Google integrates Kalshi, Polymarket data into major financial overhaul

Prediction markets like Polymarket and Kalshi are becoming increasingly difficult to ignore.

A person who never hesitates in technological innovation, Google (NASDAQ: GOOG) has unveiled an innovative AI-powered upgrade for its Google Finance platform that includes real-time data integration from prediction markets Polymarket and Kalshi.

In doing so, Google has placed crowd-driven forecasting at the center of mainstream financial markets, giving users unprecedented access to market probability insights. As a result, potential investors can now use Google Finance’s new deep search feature to ask complex questions and receive fully quoted AI-generated responses.

Based on Google’s own Gemini model, our latest toolset can now explore real-time market datasets to interpret indices and macroeconomic trends while transforming raw data into real-time, actionable reporting.

Google Finance Upgrade

| characteristic | explanation | Benefits to Users |

| Deep Search | Automated multi-source financial research Q&A tool | Comprehensive response to complex investor inquiries |

| prediction market | Real-time Polymarket and Kalshi data integration | Crowdsourced Predictive Predictive Insights |

| Income Tracking | Live audio, script and transcription comparison tools | Provide immediate revenue performance tracking and feedback |

| Pre-charting | AI Generated Technical Analysis Tool | Next-generation visualization display showing performance trends |

Polymarket & Kalshi’s Verification Drive Continues

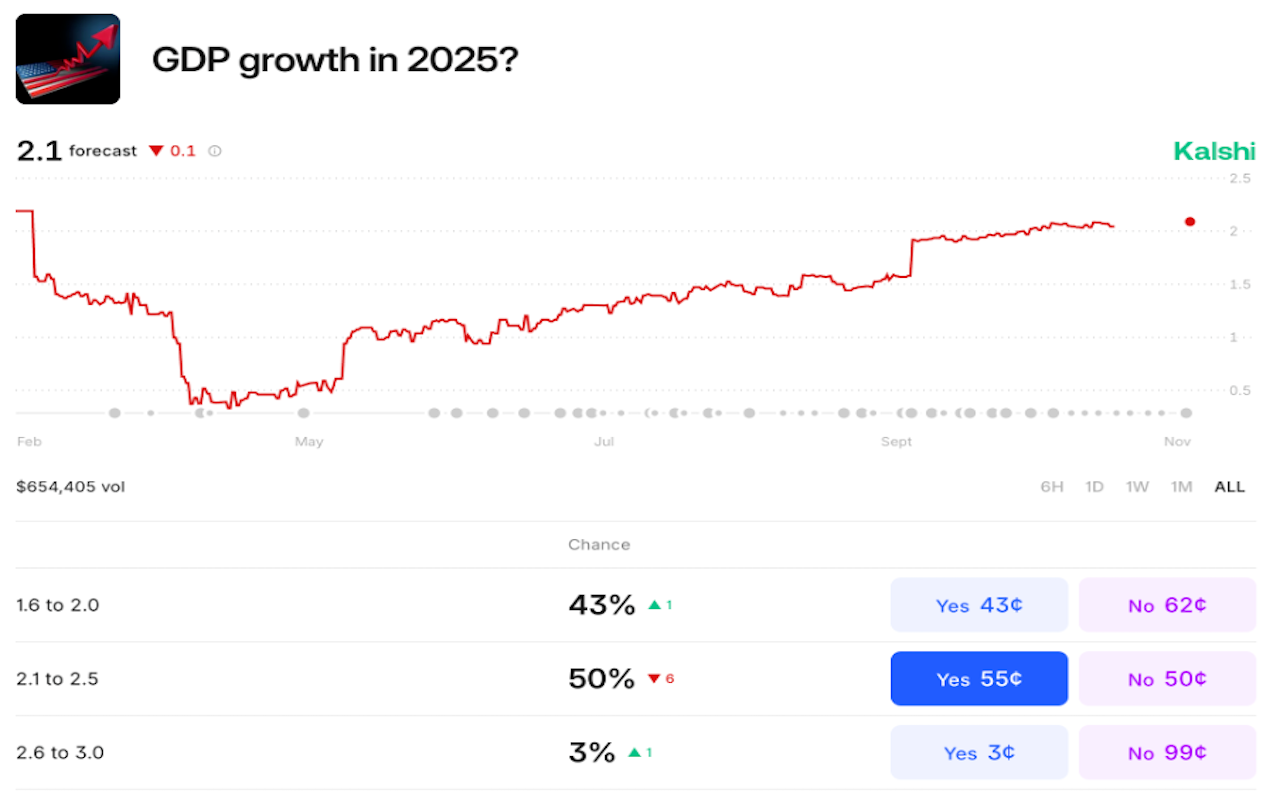

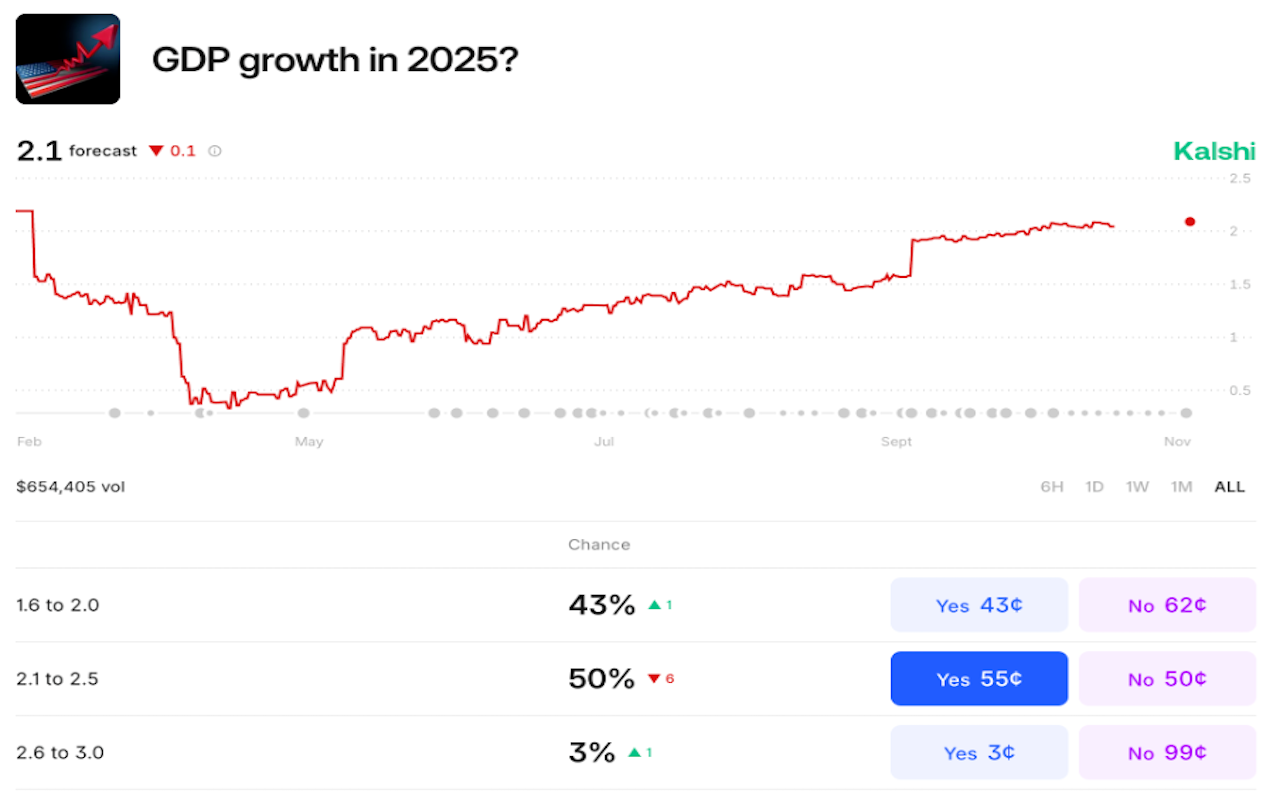

Following the latest upgrade, investors can now ask questions like “What will the GDP growth rate be in 2025?” We use Google Finance to forecast aggregate data reflecting thousands of forecast market transactions. Given that event contract sizes regularly accumulate hundreds of thousands of dollars in transactions, the resulting answers translate collective market sentiment into actionable, data-driven predictions.

Google’s inclusion of trading data from both prediction markets goes some way to solidifying Polymarket and Kalshi’s position as serious players. Especially now that the tech giant is committed to connecting real-time event-based forecasts directly to its Google Finance feed.

This news will undoubtedly further strengthen the appeal of the prediction markets sector on Wall Street. Polymarket has already raised $2 billion from Intercontinental Exchange, and Kalshi recently secured $300 million from several top venture firms, whose respective valuations had already reached $9 billion and $5 billion before the announcement.

Google’s AI improvements anger sportsbooks and state regulators

Both Polymarket and Kalshi operate in a lucrative gray area by leveraging the CFTC’s unique federal oversight, but have also drawn the ire of opponents when it comes to sports event contracts.

News of Google Finance’s inclusion of predictive market data has further increased pressure on sportsbook companies such as: DraftKings (NASDAQ: DKNG) and fan duel (NYSE: FLUT) has already seen its stock price drop since the launch of Kalshi’s NFL event contract product in September.

The introduction of sports event contracts, ostensibly protected by CFTC oversight, also effectively circumvented the authority of state gambling regulators. This is not an exception in Texas and California, where sports betting is still banned, but Kalshi continues to offer real money NFL deals without opposition.

But circumventing state regulations is one thing. Continuing to siphon state tax levies from licensed bookmakers will inevitably lead to calls for stricter enforcement of prediction market platforms. Nonetheless, Google’s adoption of prediction markets has added visibility and, more importantly, relevance to Polymarket and Kalshi not only as a sportsbook alternative, but also as an additional mainstream financial tool.

Meanwhile, Google Finance’s AI upgrade appears to be another troubling development for those with large gaming stock portfolios, as sportsbooks including DraftKings and FanDuel race to offer viable prediction markets for existing investors.