Emerging Market Links + The Week Ahead (October 6, 2025)

This weekend book excerpt has caught my attention about a growing worldwide problem that we are all increasingly grappling with:

📰 Way past its prime: how did Amazon get so rubbish? (Guardian)

Sick of scrolling through junk results, AI-generated ads and links to lookalike products? The author and activist behind the term ‘enshittification’ explains what’s gone wrong with the internet – and what we can do about it

It’s not just you. The internet is getting worse, fast. The services we rely on, that we once loved? They’re all turning into piles of shit, all at once. Ask any Facebook user who has to scroll past 10 screens of engagement-bait, AI slop and surveillance ads just to get to one post by the people they are on the service to communicate with. This is infuriating. Frustrating. And, depending on how important those services are to you, terrifying.

In 2022, I coined a term to describe the sudden-onset platform collapse going on all around us: enshittification…

* This is an edited extract from Enshittification: Why Everything Suddenly Got Worse and What to Do About It by Cory Doctorow, published by Verso at £22 on 14 October.

Its not just American tech platforms like Amazon, Facebook or Substack (for that matter) in the tech space that’s undergoing rapid “enshittification” as this recent Caixin piece also caught my attention:

🇨🇳 Cover Story: A Recipe for Satisfaction After Diners Express Doubts Over Pre-Cooked Meals (Caixin) $

A high-profile spat between a celebrity influencer and a major restaurant chain has thrust China’s booming pre-made meal industry into the spotlight, triggering consumer outrage, regulatory scrutiny and a renewed debate over food transparency.

The controversy erupted in early September when Luo Yonghao, an entrepreneur and internet celebrity, took to social media to decry what he called a “disgusting” dining experience at Xibei, a popular restaurant chain. Luo claimed that despite high prices, many dishes served were pre-made and called for laws requiring restaurants to disclose when meals were not freshly prepared.

Due to the enshittification labor/real estate situation in Singapore and Malaysia, the food at most corporate chain/casual dining restaurants is likely pre-made in a central kitchen or even a factory. I even had a headhunting candidate who was a manager of one such facility tell me several years ago that they make their food so simple that “even a Bangla can prepare it” in the restaurant kitchen (as in they can throw the vacuum-sealed frozen/chilled bag in boiling water, open it, put it on a plate, garnish and serve it…). That’s NOT exactly what I want to pay a premium for (except perhaps for food safety reasons when traveling)…

However, I am not so sure if I am ready for Doctorow’s and Luo Yonghao’s ideas of getting the government (the absolute king of “enshittification”) involved in too much “de-enshittification…” At the vary least, I hope more customers of corporate products or services start catching on and become less willing to pay a premium to tolerate it while entrepreneurs come up with some solutions or create new competition… CASE IN POINT: The fbpurity.com / F.B. (Fluff Busting) Purity extension gets rid of alot of Facebook garbage and actually makes it somewhat useable…

$ = behind a paywall

-

🌐 Emerging Market Stock Picks (September 2025) Partially $

-

Asia

-

SE Asia

-

🇮🇩 Indonesia – Bank Rakyat Indonesia (Persero) Tbk PT, Bank Central Asia Tbk PT, Bank Tabungan Negara (Persero) Tbk PT, Bank Jago Tbk PT, Bank Mandiri (Persero) Tbk PT, PT Merdeka Copper Gold Tbk, Bank Negara Indonesia (Persero) Tbk PT, Indosat Ooredo Hutchison Tbk PT, XL Smart Telecom Sejahtera, Telkom Indonesia (Persero) Tbk PT, Medco Energi Internasional Tbk PT, Astra International Tbk PT, Mitra Adiperkasa Tbk PT, Avia Avian Tbk PT, PT Trimegah Bangun Persada Tbk, Aneka Tambang Tbk PT, Alamtri Resources Indonesia Tbk PT & Perusahaan Gas Negara Tbk PT

-

🇸🇬 Singapore – Raffles Medical Group Ltd, CapitaLand India Trust, Wilmar International Ltd, Sheng Siong Group Ltd, Mapletree Pan Asia Commercial Trust, BOC Aviation Ltd, Lendlease Global Commercial REIT, ComfortDelGro Corporation Ltd, AEM Holdings Ltd, CapitaLand China Trust, UOL Group Ltd, Suntec Real Estate Investment Trust & SEA Ltd

-

🇹🇭 Thailand – AEON Thana Sinsap Thailand PCL, Central Plaza Hotel PCL, Thai Oil PCL, PTT Global Chemical PCL, Dusit Thani Freehold and Leasehold REIT, Berli Jucker PCL, Praram 9 Hospital PCL, Siam Cement PCL, Central Retail Corporation PCL, CH Karnchang PCL, Stecon Group, TIPCO Asphalt PCL, Airports of Thailand PCL, Axtra Future City Freehold and Leasehold Real Estate Investment Trust, Ally Leasehold Real Estate Investment Trust, Com7 PCL, Tisco Financial Group PCL, Thai Union Group PCL, AIM Industrial Growth Freehold & Leasehold REIT, IMPACT Growth Real Estate Investment Trust, Global Power Synergy PCL, Advanced Info Service PCL, Amata Corporation PCL & Bangchak Corporation PCL

-

-

Middle East

-

-

Africa

-

🇿🇦 South Africa – CA Sales Holdings, Stadio Holdings, Invicta Holdings Ltd, KAL Group Ltd, York Timber Holdings, PPC Ltd, Premier Group, Libstar Holdings, Metair Investments Ltd, Grindrod Limited & RCL Foods, Sabvest Capital Ltd, Afrimat Ltd, Balwin Properties Ltd & Renergen

-

-

Latin America

-

🤖 DeepSeek Analysis

-

High-Dividend Yield & Value Plays (Value & Income Investors)

-

Growth & Momentum Stories (Growth Investors)

-

Turnaround & Special Situations (Opportunistic Investors)

-

Defensive & Stable Income (Risk-Averse Investors)

-

Summary for Quick Reference

-

-

-

EM Fund Stock Picks & Country Commentaries (October 5, 2025) Partially $

-

When will Vietnam’s stock market be upgraded to EM status, 8 EMs punching above their weight, Africa’s investment potential, EM infrastructure, India & semiconductors, Aug/Sept/Q3 fund updates, etc.

-

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Insiders September 2025 (Asian Century Stocks)

Summary: The literature on insider transactions says that stocks with insider buying tend to outperform the overall market by 6-10% per year. The signal is especially strong for 1) new positions, 2) in small firms, 3) with high trading volumes, 4) by people with CFO/investment management backgrounds, 5) when they coincide with share buybacks or 6) when they occur in large clusters of individuals. In this post, I review insider transaction data from service provider Smart Insider and identify five recent insider transactions that have caught my attention, involving Converge Information & Communications Technology Solutions Inc (PSE: CNVRG), BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), G8 Education Ltd (ASX: GEM / FRA: 3EAG / OTCMKTS: GEDUF), Mst Golf Group Bhd (KLSE: MSTGOLF), and Scope Industries Bhd (KLSE: SCOPE / OTCMKTS: SCPJ).

🇯🇵 To Attract Long-Term Investors to Japanese Equities, Documents Disclosed in English Must Be Expanded (Smartkarma) $

While 95% of companies now disclose mandatory documents in English, concerns remain that when only partial disclosure is made in English, important information may not be disclosed in English.

The simultaneous disclosure of Japanese and English versions of previously delayed disclosure materials has been well received by overseas investors.

Companies’ attitudes differ significantly between documents mandated by the TSE and those that are not. Documents not subject to mandatory requirements are left to the company’s discretion.

🇯🇵 Oriental Land: The Disney Land That Disney Doesn’t Own (KonichiValue Japan)

Imagine a Disneyland that isn’t actually run by Disney. Sounds like a Chinese bootleg disaster where Mickey wears a knockoff suit… But somehow it is the world’s most successful Disney Park?

Oriental Land (TYO: 4661 / FRA: OLL / OTCMKTS: OLCLF) holds a special place in my heart as both a theme park lover and an investor. I didn’t get an insider tour under the hood like I did at Universal Studios Japan, but I’ve spent countless days at Tokyo Disney Resort marveling at its operation. Every time, the investor in me is analyzing:

How did a once-obscure Japanese firm end up running Disney’s most acclaimed parks?

What’s their secret sauce for attracting crowds even Disney’s own parks envy?

And with the stock market valuing this company at nearly ¥6 trillion (about $40 billion) even though they only own one Disney Theme Park?

Let’s journey through the lore – and the numbers – behind Oriental Land’s Disney empire.

🇯🇵 RS Technologies (3445.T): Deeply misunderstood play leveraging the high growth Chinese WFE market (Dragon Invest)

ACM Research (NASDAQ: ACMR)’s Japanese cousin might fabricate alpha just like it did

RS Technologies (TYO: 3445 / OTCMKTS: RSTCF) is a Japan based semiconductor equipment and materials company that specializes in reclaimed wafers, prime wafers, semiconductor equipment, fab construction and maintenance services among other verticals (most notably batteries and energy storage that they’ve recently entered into by establishing subsidiaries and acquiring another company in Guangdong, China and incorporating it as a subsidiary, I’ll explore this later on in the article). The company was only established in 2010 (that’s just 15 years ago, yeah exactly where were you in 2010) has grown into becoming the global leader in wafer reclaim (33% market share) and is rapidly expanding into the prime wafer market particularly in China (if you didn’t know, China is the fastest growing semiconductor market in the world and no other country even comes close), therefore making it a critical enabler in the global semiconductor supply chain and kind of a big deal if you ask me. The company operates across Japan, Greater China, Europe, US, and is also constructing a plant in Malaysia to expand into South East Asia. Yeah, yeah, I hear you asking, “ but Dragon, what is a reclaimed wafer and isn’t a prime wafer some kinda confectionary” so I’m gonna explain what exactly these two things mean now.

🇨🇳 Deep Dive: China’s Industrial Might and Domestic Policy (Chamath Palihapitiya) $

How did a country once known for cheap toys leapfrog into EVs, solar, and AI? How far will China’s newfound assets allow it to scale before its debt and demographics start to weigh it down? Read on.

🇨🇳 10 Eye-Opening Charts on China’s Economy, Markets, and Future (The Pareto Investor)

🇨🇳 China expands foreign access to bond repos to raise liquidity (The Asset) 🗃️

Action response to increased interest from institutional investors, processes enhanced to better aligned with international practices

All foreign institutional investors who trade in China’s interbank market, either directly or through the Bond Connect channel can now participate in onshore bond repos, according to a joint announcement last Friday by the People’s Bank of China ( PBoC ), the China Securities Regulatory Commission and the State Administration of Foreign Exchanges.

The repos are a useful liquidity management facility that allows investors to temporarily trade securities for cash, with a promise to reverse the deal later at a slightly higher price.

🇨🇳 China Opens Bond Repo Market Wider to Foreign Investors in Push for Global Integration (Caixin) $

China on Thursday opened wider doors to its $21 trillion bond market, granting foreign investors full access to repurchase transactions in a move regulators said will align the country more closely with global standards and deepen liquidity.

In a joint notice, the People’s Bank of China, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange said all qualified foreign institutions — including those trading through the Bond Connect link — may now take part in repos, a key short-term financing tool in global debt markets.

🇨🇳 Exclusive: China to Create Department to Tackle Trillions in Local Government Debt (Caixin) $

China’s Ministry of Finance (MOF) is set to establish a dedicated department to oversee government debt, elevating the management as a multi-year campaign to defuse local government debt risk enters a critical phase, Caixin has learned.

The new debt department will be created by converting the ministry’s existing policy research department, sources close to the ministry and local finance department officials told Caixin.

🇨🇳 Cover Story: A Recipe for Satisfaction After Diners Express Doubts Over Pre-Cooked Meals (Caixin) $

A high-profile spat between a celebrity influencer and a major restaurant chain has thrust China’s booming pre-made meal industry into the spotlight, triggering consumer outrage, regulatory scrutiny and a renewed debate over food transparency.

The controversy erupted in early September when Luo Yonghao, an entrepreneur and internet celebrity, took to social media to decry what he called a “disgusting” dining experience at Xibei, a popular restaurant chain. Luo claimed that despite high prices, many dishes served were pre-made and called for laws requiring restaurants to disclose when meals were not freshly prepared.

🇨🇳 BYD (1211 HK) Tactical Outlook: A Rally May Be Underway (Smartkarma) $

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) is currently in a position from where it could rally. Our previous insight suggested a possible bottoming area around 100.9 but the stock never reached that low.

This week the stock rallied to 114.7, then pulled back. If the stock is temporarily bottoming, it could rally past 115 and up to 130 from here.

According to our TIME MODEL the duration of the rally could be up to 3-4 weeks (2-3 more weeks up from here).

🇨🇳 BYD monthly sales fall for first time since early 2024 (FT) $ 🗃️

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)

Chinese EV champion’s growth streak ends amid tepid domestic demand

The Chinese electric vehicle champion sold just over 396,000 cars last month, down 5.5 per cent from a year earlier, according to a Hong Kong stock exchange filing on Wednesday.

🇨🇳 Dongfeng Motor (489 HK): VOYAH Listing Docs Underscore the Upside (Smartkarma) $

On 22 August, Dongfeng Motor Group Co Ltd (HKG: 0489 / FRA: D4D / D4D0 / OTCMKTS: DNFGF / DNFGY) disclosed a pre-conditional privatisation by merger by absorption by Dongfeng Motor Corporation, along with a proposed distribution and listing of VOYAH shares.

The VOYAH application proof, filed on 2 October, points to strong fundamentals and suggests that the appraised value of VOYAH and the offer are conservative.

Based on the data points from the application proof, I calculate that the implied offer is HK$12.11-12.25 per H Share, a 11.6%-12.9% premium to the appraised value of HK$10.85.

🇨🇳 Chery zooms out of the IPO gate. Now, it needs to show investors its longer-term value (Bamboo Works)

China’s leading car export brand raised more than $1 billion in its listing on Sept. 25, with its shares up 4% in their first three trading days

Chery Automobile Co Ltd (HKG: 9973)’s stock has gotten off to a solid start since its IPO last week, with upside potential for its P/E multiple compared to its biggest domestic peers

One of the car maker’s biggest challenges will be maintaining its rapid growth, which has made it China’s top exporting brand and the country’s sixth leading NEV seller this year

🇨🇳 China Opens Satellite Market to Big Three Carriers in Push for Global Edge (Caixin) $

China Mobile (SHA: 600941 / HKG: 0941 / 80941 / FRA: CTM) has received a license to operate satellite mobile communication services, ending China Telecom Corp Ltd (HKG: 0728 / SHA: 601728)’s monopoly and opening a three-way contest among the country’s state-owned carriers.

The Ministry of Industry and Information Technology announced the approval on Monday, just over 20 days after it granted a similar license to China United Network Communications Group Co. Ltd. (China Unicom (HKG: 0762 / FRA: XCI)) on Sept. 8. For years, China Telecom had been the sole licensed provider of such services.

🇨🇳 Three years after launching Chinese coffee war, Cotti runs low on steam (Bamboo Works)

The country’s second-largest domestic coffee chain has become relatively quiet over the last year, after boasting of plans to open 50,000 stores by the end of this year

Cotti Coffee had 15,000 stores as of August, far short of the 50,000 it previously targeted by the end of this year

The company’s opening of its first New York store earlier this year came around the same time as larger rival Luckin Coffee (OTCMKTS: LKNCY) entered the market, in largely symbolic moves

🇨🇳 Pagoda finds fruit in share placement as weak business weighs (Bamboo Works)

Not long after reporting bleak midyear results, the fruit seller raised $42 million in fresh funds by selling new stock at a steep discount

Shenzhen Pagoda Industrial Group (HKG: 2411 / FRA: D0V) has raised HK$327 million through a share placement, a month after reporting it swung to a loss of more than 350 million yuan in first half of 2025

The struggling fruit seller slashed its retail network by nearly 30% to 4,386 stores in the first half of the year

🇭🇰 AIA Group: Upped Credit Bets In Reserve Portfolio (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q3 Preview: A Dividend Compounder Hiding In Plain Sight (Seeking Alpha) $ 🗃️

🇰🇷 S.Korean operators report robust casino sales in September (GGRAsia)

Three operators of foreigner-only casinos in South Korea have reported year-on-year increases in gaming revenue in September, according to separate filings to the Korea Exchange.

Lotte Tour Development (KRX: 032350), promoter of the Jeju Dream Tower, said its casino sales rose 86.3 percent year-on-year in September, to nearly KRW52.95 billion (US$37.7 million). Last month’s tally was up 23.2 percent from August, according to a Wednesday announcement.

In a Thursday filing, Paradise Co Ltd (KOSDAQ: 034230) said its casino sales in September rose 4.3 percent from a year earlier, to KRW64.03 billion. Measured sequentially, the September tally fell by 20.4 percent.

Another operator of foreigner-only casinos in the country, Grand Korea Leisure Co Ltd (KRX: 114090), reported casino sales of KRW34.78 billion in September, up 1.4 percent year-on-year. Judged sequentially, the tally was down 0.8 percent.

🇰🇷 Mirae Asset Group Companies Continuing To Buy Mirae Asset Life Insurance – A Prelude to Delisting? (Douglas Research Insights) $

Mirae Asset Life Insurance Co Ltd (KRX: 085620) (Bullish)

The increased purchase of Mirae Asset Life Insurance shares by the Mirae Asset Group companies could be a PRELUDE to a potential voluntary delisting of Mirae Asset Life Insurance.

We believe that there is a relatively reasonable probability of the Mirae Asset Group taking Mirae Asset Life Insurance private in the next 1-2 years.

Mirae Asset Life Insurance is trading at only 0.4x P/B. Treasury shares represent 26.3% of its total outstanding shares.

🇰🇷 Doosan Robotics – End of Lockup Period For 34% of Outstanding Shares (Douglas Research Insights) $

Doosan Robotics (KRX: 454910) (Bearish)

There is an end of a lock-up period for 22.1 million shares (34% of outstanding shares) for Doosan Robotics (454910 KS) starting 5 October 2025.

This could potentially result in additional selling by insiders which could negatively impact its share price in the coming weeks.

Doosan Robotics’ valuation multiples remain extremely high. We remain BEARISH on Doosan Robotics.

🇰🇷 LG Chem: Announces a PRS Worth 2 Trillion Won Using Its Shares in LG Energy Solution as Base Asset (Douglas Research Insights) $

(LG Chem (KRX: 051910 / 051915) – Bullish; LG Energy Solution (KRX: 373220) – Bearish)

LG Chem announced that it plans to complete a price return swap worth about 2 trillion won (US$1.4 billion) using its stake in LG Energy Solution as the base asset.

This 2 trillion won PRS is likely to have a slightly positive impact on LG Chem and slightly negative impact on LG Energy Solution.

Our NAV valuation of LG Chem suggests implied NAV per share of 369,187 won, which is 31% higher than current levels.

🇰🇷 Acquisition of SK D&D by Hahn & Co + Tender Offer and Delisting Plans (Douglas Research Insights) $

On 1 October, it was reported in the local media that Hahn & Co (is acquiring the management rights of SK D&D Co Ltd (KRX: 210980).

This tender offer is not likely to be successful. Less than 1/3 of the 6.96 million shares that are up for tender offer could be sold by the existing shareholders.

We believe that the majority of the remaining investors in SK D&D want higher tender offer price.

🇰🇷 CMTX IPO Preview (Douglas Research Insights) $

CMTX is getting ready to complete its IPO in KOSDAQ in 4Q 2025. The company will offer a total of 1 million shares (new shares) in this IPO.

The target IPO price range is 51,000 to 60,500 won per share. The projected market capitalization after listing is 473 billion to 561.2 billion won.

CMTX began by manufacturing ceramics and sapphire components for semiconductor etching processes and has since expanded its business to include core consumable silicon components such as silicon rings and electrodes.

🇰🇷 CMTX IPO Valuation Analysis (Douglas Research Insights) $

(CMTX: Bullish)

Our base case valuation of CMTX is implied market cap of 1 trillion won or 106,847 won per share. CMTX is a likely inclusion candidate in KOSDAQ150 index in 2026.

Our base case valuation is based on P/E of 14.9x using our estimated net profit of 69 billion won in 2026.

Our base case valuation is 65% higher than the high end of the IPO price range. Given the excellent upside, we have a Positive View of this IPO.

🇵🇭 PLDT: More Entrants Encouraged By Konektadong Pinoy Act Can Pose A Significant Downside (Seeking Alpha) $ 🗃️

🇸🇬 Canaan: I’m In With Call Options As Sentiment Has Finally Turned Around (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings Is Cheaper Than It Looks (Seeking Alpha) $ 🗃️

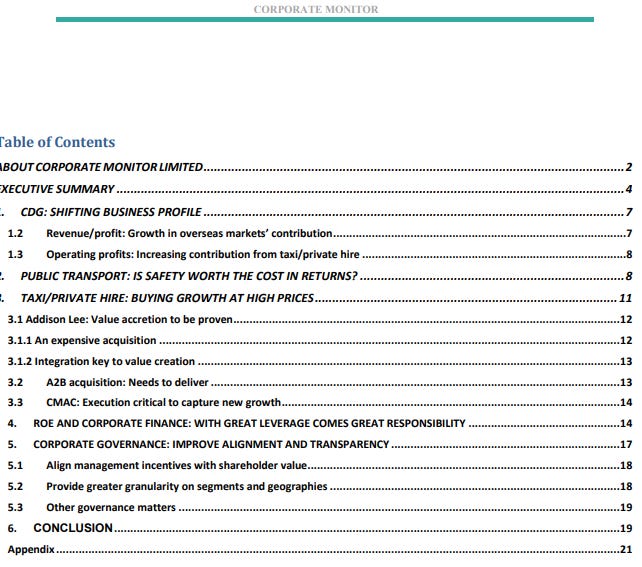

🇸🇬 ComfortDelgro: Chasing Growth, Missing Returns? (Corporate Monitor)

-

🌏🌍 ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY) – Bus, taxi, rail, car rental/leasing, automotive engineering, inspection & testing, driving centres, non-emergency patient transport services, insurance broking & outdoor advertising. 🇼 🏷️

🇸🇬 Beyond STI: 3 Singapore Stocks That Quietly Outperformed the Market in September 2025 (The Smart Investor)

Discover 3 Singapore stocks that beat the STI in September 2025, offering hidden opportunities beyond the index.

Geo Energy Resources (SGX: RE4 / FRA: 7GE / OTCMKTS: GRYRF): Total Returns 30.1% for September 2025

Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF): Total Returns 13.7% for September 2025

This multi-industry conglomerate operates across four key divisions: Geospatial (geographic information systems), Energy Engineering (oil and gas equipment), Real Estate Solutions (industrial design-and-build), and Healthcare (medical technology).

China Sunsine Chemical Holdings (SGX: QES): Total Returns 6.1% for September 2025

Get Smart: Small Caps, Stellar Returns

🇸🇬 3 Singapore Dividend Stocks Yielding Over 5%: Are They Worth the Buy? (The Smart Investor)

🇸🇬 3 Things to Watch After Centurion Accommodation REIT’s Strong IPO Debut (The Smart Investor)

CAREIT’s IPO is off to a solid start with yields above 7%. But can these returns hold once support measures roll off?

Centurion Accommodation REIT (SGX: 8C8U) or CAREIT has made a strong start for its IPO debut.

Its unit price climbed over 6% in the first week of trading on the SGX, from its IPO price of S$0.88 to above S$0.93 at time of writing.

Not bad at all for a REIT that owns dormitories and student housing.

These assets may not sound glamorous, but they are essential.

CAREIT, sponsored by Centurion Corporation Ltd (SGX: OU8), focuses on Purpose-Built Workers Accommodation (PBWA) and Purpose-Built Student Accommodation (PBSA).

1. The Australian property still needs support

2. Management fees could take a larger slice than you expect

3. The 100% payout policy is temporary

Get Smart: A strong start, but understand the details

🇸🇬 3 Blue-Chip Stocks Seeing Insider Buying in September 2025 (The Smart Investor)

Three blue-chip stalwarts are buying back their own shares, a signal that they believe that their stock is undervalued.

🇸🇬 4 Singapore Dividend-Paying Blue-Chip Stocks Paying Out Additional Dividends (The Smart Investor)

🇸🇬 3 Singapore Blue Chips Paying Dividends in October 2025 (The Smart Investor)

There’s nothing better than having cash drop into your bank account like clockwork.

From the financial fortresses of Singapore’s sole bourse operator to property moguls and industrial conglomerates, these companies show that value isn’t about chasing hype, but in the beautiful, predictable sound of cash in your account.

Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY): 15 October 2025

Hongkong Land is a premium property group with Grade A offices and luxury retail in Hong Kong Central, plus Singapore offices and development projects primarily in mainland China and Singapore, which the group is strategically winding down.

Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF): 15 October 2025

Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY): 27 October 2025

Singapore’s sole stock exchange operator posted record revenue of S$1.3 billion for the fiscal year ending 30 June 2025 (FY2025), up 11.7% year on year, with growth across all business segments.

🇸🇬 Top 3 Best Performing Singapore Blue-Chips for September 2025 (The Smart Investor)

🇻🇳 Vietnam stocks surge on regulatory reforms (The Asset) 🗃️

Hopes remain high liberalization moves will lead to market status upgrade

The benchmark VN Index has risen 30% year-to-date, marking its strongest performance in three years.

A flurry of listings in the second half of 2025 bolstered the IPO market, with Techcom Securities JSC raising 10.82 trillion dong ( US$409 million ) following a 2.5x oversubscription. Since their trading debuts in August, Taseco Land Investment JSC (HOSE: TAL) has surged by more than half while consumer finance lender F88 has risen by almost a quarter.

🇮🇳 ReNew For India’s Big Renewable Energy Potential (Seeking Alpha) $ 🗃️

🇰🇿 Freedom Holding: The Stock That Proves Emerging Markets Still Deliver (Seeking Alpha) $⛔🗃️

🇮🇳 GST Exemption: A Catalyst for Growth and Margin Headwinds for ICICI Prudential Life (Smartkarma) $

The GST Council’s decision to exempt all individual life and health insurance premiums from GST (0% vs. 18% earlier), effective September 22, 2025, is a landmark affordability move.

The immediate drop in premiums for products like term and ULIPs is expected to drive a significant surge in demand, though insurers like ICICI Prudential Life Insurance Company (NSE: ICICIPRULI / BOM: 540133) will lose ITC on expenses.

While the volume boost from higher affordability is a major long-term catalyst, immediate margin compression from ITC loss on commissions will require operational efficiency and pricing recalibration for ICICI Prudential.

🇮🇳 The Beat Ideas: ADF Foods – Can an Export-Heavy Model Withstand Tariff Pressures? (Smartkarma) $

ADF Foods Ltd (NSE: ADFFOODS / BOM: 519183) is shifting from an agency-based distribution model to a brand-led, in-house manufacturing approach, focusing on the U.S. frozen food segment to improve margins and supply control.

This strategic pivot enhances margin stability, mitigates raw material and geopolitical risks, and deepens market penetration in mainstream international retail, positioning ADF for sustainable long-term growth and profitability.

Market focus should move from export volatility to ADF’s brand premiumization and successful US greenfield execution, the key drivers of sustainable growth and long-term re-rating.

🇮🇳 Sammaan Capital: Is Abu Dhabi’s $1.06 Billion Bet the Start of a New Era? (Smartkarma) $

Sammaan Capital Ltd (NSE: SAMMAANCAP / BOM: 535789)’s Board approved a preferential issue to Avenir Investment RSC Ltd., a wholly-owned subsidiary of Abu Dhabi’s IHC, aggregating INR 8,850 crore (USD 1.06 billion) in equity and warrants.

The strategic inflow from the well-capitalized, sovereign-linked IHC provides a massive de-risking event, validates Sammaan’s new-book strategy, and signals a powerful new stream of capital flows into Indian HFC/NBFC space.

The scale, strategic nature, and pricing of the deal position Sammaan for a significant re-rating, shifting the investment thesis from asset quality clean-up to funded growth.

🇮🇳 Decoding OneSource Pharma’s Strategic Amalgamation: A Blueprint for a Global CDMO Powerhouse? (Smartkarma) $

Onesource Specialty Pharma Ltd (NSE: ONESOURCE / BOM: 544292) has approved a Composite Scheme of Arrangement to acquire Steriscience’s EuropeanCDMO and Brooks Steriscience’s Indian anti-infective assets.

The transaction adds approximately $107 million in projected FY27 revenue, significantly diversifying the portfolio, reducing single-site risk, raising the consolidated FY28 revenue outlook to over $500 million.

While the acquisition multiples appear steep for subscale assets, if management successfully delivers on ambitious growth targets, the transaction could position OneSource among the most competitive players in CDMO landspace.

🇮🇳 Hindustan Zinc: The Silver Underdog (Smartkarma) $

Hindustan Zinc Ltd (NSE: HINDZINC / BOM: 500188) has committed to a massive INR 30k−35k Crs (3.6−4.2 billion) expansion to double its metal production underpinned by record-low zinc costs and high silver contribution.

This integrated, self-funded capacity doubling effort, coupled with aggressive decarbonization and the high-margin silver tailwind, fundamentally de-risks the long-term earnings trajectory.

While the corporate restructuring remains an overhang, HZL’s strategic shift makes it a compelling, low-cost proxy for India’s industrial growth and the global silver bull cycle.

🇮🇳 Ambuja Cement Q2 Preview: Seasonal Weakness or a Strategic Pause in the 140 MTPA Road? (Smartkarma) $

Ambuja Cements (NSE: AMBUJACEM / BOM: 500425) has crossed the 100 MTPA capacity mark and is executing a roadmap for 140 MTPA by FY28 while targeting a INR1,500 per tonne EBITDA by the same year.

The integration of multiple recent acquisitions, including Orient, Sanghi, and Penna, is crucial; Q2FY26 results will offer the first look into how the new consolidated entity handles initial integration costs.

While Q1 FY26 set a high baseline, investors should anticipate sequential dip in Q2 margins, viewing it as a short-term integration blip against a decade-defining capacity and cost rationalisation strategy.

🇮🇳 LG Electronics’ BOD Gives the Green Light for LG Electronics India IPO in 2025 – Updated Valuation (Douglas Research Insights) $

LG Electronics India (Bearish)

LG Electronics (KRX: 066570 / 066575 / FRA: LGLG / LON: 39IB)’ BOD finally approved a plan to sell a 15% stake in LG Electronics India in an IPO to be completed in 2025.

According to local media, LG Electronics India is now valued at about US$13 billion which is higher than LG Electronics’ market cap of US$8.8 billion.

Our base case valuation of LG Electronics India is implied market cap of 1,280 billion INR or US$14.4 billion.

🇮🇳 LG Electronics India IPO: Attractive Upside (Douglas Research Insights) $

(LG Electronics India: Bullish)

After incorporating the company’s FY25 results, we have tweaked our income statement estimates and valuations of LG Electronics India IPO.

Our base case valuation is target price of 1,514 INR which is 33% higher than the high end of the IPO price range.

It appears that the company wants the IPO to be successful and after much review the company has decided to price the IPO at more attractive levels to new investors.

🇮🇳 LG Electronics India IPO: Updates Support the Bull Case (Smartkarma) $

🇮🇳 LG Electronics India IPO: Big Market Cap, Small Float -> Small Passive Flows (Smartkarma) $

LG Electronics India (123D IN) is looking to list on the exchanges by selling 101.8m shares at a valuation of US$8.7bn and raising around US$1.3bn in its IPO.

The new valuation is around 24% lower than the rumoured valuation at the time of the DRHP filing last December.

The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

🇮🇳 Tata Capital IPO: Big Listing, Big Valuation, Small Float (Smartkarma) $

Tata Capital Limited (TATACAP IN) is looking to list on the exchanges by selling up to INR155bn (US$1.75bn) of stock at a valuation of around INR 1,384bn (US$15.6bn).

The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in June 2026.

The stock should be added to the Large Cap segment in the AMFI Classification in January and to the Nifty Next 50 Index in March.

🇮🇳 Tata Capital IPO : Update on Q1FY26 Financials, IPO Valuation, Peer Comparison and View (Smartkarma) $

🇮🇳 Tata Motors (TTMT IN) Demerger: Interesting Index Implications (Smartkarma) $

Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) is demerging the company into two separate listed entities that will focus on the Passenger Vehicle business and the Commercial Vehicle businesses.

Based on the estimated valuation for the two entities, both stocks will continue to remain in the MGlobal Index and the FGlobal Index.

NIFTY and SENSEX trackers will need to sell their Commercial Vehicle business holdings soon after listing. There could be selling in the Passenger Vehicle business holdings at a later rebalance.

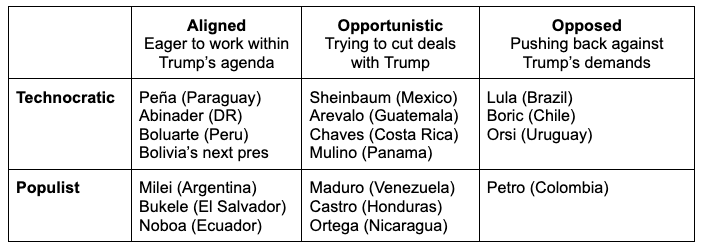

🌎 A map of how Latin American leaders respond to Trump – September 2025 (Latin America Risk Report)

My analysis is provided in both chart and map form for you to disagree with!

I published an initial version of the chart below in February, right after Trump took office, and then updated it in April. It’s a thought exercise, building an imperfect framework to understand how leaders react to Trump and how their relationship changes over time. With UNGA and other recent news, it’s a good week to update it.

🌎 Ternium: One Of The Best Steel Options Even With Tariffs (Seeking Alpha) $ 🗃️

-

🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🌎 Corporacion America Airports: Well-Positioned To Benefit From Increased Activity (Seeking Alpha) $⛔🗃️

🌎 Mercado Libre’s Double Trouble Amazon & China Threat (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Two Times Three Is $100 Billion (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: The Easy Gains Are Gone (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Don’t Wait Till It Enters Beast Mode (Seeking Alpha) $ 🗃️

🇦🇷 Argentina’s wily currency traders drain Javier Milei’s dollars (FT) $ 🗃️

🇦🇷 Lithium Americas: Strategic For The U.S., Risky For Investors (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Americas: Fairly Valued As ‘Too Big To Fail’ Support Grows (Downgrade) (Seeking Alpha) $ 🗃️

🇦🇷 Grupo Supervielle S.A. (SUPV) Presents at Latin Securities Argentina in London – Slideshow (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: Leaner, Profitable, And Ready For Significant Growth (Seeking Alpha) $ 🗃️

🇧🇷 Banco do Brasil S.A. (BDORY) Analyst/Investor Day – Slideshow (Seeking Alpha) $ 🗃️

🇧🇷 WEG S.A. (WEGZY) Analyst/Investor Day – Slideshow (Seeking Alpha) $ 🗃️

-

🇧🇷 WEG SA (BVMF: WEGE3) – Operates worldwide in the electric engineering, power & automation technology areas. Electric motors, generators, transformers, drives & coatings. 🇼 🏷️

🇧🇷 Gerdau S.A. (GGB) Analyst/Investor Day – Slideshow (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: High Multiples Mask A Rare Deep Value Fintech (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Hypergrowth At A Discount (Seeking Alpha) $ 🗃️

🇵🇪 Credicorp: Bull Thesis Has Played Out (Rating Downgrade) (Seeking Alpha) $ 🗃️

-

🌎 Credicorp (NYSE: BAP) – Universal banking, insurance & pension platform, microfinance, investment banking & wealth management. 🇼

🌐 Nebius: One Hyperscaler Already In – How Many More Will Join The Party? (Seeking Alpha) $ 🗃️

🌐 Nebius: Not Priced For AI Domination (Yet) (Seeking Alpha) $ 🗃️

🌐 Nebius: Not Just A Neocloud But An Entire Ecosystem (Seeking Alpha) $ 🗃️

🌐 Why Nebius Could Be Worth $138 A Share After The Microsoft Deal (Seeking Alpha) $ 🗃️

🌐 Nebius: Premium Valuation, Explosive Growth (Seeking Alpha) $ 🗃️

🌐 Nebius: Overvaluation Miss Becomes A Win (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: Winter Is Coming – So Is GPU Demand (Double Upgrade) (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

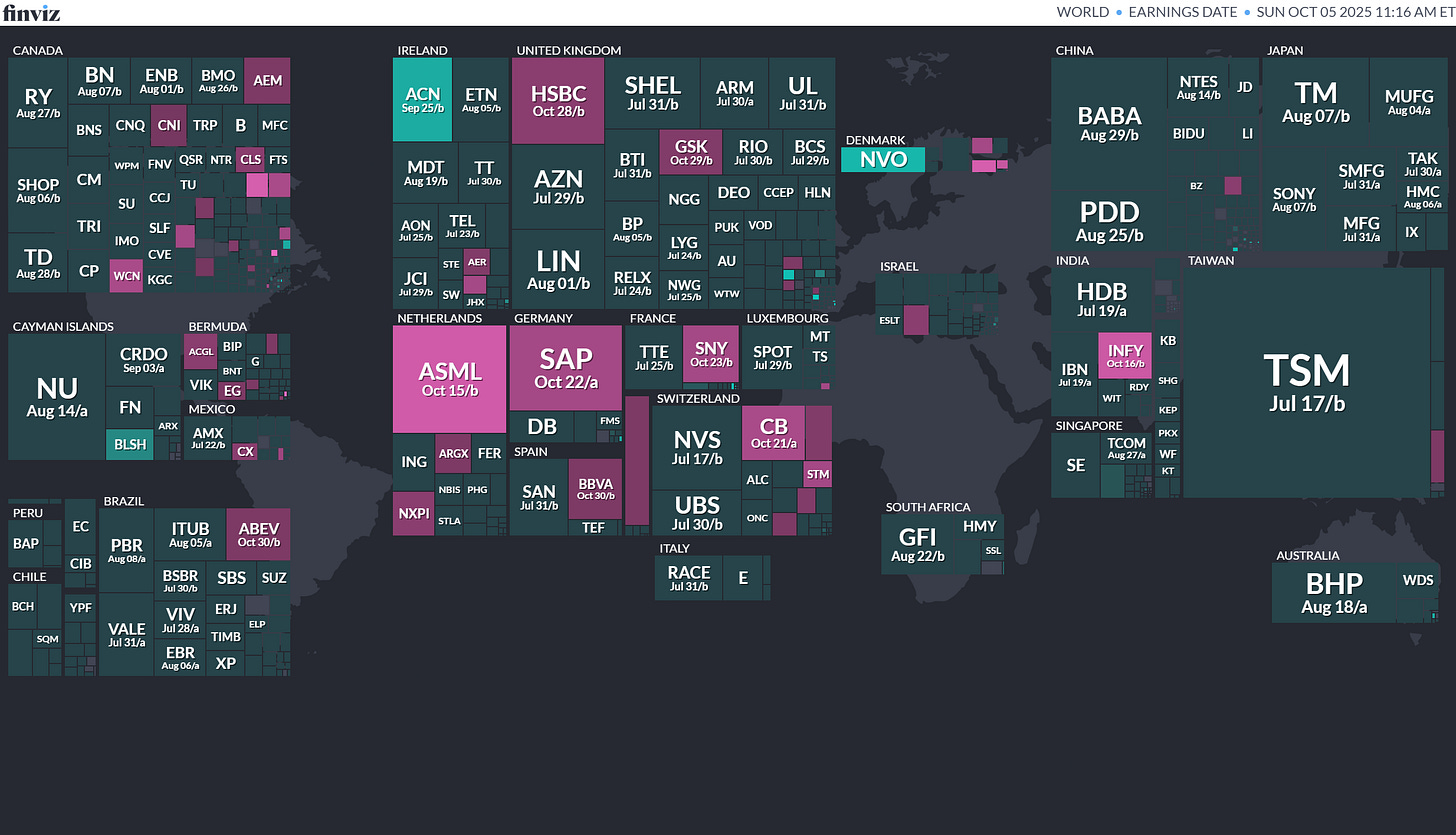

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

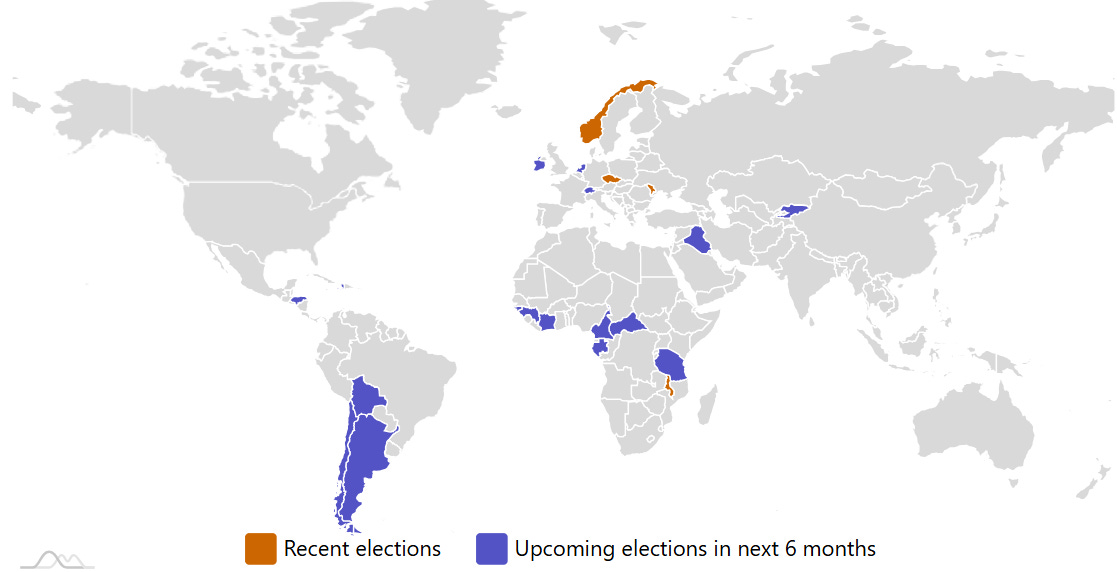

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

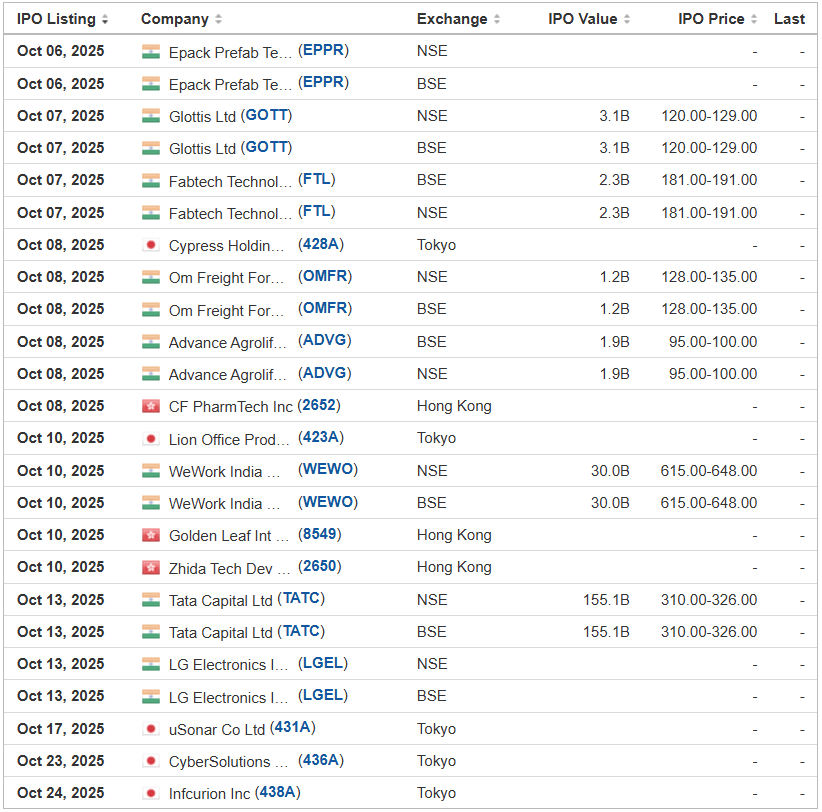

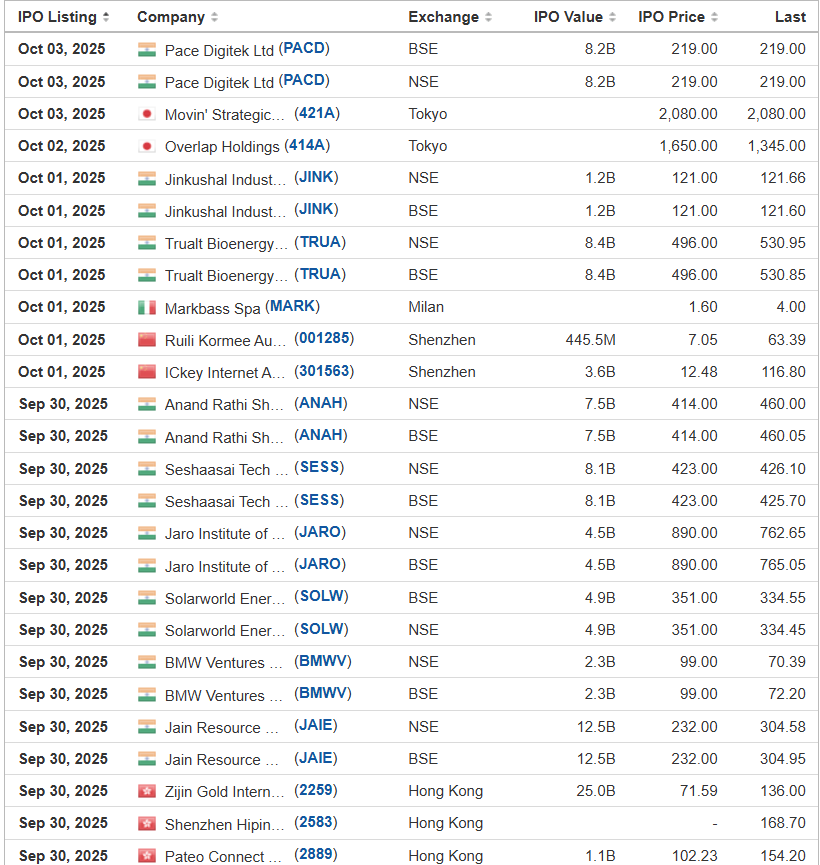

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

CCH Holdings Ltd. CCHH Cathay Securities, $1.3M Shares, $4.00-4.00, $5.0 mil, 10/3/2025 Priced

(Incorporated in the Cayman Islands)

We are one of the leading specialty hotpot restaurant chains in Malaysia, specializing in chicken hotpot and fish head hotpot. With roots in George Town, Penang, Malaysia since 2015, we have become a top player in the specialty hotpot market in Malaysia. According to Frost & Sullivan, we were the third-largest specialty hotpot restaurant chain in Malaysia in terms of revenues generated by company-owned restaurants for the year ended December 31, 2024. Our Chicken Claypot House (鸡煲之家) brand, according to Frost & Sullivan, was the largest chicken hotpot brand in Malaysia in terms of number of restaurant outlets as of June 30, 2025.

Note: The “CCH” in the holding company’s name stands for Chicken Claypot House, the brand name of its chicken hotpot restaurants.

We are committed to providing the most authentic Sichuan hotpot experience with Hong Kong style chicken hotpot traditions, to suit the discerning Malaysian palate. With our established brands in specialty hotpot and exclusive signature dishes that are well received by customers, we are committed to further expanding our reach in Malaysia and beyond.

We offer catering services in Malaysia and outside Malaysia mainly under two brands, namely Chicken Claypot House (鸡煲之家) for our chicken hotpot restaurants and Zi Wei Yuan (紫薇园) for our fish head hotpot restaurants through a combination of company-owned restaurant outlets and franchised restaurant outlets. As of the date of this prospectus, we operate or license a total of 32 restaurant outlets, among which there are 20 Chicken Claypot House restaurant outlets, four Zi Wei Yuan restaurant outlets, three Chicken Claypot House-Zi Wei Yuan cross-over restaurant outlets, a food court, three restaurant outlets under the brand Bibixian (比比鲜) focusing on Teochew-style chicken hotpot, and a restaurant outlet under the brand Banbudian Bistro (先启半步颠) offering Sichuan cuisine. Among the 28 restaurant outlets operated or licensed by us in Malaysia, there are 15 company-owned restaurant outlets and 13 franchised restaurant outlets, as of the date of this prospectus. Currently, we also have four franchised restaurant outlets located in three other countries, including Thailand, Indonesia and China.

The cultural diversity in Southeast Asia has created a distinctive fusion cuisine landscape, and hotpot with traditions rooted in China has become a popular dining choice among customers. According to Frost & Sullivan, the market size in terms of revenues of specialty hotpot restaurants in Southeast Asia increased from US$1,592.3 million in 2019 to US$1,827.7 million in 2024 at a CAGR of 2.8%, and is expected to reach US$2,645.1 million in 2029, representing a CAGR of 7.7% from 2025 to 2029. To seize the market opportunity, we have been actively but also prudently expanding the network of our restaurant outlets in Malaysia. We are also poised for strategic expansion into other locations in Southeast Asia, such as Vietnam, Cambodia and Indonesia, as well as other international locations with significant growth potentials such as Hong Kong, Taiwan and the U.S.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: CCH Holdings Ltd. priced its small IPO at $4.00 – the low end of its range – and sold 1.25 million shares – the number of shares in the prospectus – to raise $5.0 million on Thursday night, Oct. 2, 2025. Background: CCH Holdings Ltd. disclosed the terms for its small IPO on Sept. 12, 2025, in an F-1/A filing: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, if priced at the $5.00 mid-point of its range. Background: CCH Holdings Ltd. filed its F-1 on Aug. 27, 2025, without disclosing the terms for its micro-cap IPO. Some IPO pros, however, believe that CCH Holdings, Ltd. intends to raise between $6 million and $9 million in its IPO – or about $7.5 million, if the deal’s estimated proceeds fall midway between those points.)

BM Acquisition BMAQU D. Boral Capital (ex-EF Hutton), $6.0M Shares, $10.00-10.00, $60.0 mil, 10/10/2025 Week of

(Incorporated in the Cayman Islands)

We are a newly organized blank check company based in Malaysia.

We aim to acquire an operating business primarily located in Southeast Asia that generates annual revenues between $15 million and $30 million. We will not pursue a prospective target company based in or having the majority of its operations in China. Throughout this prospectus, “PRC” or “China” refers to the People’s Republic of China, including the Hong Kong Special Administrative Region and the Macau Special Administrative Region and, for the purpose of this prospectus only, excluding Taiwan.

Our management team:

Traviss Loong Kam Seng, our CEO and chairman, is a visionary entrepreneur and financial strategist with a proven ability to scale businesses across healthcare, aesthetics, and FinTech. He has served as director of Astica Sdn. Bhd. in Selangor, Malaysia, a premier ambulatory care center specializing in plastic surgery, since April 2023, where he oversees patient-centric clinical services and advanced surgical technologies. He concurrently serves as director of BR Aesthetic Sdn. Bhd., a leading aesthetic treatment center offering non-surgical anti-aging solutions, and as director of SM Prominent Sdn. Bhd., a high-growth, premier distributor of advanced beauty products and medical aesthetic equipment serving clinics across Malaysia with high-performance solutions and exclusive technologies.

Loong Kam Hoong, our CFO, has been serving as finance account manager at Wizalda Marketing Sdn. Bhd., a trading and plastic injection company that achieved 2,405% revenue growth between 2018 and 2024, since September 2019, where he oversees portfolio management, cash flow optimization, and P&L analysis to drive financial health and operational efficiency. From September 2019 to September 2022, Mr. Loong served as production manager at Loong Weng Plastic Industries Sdn Bhd, where he managed daily production operations, implemented cost-saving measures, and developed forecasting systems that improved production planning and revenue tracking.

Ms. Mok Siew Ming, our COO, is a self-made entrepreneur and marketing strategist with a proven ability to scale businesses in the beauty and aesthetics industry. She has served as a director of SM Prominent Sdn. Bhd., a high-growth, premier distributor of advanced beauty products and medical aesthetic equipment serving clinics across Malaysia with high-performance solutions and exclusive technologies, since November 2018. Under her leadership, the company achieved 30% annual revenue growth and established itself as a pioneer in innovative marketing practices and client-focused operations. In 2022, SM Prominent Sdn. Bhd. commenced a new business line and income stream as an agency that introduces clients to BR Aesthetic Sdn. Bhd., an aesthetic clinic in Malaysia.

(Note: BM Acquisition Corp. filed terms in F-1 and F-1/A filings for its SPAC IPO: 6 million units at $10.00 each to raise $60 million. Each unit consists of one share of stock and one-half of one redeemable warrant.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), $1.8M Shares, $4.00-6.00, $9.0 mil, 10/10/2025 Week of

(Incorporated in the Cayman Islands)

We are a manpower service provider based in Singapore. Manpower service providers (“MSP”) serve as a bridge between job seekers and businesses to meet each other’s recruitment needs. Typically, MSPs create a platform whereby employers can list job opportunities and recruit individuals looking to secure full, temporary or part-time employment meeting their respective criteria. For companies, MSPs assist the recruitment process to meet particular staffing needs, saving companies time, money, and effort. For job seekers, MSPs help them find an appropriate job matching their skill sets as quickly as possible, and exposing them to more opportunities through their vast network.

Our customers fall into a wide range of industries, including warehouse and logistics, food and beverage, cleaning, manufacturing, retail and events. To provide better service to our customers, we pay close attention to the changing needs of our customers, including new developments in their respective industries, which helps us anticipate the specific roles and skills that they will need. We believe this attention to detail gives us a significant competitive advantage and improves customer loyalty.

We have developed a proprietary platform which connects job seekers and employers through a unique matching program utilizing specific character and skill recognition matrices. Our platform operates a comprehensive database that records the skill preferences and requisite applicant characteristics of our business customers and job criteria of job seekers, thereby reducing reliance on subjective human analysis which can be extremely time consuming and inefficient. While many MSPs offer similar services, we believe our model is more specifically focused on our customers’ individual criteria, therefore we tend to deliver a more tailored approach, rather than providing a one-size-fits-all service.

Job Seekers – We believe we stand out to job seekers in two important ways: (i) we have developed a mobile app to enable clients real-time access to the data and therefore opportunities, and (ii) we are the first manpower provision company operating with an app platform in Singapore that is compensating part-time workers on the very same day they finish their jobs.

We have artificial intelligence (“AI”) technology integrated into our “EL Connect App” to create a positive user-friendly experience for part-time job seekers.

Employers – For employers, in addition to the EL Connect App, we have also developed our “Taskforce App.” Our TaskForce App is a smart platform to digitalize building and property operations management. Our TaskForce App integrates internet of things (“IoT”) sensors, facial recognition systems and robotics into facilities and workforce management in buildings and properties. TaskForce App bridges the gap between the employees of our customers, such as site supervisors who oversee property management, and contractors or crews of our customers, who perform individual duties and tasks, addressing inefficiencies in traditional and paper-based processes of property management. Our TaskForce App seeks to achieve optimal performance and productivity for our customers by enabling their employees to have real-time monitoring of facilities and workforce management and providing them instant access to a variety of information ranging from attendance records of contractors or crews to real-time usage of consumable supplies in a facility. This has become an invaluable tool to our customers which has prompted us to monetize its application by opening it up to customer subscriptions and licensing, which we expect will become a growing revenue stream.

We derive our revenue primarily from the following sources: (i) manpower supply services – which provides part-time manpower to customers on our employment and recruitment portal “EL Connect Mobile”; (ii) manpower contracting services – which provides cleaners for cleaning services; (iii) software as a service (“SaaS”) sales, which grants users the right to access our “Taskforce” app; (iv) software licensing sales, which grants clients the right to use the Taskforce app customized to their specific requests (updates and maintenance included); and (v) project management services.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended June 30, 2024.

(Note: ELC Group Holdings Ltd. priced its small IPO at $4.00 – the low end of its range – on Wednesday night, Aug. 27, 2025. Background: ELC Group Holdings Ltd. increased its IPO’s size again – this time to 1.8 million shares – up from 1.7 million shares – and kept the price range modest at $4.00 to $6.00 – to raise $9.0 million, according to an F-1/A filing dated Aug. 25, 2025.)

(Note: ELC Group Holdings Ltd. raised the size of its IPO to 1.7 million shares – up from 1.25 million shares originally – and kept the price range at $4.00 to $6.00 – to raise $8.5 million. Background: ELC Group Holdings Ltd. disclosed the terms for its small IPO – 1.25 million shares at a price range of $4.00 to $6.00 – to raise $6.25 million, if priced at the $5.00 mid-point of its range, according to an F-1/A filing dated June 27, 2025. Initial Filing: ELC Group Holdings Ltd. filed its F-1 on March 4, 2025.)

OBOOK Holdings (Direct Listing) OWLS D. Boral Capital (ex-EF Hutton) (Financial Adviser), $0.0M Shares, $0.00-0.00, $0.0 mil, 10/10/2025 Week of

(Incorporated in the Cayman Islands)

Note: This is NOT an IPO. This is a Direct Listing on the NASDAQ. D. Boral Capital will serve as the financial adviser. Existing shareholders will sell stock in the direct listing. No new stock will be issued and/or sold, according to the prospectus..

The company’s operating entity, OwlTing Group, runs blockchain-driven service platforms for companies in a variety of industries:

-

OBOOK – for e-commerce, hospitality and payments – for companies and people involved in cross-border transactions;

-

OwlPay – for payment products and services

-

OwlNest – for hospitality products and services

-

OwlTing Market – for an e-commerce platform and services.

Note: Net loss and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: OBOOK Holdings’ shareholders will sell up to 4.73 million shares (4,729,695 shares) of stock in the NASDAQ Direct Listing, according to an F-1/A filing dated Sept. 19, 2025. No reference price has been set yet. In 2025, OBOOK Holdings said its stock sold for $10.00 per share in a private placement, according to the prospectus.)

Smart Logistics Global Ltd. SLGB Craft Capital Management/Revere Securities, $1.0M Shares, $5.00-6.00, $5.5 mil, 10/10/2025 Week of

We are a holding company whose operating subsidiary in China manages a business-to-business logistics provider, focused on the transportation of industrial raw materials. (Incorporated in the Cayman Islands)

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: Smart Logistics Global Ltd. filed an F-1/A dated Aug. 20, 2025, in which it named Craft Capital Management as the new lead left underwriter, to work with Revere Securities. Smart Logistics Global Ltd. is offering 1.0 million shares at a price range of $5.00 to $6.00 to raise $5.5 million.)

(Background: Smart Logistics Global Ltd. withdrew its original IPO plans in a letter to the SEC on July 14, 2025, because more than six months had elapsed since the company had updated its IPO filing. On that same date – July 14, 2025 – Smart Logistics Global Ltd. refiled its IPO plans – same terms as the original prospectus with 1 million shares at a price range of $5.00 to $6.00 – and the disclosure of a new sole book-runner, Revere Securities, to replace the previous underwriting team of Benjamin Securities and Prime Number Capital.)

(More Background: Smart Logistics Global Ltd. filed an F-1/A dated Dec. 6, 2024, and updated its financial statements through the period ending June 30, 2024. Background: Smart Logistics Global Ltd. filed an F-1/A dated Nov. 20, 2024, and disclosed the terms of its IPO: The company is offering 1 million shares at a price range of $5.00 to $6.00 to raise $5.5 million. Background: Smart Logistics Global Ltd. filed its F-1 for its IPO on Oct. 4, 2024, with estimated IPO proceeds of $10 million.)

Thunderstone Acquisition Corp. TDSTU D. Boral Capital (ex-EF Hutton)/ARC Group Securities, $5.0M Shares, $10.00-10.00, $50.0 mil, 10/10/2025 Week of

(Incorporated in the Cayman Islands)

Our efforts to identify a prospective target business will not be limited to a particular industry or geographic location.

Our sponsor is a British Virgin Islands business company, which was formed to invest in us. The sole member and sole director of the sponsor is Xunlei Lu, our Chief Executive Officer and a director. Mr. Lu controls the management of our sponsor, including the exercise of voting and investment discretion over the securities of our company held by our sponsor.

Mr. Xunlei Lu has served as our Chief Executive Officer since July 2025 and is a member of our board of directors. He is a seasoned entrepreneur and executive with nearly two decades of operational and leadership experience in the supply chain. Since September 2005, Mr. Lu has served as the Chief Executive Officer of Living Stone Pearl Company, a well-established manufacturer and wholesaler specializing in small-size freshwater pearls. Under his leadership, the company has grown into one of the leading suppliers in its niche market and has maintained a long-standing commercial relationship with Tiffany & Co., serving as a pearl supplier since 2008. Mr. Lu holds a Master of Business Administration degree from Oklahoma City University and a Bachelor’s degree from the City University in Canada.

Mr. Hengfeng Ge has served as our Chief Financial Officer since July 2025. Mr. Ge has been with Addor Capital (毅达资本), a top-tier Chinese venture capital firm with over RMB 100 billion under management, since 2016. He has served as a partner since October 2022, focusing on identifying and investing in high-growth technology companies across both early-stage and mature-stage opportunities. His investment activities spanned venture capital, mergers and acquisitions, and private placements, and he was also involved in the formation and management of several VC and PE funds. Mr. Ge has been recognized for his investment achievements, including being named one of China’s “40 Under 40 Investors” by Cyzone.cn (创业邦) in 2023 and one of China’s Best Young Investors by China Bridge (融中) in 2025. Mr. Ge holds two Master’s degrees from the University of New South Wales, one in Technology and Innovation Management and another in Photovoltaics and Solar Energy.

(Note: Thunderstone Acquisition Corp. disclosed its proposed symbol – “TDSTU” – and added ARC Group Securities as a co-book-runner to work with D. Boral Capital, the lead left book-runner. (D. Boral Capital was formerly known as EF Hutton.) Background: Thunderstone Acquisition Corp. filed an S-1/A dated Aug. 14, 2025, disclosing that ARC Group Securities has been named a joint book-runner to work with lead left underwriter D. Boral Capital (ex-EF Hutton). Background: Thunderstone Acquisition filed its S-1 on July 9, 2025, for its SPAC IPO and disclosed the terms: 5 million units at $10.00 each to raise $50.0 million. Each unit consists of one ordinary share and one right to receive one-eighth (1/8th) of a share upon the consummation of an initial business combination.)

Agencia Comercial Spirits AGCC D. Boral Capital (ex-EF Hutton)/Revere Securities, $1.8M Shares, $4.00-6.00, $9.0 mil, 10/13/2025 Week of

(Incorporated in the Cayman Islands)

We are a whiskey retailer and distributor based in Taipei City, Taiwan.

We are committed to offering imported whiskey of world-class quality to our clients. Agencia Taiwan has grown rapidly since its inception, leveraging its extensive industry experience, strategic partnerships and innovative business model to establish itself as a trusted and prominent player in the whiskey market. Our mission is to enhance the whiskey experience in Taiwan and other Asia-Pacific countries by offering expert guidance, competitive pricing and exceptional customer service.

Our Group operates across three primary business areas:

• Bottled Whiskey Sales: Sourcing bottled whiskey from local suppliers in Taiwan and reputable distilleries in the UK, the company, along with its downstream distributors, sells these products to bars, restaurants, nightclubs, VIP lounges and corporate clients.

• Raw Cask Whiskey Sales: Starting in 2023, our group expanded into the procurement and sale of raw cask whiskey sourced directly from distilleries in the UK. These unprocessed casks are sold directly to other liquor and spirits distributors, enabling our Group to tap into a broader market segment.

• Cask-to-bottle and distribution business: Beginning in 2025, our Group ventured into the cask-to-bottle and distribution business, which involves brand-authorized whiskey bottling, packaging and sales. Under this model, it obtains brand licenses, sources raw cask whiskey directly from brand owners, and conducts bottling and packaging in Taiwan with the aid of local contract manufacturers.

From 2020 to now, our development can be divided into the following stages:

• Start-up period (2020-2022): During its initial years, our Group primarily focused on bottled whisky sales, following a business-to-business (B2B) model. By sourcing both locally and internationally, our Operating Subsidiary developed a network of suppliers and clients.

• Growth period (2023-2024): Our Group expanded its operations to include the sale of raw cask whiskey sourced directly from distilleries, accounting for a significant portion of its revenue. This diversification allowed it to offer unique high-quality products while continuing to focus on B2B relationships.

• Expansion in 2025 and Beyond: Our Group plans to expand its operations to include collaboration with brand owners. This will involve obtaining brand authorization through the payment of licensing royalties, sourcing raw cask whiskey from these brand owners, and conducting bottling and packaging in Taiwan, primarily through local contract manufacturers, for which processing fees will be incurred. Our Group will then market and sell products under the respective brands. Initially, the primary customers will be distributors, focusing predominantly on a business-to-business model.

“From Barrel to Bottle” represents our Group’s core value, highlighting its dedication to delivering a comprehensive one-stop whiskey distribution service. Our Group provides an extensive range of products and utilizes a diverse array of sales channels. Consequently, both business volume and profit have experienced average annual growth. Our distribution channels encompass a broad swath of Taiwan, including clubs, restaurants, bars, hotels, VIP lounges, and corporate clients through our downstream distributors. Looking ahead, we aim to further diversify our product offerings, expand its footprint in the Asia-Pacific region, and solidify our position as a trusted key whisky distributor. By combining our client-centric approach, strategic partnerships, and focus on premium products, we believe that we are well-positioned to capture a significant share of the growing demand for high-quality whiskey in Asia and beyond.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2024.

(Note: Agencia Comercial Spirits filed its F-1 on July 10, 2025, and disclosed the terms for its IPO: 1.75 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, if priced at the $5.00 mid-point of its range.)

Antharas Inc. AAS D. Boral Capital (ex-EF Hutton), $1.3M Shares, $4.00-5.00, $5.6 mil, 10/13/2025 Week of

(Incorporated in the Cayman Islands)

We are a property developer in Malaysia. We manage all aspects of real estate development while offering a wide range of services to our clientele.

We conduct our business through Antharas Hills. Antharas Inc is a holding company.

We are a full-service community property developer based in Kuala Lumpur, Malaysia which manages all aspects of real estate development and offers a comprehensive range of services to our clients. As of the date of this prospectus, our property management portfolio consists of one property, which remains partially sold.

We aim to provide a holistic approach, and to that end our mission is to support innovative living by developing new properties in an all-in-one ecosystem through property technology, or “PropTech,” that we believe will enrich the lives of those residing in our managed properties.

We believe, 2025 will be an exciting year for the Company as we plan to offer new products and services, in PropTech (property technology, as further defined below) and hospitality. As of the date of this prospectus, some of our PropTech products are market-ready but no sales of our PropTech products have been completed. There can be no assurance that we can sell any of our PropTech products at all.

On the hospitality front, we expect to begin to generate revenues by the end of the third quarter of 2025. However, there can be no assurance that we will achieve this timeline or generate revenue as anticipated.

Our property development target market is strategically set in Southeast Asia (“SEA”), beginning with a solid business foundation in Malaysia, which boasts excellent physical infrastructure and stable, conducive government policies.

Antharas 1 is located in the heart of Genting Permai, a stone’s throw away from Genting Highlands, otherwise known as Genting – The City Of Entertainment. Also, being only 40 kilometers north of Kuala Lumpur, Antharas 1 comes with unrivalled views, nestled by natural forestry and habitats. Comprising of three towers of 41, 28 and 30 stories respectively; the project consists of a total of 476 residential units and 14 retail units.

Our development pipeline consists of two planned projects, Grand Antharas and Austin Antharas, which are in the preliminary stage of pre-construction development and remain tentative. These projects include Austin Antharas, our service apartment project in Johor Bahru, Johor, Malaysia, and Grand Antharas, our condominium complex project in Genting Permai, Genting Highlands, Malaysia. Completion of the Grand Antharas project is contingent on securing bank financing, finalizing the land acquisition agreement, and obtaining regulatory approvals, none of which are guaranteed as of the date of this prospectus. Of the estimated net proceeds from this Offering, approximately 46% will be allocated to land acquisition costs for future property development projects, including Grand Antharas. A portion of this amount will fund 20% of the land acquisition costs for Grand Antharas, with the remaining 80% expected to be financed through bank financing. However, as of the date of this prospectus, there is no definitive agreement in place for such financing. The formal application and approval of such financing facility can typically only be secured upon execution and stamping of the definitive sale and purchase agreement for the land acquisition, which is currently in process and not yet finalized. The completion of this project, including the land acquisition, is contingent on securing additional funding, which has not yet been obtained. There can be no assurance that the Company will be able to secure such financing on favorable terms or at all. See “Risk Factors – Our ability to complete the Grand Antharas project and other potential future projects depends on obtaining additional financing, which may not be available on favorable terms or at all.” For more information on these future development projects, see “Business – Antharas Hills – Tech-Driven Property Development – Our Project Pipeline.”

PropTech. Through our subsidiary PDI Design and our in-house technology team, we are dedicated to developing technologies tailored for advanced building management and property technologies, enabling us to build a unified ecosystem that will grow close-knit communities. This will drive a holistic vision of connected living. PropTech products include property management tools, intelligent parking, intelligent elevators, intelligent security, efficient unmanned delivery systems, intelligent spaces and personalized services, all managed with digital technology. As of the date of this prospectus, some of our PropTech products are market-ready but no sales of our PropTech products have been completed. We plan to install our PropTech products into all of our projects, including Antharas 1, Grand Antharas and Austin Antharas, and to commercialize and sell them separately to other developers. However, there can be no assurance that we can sell any of our PropTech products at all. We are also continuously developing new PropTech features in-house, including enhancements to market-ready products.

Hospitality. Through our subsidiary Antharas M, we plan to offer distinctive hospitality management through our franchise agreement with Wyndham Hotels. By the end of the third quarter of 2025, we expect to provide the full range of hospitality services at a facility to be named “Wyndham Garden Suites Genting Highlands” (“Wyndham GS Genting”), which is located in one of the three towers of Antharas 1. We expect to begin to generate revenues from our hospitality services by the end of the third quarter of 2025. However, there can be no assurance that we will achieve this timeline or generate revenue as anticipated.

Malaysia Real Estate Market. According to Mordor Intelligence Malaysia Real Estate Market Size and Share Analysis Report published in 2023, the overall real estate market in Malaysia (including residential, commercial and other property types), was estimated at USD 34.47 billion in 2023 and is expected to grow to USD 47.53 billion by 2028, at a compound annual growth rate (“CAGR”) of 6.64%.

Southeast Asia PropTech Market. According to the PropTech Global Trends 2022 Annual Barometer, the PropTech market in Southeast Asia remains relatively untapped and shows significant potential for growth.

Malaysia Hospitality Services Market. According to Mordor Intelligence Hotel Industry in Malaysia Size and Share Analysis report published in 2022, the value of the hospitality industry in Malaysia was estimated at USD 4 billion in 2022, and the hospitality industry in Malaysia was poised for significant growth with an expected CAGR of over 6.5% from 2023 to 2028. This growth is bolstered by the Malaysian government’s Smart Tourism 4.0 Initiative, which focuses on digitizing the sector and developing smart tourism products and infrastructure.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: Antharas is offering 1.25 million shares at a price range of $4.00 to $5.00 to raise $5.63 million, if priced at the $4.50 mid-point of its range.)

Bgin Blockchain Ltd. BGIN D. Boral Capital (ex-EF Hutton), $6.0M Shares, $5.00-7.00, $36.0 mil, 10/13/2025 Week of

We make cryptocurrency mining equipment. Our focus is on alternative currencies. (Incorporated in the Cayman Islands)

Through our operating subsidiaries, we are a digital asset technology company based in Singapore, Hong Kong, and the U.S. with proprietary cryptocurrency-mining technologies and a strategic focus on alternative cryptocurrencies.

For the fiscal year ended December 31, 2022, we generated substantially all of our revenue from cryptocurrency mining. Since April 2023, we have generated revenue from selling mining machines designed by us, and sales of mining machines contributed approximately 85.43% and 65.71% of our total revenue for the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, respectively.

Our subsidiaries design and sell mining machines equipped with our proprietary 8nm or 12nm ASIC chips under different series dedicated to the mining of KAS coins, ALPH coins, RXD coins, and ALEO coins. These machines are available for purchase only through our website, iceriver.io. Customers may view and place orders for machines they intend to purchase directly through the website, and have the option to enroll in our miner hosting services, through which we operate and manage mining machines on customers’ behalf in return for service fees. Customers purchasing machines sold by our subsidiaries are primarily based in Hong Kong, the U.S. and Southeast Asia. For the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, we sold an aggregate of 67,998 and 47,252 mining machines, respectively, to customers across the world. As of the date of this prospectus, we host a total of 4,020 machines on behalf of our customers, of which 2,969 are in operation at our mining farm located in York, Nebraska, and a hosting facility in Coon Rapids, Iowa, and 1,051 are stored in our warehouse in Beatrice, Nebraska.

As our subsidiaries produce cryptocurrencies through their mining operations, they exchange cryptocurrencies mined for fiat currency on a regular basis to generate cash flow to fund our subsidiaries’ business operations. We attribute our substantial growth since our inception to our competitive advantages in our subsidiaries’ research and development capacities, our experienced and visionary management team, and our strategic focus on alternative cryptocurrency mining. According to the Frost & Sullivan Report, alternative cryptocurrencies refer to cryptocurrencies other than Bitcoin and Ethereum. Alternative cryptocurrencies are generally considered to have more growth potential with higher risks compared to large-capitalization cryptocurrencies. To mitigate such risks and maximize profit potential, our subsidiaries adopt a flexible approach to mining operations by using their proprietary cloud-based mining machine management software to monitor mining results on a daily basis and, on an as-needed basis, adjust the ratio of cryptocurrencies to be mined.

We believe that the strong design of our mining machines and the research and development capabilities of our subsidiaries represent key competitive strengths that afford us the ability to conduct cryptocurrency mining with greater computing power and power efficiency. Our subsidiaries fully rely on their self-designed mining machines for their daily cryptocurrency mining operations. To date, through our subsidiaries, we have designed 26 and put into use 14 different models of cryptocurrency mining machines, each specifically adapted and dedicated to alternative cryptocurrency mining.

As of the date of this prospectus, our subsidiaries own a total of 48,277 mining machines for operation purposes, of which 34,390 are in operation, 11,475 are not operated and are stored in mining farms and hosting facilities in the U.S. or our warehouses in Hong Kong and Beatrice, Nebraska, and 2,412 are currently being detained by U.S. Customs and Border Protection (“U.S. Customs”) and are now the subject of re-export proceedings. See also “Business — Legal Proceedings.” Through our subsidiaries, we currently manage and operate some of our mining machines in the U.S. at mining farms owned by our subsidiaries in Omaha, Nebraska, and York, Nebraska. The remaining mining machines are hosted by third-party hosting service providers at four different locations in the States of Iowa, Texas, West Virginia and Ohio. As of the date of this prospectus, other than 425 mining machines located in our warehouse in Hong Kong, all the mining machines owned by our subsidiaries are located in the U.S. See “— Growth Strategies — Improving and Integrating Our Business Model to Encompass a Value Chain.”

We strive to continuously develop and implement technological improvement into our subsidiaries’ mining process. The technological cornerstone of our subsidiaries’ cryptocurrency mining operations is their proprietary cloud-based mining machine management software, which is used at all of the mining farms in which our subsidiaries maintain and operate mining machines, and allows them to make timely and informed decisions as to the use and management of their mining machines.

Since September 2023, we have been operating a mining pool, currently dedicated to mining five cryptocurrencies, through which we generate income by receiving crypto coins as rewards and deducting a percentage of such rewards as pool fees from payouts to pool participants. See “— Mining Pool.”

For the fiscal years ended December 31, 2022, and December 31, 2023, and the six months ended June 30, 2024, the company’s business operations were heavily dependent upon KAS coins. See “Risk Factors — Risks Related to Our Business and Industry — Our business operations are heavily dependent upon the stability and popularity of KAS coins” and “Industry — Total Market Capitalization of Cryptocurrencies — KAS.”

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: Bgin Blockchain Ltd. cut its IPO’s size to 6 million shares – down from 6.25 million shares originally – and cut the price range to $5.00 to $7.00 – down from $7.00 to $9.00 initially – to raise $36.0 million, if priced at the $6.00 mid-point of its new range, according to an F-1/A filing dated July 31, 2025. Background: Bgin Blockchain Ltd. disclosed its IPO’s terms on March 20, 2025, in its FWP (free writing prospectus): 6.25 million shares at a price range of $7.00 to $9.00 to raise $50.0 million, if priced at the $8.00 mid-point of the range.)

(Note: D. Boral Capital is the sole book-runner, replacing Chardan and The Benchmark Company, the joint book-runners.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, $4.2M Shares, $4.00-4.00, $16.6 mil, 10/13/2025 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.

We commenced selling and delivering two models of electric light commercial vehicles, ELEMO and ELEMO-K, in Japan in April 2022 and July 2022, respectively, and have been working with Cenntro, our cooperating manufacturer, to produce them under our brand, “ELEMO,” in its factory in Hangzhou, China. ELEMO is the first electric vehicle we sell and (it) is the second electric light commercial vehicle that has ever been sold in Japan since the commencement of sales of MINICAB-MiEV in December 2011, which was the first electric light commercial vehicle produced by Mitsubishi Motors Corporation. Since June 2023, we have commenced the sales of a new model called “ELEMO-L,” a van-type electric vehicle that could be used for commercial and recreational camping purposes, which we expect may enable us to increase consumer market penetration.