Emerging Market Links + The Week Ahead (November 24, 2025)

A couple of reports worth noting have come out in recent weeks starting with the Asia Generational Wealth Report 2025 which noted that Asia’s great family wealth handoff well underway 🗃️:

Legacy, succession challenges at forefront amid meteoric rise in value of region’s private wealth, set to hit US$99 trillion by 2029

Over 60% of Asia’s high-net-worth ( HNW ) individuals are above the age of 60, with much of their wealth embedded in family enterprises, as such, succession, once seen as a matter of tradition, has now become a high-stakes corporate and in some instances, an emotional negotiation.

The Hong Kong Affluent Study noted that Hong Kong’s multimillionaires now account for 7% of population 🗃️ and that the:

Ultra-affluent class pivots to active wealth management, sharpens focus on legacy planning

The average age at which these multimillionaires made their first million was 34, with stocks and funds being their major investment tools. On average, they bought their first home at the age of 33.

Finally, most retail investors in Singapore hold digital assets 🗃️ according to the Pulse of Crypto – Singapore 2025 survey:

Maturing market less swayed by volatility and more inclined towards long-term exposure

The headline figure is that 61% of respondents reported holding cryptocurrency, marking a substantial move into mainstream adoption. However, the average portfolio allocation of 6% to 12% suggests investors are still cautiously engaged, rather than fully committed.

Notably, 58% of respondents describe themselves as long-term holders, while only 22% are active traders. It appears a “hold on for dear life” ( HODL ) culture has taken root, reflecting a maturing market that is less swayed by volatility and more inclined towards measured exposure.

I’m surprised at that number but the the survey was skewed toward “digitally engaged users” and it was the younger ones among them who tended to hold the crypto…

With that said, I have written about the CLOB stock trading fiasco of the late 1990s that burned many Singaporean investors (who were no doubt disproportionally young and are now reaching retirement age) speculating on Malaysian stocks in an unrecognized market. They in turn asked why their government had even allowed them to invest in CLOB – something I am sure the Singaporean government would not want to happen again should something similar happen with crypto markets…

$ = behind a paywall

-

🇰🇷 Korean Stock Picks (October 2025) Partially $

-

Korean market updates

-

LG Innotek, Hyundai Motor, W-Scope Chungju Plant, SK Telecom, Hyundai Glovis, Hyundai Steel, Samsung E&A, Samsung Electronics, ST Pharm, Samsung Electro-Mechanics, SK Hynix, Samsung Biologics, Samsung C&T, Samsung SDI, POSCO Holdings, GS Retail, POSCO International, Hanmi Pharmaceutical, LG Energy Solution, Daeduck Electronics, BGF Retail, Samsung Heavy Industries, GS E&C, DL E&C, Daewoo Engineering & Construction Co Ltd, HD Hyundai Mipo, HD Hyundai Heavy Industries, Hyundai Engineering & Construction, Korean Air, Cosmecca Korea, PharmaResearch, Krafton, JYP Entertainment, Dear U, JB Financial Group, Woori Financial Group, SK Square, Pan Ocean, Hanwha Ocean, OCI Holdings, HYBE, SM Entertainment, Kakao Corp, Netmarble, NAVER, Hotel Shilla, Hyundai Department Store, Shinsegae Inc & LX International

-

🤖 DeepSeek Analysis

-

-

🌐 EM Fund Stock Picks & Country Commentaries (November 23, 2025) Partially $

-

India (the best anti-AI market?), EHang Holdings (flying cars), We Buy Cars Holdings, Techcom Securities, investment case for Africa, capturing mispriced quality in EMs, Q3/October fund updates, etc.

-

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia’s great family wealth handoff well underway (The Asset) 🗃️

Legacy, succession challenges at forefront amid meteoric rise in value of region’s private wealth, set to hit US$99 trillion by 2029

Asia is not just creating wealth, it is now confronting the challenge of preserving it, responsibly and collectively, across generations, finds the Asia Generational Wealth Report 2025 published by UOB Private Bank, Boston Consulting Group ( BCG ) and the National University of Singapore ( NUS ) Business School.

By 2029, Asia’s private wealth, the report notes, is forecast to reach in the region of US$99 trillion, accounting for a quarter of global holdings. However, this wave of prosperity is coming up against a demographic reality.

Over 60% of Asia’s high-net-worth ( HNW ) individuals are above the age of 60, with much of their wealth embedded in family enterprises, as such, succession, once seen as a matter of tradition, has now become a high-stakes corporate and in some instances, an emotional negotiation.

🇯🇵 These Japanese Stocks will crash when US AI Bubble Bursts (KonichiValue) $

🇨🇳 In Depth: China Puts Industry, Consumers at Heart of Next Five-Year Plan (Caixin) $

China’s economic game plan for the rest of the decade seeks to shift the focus of policymaking toward the real economy by modernizing industry, jump-starting sluggish household spending and easing the risks bubbling up from the country’s mountain of local government debt.

The country’s leadership approved the blueprint for the 15th Five-Year Plan, which covers the years 2026 to 2030, at the Fourth Plenum of the Communist Party’s 20th Central Committee in late October. The blueprint lays the groundwork for China to achieve an overarching goal of becoming a “medium-developed country” — defined as doubling 2020 per capita GDP — by 2035. For that to happen, China’s economy needs to grow by at least 4.17% a year on average over the next decade, according to an official explanation.

🇨🇳 Unraveling China’s Productivity Paradox (Gavekal)

China is the world’s leader in manufacturing. It contributes around 30% of global manufacturing value-added and as much as two-thirds of physical output in shipbuilding, electric vehicles, lithium batteries, commercial drones and solar panels. It employs cutting-edge technology, installing over half of the world’s industrial robots in 2024, with a robot density 50% higher than the US. It boasts over 30,000 smart factories, including autonomous “dark factories” operating without workers or lights around the clock. Tesla’s Shanghai Gigafactory produces twice as many vehicles per worker as its California plants.

Yet almost all available studies claim that China’s manufacturing labor productivity is significantly lower than that of the US, with estimates as low as a single-digit percentage of US levels. This seems a paradox: China’s manufacturing is globally competitive, yet not productive? Is China’s manufacturing efficiency an illusion?

🇨🇳 Alibaba (BABA): Fundamentals > Headlines (Coughlin Capital)

There’s a declassified memo floating around DC claiming Alibaba (NYSE: BABA) has been helping the Chinese military with tech that could be used against the US. Payments, data, IP-theft tools, the usual laundry list.

Alibaba didn’t waste time responding. They called the claims “completely false,” questioned the motivation behind the leak, and pointed out the FT couldn’t verify any of it.

And that’s really where Alibaba sits today, right at the intersection of two forces I don’t think the market has fully priced in.

A multi-year China equity bull market built on policy support and a gigantic savings pool that has to leave bank deposits at some point

Alibaba’s position as China’s leading full-stack AI and cloud platform, with most of the restructuring behind it

This post is my attempt to lay out a clean, valuation-anchored bull case. I will lean bullish, but I am not ignoring the obvious risks.

🇨🇳 PDD Q3 2025: The Earnings and the Long-Tail Risk I Was Missing (The Great Wall Street) $

The only company talking risks while rivals sell fantasies.

And then there is PDD Holdings (NASDAQ: PDD) or Pinduoduo the strange outlier: the one player that insists on highlighting what could go wrong. No victory laps, no fantasy projections. Their international expansion could easily be framed as a “massive opportunity across multiple continents.” Instead, they talk about “heightened uncertainty,” “regulatory unpredictability,” and “volatility in outcomes.” If JD owned Temu, we all know the script would sound very different — including dozens of mentions of “consumer mindshare.”

I’ve been thinking a lot about why Pinduoduo behaves this way, and a few weeks ago the pieces finally fell into place. A conversation with one of ByteDance’s early investors, my wife reading a book about Duan Yongping — Colin Huang’s mentor — and several smart investors who pointed this out to me long ago made me realise I had completely underestimated a long-term tail-end risk for Pinduoduo.

But before getting to that, a quick look at the earnings. Nothing in the numbers should surprise anyone who understands what is actually happening. What is far more interesting, as always with Pinduoduo, is what they don’t say — what is happening behind the curtain.

🇨🇳 JD.com Launches Food Delivery App and Reviews Service to Take On Meituan (Caixin) $

JD.com (NASDAQ: JD / SGX: HJDD) has launched a standalone food delivery application and an independent user-review service, intensifying its competition with Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) in China’s sprawling local services market.

Company founder and chairman Richard Liu announced on Monday that the e-commerce heavyweight will roll out a dedicated food delivery app, as well as a new review platform called “JD Dianping.” The platform will also introduce “JD Zhenbang,” an AI-powered ranking system designed to rival Meituan’s widely used Dianping listings. Liu said the app was developed in response to user feedback that food delivery services were too hard to locate within JD.com’s main app. The new application is currently available only for Android users.

JD Dianping will cover five major lifestyle sectors, including dining, hotels and entertainment. Its Zhenbang system will use artificial intelligence to aggregate online reviews, track real user behavior and incorporate results from blind testing conducted by a planned 100,000 testers. Liu emphasized that the rankings will not be commercialized, asserting that monetization of such platforms undermines fairness.

🇨🇳 JD Q3 ‘25 update (Sunrise Capital)

Food delivery investments showing promise

JD.com (NASDAQ: JD / SGX: HJDD)’s top-line showed strong growth, with its ecosystem strategy working out. Food delivery looks to be the key to unlock growth in retail: in both 1P, 3P and logistics segments. While we wait for the other Chinese tech firms to announce their results, JD’s investments are working.

However, in ever usual fashion, JD’s stock price movement remains a disappointment post earnings.

So what’s happening? let’s dive deeper into the key highlights.

🇨🇳 $JD.us Quick Pitch (Chop Wood, Carry Water Newsletter)

JD.com (NASDAQ: JD / SGX: HJDD) operates as a supply chain-based technology and service provider in China.

Think of JD.com as one of the twin pillars of China’s massive e-commerce world. What makes them unique is that they own the entire process, they don’t just sell things online, they also run a nationwide logistics and delivery system.

Its business model runs on two main engines:

Net product revenues, driven by JD’s direct online retail operations — selling a wide range of goods directly to consumers.

Net service revenues, an increasingly important stream that includes fees from its third-party marketplace, marketing services, and logistics solutions provided to external clients.

JD.com has a huge competitive edge thanks to its proprietary, nationwide fulfillment infrastructure. Building this network of warehouses and dedicated delivery teams costs an absolute fortune and takes years. Because it’s so difficult for competitors to copy, JD.com has exceptional control over the entire customer experience and that’s a big deal.

🇨🇳 BRIEF: Kuaishou’s third-quarter profit jumps as AI fuels growth (Bamboo Works)

Short-video platform Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) reported on Wednesday its revenue rose 14.2% year-on-year to 35.6 billion yuan ($5 billion) in the third quarter, while its profit jumped 37.3% to 4.49 billion yuan.

The company’s average daily active users (DAU) exceeded 416 million during the period, up 2.1% year-on-year. Average online marketing service revenue per DAU rose 11.54% to 48.3 yuan.

The company’s online marketing services revenue jumped 56.6% year-on-year to 20.1 billion yuan, mainly due to the use of AI technology to upgrade its marketing product solutions. Other services revenue climbed 41.3% to 5.9 billion yuan, largely propelled by advanced AI capabilities that boosted product performance. Revenue from the company’s livestreaming business rose 2.5% year-on-year to 9.57 billion yuan.

🇨🇳 Lenovo Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇨🇳 Lenovo: Still A ‘Buy’ With Earnings Surprise And Positive Outlook (Seeking Alpha) $ 🗃️

-

🌐 Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) 🇭🇰 – Designing, manufacturing & marketing consumer electronics, PCs, software, servers, converged & hyperconverged infrastructure solutions, etc. 🇼

🇨🇳 China Int’l Development ditches leather for power semiconductors (Bamboo Works)

The leather goods maker has signed an MOU to acquire power semiconductor maker Lonten, after an earlier deal to invest in a blockchain company collapsed

China International Development Corp Ltd (HKG: 0264) has agreed to acquire power semiconductor maker Lonten in a deal worth up to HK$9 billion

The deal, if completed, would most likely equate to a backdoor listing for Lonten, which is much larger than the money-losing China International Development

🇨🇳 Investors Flock to Chinese eVTOLs Chasing Regulatory Green Lights (Caixin) $

A trio of Chinese startups developing electric vertical takeoff and landing (eVTOL) aircraft secured fresh funding in November, underscoring growing investor appetite for companies making measurable headway in regulatory certification.

Govy Technology Co. Ltd., backed by state-owned automaker Guangzhou Automobile Group (HKG: 2238 / SHA: 601238 / FRA: 02G / OTCMKTS: GNZUF / GNZUY), said it closed a 200 million yuan ($28 million) pre-A funding round on Nov. 14. That same day, rival firm Shanghai Volant Aerotech Co. Ltd. announced it had raised several hundred million yuan in a Series B+ round. A week earlier, TCab Tech disclosed it secured 300 million yuan in a new funding round.

🇨🇳 Chinese Self-Driving Firms Accelerate Into Middle East, Southeast Asia (Caixin) $

Chinese autonomous driving companies are accelerating their expansion into overseas markets, securing major financing and landing pilot projects in the Middle East and Southeast Asia.

Autonomous delivery vehicle maker Neolix Technologies Co. Ltd. last month raised more than $600 million in a Series D funding round led by Dubai-based investment firm Stone Venture, laying the financial foundation for its foray into the United Arab Emirates. The move is part of a broader trend that has seen Chinese players like Mogo.ai Information and Technology Co. Ltd. establish a presence in overseas markets.

As the industry matures on the Chinese mainland, these companies are seeking new avenues for growth and commercialization abroad. Their overseas expansion is a test of not only their technology but also their ability to navigate complex and varied international regulations, address data localization requirements, and adapt to different business cultures. This push signals a new phase in the global race for autonomous mobility, where Chinese firms are emerging as significant contenders.

🇨🇳 In Depth: China’s Steelmakers Look Abroad as Domestic Pressures Mount (Caixin) $

It wasn’t the drop in production that alarmed China’s steel industry this year. It was that demand fell even faster.

By the end of September, Chinese mills had produced 746 million tons of crude steel, down 2.9% from a year earlier. But domestic consumption slumped 5.7% to just under 649 million tons, a much steeper decline. The imbalance sent a clear message: in the world’s largest steel-producing nation, the core problem isn’t output. It’s overcapacity, with too few buyers at home to absorb what’s being produced.

🇨🇳 XJ International learns financial lesson as heavy debt prompts school asset sales (Bamboo Works)

A prolonged downturn in China’s private higher-education sector has weighed heavily on the debt-heavy company, which is selling assets in a bid to survive

XJ International Holdings Co Ltd (HKG: 1765 / FRA: HE1)’s latest asset sale is priced at just 10 million yuan, but will bring the company 120 million yuan annually in debt it is owed by the asset being sold

The private school operator has fully redeemed its $350 million zero-coupon convertible bond, eliminating its foreign-currency debt risk

🇨🇳 Vaping leader RLX wins over skeptics with global diversification (Bamboo Works)

The company reported that more than 70% of its third-quarter revenue came from outside its challenging home China market

Acquisitions in Asia and Europe lifted RLX Technology (NYSE: RLX)’s revenue by 49% in the third quarter, sparking a rally for its shares

The company’s gross margin improved by 4 percentage points in the quarter, as its revenue gains outpaced a smaller rise in its production costs

🇨🇳 In Depth: Thailand Turns to Pop Mart, Miniso to Win Back Chinese Tourists (Caixin) $

On a late October morning, a long queue snaked through Siam Square, the bustling heart of Bangkok’s shopping district. The crowd had gathered for the grand opening of the first overseas Miniso Land — a multistory superstore for trendy toys.

The ground floor of the new MINISO Group Holding (NYSE: MNSO) flagship location was a shrine to Disney’s “Zootopia 2.” Local influencers in cosplay and media guests browsed aisles of co-branded merchandise, part of a global launch that the Chinese toy retailer chose to debut in Thailand.

🇨🇳 Luckin eyes new challenge to Starbucks with potential Costa bid (Bamboo Works)

China’s leading coffee chain is reportedly in discussions with one or more banks for a $900 million loan to finance a bid for the British coffee chain, which is being sold by Coca Cola

Luckin Coffee (OTCMKTS: LKNCY) is reportedly considering a bid for Costa Coffee, potentially in partnership with Chinese private equity firm Centurium, according to media reports

An acquisition would sharply boost Luckin’s global footprint, giving it more than 33,000 stores in around 50 markets, approaching Starbucks’ 40,990 stores worldwide

🇨🇳 🇭🇰 Hang Seng Index (HSI) Rebalance: Innovent Biologics Turns a Profit, Gets Added (Smartkarma) $

🇨🇳 🇭🇰 HSCEI Index Rebalance: 3 Changes; Yum China In; Double Add for Innovent Bio (Smartkarma) $

🇭🇰 Hong Kong Expected to Swing to Budget Surplus on Stock Market Boom (Caixin) $

Hong Kong is projected to swing to a HK$15.6 billion ($2.2 billion) fiscal surplus in the 2025/26 fiscal year, which runs from April to March, according to Deloitte, a sharp reversal driven by a stock market boom that has bolstered stamp duty revenue.

The forecast contrasts starkly with the government’s own prediction from February of a HK$67 billion deficit.

🇭🇰 Hong Kong’s multimillionaires now account for 7% of population (The Asset) 🗃️

Ultra-affluent class pivots to active wealth management, sharpens focus on legacy planning

Hong Kong’s multimillionaire population – those with over HK$10 million ( US$1.28 million ) in total net assets and at least HK$1 million in liquid assets – is estimated to have increased to 395,000 as of the second quarter of 2025, representing around 7% of the total adult population ( aged 21 to 79 ), according to a new study.

Their median net asset value stood at HK$20.5 million, while their median liquid asset value was HK$10 million, Citi says in the 21st edition of its Hong Kong Affluent Study.

The average age at which these multimillionaires made their first million was 34, with stocks and funds being their major investment tools. On average, they bought their first home at the age of 33.

🇲🇴 Macau government estimates full-year 2026 casino GGR will reach US$29 billion (GGRAsia)

The Macau government has forecast the city’s casino gross gaming revenue (GGR) will reach MOP236 billion (US$29.43 billion) for full-year 2026, according to its freshly-issued 2026 fiscal budget plan.

That would represent a 3.5-percent increase from the government’s revised June forecast for full-year 2025 GGR, of MOP228 billion. That revision had been announced after worse-than-expected gaming performance from November 2024 to April this year.

🇲🇴 Nearly 3.5mln visitors to Macau in October, up 11pct from a year earlier (GGRAsia)

Macau recorded just over 3.47 million visitors in October, up 10.8 percent from a year ago, according to data issued on Friday by Macau’s Statistics and Census Bureau.

The tally of same-day visitors to the city last month rose 17.6 percent year-on-year, to just above 2.10 million, while that of overnight visitors grew by 1.7 percent, to nearly 1.37 million.

The average length of visit “held steady” year-on-year, at 1.1 days, stated the statistics bureau.

The number of visitors from mainland China in October increased by 12.0 percent year-on-year, to 2.53 million, with those travelling under the Individual Visit Scheme rising by 22.6 percent from a year earlier, to 1.32 million.

International visitors totalled 260,944 last month, 22.9-percent higher than in October 2024.

🇲🇴 SJM shelves plan to acquire Ponte 16 property, casino to close on November 28 (GGRAsia)

Macau gaming licence holder SJM Resorts Ltd says it decided not to proceed with the previously-announced plan to acquire casino hotel complex Ponte 16 (pictured). As such, Casino Ponte 16 will stop operating at 11.59pm on November 28, said the company in a Thursday press release.

SJM Resorts, a unit of Hong Kong-listed SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY), stated: “Following a comprehensive business review, the company will not proceed with the previously stated intention to acquire the property where Casino Ponte 16 is located.”

The closure of Casino Ponte 16 will leave three satellites remaining in Macau, all of them under SJM Resorts licensing. They are: Casino Landmark, Casino Kam Pek Paradise, Casino Fortuna.

🇲🇴 SJM satellite venue Casino Fortuna to shut on December 10 (GGRAsia)

Satellite venue Casino Fortuna, part of Hotel Fortuna (pictured) on Macau peninsula, is due to cease operations on December 10, according to an internal notice by the property’s promoter seen by GGRAsia.

The venue is run under the gaming licence of SJM Resorts Ltd, a unit of Hong Kong-listed SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY).

🇹🇼 Silicon Motion: Gen5, Mobile, And Early Enterprise Traction Strengthen The Buy Case (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Pricing Power And Profitability (Seeking Alpha) $ 🗃️

🏰TSMC Deep Dive: The Invisible Engine of AI (Invest in Quality) $

Owning the factory behind the world’s AI and technology revolution.

I’ve taken a deep dive into one of the most impressive compounding machines in the middle of the AI/Semiconductor industry to better understand the business.

What did I learn?

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) is one of the most impressive compounders I’ve ever researched.

🇹🇼 Hon Hai Precision Industry Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇼 ASE Technology: Advanced Packaging Inflection Point (Seeking Alpha) $ 🗃️

🇰🇷 KRX Announces Changes to KOSPI200 Index (Douglas Research Insights) $

KRX announced changes to KOSPI200 and KOSDAQ150 indices. These changes will be effective from 12 December 2025.

In KOSPI200, there are 8 new additions and 8 deletions. Among the new additions include LG CNS Co Ltd (KRX: 064400), Sanil Electric Co Ltd (KRX: 062040), Asia Holdings Co Ltd (KRX: 002030), and Paradise Co Ltd (KOSDAQ: 034230).

There could be a buying opportunity for LG CNS due to its inclusion in KOSPI200 combined with its attractive valuations and accelerating sales and operating profit growth in 2026.

🇰🇷 Kangwon Land Inc’s plan to raise corporate value progressing well: firm (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land – the only casino in South Korea that allows local residents to gamble – says implementation of its plan to boost its corporate value is progressing well, with “100 percent of 2024 targets achieved”.

The company on Tuesday released an implementation status report for its “Value-up Plan”, disclosed in a filing to the Korea Exchange.

The original plan had been announced in October 2024. According to that document, Kangwon Land Inc aimed to reach a total shareholder payout ratio of 60 percent by 2026.

🇰🇷 Kangwon Land Inc updates US$2bln revamp plan for casino and resort biz, but depends on national government nod: acting CEO (GGRAsia)

Under the revamp for the resort, the facilities would include “media-driven attractions to compete with overseas integrated resorts,” the release said. That was understood to refer to concerts and other large-scale events.

Separately in August, Kangwon Land (KRX: 035250) had mentioned plans for an under-construction new building, to include a second casino for the property. That update mentioned a likely launch for that new facility in early 2028. That is understood to be different from the fresh casino structure outlined in Wednesday’s announcement.

The 2025 K-HIT master plan also encompasses a spa resort and seven types of sport facilities.

🇰🇷 KT Corporation’s Business Improves, But Security Breach Counsels Caution (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇰🇷 KT Corporation: The Short-Term Headwinds Warrant Holding (Seeking Alpha) $ 🗃️

🇰🇷 KT Corporation: Focus On Network Hack And Capital Return (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇰🇷 Samsung Electronics: Value, Scale, And The Future Of Semiconductors (Seeking Alpha) $ 🗃️

🇰🇷 Korea Small Cap Gem #49: Chunil Express (Douglas Research Insights) $

Seoul Express Bus Terminal is finally being redeveloped. Official registered value of this property is 1 trillion won. Market value could be much higher at more than 1.5 trillion won.

Chunil Express Co Ltd (KRX: 000650) owns 16.67% stake in Seoul Express Bus Terminal. We believe Chunil Express’ share price could rise sharply (more than double from here) in the next few days/weeks.

Redevelopment of the Seoul Express Bus Terminal has been discussed repeatedly for more than two decades. It appears that the major redevelopment of this area will FINALLY be taking place.

🇰🇷 Samyang Foods: Block Deal Sale of 103 Billion Won of Treasury Shares (Douglas Research Insights) $

Samyang Foods Co Ltd (KRX: 003230) is pursuing a block deal sale of 103 billion won of its treasury shares to secure additional funds for facility investment and improve its financial structure.

Samyang Foods plans to sell 74,887 common shares (0.99% of issued shares) at 1,372,000 won per share. The expected block deal price is 1% lower than the current price.

The counterparties of this block deal sale have already been announced which include Viridian Asset Management, Jump Trading, and Weiss Asset Management.

🇰🇷 Ulta Beauty Vs CJ Olive Young (Let the Rumble Begin)! (Douglas Research Insights) $

In this insight, we discuss how Olive Young is likely to be a serious long-term threat to Ulta Beauty (NASDAQ: ULTA) (market cap of US$22.3 billion) in the United States.

CJ Corp (KRX: 001040 / 001045 / 00104K) is the largest shareholder of CJ Olive Young. On 19 November, CJ Olive Young announced that it plans to open its first store in California in May 2026.

There is a growing probability that CJ Olive Young could successfully grow its business in the US, especially due to the continued strong demand for Korean cosmetics.

🇰🇷 Naver Financial and Dunamu BODs To Decide on A Comprehensive Stock Swap on 26 November (Douglas Research Insights) $

Dunamu and Naver Financial are expected to hold separate board meetings on 26 November and the potential merger of the two companies is on the agenda.

The valuation of Dunamu is expected to be about 15 trillion won and the valuation of Naver Financial is expected to be about 5 trillion won.

This merger offers clear long-term advantages, including the opportunity to compete globally with overseas fintech firms like PayPal and Coinbase. Additionally, the collaboration strengthens Korea’s position as a stablecoin leader.

🇰🇷 Samsung Bioepis Holdings and Samsung Biologics to Start Trading on 24 November (Douglas Research Insights) $

Samsung Bioepis Holdings and Samsung Biologics (KRX: 207940) will start to trade on 24 November. We remain positive on Samsung Biologics/Samsung Bioepis Holdings.

Operating profit more than doubled, up 115.3% YoY in 3Q25, indicating significant operating leverage. The company’s excellent results in 3Q25 is likely to positive impact the newly listed shares.

Biologics division achieved 1.26 trillion won in sales with a 50% operating margin, while the Bioepis unit generated sales of 441 billion won with a 29% operating margin in 3Q25.

🇰🇷 Aimed Bio IPO Book Building Results Analysis (Douglas Research Insights) $

Aimed Bio finalized its IPO price at 11,000 won, which is at the high end of the IPO price range. Aimed Bio will be listed on KOSDAQ on 4 December.

A total of 2,414 domestic and international institutional investors participated in this IPO. The demand ratio of the IPO was 672 to 1 among the institutional investors.

Based on the final offering price, the offering amount is projected to be approximately 70.7 billion won, resulting in a market capitalization of approximately 705.7 billion won.

🇰🇷 TMC IPO Preview (Douglas Research Insights) $

TMC is getting ready to complete its IPO in Korea in December 2025. The IPO price range is from 8,000 won to 9,300 won per share.

TMC is one of the largest Korean producers of specialty industrial cables used for shipbuilding, marine, optical cables, and nuclear power.

At the IPO price range, the expected market cap of the company is from 193 billion won to 224 billion won.

🇰🇷 Coupang Power Play: What Taiwan, Eats, & New Services Reveal About Its Global Ambitions! (Smartkarma) $

Coupang, Inc. (NYSE: CPNG)’s recent financial results for the third quarter of 2025 reveal a mix of strong growth and strategic investment, showcasing its efforts to strengthen its foothold in both existing and new markets.

The company reported an 18% year-over-year growth in consolidated revenues, reaching $9.3 billion for the quarter, with revenue growth expanding to 20% when adjusted for constant currency.

This growth was further complemented by an improvement in gross profit margins, which expanded by over 50 basis points to 29.4%, and adjusted EBITDA margins, which rose by 10 basis points to 4.5%.

🇮🇩 PT Bumi Resources Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇮🇩 PT Avia Avian Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇲🇾 Genting Bhd now controls over 60pct in Genting Malaysia (GGRAsia)

Malaysia-based conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) now controls 60.63 percent of Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), amid the parent’s takeover bid for the subsidiary, a global casino operator, according to Wednesday filings to Bursa Malaysia.

The increase was effected via acquisition of relevant interest in Genting Malaysia shares, based on stockholder acceptances relating to the takeover offer made by the parent. The latest acquisitions were via entities linked to Genting Bhd.

In mid-October, Genting Bhd made a circa US$1.59-billion bid to acquire all shares in Genting Malaysia that it didn’t already own, aiming to delist the unit from Bursa Malaysia.

Genting Bhd’s takeover offer became mandatory earlier this month, after the parent’s stake in Genting Malaysia surpassed 50 percent.

🇲🇾 Sime Darby Berhad (SMEBF) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

🇵🇭 Ownership of brick-and-mortar casino to help build revenue, boost customer retention: DigiPlus president (GGRAsia)

The acquisition of a land-based casino in the Philippines will help online gaming operator DigiPlus Interactive (PSE: PLUS) retain customers and increase its revenue, says the firm’s president, Andy Tsui (pictured).

Philippines-listed DigiPlus is set to subscribe to convertible notes of Hong Kong-listed International Entertainment Corporation (HKG: 1009), worth HKD1.60 billion (US$205.8 million). International Entertainment runs the New Coast Hotel Manila property in the Philippine capital.

Once fully converted, the notes would give DigiPlus a 53.89-percent stake in International Entertainment, based on the enlarged share capital.

🇵🇭 The Keepers Holdings, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇵🇭 Jollibee Foods Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌐 Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) – Foreign & local fast food/restaurant brands in the Philippines & abroad (Chowking, Greenwich, Red Ribbon, Mang Inasal, etc.). 🇼

🇵🇭 JG Summit Holdings, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌏 JG Summit Holdings (PSE: JGSHI / OTCMKTS: JGSHF / JGSMY) – Conglomerate. Air transportation, banking, food manufacturing, hotels, petrochemicals, power generation, publishing, real estate & property development & telecommunications. 🇼

🇵🇭 Security Bank Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Singapore to Launch Nasdaq Dual-Listing Board to Revive Stock Market (Caixin) $

Singapore will launch a new listing platform around mid-2026 that allows companies to dual-list on the Nasdaq and the Singapore Exchange (SGX) using a single prospectus.

The initiative, announced Wednesday by the Monetary Authority of Singapore (MAS), targets issuers with a market cap of at least S$2 billion ($1.5 billion) and aims to bridge Asian high-growth companies with U.S. capital pools.

🇸🇬 Most retail investors in Singapore hold digital assets (The Asset) 🗃️

Maturing market less swayed by volatility and more inclined towards long-term exposure

Singapore’s crypto market is moving from the fringe to mainstream for investors, according to a new report jointly released by MoneyHero and Coinbase Global.

The Pulse of Crypto – Singapore 2025 survey, which polled over 3,500 retail investors and members of the “crypto-curious” public in August, reveals a significant shift in participation and priorities across the city-state’s digital asset landscape.

The headline figure is that 61% of respondents reported holding cryptocurrency, marking a substantial move into mainstream adoption. However, the average portfolio allocation of 6% to 12% suggests investors are still cautiously engaged, rather than fully committed.

Notably, 58% of respondents describe themselves as long-term holders, while only 22% are active traders. It appears a “hold on for dear life” ( HODL ) culture has taken root, reflecting a maturing market that is less swayed by volatility and more inclined towards measured exposure.

🇸🇬 SATS Ltd. 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Singapore Airlines Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Singapore Telecommunications Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Canaan Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Sea Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Sea: Pullback May Continue In The Near-Term (Rating Downgrade) (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Sea Ltd 3Q25 Earnings: The Rice Field Advantage (Nikhs)

Margins compress, but infrastructure compounds — why Sea’s “rice field” know-how could turn short-term pain into long-term moat.

Sea Limited’s stock fell following 3Q25 results that beat on revenue ($6.0 billion versus $5.65 billion expected) and EBITDA ($874 million versus $846 million expected). The problem: e-commerce operating margins compressed to 0.6% of GMV, down from 0.8% the prior quarter.

Weakness or strategy? Four datapoints from the same quarter:

Advertising revenue grew 70% YoY; ad take-rate rose 80 basis points while conversion improved 10%

Value-added services revenue (logistics) fell 5.7% from “subsidy net-offs”

Credit book grew 70% to $7.9 billion with NPLs stable at 1.1%

Garena gaming bookings jumped 51% to $841 million—best quarter since 2021

🇸🇬 Asian Pay Television Trust 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌏 Asian Pay Television Trust (SGX: S7OU / OTCMKTS: APTTF) – First listed business trust in Asia focused on pay-TV & broadband businesses. Pay-TV & broadband businesses in Taiwan, Hong Kong, Japan & Singapore. 🏷️

🇸🇬 Bitdeer Earnings: Carried By Self-Mining Amid Lofty AI Goals (Seeking Alpha) $ 🗃️

🇸🇬 Oversea-Chinese Banking Corporation Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 STI Hovering at 4,500: Is Singapore Set for a Breakout? (The Smart Investor)

Explore whether the STI near 4,500 could break out as earnings, rates and fund flows shape Singapore’s market outlook.

What’s Driving the STI Rally

The Banks: Still the Backbone of the STI

REITs and Yield Plays Regaining Momentum

The X-Factor: Industrials and Renewables

What Could Hold the STI Back

What This Means for Investors

🇸🇬 These 4 Blue-Chip Stocks Are Down, But Could Be Hidden Gems (The Smart Investor)

Each of these Singapore stocks has its own set of headwinds, but also reasons why thoughtful investors might consider them as potential hidden gems.

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) – Stability Behind the Dip

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) – Turnaround in Progress

Global trade disruptions had impacted SATS’s business, and the company’s acquisition of Worldwide Flight Services (WFS) had increased its debt levels, raising concerns for its investors.

United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) – Value in a Softer Rate Cycle

UOB’s shares have been under pressure because of narrowing net interest margins (NIMs) amid interest rate cuts, increased provisions, and global trade uncertainties.

Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) – Waiting for the Next Tourism Wave

Common Traits Among These Hidden Gems

What This Means for Investors

Get Smart: Not All Dips Are Dangerous

🇸🇬 Beyond STI: 3 Singapore Dividends Stocks to Boost Your Retirement Income (The Smart Investor)

🇸🇬 Hidden Gems: 3 Singapore Stocks With Higher Dividend Yields than the STI (The Smart Investor)

🇸🇬 If You Invested $10,000 in Keppel 10 Years Ago, Here’s What You’d Have Today (The Smart Investor)

In 2015, Donald Trump was viewed as a longshot candidate for president, a non-profit called OpenAI had just been founded, and Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) was a conglomerate that derived 60% of its revenue from the offshore and marine (O&M) business, with the remainder from the property, infrastructure, and investment segments.

This meant that its share price was highly correlated to the price of oil, which was experiencing a significant downturn at the time.

Much has changed since then.

🇸🇬 DBS, OCBC or UOB: Which Bank Looks Cheapest Now? (The Smart Investor)

Comparing the valuations of Singapore’s top banks — DBS Group Holdings, OCBC Bank and United Overseas Bank — to uncover which offers the best value for long-term investors.

🇸🇬 3 REITs I’d Own for Steady Monthly Income (Part 1) (The Smart Investor)

🇸🇬 5 REITs I’d Own for Steady Monthly Income (Part 2) (The Smart Investor)

🇸🇬 CICT vs FLCT: Which REIT Will Recover Faster When Financing Costs Ease? (The Smart Investor)

In a world of lower rates, we examine whether CapitaLand Integrated Commercial Trust (CICT) or Frasers Logistics & Commercial Trust (FLCT) presents a better buy.

CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) — Singapore’s Commercial Powerhouse

As of 30 September 2025, CICT holds a diversified portfolio with its retail, office, and integrated development assets contributing 36.9%, 33.4%, and 29.8% respectively, of its net property income.

Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF) — The Global Logistics & Commercial Player

The logistics operator has 45.6% exposure to Australia, 41.9% exposure to Europe, and only 12.5% Singapore exposure.

🇹🇭 Minor International Public Company Limited WT EXP 073123 (MINRF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

🇹🇭 CP Axtra Public Company Limited (SMKUY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

🇹🇭 Banpu Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌐 Banpu PCL (BKK: BANPU / BANPU-R / FRA: NVAC / OTCMKTS: BAPUF) – Energy resources (coal & gas); energy generation (conventional & renewable); & energy technology (wind & solar, storage systems & energy technologies). 🇼

🇹🇭 Osotspa Public Company Limited (OSOPF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

-

🇹🇭 Osotspa PCL (BKK: OSP / OTCMKTS: OSOPF) – Produces, markets, & distributes consumer goods. Core products are beverages & personal care + provides product manufacturing, packaging, & distribution services. 🇼 🏷️

🇹🇭 BTS Group Holdings Public Company Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 Osotspa Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🇹🇭 Osotspa PCL (BKK: OSP / OTCMKTS: OSOPF) – Produces, markets, & distributes consumer goods. Core products are beverages & personal care + provides product manufacturing, packaging, & distribution services. 🇼 🏷️

🇹🇭 PTT Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 Thai Oil Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 IRPC Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 Rabbit Holdings Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 PTT Global Chemical Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 Berli Jucker Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌏 Berli Jucker PCL (BKK: BJC / BJC-F / OTCMKTS: BLJZY) – Manufactures, distributes & services for packaging, consumer, healthcare & technical & modern retail supply chain businesses. 🏷️

🇹🇭 Thai Wah Public Company Limited 2025 Q3 – Results – Earnings Call Presentation Seeking Alpha)

-

🌏 Thai Wah PCL (BKK: TWPC / TWPC-F) – Tapioca starch & starch-related products, food products & biodegradable products.

🇻🇳 VinFast Auto Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇮🇳 Global banks pour into India as regulators open up to foreign money (FT) $ 🗃️

🇮🇳 Mahindra & Mahindra Limited (MAHMF) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

🇮🇳 Mahindra & Mahindra Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇮🇳 Yatra Online, Inc. 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌐 Yatra Online (NASDAQ: YTRA) – Corporate travel services provider. Airline tickets, hotel & holiday packages & other services. 🇼

🇮🇳 Amber Enterprise–Shogini Deal: A Strategic Leap Toward Full-Stack Electronics Manufacturing (Smartkarma) $

Amber Enterprises (NSE: AMBER / BOM: 540902) has signed a definitive agreement to acquire a majority stake in Pune-based PCB manufacturer Shogini Technoarts through its subsidiary ILJIN Electronics (India) Pvt. Ltd.

This move strengthens Amber’s backward integration in printed circuit boards at a time when India’s PCB market is expanding quickly and still relies heavily on imports.

The acquisition supports Amber’s transition from a primarily HVAC and consumer-durables component player to a more complete EMS and PCB solutions provider, an important shift that deserves closer analysis.

🇮🇳 Decoding Asian Paints Execution Supremacy Amidst New Competition (Smartkarma) $

Asian Paints Ltd (NSE: ASIANPAINT / BOM: 500820) achieved a 7-quarter high in Q2FY26 with 10.9% domestic volume growth, driven by easing raw material costs and strategic integration, leading to a 2% margin expansion.

Despite heavy monsoons, strong execution drove a double-digit volume rebound, signaling stabilized consumer demand. This coupled with a key competitor’s executive loss, validates the firm’s defensive market position.

Asian Paints’ strong performance deserves a premium valuation but justifying it hinges on the perfect execution of its backward integration project and defending its competitive position.

🇰🇿 Kaspi: Worried About VAT Changes (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇮🇱 Mobileye: ADAS Thrives While Advanced Products Stuck In Neutral, Still Undervalued (Seeking Alpha) $ 🗃️

🇮🇱 Ituran: Steady As She Goes, But Moderating Our Bullish Stance Now (Seeking Alpha) $ 🗃️

-

🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🇮🇱 Elbit Systems: Backlog Supports Growth, But Valuation And Cash Flows Limit Upside (Seeking Alpha) $ 🗃️

🇮🇱 Elbit Systems Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🌍 Endeavour Mining: A Solid Buy-The-Dip Candidate (Seeking Alpha) $ 🗃️

🇿🇦 Reunert Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌐 Reunert Ltd (JSE: RLO / FRA: 6W0 / OTCMKTS: RNRTY) – Industrial goods & services (electronic engineering, ICT & applied electronics).

🇿🇦 Vodacom Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇿🇦 Mr Price Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌍 Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY) – Cash-based omni-channel fashion-value retailer with 4 segments: Apparel, Homeware, Financial Services & Telecoms. 🇼 🏷️

🇿🇦 Astral Foods Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇿🇦 MTN Group Limited (MTNOY) Q3 2025 Sales/ Trading Statement Call – Slideshow (Seeking Alpha)

🇿🇦 Ninety One Group 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇨🇿 CEZ, a. s. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🇪🇺🏛️ CEZ as (PSE: CEZ / WSE: CEZ / FRA: CEZ / OTCMKTS: CZAVF) – Generation, distribution, trading & sale of electricity & heat; trading & sale of natural gas; provision of comprehensive energy services from the new energy sector & coal mining. One of the 10 largest energy companies in Europe. 🇼 🏷️

🇬🇷 Public Power Corporation S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇭🇺 Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇵🇱 Orlen S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🇪🇺🏛️ Orlen SA (WSE: PKN / FRA: PKY1) or Polski Koncern Naftowy ORLEN Spólka Akcyjna – Poland’s state-controlled MNC oil refiner & petrol retailer providing energy & fuel 100M+ Europeans. Biggest network of fuel stations in CEE – Poland, Germany, Czechia, Slovakia & Lithuania. 🇼 🏷️

🇵🇱 Powszechny Zaklad Ubezpieczen SA 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🇪🇺🏛️ PZU SA (WSE: PZU / FRA: 7PZ / FRA: 7PZ0) or Powszechny Zaklad Ubezpieczen SA – Largest financial conglomerate in Poland & Central & Eastern Europe. Life, non-life & health insurance plus banking, investment, pension & health care products. 🇼 🏷️

🇵🇱 Cyfrowy Polsat S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🌎 Latin America as the Last Asymmetric Bet, Part 1 (TheOldEconomy Substack)

The report is divided into two chapters:

In today’s publication, I cover LatAm’s strengths. In the next chapter, I will talk about how to get exposure to Latin America, in other words, strategies and instruments.

🌎 Tenaris Q3 And 2025E Update: Continued Risk, Especially With Market Downside (Seeking Alpha) $ 🗃️

🌎 Adecoagro: Farming Powerhouse With A Crypto Giant Shareholder Taking Big Steps For Expansion (Seeking Alpha) $ 🗃️

-

🇦🇷 🇧🇷 🇺🇾 Adecoagro Sa (NYSE: AGRO) – Luxembourg HQ’s agro industrial company that produces & manufactures food & renewable energy. 3 segments: Farming; Sugar, Ethanol & Energy; & Land Transformation. 🏷️

🌎 Globant S.A.: Bottom-Feeding In AI/Software At Less Than 10x P/E (Seeking Alpha) $ 🗃️

🌎 Globant: Core Business Demand To Recover In 2026, AI-Led Inflection Ahead (Seeking Alpha) $ 🗃️

🌎 Globant Sees GenAI Transformation Near, But I’m Skeptical (Downgrade) (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: The Recent Dip Is A Gift (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Fintech Growth And Margin Expansion Set The Stage For A 2026 Re-Rating (Seeking Alpha) $ 🗃️

🌎 MercadoLibre – The Latin American Leviathan (Darius Dark Investing)

An In-Depth Analysis

The Q3 2025 miss on EPS is just noise. The signal of value is the 39.5% revenue growth, the 21% user growth, the 83% expansion in the credit book, and the strategic deepening of the moat through logistics density and regulatory lobbying. Management is demonstrating an intelligent capital allocation strategy: suppressing short-term profits to secure an unassailable long-term monopoly.

By 2030, Latin America will likely be a digital-first economy. MercadoLibre (NASDAQ: MELI) is building the infrastructure for that reality – the roads, the banks, the advertising billboards, and the entertainment hubs. The margin compression we see today is simply the cost of paving the roads that they will toll for the next decade.

For the investor with a horizon beyond the next quarter, the current dip is a gift.

🌎 MercadoLibre Q3’25 Earnings: The Margin Compression Is the Strategy, Not the Problem (Nikhs)

Why MercadoLibre (NASDAQ: MELI)’s falling margins and rising unit efficiency signal an offensive move—not a defensive stumble—against Amazon, Shopee, and Nu Holdings (NYSE: NU).

My first reaction to these results wasn’t about the profit “miss”—it was wondering how long it would take Wall Street to understand what’s actually happening. The answer, based on the initial -7.7% selloff following the Amazon-Nubank partnership announcement days later, is: not yet.

This quarter wasn’t disappointing. It was a declaration of war.

🌎 DLocal (DLO): Q3 2025 Earnings Review (MVC Investing)

In this article, I’ll break down everything you need to know from the Earnings Report.

The market may focus on declining take rates or temporary margin noise, but Pedro Arnt is clearly optimizing Dlocal (NASDAQ: DLO) to maximize long-term shareholder value, not quarter-to-quarter optics. What ultimately drives stock prices over multi-year horizons is earnings/FCF per share growth, and the company is executing exceptionally well on that front.

Short-term fluctuations are simply the price of admission when operating across 40+ emerging markets. Margins will always have some lumpiness: regulatory changes in one country, FX volatility in another, temporary mix shifts in a third. None of that changes the structural trajectory of the business. The real story is the relentless expansion of TPV, deepening merchant penetration, stronger cross-border flows, and the acceleration of new product adoption.

The fundamentals remain extremely compelling:

🌎 Arcos Dorados Holdings Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌎 Arcos Dorados Holdings Inc (NYSE: ARCO) – World’s largest independent McDonald’s franchisee. Exclusive right to own, operate & grant franchises of McDonald’s restaurants in 20 Latin American & Caribbean countries & territories. 🇼 🏷️

🇦🇷 Lithium Argentina: Waiting For A Significant Pullback (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Americas: Q3 Shows Clear Deterioration, Not Progress (Seeking Alpha) $ 🗃️

🇦🇷 Central Puerto: A Key Player In Argentina’s Growing Energy Demand (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres Lenders Claim Default, And Dilution Risks Are Higher Than Ever (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres Crop Solutions Corp. 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Grupo Mateus (Global Outperformers)

A Brazilian founder-led grocery chain

My deep dive into the grocery retail industry explored the history of grocery retail since the late 1800s, the product categories and their economics and highlighted 11 top quality listed grocery retail chains from around the world. Of these 11 companies, only one was valued below 10x earnings despite being of good quality with long-term growth prospects.

That company was Grupo Mateus SA (BVMF: GMAT3), a Brazilian multi-format grocery retailer, founded by its current chairman, Ilson Mateus and is currently the third largest grocery chain in Brazil. Grupo Mateus is presently what I call a “triple-engine” stock, that is, a company that has good quality, high growth and is deeply undervalued.

🇧🇷 Marfrig Global Foods Will Need Packaged Food Growth To Offset Commodity Pressures (Seeking Alpha) $ 🗃️

🇧🇷 Companhia Paranaense de Energia – COPEL (ELP) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇧🇷 Vinci Compass Is Starting To Look Expensive On A Current Basis, But Withholds Tailwind Trends (Seeking Alpha) $ 🗃️

-

🇧🇷 Vinci Partners Investments Ltd (NASDAQ: VINP) – Alternative investments platform. Specialized asset management, wealth management & financial advisory services to retail + institutional clients in Brazil. 🏷️

🇧🇷 Banco do Brasil Q3 Earnings: Nothing Constructive To Hold On To (Seeking Alpha) $ 🗃️

🇧🇷 PagSeguro Digital Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Nu Holdings Q3’25: Building the Moat While Breaking Records (Nikhs)

How Nu Holdings (NYSE: NU) is converting scale and data into a self-reinforcing AI advantage — proving the playbook in Mexico and revealing the intelligence engine behind its 31% ROE.

Nu Holdings reported another record quarter. Revenue hit $4.2 billion, net income reached $783 million, and Return on Equity achieved a stunning 31%. The company’s customer base swelled to 127 million, with engagement at 83%. By every headline measure, it was a resounding success.

Yet the market’s reaction was muted. One number gave investors pause: Nu’s efficiency ratio stood at 27.7%. For a company whose thesis is built on structural cost advantage, any efficiency question feels threatening. This created a paradox: how can a company become more profitable while costs haven’t fallen proportionally?

The answer is that the market is misinterpreting the signal. This quarter was not about extracting every last basis point of margin. It was about the deliberate cost of building an unassailable, AI-powered moat. To understand this, look at Nu not as a bank that uses technology, but as a three-layer system where each component reinforces the others.

🇧🇷 Klabin: From Heavy CapEx To Heavy Cash Flow, The Bull Case Strengthens (Seeking Alpha) $ 🗃️

🇧🇷 Sendas Distribuidora S.A. (ASAIY) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇧🇷 SLC Agrícola S.A. (SLCJY) Presents at Bradesco BBI 15th CEO Forum – Slideshow (Seeking Alpha)

-

🇧🇷 SLC Agricola SA (BVMF: SLCE3 / FRA: GJ9 / OTCMKTS: SLCJY) – One of the world’s largest grain & fiber producers (cotton, soybean and corn + cattle raising, integrating crop-livestock). 🇼 🏷️

🇧🇷 Ambev: Stable Performance And Great Potential For 2026 (Seeking Alpha) $ 🗃️

🇧🇷 Cosan S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Rumo S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 StoneCo Will Need To Amp Up Returns To Shareholders To Avoid Over Capitalizing (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: High-Growth Bargain With Double-Digit Buyback Yield (Seeking Alpha) $ 🗃️

🇧🇷 XP Inc. Q3: Flows Recover, Advisory Scales Up, And Risk Perception Declines (Seeking Alpha) $ 🗃️

🇧🇷 XP Remains Attractive Despite Qualitative Concerns (Seeking Alpha) $ 🗃️

🇧🇷 XP Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌎 XP Inc (NASDAQ: XP) – Wealth management & other financial services (fixed income, equities, investment funds & private pension products). 🇼

🇨🇱 Sociedad Química y Minera de Chile S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇨🇱 LATAM Airlines Group S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇨🇴 Colombia – FARC/EMC scandal shakes Petro’s government (Latin America Risk Report)

🇨🇴 Cementos Argos S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇨🇴 Ecopetrol: I’m Bullish On Colombia, Less Excited About Oil Exposure (Seeking Alpha) $ 🗃️

-

🇨🇴🏛️ Ecopetrol SA (NYSE: EC) – Organized under the form of a public limited company, of the national order, linked to the Ministry of Mines & Energy. Mixed economy company of an integrated commercial nature in the oil & gas sector. 🇼 🏷️

🇨🇴 Grupo de Inversiones Suramericana S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇲🇽 Mexico – What’s your protest baseline? (Latin America Risk Report)

🇲🇽 Grupo Aeroportuario Del Centro Norte: Record Margins, Strong Cash Flow, And Mexico’s Most Efficient Airport Operator (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Televisa: ViX Streaming Growth Can Offset The Legacy Subscriber Declines (Seeking Alpha) $ 🗃️

🇲🇽 FEMSA Squeezed By Weaker Consumer Spending In Mexico (Seeking Alpha) $ 🗃️

🇵🇦 Copa Holdings Remains A ‘Strong Buy’ Despite Q3 Sell-Off (Seeking Alpha) $ 🗃️

🇵🇦 Copa Holdings: Q3 Earnings Confirm A Rare Gem In A Tough Industry (Seeking Alpha) $ 🗃️

🌐 Nebius: Why I Am Going All-In (Seeking Alpha) $ 🗃️

🌐 Nebius Stock: With Great Volatility Comes Great Opportunity (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius Group: Buy The Dip In This Quiet Giant In AI Hyperscaling (Seeking Alpha) $ 🗃️

🌐 Nebius: A Brutal Selloff That Should Shock No One (Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: Valuation Update After Q3 Results — Raising Price Target To $147 (Seeking Alpha) $ 🗃️

🌐 Nebius: Wall Street’s Blind Spot (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Nebius: Deep Dive Analysis (HatedMoats)

The Most Misunderstood AI Stock of 2025: Why the Market’s Panic Is Our Opportunity.

Short-Term Outlook (< 1 Year)

For short-term traders, volatility will persist. Expect choppiness around earnings or macro news, with Nebius Group NV (NASDAQ: NBIS) likely trading in a wide band ($80–$120) as the market digests its rapid spending. We rate it a “Moderate Buy” to “Hold” in the very short term, acknowledging the potential for further hiccups (e.g., if 2026 guidance spooks investors) that could offer even better entry points.

Long-Term Outlook (3-5 Years)

However, for long-term investors (3–5 years) who can ride out the waves, we lean towards an emphatic “Strong Buy.” The confluence of Nebius’s growth trajectory and its now more palatable price skews the risk/reward favorably. Our analysis suggests a ~70% chance Nebius will outperform the market over this period. If the base-to-bull case executes, shareholders could see substantial appreciation. Nebius’s unique positioning as the “neo picks and shovels” of the AI gold rush makes it, to us, a worthy portfolio addition.

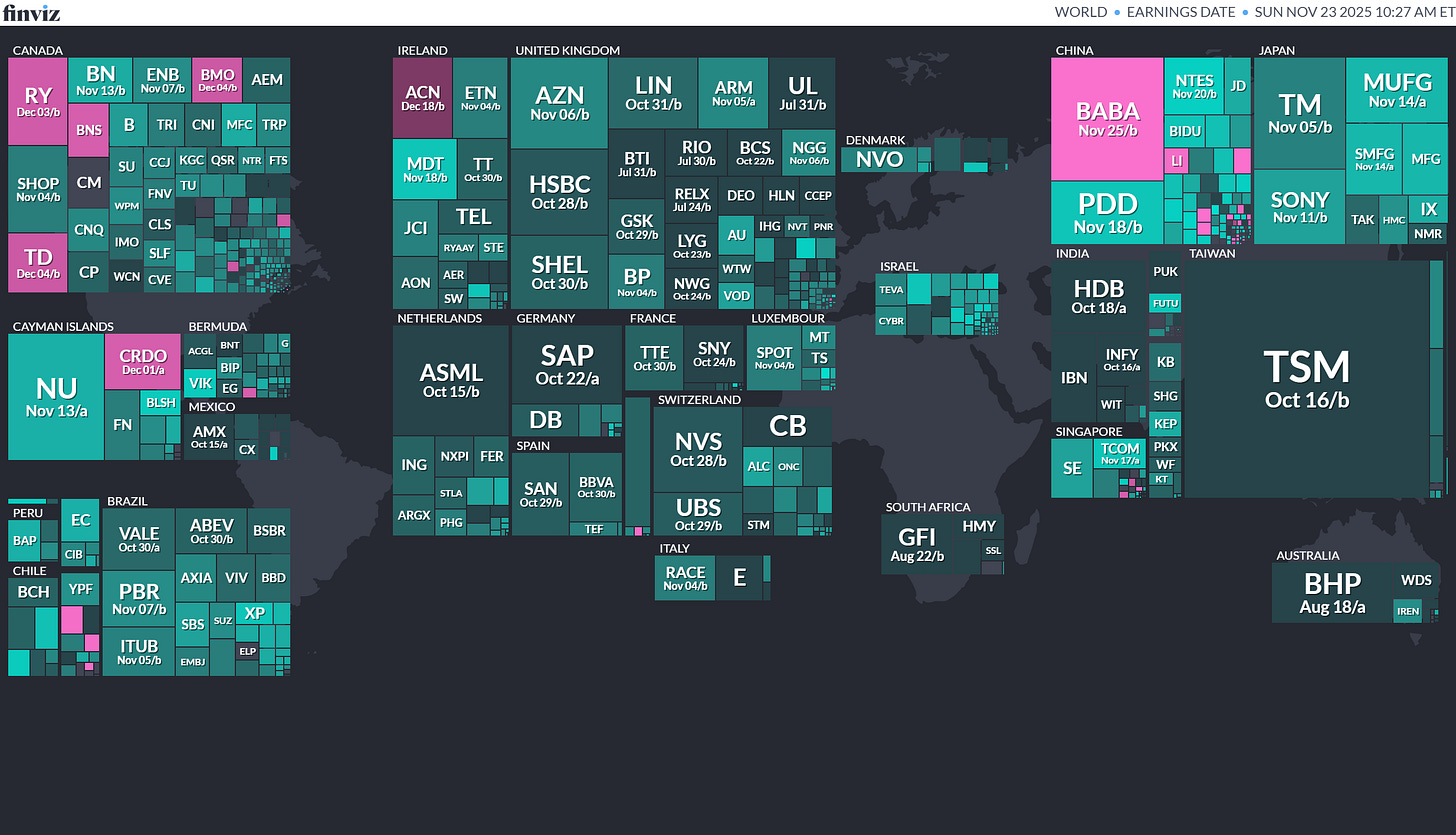

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

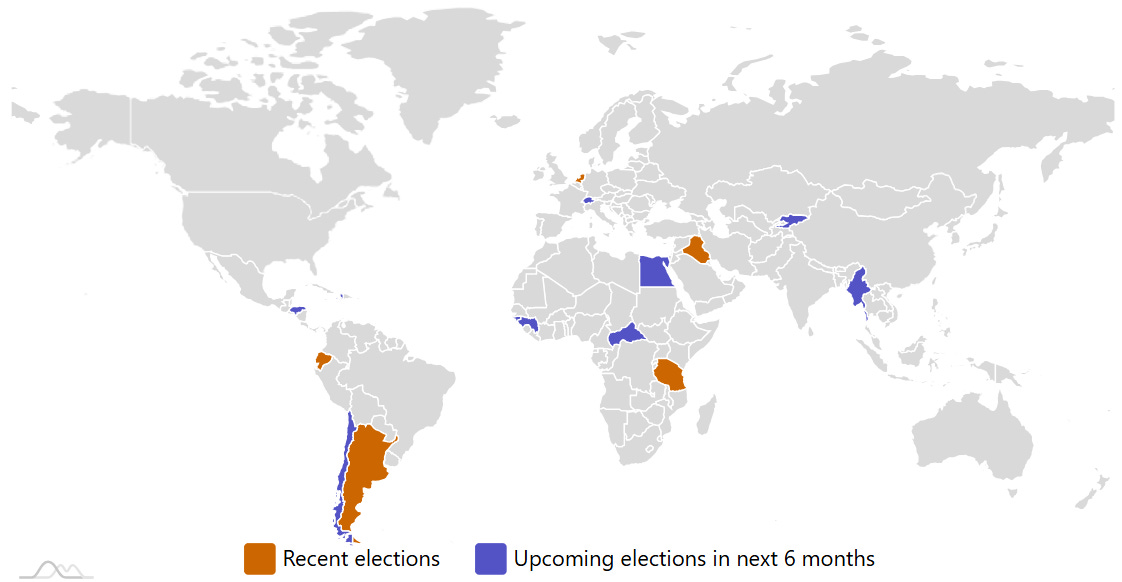

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

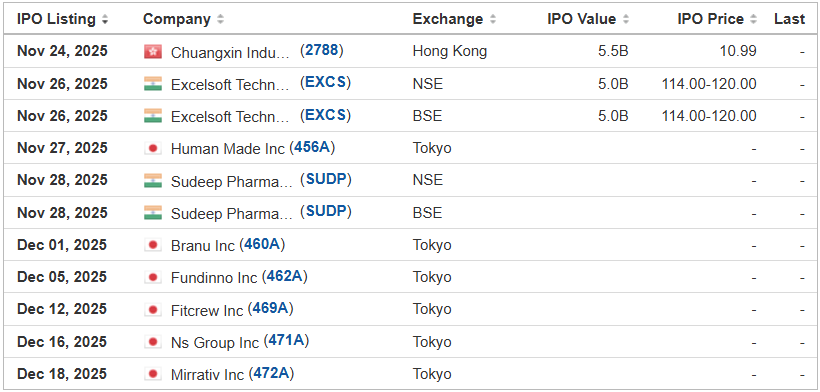

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Hall Chadwick Acquisition Corp. HCACU Cohen & Company Capital Markets, 18.0M Shares, $10.00-10.00, $180.0 mil, 11/21/2025 Priced

(Incorporated in the Cayman Islands)

While we may pursue an initial business combination target in any industry or geographical location, we believe that the technology, critical materials and energy sectors offer particularly compelling business combination opportunities for our team.

(Note: Hall Chadwick Acquisition Corp. priced its SPAC IPO in sync with the terms in the prospectus – 18 million units at $10.00 each to raise $180 million – on Thursday night, Nov. 20, 2025. Each unit consists of one share of stock and one right to receive one-tenth (1/10th) of a share of stock upon the consummation of the initial business combination. Background: Hall Chadwick Acquisition Corp. filed its F-1 for its SPAC IPO in August 2025 and disclosed the terms: 18 million units at $10.00 each to raise $180 million.)

Monkey Tree Investment Ltd. MKTR Craft Capital Management/Revere Securities, 1.6M Shares, $4.00-5.00, $7.0 mil, 11/24/2025 Week of

(Incorporated in the Cayman Islands)

We run English learning centers for children in Hong Kong.

We offer children’s language classes – mostly in English – and some in Mandarin. We serve students ages 3 to 14 through our 20 learning centers in Hong Kong that offer classes in phonics, reading, grammar, writing, conversation and preparation for exams.

We have licensed the “Monkey Tree” brand to other operators that run another 38 centers in Hong Kong.

Note: Net income and revenue are in U.S. dollars for the year that ended March 31, 2025.

(Note: Monkey Tree Investment Ltd. named Craft Capital Management as its lead left underwriter in an F-1/A filing dated Oct. 21, 2025 – to work with Revere Securities. Background: Monkey Tree Investmenet Ltd. disclosed its IPO terms on Aug. 15, 2025, in an F-1 filing: The company is offering 1.6 million shares at a price range of $4.00 to $5.00 to raise $7.0 million, according to its F-1 filing dated Aug. 15, 2025.)

Regentis Biomaterials, Ltd. RGNT ThinkEquity, 1.0M Shares, $10.00-12.00, $11.0 mil, 11/26/2025 Wednesday

We are a regenerative medicine company developing orthopedic hydrogel implants. (Incorporated in Israel)

We are a regenerative medicine company dedicated to developing innovative tissue repair solutions that seek to restore the health and enhance the quality of life of patients. Our current efforts are focused on orthopedic treatments using our Gelrin platform based on degradable hydrogel implants to regenerate damaged or diseased tissue. Gelrin is a unique hydrogel matrix of polyethylene glycol diacrylate (a polymer involved in tissue engineering) and denatured fibrinogen (a biologically inactivated protein that normally has a role in blood clotting).

Our lead product candidate is GelrinC, a cell-free, off-the-shelf hydrogel that is cured into an implant in the knee for the treatment of painful injuries to articular knee cartilage. GelrinC was approved as a device, with a Conformité Européene, or CE, mark in Europe, in 2017 (number 3900600CE02); we plan to identify strategic partners in Europe to bring our product to market. While we currently do not have any strategic partners in place in Europe, we plan to engage strategic partners in Europe in the future.

With GelrinC, we aim to bring to market a product for the therapy of an unmet need for the large market of cartilage injuries in the knee. Because GelrinC serves as an impenetrable barrier that stops cells from migrating away from the wound’s edges, we believe our product is the only product that helps to regenerate cartilage inwards from the edges of the cell walls. Creating new contiguous tissue is not the natural, lowest energy, alternative for cartilage cells. If such cells were left alone, they would tend to migrate and either not create new cartilage tissue or create cartilage tissue that is fibrotic (containing an excessive deposition of extracellular matrix, leading gradually to the disturbance and finally to loss of the original tissue architecture and function). By GelrinC creating such impenetrable barrier and thereby preventing the migration of the cells, the cells are forced to take a different route of creating aggregate and contiguous tissue. Unlike GelrinC, cellular products used by competing companies require a plug of two layers of which the lower layer is a mineral scaffold, which is a foreign body material that has been engineered to be inserted into the bone tissue even though the bone is often healthy. Additionally, GelrinC does not have any biological activity. As a result, we believe our product offers a simple and economic procedure, which we believe will allow patients to recover quickly with potentially long-term outcomes.

Note: Net loss is for the 12 months that ended June 30, 2025. The company has not generated any revenue to date, the prospectus said.

(Note: Regentis Biomaterials, Ltd. increased its IPO’s size to 1.0 million shares – up from 909,090 shares – and kept the price range at $10.00 to $12.00 to raise $11.0 million, according to its S-1/A filing in May 2025. Initial Filing: Regentis Biomaterials, Ltd. is offering 0.9 million shares (909.090 shares) at a price range of $10.00 to $12.00 to raise $10.0 million, according to the company’s S-1 filing dated March 11, 2025.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 12/1/2025 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

ALE Group Holding Limited ALEH D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 12/1/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: D. Boral & Company (formerly E.F. Hutton) is the sole book-runner. Background: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Anew Health Ltd. AVG D. Boral Capital (ex-EF Hutton), 1.8M Shares, $4.00-6.00, $9.0 mil, 12/1/2025 Week of

(Incorporated in the Cayman Islands)

Established in 2007, we are a Hong Kong-based pain management and health services provider with over 16 years of experience in pain management and functional enhancement, under our “ANKH” brand. ANKH, stands for “A New Key to Health”, testifying our aspiration to be a health brand not only for alleviating physical pain but also for allowing individuals to emanate joy, health, and vitality from within and throughout.

We offer a broad range of non-surgical, non-invasive, and non-pharmacological pain management treatment and therapies, functional enhancement therapies, and topical use and dietary supplements health products, to our clients to eliminate pain points, invigorate blood circulation, enhance the body’s detoxification function, strengthen muscle and joint, and ultimately enhance functionality.

The theoretical and technological underpinning of our therapies and treatment, the “RDS+” (Restore, Detox, and Strengthen) approach to pain management and function enhancement, combines the wisdom of Traditional Chinese Medicine (“TCM”) and various energy-based treatment and therapy devices we sourced internationally, to enable our trained therapists performing broad range of treatment procedures involving the use of laser, bioelectrical current, electromagnetic, radiofrequency, and ultrasound, and to provide symptomatic relief and addressing root cause of our client’s pain and subhealth condition, reducing the chances of pain and condition recurrence, ultimately helping our clients to regain health and vitality.

Our “RDS+” approach to pain management and function enhancement is inspired by the concept of meridian system (Jing Luo) of Traditional Chinese Medicine. Jing Luo, commonly translated as meridians, is a concept in Traditional Chinese Medicine describing the network of pathways through which vital energy, or Qi, and blood circulate in the body. According to the Traditional Chinese Medicine theory, the stagnation, blockage, or the deficiency of the flow of Qi, are the root cause of pain and illness. Our RDS+ approach to pain management and function enhancement combines the wisdom of Traditional Chinese Medicine, the modern technology and various advanced energy-based treatment devices, to restore, detox, and strengthen the healthy flow of Qi, and to ease and eliminate acute and chronic musculoskeletal and nociceptive pain, alleviate muscle fatigue, relieve muscle stiffness, remove stagnation, detoxing metabolic wastes, improve blood circulation, strengthen muscle and joints, and ultimately enhance body functionality.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2025.

(Note: Anew Health Ltd. is offering 1.8 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, according to its SEC filings for its IPO.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 12/1/2025 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.