EM Fund Stock Recommendations and Country Commentary (October 19, 2025)

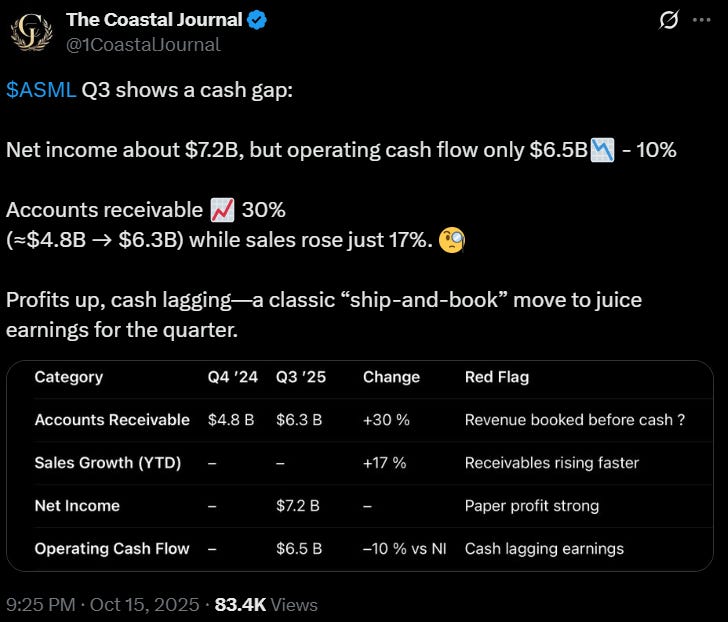

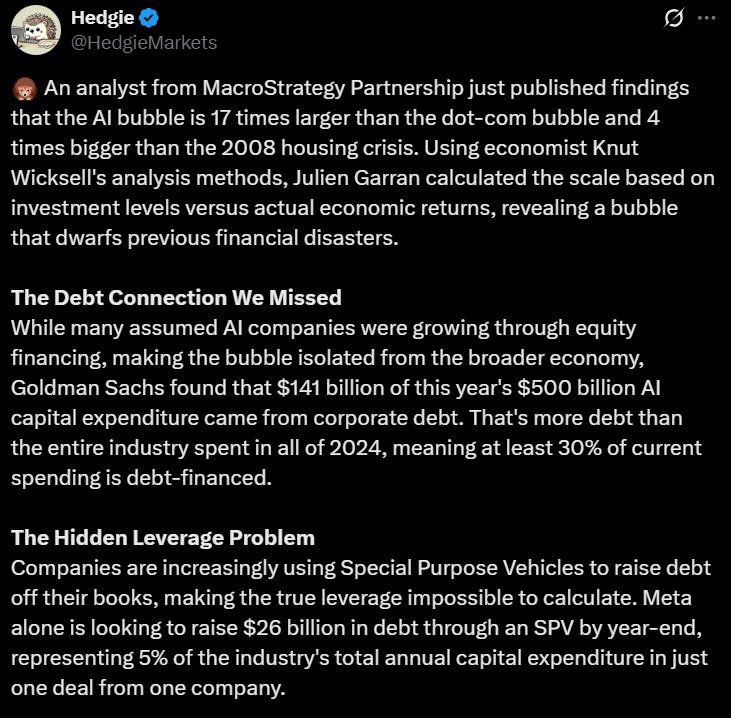

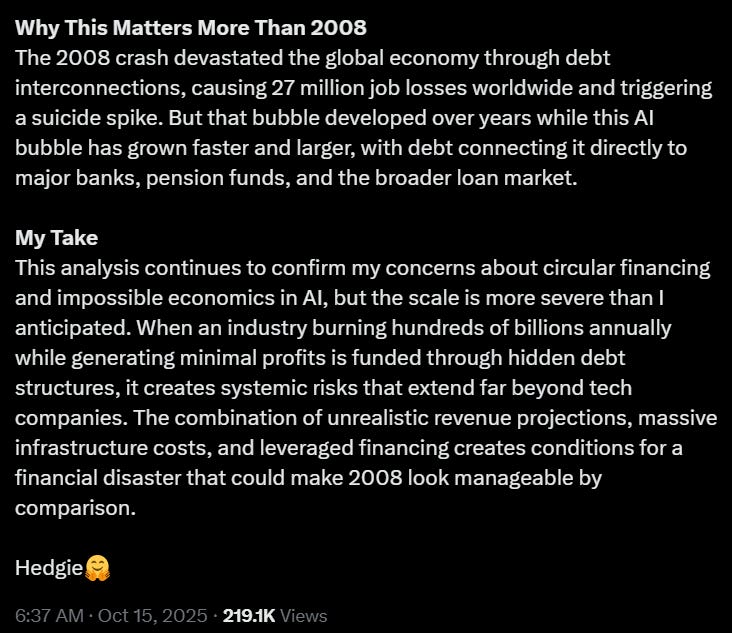

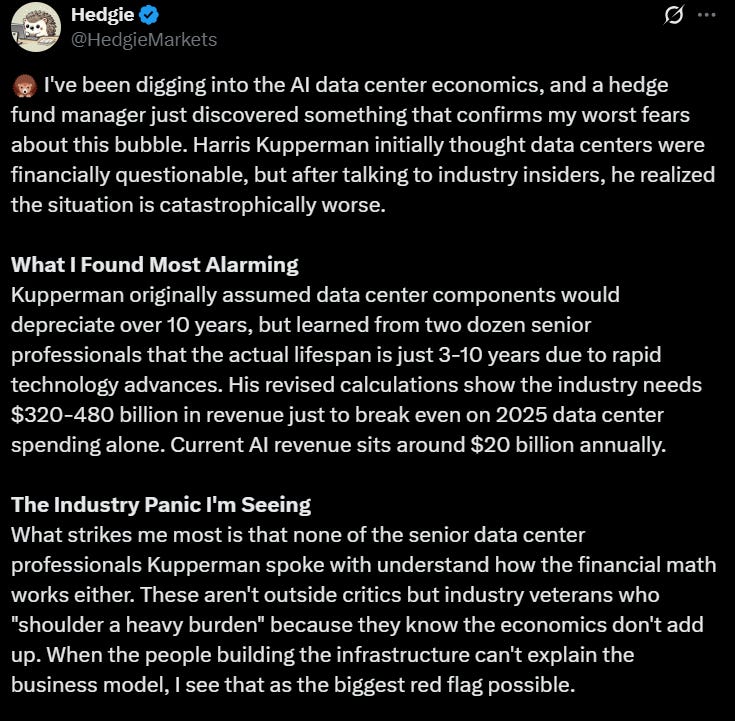

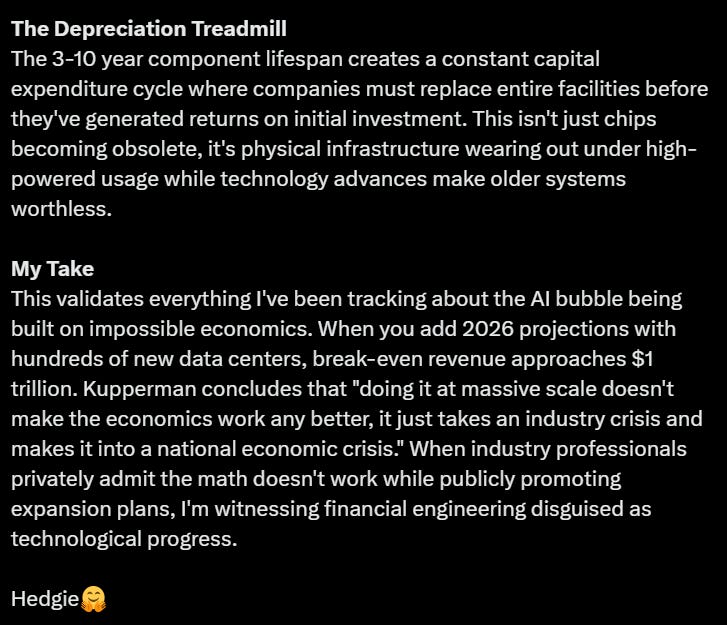

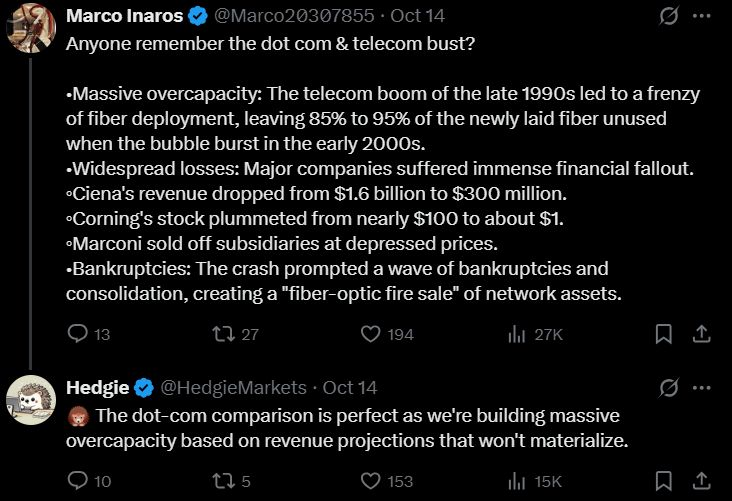

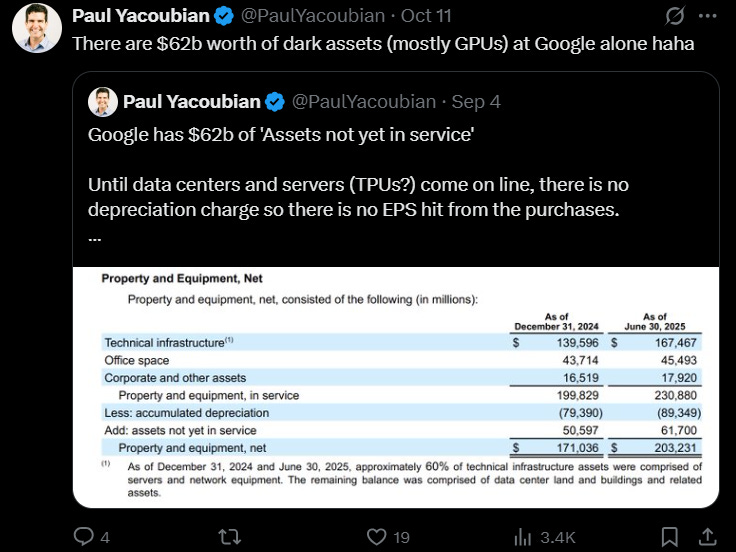

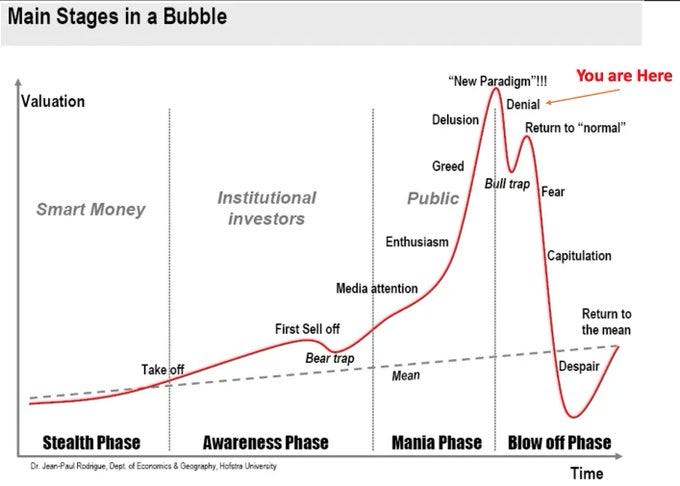

as guaranteed last weekMore people are starting to question the “AI boom.”

Note: We have mentioned Kuppy’s very rational and thoughtful thoughts. Global Crossing is reborn… piece at the end of august:

Here’s another one (and there’s no doubt that all those pointless AI slop videos about clicking are sucking up your GPU).

The chart omitted his appearance on Mad Money with Jim Cramer. scam Convince retail investors to keep inflating the bubble.

Again, I free Chinese AI providers like DeepSeek help extract, organize or analyze the information I provided for this post, and they do this very well (even if they don’t match the output format – perhaps I can alleviate this with more detailed instructions). Beyond that, it’s still quite a bit of work to ask a search function (as in external research) to do what it needs to do (although I know I’m now providing a footnote with a link).

Over the past week, I’ve been trying to find additional providers of free stock research or media that consistently provide good coverage so I can include them in my monthly stock recommendation posts. AI has helped to some extent, but we still find new sources by looking at Google’s blue links page (the old-fashioned way) or searching media publications themselves.

Now that the internet is full of garbage and outright misinformation or just plain misinformation, I’m not sure how AI search (aka research capabilities) can be improved. This means that knowing an “expert” or source who can provide accurate information (or the ability to have AI only use selected sources – which can be embedded in user prompts) is increasingly worth its weight in gold.

If it turns out that I’m right now that AI is a bubble, it might be worth listening to “experts” or sources like the aforementioned sources instead of the money, media sources, and people like Jim Cramer who have helped overestimate AI.

As of mid-October, more September/Q3 fund updates are available. The post with all the funds is here .) with new studies starting with some non-EM studies:

-

🔬🌐🚩 Investing Beyond the Cycle: Equity Opportunities in a Slow-Growth World (Capital Fair) – At the same time, the trade framework that has driven globalization for decades is also under pressure. Supply chains are changing, developed countries are struggling with high import costs, and export-driven emerging markets are facing declining demand and limited room for policy maneuver.

-

🇺🇸 rollins inc (NYSE: role) – We are a pest control company that serves residential and commercial customers. 🇼

-

🇺🇸 Heico Co., Ltd. (NYSE: here) – Components and systems (aviation, defence, space, medical and communications). 🇼

-

🇺🇸 Amphenol Co., Ltd. (NYSE: APH) – Electronic and fiber optic connectors, cables and interconnection systems (coaxial cables, etc.). 🇼

-

-

🔬🇬🇧 In the UK you don’t get paid to work (Morgan Stanley) – The UK’s current policies create many obstacles for British citizens to work. These policies impose enormous costs at the individual and microeconomic levels and are a major drag on GDP. Until anger and apathy about economic policy abate, it is difficult to imagine an optimistic scenario for UK assets.