According to the submission, this approach has converted the company to the largest corporate holder of assets, and a series of famous purchases have marked the journey.

- August 2020: The first major bitcoin purchase, 21,454 BTC, for $ 11,653, for $ 250 million, respectively.

- December 2020 -February 2021: Additional purchases have been unlocked more than 90,000 BTC using more than $ 1 billion convertible notes.

- September 2, 2025: I bought 4,048 BTC for $ 111,000 for $ 448.3 million.

- September 8, 2025: It acquired 1,955 BTC and acquired $ 227.4 million.

- September 22, 2025: The value of 850 BTC has been added for nearly $ 99.7 million.

- September 29, 2025: A total of $ 22.1 million, with a total of 196 BTC, a total of 640,031 BTC, with an average of $ 73,983 per coin, about $ 47.33 billion.

source: Strategy

In particular, these acquisitions were consistently raised through stocks and debt channels, and often raised funds through market stock programs and preferred stock issuance.

Since the announcement of $ 22.1 million Bitcoin purchases, the stock of the strategy (MSTR) has increased by 5.62% on Monday to $ 326.42. At the end of the state, the strategy was to give the encryption bounce of $ 351.61, with an impressive 13.77% profit.

Despite the rally, the MSTR is maintained much lower than the $ 470 or more of $ 470 in the late 2024 weeks. The data also found that stocks recorded more than 70 days of transactions in one day swing, exceeding 5%last year.

Bitcoin recovered well last week and made more than $ 122,000 when the article was published.

Bitcoin price source: TradingView

In this background, the latest purchase of the strategy appears to be a smart bet, and as the market continues to develop for the next few months, there is a greater rise.