Emerging Market Links + The Week Ahead (January 12, 2026)

Caixin has reported that China’s deposit maturity wave puts household money to the test as there is a looming wave of maturing household deposits that could reshape how Chinese savers allocate their wealth in 2026 (as years of falling interest rates erode the appeal of rolling money back into banks).

Estimates suggest that between 30 trillion yuan ($4.3 trillion) and 60 trillion yuan in two-year and longer-term fixed deposits will come due this year, many of which were placed after 2020, when market volatility and the pandemic drove households toward precautionary savings. With deposit rates now at low levels, the scale and timing of these maturities have become a key focus for markets.

Perhaps some of that money will find its way into the Chinese stock market.

Finally, The Asset has reported or asked what de-dollarization as US currency set for mild recovery in 2026 🗃️:

Speaking at a recent UBS event on the global currency outlook, Rohit Arora, head of the bank’s Asia FX and rates strategy, framed 2026 not as a reversal of the dollar’s role but as a normalization following public narratives about de-dollarization in the past year that many investors and critics now consider exaggerated.

“There’s been no convincing evidence of de-dollarization or diversification away from US assets,” Arora says, noting that capital inflows into US markets remain resilient despite last year’s volatility.

UBS expects the US dollar index ( DXY ) to experience a moderate recovery in 2026, anticipating a 2-3% overall gain for the year, which would see the DXY rebound to around the 100 mark by the year’s end. This follows a sharp depreciation of roughly 10% in 2025.

Our July 20 / July 6th posts discussed why the dollar is not going to “collapse” (like certain online gurus have been screaming about for years) with Ed Dowd predicting that as long as the U.S. Dollar Index holds above the 89.10 level (approximately where I have the line in the following chart), the Dollar will remain in a longer term bull market:

$ = behind a paywall

-

🌐 EM Fund Stock Picks & Country Commentaries (January 11, 2026) Partially $

-

Venezuela scenarios/market implications/crude reality, navigating the Latin American power shift, secret 7 EM AI value chain stocks, beware of the crowded trades, Dec/Q4 fund updates, etc.

-

-

🇰🇷 Korean Stock Picks (November-December 2025) Partially $

-

Tomocube, Shinsegae, F&F, Misto Holdings, PharmaResearch, ST Pharm, LG Innotek, Hansae, Youngone Corp., SoluM, Shinsegae International, Samsung Biologics, Jeju Air, LG Electronics, Samsung Electro-Mechanics, SK Oceanplant, Meritz Financial Group, Samsung Fire & Marine, Samsung Life, Korea Investment Holdings, KEPCO, HMM, Lotte Chemical, OCI Holdings, Dentium, PearlAbyss Corp, NCsoft, Wemade, Shift Up, Classys, CJ Logistics, Cosmax, Kolmar Korea, CS Wind, Daewoong Pharmaceutical, Samsung Securities, KT, Kumho Petrochemical, Kia Corp, GS Retail, Kakao, L&F, Hugel, Cosmecca Korea, DL E&C, APR, LIG Nex1, Netmarble, HD Korea Shipbuilding & Offshore Engineering, SM Entertainment, Hanwha Solutions, Hyundai Department Store, LG Uplus, Korea Aerospace Industries, Kakao Games, NAVER, Hyundai Livart, GS Engineering & Construction Corp, Celltrion, HD Hyundai Mipo, Dear U, Krafton, Hanwha Aerospace, GC Biopharma, HD Hyundai Heavy Industries, JB Financial Group, S-Oil, i-SENS, Hyundai Rotem, Industrial Bank of Korea, iM Financial Group, BNK Financial Group, Shinhan Financial Group, Hana Financial Group, POSCO Future M, Hanwha Systems, Woori Financial Group, SK Innovation, LG Chem, HD Hyundai, KB Financial Group, Hyundai Mobis, Soop, Daewoo Engineering & Construction Co Ltd, Hyundai Engineering & Construction, NH Investment & Securities, Kiwoom Securities & Hyundai Motor

-

🤖 DeepSeek Analysis

-

Summary of Top Picks by Investor Profile

-

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🇨🇳 China Securities Regulator Sets Out Coordinated Financial Fraud Crackdown (Caixin) $

China’s top securities regulator has set out a coordinated crackdown on financial fraud, convening a high-level meeting with law enforcement, judicial and financial agencies as Beijing seeks to shore up investor confidence.

The meeting, chaired on Monday by China Securities Regulatory Commission (CSRC) Chairman Wu Qing, included officials from the Supreme People’s Court, the Ministry of Public Security, the People’s Bank of China and the Ministry of Finance. Authorities pledged closer coordination across administrative, criminal and civil channels to punish market misconduct.

🇨🇳 Analysis: China’s Deposit Maturity Wave Puts Household Money to the Test (Caixin) $

A looming wave of maturing household deposits could reshape how Chinese savers allocate their wealth in 2026, as years of falling interest rates erode the appeal of rolling money back into banks.

Estimates suggest that between 30 trillion yuan ($4.3 trillion) and 60 trillion yuan in two-year and longer-term fixed deposits will come due this year, many of which were placed after 2020, when market volatility and the pandemic drove households toward precautionary savings. With deposit rates now at low levels, the scale and timing of these maturities have become a key focus for markets.

🇨🇳 With Golden Shares, Governments Rewrite the M&A Rulebook (Caixin) $

Governments are increasingly adopting “golden shares” to retain influence in companies involved in cross-border mergers and acquisitions, signaling a shift from preapproval oversight to ongoing supervision and presenting fresh regulatory headwinds for Chinese firms pursuing global expansion, legal experts said.

The mechanism allow governments to maintain strategic rights in a company while holding only a minimal stake. These rights — such as veto power over asset sales or relocation of headquarters — give regulators access to sensitive information and leverage over key decisions, said Yin Ranran, a partner at the a joint operation between Shanghai-based Ruimin Law Firm and Britain’s Freshfields who specializes in antitrust and foreign investment reviews.

🇨🇳 China’s chip consolidation accelerates with SMIC, Hua Hong buyouts (Bamboo Works)

Two of the country’s leading fabs announced buyouts of government partners in their non-wholly owned subsidiaries last week

Semiconductor Manufacturing International Corporation (SMIC) (HKG: 0981 / SHA: 688981 / SGX: HSMD / FRA: MKN2) and Hua Hong Semiconductor (SHA: 688347 / HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF) are consolidating ownership of their assets by buying out their government investors, eliminating profit-sharing and internal fab competition

China’s government chip investment strategy has produced mixed results, including lucrative exits alongside massive failures like the collapse of Wuhan Hongxin

🇨🇳 Montage Technology H Share Listing: The Investment Case (Smartkarma) $

Montage Technology Co Ltd (SHA: 688008), the world’s largest memory interconnect chip supplier, has filed its PHIP for an H Share listing to raise US$1 billion.

In 2024, Montage was the largest supplier of memory interconnect chips, with 36.8% market share.

The investment case rests on an industry-leading position, a robust core business, an improving margin profile, cash generation, and a reasonable valuation.

🇨🇳 Meta cuts Manus free from China, as regional lender gets premium bailout (Bamboo Works)

Meta’s acquisition of AI startup Manus explicitly excludes Manus’ Chinese operations, signaling a trend of Chinese entrepreneurs moving to Singapore

A local government’s decision to buy Weihai Bank Co Ltd (HKG: 9677 / FRA: 8K0) shares at a premium rather than a discount is aimed at maintaining confidence in the lender

🇨🇳 Baidu Spins Off Kunlunxin — And China’s AI War Against Nvidia Escalates! (Smartkarma) $

Baidu (NASDAQ: BIDU) is making headlines with its AI chip subsidiary, Kunlunxin, filing for an IPO on the Hong Kong Stock Exchange, underscoring China’s intensified efforts to reduce dependence on U.S. chipmakers amid widening tech export restrictions.

The filing, confirmed on January 1, 2026, comes at a time when Nvidia, the global AI chip leader, remains hamstrung in China due to U.S. regulatory curbs.

Analysts from Jefferies estimate Kunlunxin’s valuation could land between $16 billion and $23 billion, suggesting high investor appetite for domestic AI semiconductor plays.

🇨🇳 After winning global EV crown, BYD faces new challenge with profitability test (Bamboo Works)

China’s EV giant overtook Tesla in unit sales last year, but margin pressure, overseas risks and a controversial financing model raise questions on whether it can still deliver shareholder value

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)’s global sales surge has not translated into higher profitability, as the company faces pressures from an ongoing price war at home and falling profits per vehicle

The unwinding of the leading EV maker’s supplier‑financing scheme and rising overseas challenges threaten to lift its debt ratio and dampen its expansion

🇨🇳 BYD (BYDDF): Don’t Blink or You Might Miss Them Become the World’s Largest Automaker (The Rational Investor)

Wang Chuanfu One of Histories Best CEO’s

The Prediction: In 7 to 10 years, BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) will surpass Toyota to become the largest automaker in the world by volume.

If that sounds impossible, look at the last six years. In 2020, BYD was a regional player selling roughly 400,000 vehicles a year. Most western investors had never heard of them. Fast forward to the end of 2025: BYD just closed the year with 4.6 million vehicles sold globally (63% annual CAGR). That is more than a 10x increase in six years. More importantly, they officially took the crown for fully electric vehicles (BEVs), selling 2.26 million units in 2025 compared to Tesla’s 1.64 million.

How do they get from 4.6 million to overtaking Toyota’s 11 million? The thesis rests on four pillars:

The CEO – Wang Chuanfu

True Vertical Integration

A Home Court advantage

The Math

Let’s break them down.

🇨🇳 Mineye navigates bumpy financial road littered with losses, stock volatility (Bamboo Works)

The autonomous driving company has taken multiple new steps to support its shares, including share lockup period extensions, buybacks and increased purchases by some big investors

Minieye Technology Co Ltd (HKG: 2431) has conducted two share placements to raise additional funds in the year since its listing

The autonomous driving technology company accrued aggregate losses of 760 million yuan between 2021 and 2024

🇨🇳 Eve Energy powers toward Hong Kong IPO, undeterred by price wars (Bamboo Works)

The world’s fifth-ranked EV battery maker is following market leader Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) with plans to complement its Shenzhen listing with a new one in Hong Kong

Lithium battery maker EVE Energy Co Ltd (SHE: 300014) has filed to list in Hong Kong, pivoting to energy storage products and overseas sales as price wars hit its core EV battery sales in China

The company has dropped plans for a third phase of its Malaysian factory and is shifting its focus to a new facility in Hungary set to start production in 2027

🇨🇳 In Depth: China Reins In High-Cost Personal Lending as Risk Concerns Grow (Caixin) $

China’s multitrillion-yuan high-cost personal lending market is showing signs of strain, as regulators move to rein in interest rates.

The move comes as large numbers of borrowers remain burdened by high-interest debt. Industry insiders warn that pushing rates lower could roil the sector, squeeze margins and choke off a crucial source of funding for riskier borrowers.

🇨🇳 China Renaissance dabbles in sour loans, hoping for sweet returns (Bamboo Works)

The investment bank will buy two portfolios of nonperforming personal loans as it continues to recover from a crisis with the abrupt departure of its high-powered founder two years ago

China Renaissance Holdings Ltd (HKG: 1911 / OTCMKTS: CSCHF) will buy two portfolios of impaired personal loans from subsidiaries of online loan facilitator Qfin for 308 million yuan

The move comes as China’s economic slump yields a growing pile of bad debt, creating potentially lucrative – but also risky – opportunities for private sector investors

🇨🇳 Pop Mart Expands Global Production to Meet Surging Demand (Caixin) $

Chinese toymaker Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) has begun shipping products from newly added partner factories in Indonesia, Cambodia and Mexico, extending its production network to six global bases to meet surging overseas demand.

Previously limited to the Chinese mainland and Vietnam, the expansion is designed to serve Southeast Asia, Mexico and North America, the company said recently. The push follows a supply squeeze in the first half of 2025, when a global frenzy for Labubu — a character from its THE MONSTERS intellectual property (IP) series — led to widespread product shortages and inflated secondhand market prices.

🇨🇳 ONC: Inside the China Access Strategy & What It Could Change for Pipeline Approvals! (Smartkarma) $

BeOne Medicines (NASDAQ: ONC) has released its Q3 2025 financial results, highlighting both impressive growth and potential opportunities, as well as challenges that remain.

The company’s revenue rose to $1.4 billion, reflecting a robust year-on-year growth of 41%.

BRUKINSA, a major revenue driver, achieved over $1 billion in global sales for the quarter, affirming its position as the top BTK inhibitor worldwide.

🇨🇳 Legend Biotech: The Outpatient Advantage—A Practical Edge That Could Accelerate CARVYKTI Adoption Beyond Academic Centers! (Smartkarma) $

Legend Biotech (NASDAQ: LEGN) reported strong financial results for the third quarter of 2025, highlighting significant progress in its CARVYKTI program and future growth prospects in cell therapy.

The company’s financial performance drew attention with net trade sales for CARVYKTI reaching approximately $524 million, marking an 84% increase year-over-year.

This positioned CARVYKTI as a prominent player in the CAR-T cell therapy market, particularly for multiple myeloma, illustrating its potential to become an increasingly vital revenue stream.

🇨🇳 Shanghai Iluvatar CoreX Semiconductor Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Iluvatar CoreX Semiconductor is target price of HK$242 per share, which is 67.4% higher than the IPO price of HK$144.6 per share.

Our base case valuation is based on P/S multiple of 56.9x our estimated sales of 932.8 million RMB in 2025.

Our target P/S multiple is 60% discount to the comps’ average P/S multiple in 2025.

🇭🇰 Policy forces shift offshore Chinese IPO tide to Hong Kong from New York (Bamboo Works)

New listings raised $36 billion on the Hong Kong Stock Exchange in 2025, accounting for nearly one-quarter of IPO fundraising worldwide

Hong Kong took the global crown for IPO fundraising last year, as Chinese companies flooded the market

The listing frenzy has been largely propelled by policy changes, and looks set to continue this year with nearly 400 active IPO applications in Hong Kong’s pipeline

🇲🇴 Macau GGR ‘very strong’ in early Jan, setting up for a solid 1Q: Seaport (GGRAsia)

Macau casino gross gaming revenue (GGR) in January started “very strong,” suggests Seaport Research Partners, with the institution forecasting a 19-percent year-on-year growth this month.

“Our January estimate is plus 19 percent year-on-year (plus 4 percent month-on-month) with the growth rate helped by an easy comparison” to January 2025, wrote analyst Vitaly Umansky in a Wednesday memo. That, he added, sets up the market for a “solid” first-quarter GGR tally, up 14 percent from a year earlier, according to the institution’s forecast.

“We estimate that the month has started quite strong – possibly over MOP850 million (US$106.0 million) per day in the January 1 to 4 holiday weekend,” Mr Umansky stated.

Macau’s casino GGR for calendar-year 2025 reached MOP247.40 billion, a 9.1-percent increase from the previous year, according to official data.

🇲🇴 Macau GGR in first 11 days of January was ‘steady’ and hit US$1bln says JPM (GGRAsia)

Macau casino gross gaming revenue (GGR) for the first 11 days of January was MOP8.05 billion (US$1.00 billion), or MOP731 million a day, according to a Monday memo from JP Morgan, citing its own research.

The trend should “ease investors’ concerns” about signs of a gaming demand slowdown at the end of last year, when average daily GGR was MOP620 million to MOP630 million, added the institution.

Citing industry “checks” as the source, the brokerage suggested Macau’s GGR last week was MOP692 million a day, following a “long weekend” at MOP800 million a day over the new calendar year.

The ‘long weekend’ referred to the first three days of January – a Thursday to Saturday – on official holiday on the Chinese mainland, as designated by China’s State Council. In 2025 China’s official holiday for calendar new year was only January 1.

Macau’s GGR performance has shown a “steady” trend so far this month, suggested JP Morgan.

🇲🇴 NBA, China National Games and satellite closures cost Macau ops in 4Q: analysts (GGRAsia)

Fourth-quarter operating leverage in the Macau casino market was negatively affected by a number of cost factors, suggests Citigroup.

“If it were not for the incremental operating expenses from the NBA China Games and the 15th National Games, plus the costs related to SJM’s satellite casino closure, operating leverage for the industry in the fourth quarter would have been much greater,” wrote analysts George Choi and Timothy Chau.

They nonetheless expect Macau-market fourth-quarter earnings before interest, taxation, depreciation, and amortisation (EBITDA) to have risen 13 percent year-on-year to just under US$2.25 billion.

🇲🇴 Upgrade of SJM’s ratings unlikely at present, says Moody’s (GGRAsia)

Moody’s Ratings says an upgrade of the ratings of Macau gaming operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) “is unlikely at present”, given the “negative outlook” that the institution has on the casino concessionaire.

The commentary was part of a Monday report in which Moody’s assigned a ‘B1’ rating to the proposed senior unsecured U.S. dollar notes to be issued by SJM International Ltd and guaranteed by SJM Holdings.

The parent has said it will use the proceeds mainly for refinancing existing indebtedness and general corporate purposes.

🇲🇴 SJM cash flow weak but liquidity okay after funding repayment of bonds due 2026: Lucror (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is likely to report it had negative free cash flow in 2025 due to its acquisition of the L’Arc Hotel complex on the city’s peninsula, as well as the firm’s pledged purchase of certain gaming space at its historic Hotel Lisboa next door.

That is according to Lucror Analytics, a Singapore-based specialist in credit research. But the institution added that SJM Holdings should have “adequate” liquidity, given it has funding in place to repay its bonds maturing this year.

SJM Holdings is paying an aggregate of HKD1.75 billion (US$224.8 billion) for the acquisition of Casino L’Arc Macau – formerly a satellite gaming venue – and its associated hotel. The complex became a company-managed venue with effect from December 30.

SJM Holdings – the predominant supplier of gaming rights to Macau’s legacy satellite-casino sector – saw the era of that business segment conclude at year-end.

🇲🇴 SJM announces US$540mln in senior notes priced at 6.5pct with a 2031 maturity (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is to issue next Thursday (January 15), US$540-million gross in senior unsecured notes at 6.500-percent annual interest and due in 2031. That is according to a Friday filing with the Hong Kong bourse.

The issuance – via a wholly-owned subsidiary, SJM International Ltd – would “extend the maturity profile of the group’s indebtedness and enhance the group’s financial flexibility”, said SJM Holdings.

The casino operator stated it would seek a listing of the U.S.-dollar denominated notes on the Hong Kong Stock Exchange, and had received an eligibility letter from the bourse about the matter.

🇲🇴 Galaxy Ent hosted 212 shows and sports events in 2025, pledges to help Macau be entertainment hub (GGRAsia)

Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) hosted 212 entertainment and sports events in 2025, as part of its efforts to promote the city as a “World City of Entertainment”. That is according to a statement issued by the company.

Macau has a policy aspiration to be a “City of Entertainment”, in the words of a local-government slogan. The aim is to increase the economic contribution of shows, concerts and other non-gaming entertainment to the city’s tourism market.

Taiwan Dual-Listings Monitor: TSMC Major Spread Breakdown; ASE & ChipMOS Opportunities

🇹🇼 Taiwan Semiconductor Quietly Turns The AI Choke Point Into Pricing Power (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q4 Preview: Bullish, But Memory Inflation Could Break The 2026 Growth Story (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: The Ultimate AI Infrastructure Play With A $358 Target And +18% Upside (Seeking Alpha) $ 🗃️

🇹🇼 The Physics of Money: Why TSMC Has Won the AI War (Staying Rational)

Moore’s Law is no longer about science. It’s about who can afford $20+ billion bets.

They say software eats the world, but physics eats capital. This memo isn’t about chips; it’s about the brutal economics required to print them.

To understand my Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) investment case, we must first map the terrain. The semiconductor value chain is not a linear assembly line; it is a complex interdependent web of monopolies and oligopolies where value capture is highly concentrated.

🇹🇼 First Financial Holding Co., Ltd. (FFHMY) Presents at 2026 Goldman Sachs Asia Financials Corporate Day – Slideshow (Seeking Alpha)

🇹🇼 Fubon Financial Holding Co., Ltd. (FUISF) Presents at 2026 Goldman Sachs Asia Financials Corporate Day – Slideshow (Seeking Alpha)

🇹🇼 Chunghwa Telecom: From Government Cyber Contracts to Smart Rail—The Multi-Engine Strategy Driving the Next Growth Phase! (Smartkarma) $

Chunghwa Telecom (TPE: 2412 / NYSE: CHT), one of Taiwan’s leading telecommunications companies, presented its third-quarter 2025 results with several notable outcomes.

The company reported robust financial performance, surpassing its forecast in key areas such as revenue, operating income, net income, and earnings per share (EPS).

Chunghwa Telecom’s revenue for the third quarter reached TWD 57.92 billion, marking the highest third-quarter revenue level since 2017 and reflecting a 4.2% increase compared to a year ago.

🇹🇼 Phison Electronics (8299 TT): Double Index Inclusion <-> Huge Run Up (Smartkarma) $

The huge up, up and away for Phison Electronics Corp (TPEX: 8299) should lead to one global index inclusion in February and then another in March.

While there is over US$750m to buy across the indices, the recent jump in trading volume results in a small impact of 1.9 days of ADV.

Phison Electronics (8299 TT) trades more expensive compared to its peers and positioning appears to have run ahead of the index inclusions.

🇰🇷 FSC Allows Korean Securities Trading Account Opening For IBKR and 3 Other Foreign Firms (Douglas Research Insights) $

On 9 January, FSC announced that it will allow Korean securities account opening for IBKR and three other foreign firms including Emperor Securities, TFI, and BancTrust.

FSC announced that overseas traders will be able to access the Korean won on a 24 hours real-time exchange rates basis from July 2026.

KOSPI is up 82% in the past one year and the likelihood of Korea becoming Developed Market status is a key factor driving higher share prices of Korean stocks.

🇰🇷 ‘South Korea’s Google’ pitches AI alternative to US and China (FT) $ 🗃️

NAVER (KRX: 035420 / OTCMKTS: NHNCF) targets countries reluctant to use American and Chinese cloud systems out of security concerns

Naver, the search engine group often called “South Korea’s Google”, is pitching its cloud services to countries in the Middle East and south-east Asia as an alternative AI option to US and Chinese technology giants.

🇰🇷 Korea Electric Power: Spotlight On Electricity Tariffs And Cash Distributions (Seeking Alpha) $ 🗃️

-

🇰🇷 KEPCO (NYSE: KEP / KRX: 015760 / FRA: KOP) or Korea Electric Power Corporation – Integrated electric utility company. Generation, transmission & distribution of electricity in Korea where it’s the largest electric utility. 🇼 🏷️

🇰🇷 A Block Deal Sale of 10% Stake in HPSP by Crescendo Equity Partners (Douglas Research Insights) $

After market close on 6 January, it was announced that Crescendo Equity Partners (backed by Peter Thiel) plans to conduct a block deal sale of a 10% stake in HPSP (KOSDAQ: 403870).

The block deal sale price per share is estimated at 35,050 won to 36,800 won, (10.5% to 6.0% discount respectively compared to the closing price on 6 January).

We are positive on this block deal and we would take the deal, mainly due to the solid business fundamentals of HPSP, attractive block deal discount, and reasonable valuations.

🇰🇷 TIGER Semiconductor TOP 10 ETF > 3 Trillion Won in AUM: Impact on FnGuide Index’s Next Rebalance (Douglas Research Insights) $

FnGuide announced that Mirae Asset TIGER Semiconductor TOP 10 ETF, which operates based on its FnGuide’s own index, surpassed 3 trillion won in net assets.

In this insight, we discuss the impact of this change on FnGuide Semiconductor Top10 Index Rebalance in April 2026.

ISC Co (KOSDAQ: 095340) is a potential inclusion candidate (borderline) in the FnGuide Semiconductor Top10 Index Rebalance in April 2026.

🇰🇷 Block Deal Sale of 4.1% Stake in HD Hyundai Marine Solution by KKR (Douglas Research Insights) $

After the market close on 7 January, it was reported that KKR is selling a 4.1% stake in HD Hyundai Marine Solution (KRX: 443060) in a block deal sale.

The block deal price is expected to be set at 177,630 to 181,450 won per share, a 7-5% discount from the closing price on 7 January (191,000 won).

We are positive on this block deal sale. The block deal discount and this is coupled with a recent share price decline making the overall valuations more reasonable.

🇰🇷 Tender Offer of Echo Marketing & Risk of CEO Kim Acting As White Knight in Mgmt Dispute of Hojeon (Douglas Research Insights) $

A week has passed since Bain Capital first announced a tender offer of Echo Marketing Co Ltd (KOSDAQ: 230360) whose share price has risen 49% since then.

With regards to Echo Marketing CEO Kim acting as a white knight in the management dispute of Hojeon, there is no rush for him to stage a massive M&A fight.

Post tender offer, a more realistic scenario is for Bain Capital to acquire close to 70% to 80% of total outstanding shares in Echo Marketing

🇰🇷 Boston Dynamics’ Next-Gen Atlas Robot Boosts Higher Valuation for Hyundai Motor Group Companies (Douglas Research Insights) $

The introduction of the next-generation Atlas robot at CES 2026 has been a huge success for Boston Dynamics/Hyundai Motor Group companies.

HMG aims to achieve mass production capacity of 30,000 Atlas units annually by 2028, signaling a transition from prototypes to volume-manufactured humanoid robots.

If Boston Dynamics/Hyundai Motor Group companies are able to successfully produce these robots, many investors could attach higher valuation multiples on Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF).

🇰🇷 KT Corp: Likely to Outperform Due to IPOs of HD Hyundai Robotics and K-Bank in 2026 (Douglas Research Insights) $

Although KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) has been underperforming KOSPI in the past six months, we now expect KT to outperform mainly due to its minority stakes in HD Hyundai Robotics and K-Bank.

HD Hyundai Robotics and K-Bank which are two of the largest IPOs that are expected to be completed in Korea in 2026.

The IPOs of HD Hyundai Robotics and K-Bank are likely to have a positive impact on KT whose stakes in these companies could be worth nearly 1.9 trillion won.

🇰🇷 Initial Thoughts on the HD Hyundai Robotics IPO (Douglas Research Insights) $

HD Hyundai Robotics is getting ready to complete its IPO in Korea in 2026. HD Hyundai Robotics is expected to be one of the largest IPOs in Korea this year.

The market currently estimates the value of HD Hyundai Robotics to be about 6-7 trillion won, up from a recent private market valuation of 1.8 trillion won in October 2025.

If HD Hyundai Robotics is valued at 7 trillion won, an 80% stake held by HD Hyundai Co Ltd (KRX: 267250) would be worth 5.6 trillion won (31% of HD Hyundai’s market cap).

🇰🇷 Deokyang Energen Corp IPO Preview (Douglas Research Insights) $

Deokyang Energen is getting ready to complete its IPO on the KOSDAQ exchange in January.

The IPO price range is from 8,500 won to 10,000 won per share. At this price range, the IPO offering amount is from 63.8 billion won to 75 billion won.

Deokyang Energen is a leading producer of high purity hydrogen in Korea that are used in semiconductor, petrochem, fuel-cells, and other uses.

🇲🇾 Mega Fortris drops plan for card manufacturing business in Macau (GGRAsia)

Malaysia-listed security seal specialist Mega Fortris Bhd (KLSE: MEGAFB) has abandoned a plan to set up a manufacturing business in Macau for supplying and handling of playing cards in sealed security boxes. The group cited challenges in finding suitable premises in Macau and high rental costs as reasons for the decision.

The information was disclosed in a Tuesday filing, proposing the reallocation of gross proceeds raised from the firm’s initial public offering (IPO) in November.

The group intends now to reassign the use of MYR45.0 million (US$11.1 million) of the IPO proceeds that was originally earmarked for capital expenditure for the new business venture in Macau.

In October, when it announced the IPO, Mega Fortris said it planned to set up a “manufacturing line” in Macau, by purchasing and installing specialised machinery and equipment, which was to be “consigned to a subcontractor and installed at the subcontractor’s premises in Macau”.

🇸🇬 MAS moves to ease dual listings on SGX-Nasdaq board (The Asset) 🗃️

Proposals seek to reduce duplication and delay in meeting requirements across two jurisdictions

The Monetary Authority of Singapore ( MAS ) has unveiled proposed legislative and regulatory changes aimed at making it easier for companies to pursue dual listings on the Global Listing Board ( GLB ), a newly created platform jointly developed by the Singapore Exchange ( SGX ) and Nasdaq.

The MAS hopes these proposals, now open for public consultation, will contribute significantly to strengthening Singapore’s position as a key global capital market.

🇸🇬 I’m Upgrading Karooooo To A Buy On Profitable Revenue Growth (Seeking Alpha) $ 🗃️

-

🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 China Yuchai: Positive On Strong HDT Sales And Data Center Growth Potential (Seeking Alpha) $ 🗃️

🇸🇬 Return of the Power King (Maius Partners)

Ride the Momentum, Pursue Long-Term Success: A 75-Year Odyssey from a Labor Reform Camp to a Global Power King

The story of China Yuchai International Limited (NYSE: CYD) is among the most compelling—and persistently misunderstood—sagas in the universe of U.S.-listed Chinese equities. For more than three decades, the company has reigned “King” of China’s internal combustion engine (ICE) market, commanding a leading share across heavy-duty trucks, buses, and off-road machinery through its core operating subsidiary, Guangxi Yuchai Machinery Company Limited (GYMCL).

Yet for most of its public life, CYD has traded at valuations implying terminal decline. This discount was not driven by operating irrelevance, but by a toxic mix of corporate governance complexity, the infamous “Golden Share” structure held by Hong Leong Asia Ltd (SGX: H22 / FRA: HOM), and a persistent conglomerate discount that trapped investor perception in the early 2000s.

As investors look toward 2026, however, the foundations underpinning this narrative are shifting.

🇸🇬 Grab Holdings: Its Unparalleled Ecosystem Is Still Far Ahead Of The Competition (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: The Profitability Inflection Point (StockOpine’s Newsletter)

Dominant, growing, and finally profitable. Is it time to buy?

It’s been a while since our last deep dive as we spent the past few weeks focused on valuation updates and the holiday period slowed longer-form work. We’re starting the year with Grab Holdings Limited (NASDAQ: GRAB), Southeast Asia’s leading on-demand platform spanning mobility, delivery, advertising, and financial services. This report looks at how the business is evolving as it moves from scale to profitability. We’re confident this one was worth the wait and wish everyone a strong investing year ahead.

Contents:

🇸🇬 A Deep Dive on Sea Limited (SE) (RS Capital)

Southeast Asia’s Three-Headed Monster

Contents

Introduction

Company

Moats

Growth

Profitability

Health

Outlook

Valuation

Risks

Thesis

Of all the stocks I’ve followed, Sea Limited (NYSE: SE) is the stock I’ve covered the longest — spanning more than 5 years and 10 articles.

Given my interest in growth stocks and my daily exposure to Shopee (I live in Indonesia, one of SE’s most important markets), it’s only natural that I have SE in my coverage universe.

🇸🇬 CapitaLand to acquire stakes in three India data centres (The Asset) 🗃️

Deal comes after fund raises S$150 million at first close

CapitaLand Investment Limited (SGX: 9CI), a Singapore-listed global real asset manager, has raised about S$150 million ( US$116 million ) at the first close of its CapitaLand India Data Centre Fund ( CIDCF ).

The fund focuses on data centre development opportunities in India’s key data centre corridors. It was anchored by a third-party global institutional investor, with a GP commitment from CLI. CIDCF is targeting a final close of approximately S$300 million.

With the first close, CIDCF will acquire a 20.2% interest in each of three data centres in India from CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF) for 7.02 billion rupees ( US$77.6 million ).

🇸🇬 Singapore Banks Are at Record Highs. What Can We Expect in 2026? (The Smart Investor)

Singapore bank stocks are trading near record highs. Here’s what could drive returns and dividends in 2026, and what risks investors should watch.

Singapore’s three main banks, namely DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), and United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) are at, or nearing, all-time highs after experiencing strong rallies over the past few years.

Why Singapore Banks Performed So Well

Dividends in Focus: Can Payouts Stay Elevated in 2026?

The Interest Rate Question: Headwind or Normalisation?

Valuations at Record Highs: Priced for Perfection?

Risks to Watch in 2026

Get Smart: From Growth to Steady Compounding

🇸🇬 DBS at All-Time Highs: Is the Share Price Still a Buy in 2026? (The Smart Investor)

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) just delivered another record quarter, backed by resilient income and strong dividends. But with the share price at all-time highs and interest rates easing, the bigger question is whether the fundamentals can keep up in 2026.

We take a look at the bank’s most recent numbers and see if this rally is sustainable, heading into 2026 and beyond.

Record Income, Even as Rates Ease

Net Interest Margins Are Compressing — But Holding Up

Fee Income Is Doing the Heavy Lifting

Asset Quality and Loan Growth Remain Solid

Dividends Remain a Key Pillar of the DBS Story

What Could Limit Further Share Price Upside

What This Means for Investors

Conclusion – Get Smart: Record Results Set a Higher Bar

🇸🇬 Are Bank Dividends Still Worth It After Interest Rate Cuts? (The Smart Investor)

🇸🇬 Is It Too Late to Buy DBS, Singtel, or ST Engineering? (The Smart Investor)

Are DBS, Singtel, and ST Engineering too expensive to buy now? We examine whether these blue-chip stocks remain attractive despite their strong share price performance.

🇸🇬 3 Dividend Stocks That Benefit from MAS’s S$5 billion Scheme for Local Equities (The Smart Investor)

MAS’s S$5 billion scheme could boost Singapore equities. Here are three dividend stocks that may benefit from the initiative.

Small-cap (market capitalisation of under S$1 billion) and mid-cap (market cap of between S$1 billion and S$5 billion) stocks are poised to benefit.

Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) – A Defensive Retail Champion

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) – The Fintech Trailblazer

UMS Integration Ltd (SGX: 558 / OTCMKTS: UMSSF) or UMS Holdings – AI‑Driven Growth Potential

UMS sits at the heart of the semiconductor supply chain, with chip‑related manufacturing making up most of its business, supported by smaller segments such as aerospace and materials distribution.

What This Means for Investors

Conclusion – Get Smart: Position Before the Crowd

🇸🇬 3 Blue-Chips Ready for a Strong Year Ahead (The Smart Investor)

🇸🇬 4 Singapore Blue-Chip Stocks You Can Buy and Hold Forever (The Smart Investor)

🇸🇬 ST Engineering vs Sembcorp: Which Industrial Powerhouse Offers Better Value Now? (The Smart Investor)

ST Engineering and Sembcorp are both climbing on strong earnings, but which industrial giant offers better value and long-term upside for investors today?

Business Overview: Different Models, Different Strengths

Financial Comparison: Profitability, Cash Flow & Balance Sheet

Growth Drivers: Where Will Future Returns Come From?

Dividend Profile: Which Company Rewards Shareholders More?

Valuation: Which Stock Offers Better Value Today?

Risk Factors Every Investor Should Note

Verdict: Which Industrial Powerhouse Offers Better Value Now?

Get Smart: Match the Stock to Your Investment Goals

🇸🇬 3 Under-the-Radar Singapore Stocks to Fuel Your 2026 Passive Income (The Smart Investor)

🇸🇬 3 Cash Rich Stocks Paying More Than 5% Dividends (The Smart Investor)

🇸🇬 5 Worry-Free Singapore Stocks You Can Park in Your CPF Investment Account (The Smart Investor)

🇸🇬 CICT Dividend Yield: Is the Current Payout Sustainable for 2026? (The Smart Investor)

With a solid yield now, investors ask: can CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) sustain its payout through 2026 and beyond?

CapitaLand Integrated Commercial Trust (CICT) has long been a REIT prized for its stable payout, with a record stretching back to 2002.

Trading at a trailing distribution yield of 4.6%, CICT boasts a decent yield.

This distribution is particularly attractive in a world of macroeconomic uncertainty, marked by threats from tariffs, and inflation fears.

But, is this yield sustainable moving forward?

What Drives CICT’s Dividend: Key Fundamentals

Recent Performance and Payout History

Risks That Could Threaten Payout Sustainability in 2026

What to Watch in 2026 to Gauge Sustainability

Get Smart: Smart Income Investing Means Monitoring, Not Assuming

🇸🇬 4 Singapore REITs to Watch in January 2026 (The Smart Investor)

🇸🇬 Beyond Blue Chips: 3 Cash-Rich Stocks Paying More than Your CPF (The Smart Investor)

Find out which three cash-rich Singapore stocks pay higher yields than CPF, with strong balance sheets and steady cash flows.

HRNetGroup (SGX: CHZ)

HRnetGroup is a recruitment powerhouse with 33 years of history and a presence in 18 Asian cities.

Its business model balances high-margin permanent placements via Professional Recruitment with recurring revenue from Flexible Staffing.

Valuetronics Holdings (SGX: BN2 / FRA: GJ7)

Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF)

Boustead Singapore, established in 1828, offers a diversified portfolio ranging from Geospatial technology to Energy Engineering.

Get Smart: Focus on the Fortress

🇸🇬 3 Defensive Stocks to Protect Your Portfolio in 2026 (The Smart Investor)

🇸🇬 Start 2026 Strong: 3 Dividend Stocks That Could Boost Your Passive Income (The Smart Investor)

🇸🇬 5 Cash-Rich Companies With Rock-Solid Balance Sheets and Rising Dividends (The Smart Investor)

Discover five cash-rich Singapore companies with strong balance sheets, dependable earnings and rising dividends — ideal for investors seeking long-term stability and steady passive income.

What Defines a “Cash-Rich, Rock-Solid” Company?

Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF): Slow and Steady Compounding

Sheng Siong’s essential groceries business allowed it to grow its free cash flow (FCF) at an impressive compound annual growth rate (CAGR) of 18.3% over the last decade, to S$221.9 million as of the last 12 months (LTM).

Wee Hur Holdings Ltd (SGX: E3B / FRA: 3YM): Construction Exposure with Stable Recurring Income

Riding the construction boom in Singapore, Wee Hur’s future growth looks bright.

The company recently secured two HDB construction contracts (worth around S$439.4 million), due to be completed between 2028 and 2029.

PropNex (SGX: OYY): Property Exposure with zero debt

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF): Healthcare Provider with a Giant Net Cash Position

The provider of a plethora of medical-related services in Singapore and across Asia, Raffles Medical boasts an impressive dividend history: the group has paid a consistent annual dividend for the past 15 years.

Riverstone Holdings (SGX: AP4): Healthcare provides Stability, with an AI growth angle

Since listing, Riverstone Holdings Limited has never missed an annual dividend, and it boasts a LTM dividend yield of 4.7%.

Its healthcare business (gloves and personal protective equipment) provides a resilient base to generate sustainable FCF, averaging around RM 540 million between 2020 and 2024, consistently across market cycles.

Get Smart: Strong Balance Sheets Build Strong Returns

🇮🇳 Are You A European Company With An Indian Subsidiary? IPO It!* (Alluvial Capital)

*Resulting valuation uplift not guaranteed

In recent years, the Indian stock market has shown strong performance. The MSCI Index is up 15.4% annualized over the last 5 years. The Indian market features high participation by retail investors, who are willing to pay lofty multiples for companies with open-ended growth profiles. Sound familiar? A strong 2025 notwithstanding, European stock markets have not rewarded investors in the same way, and valuation multiples for mature companies are low.

Let’s say you’re in charge of a mature, profitable European company. Think an industrial, a retailer, a consumer staples business, or anything else that has little or nothing to do with AI or aerospace/defense or any other hot sector. The market is likely pricing your shares at less than 15x earnings. But let’s say you have a subsidiary in India. This subsidiary is a fairly small part of your business, but it is profitable and growing at 20% or higher. You could do nothing and hope the market eventually recognizes the value of this high-growth asset, or you could do an IPO and sell 25-50% of your Indian subsidiary. You’ll have a nice cash windfall, and hopefully, your subsidiary will trade at 30-40x earnings or more, highlighting the value of the shares you continue to own. As time goes on, you can place more subsidiary shares, benefitting your own shareholders. Maybe the market will credit your company for the observable value of the now-public Indian subsidiary, and your shares will zoom.

🇮🇳 Indian oil refiners see opportunity in Donald Trump’s Venezuela action (FT) $ 🗃️

🇮🇳 MakeMyTrip: India Aspirational Consumption Play, Valuation Stretched (Seeking Alpha) $ 🗃️

🇮🇳 Car Trade Tech: Driving PAT Growth Via Massive Operating Leverage (Smartkarma) $

CarTrade (NSE: CARTRADE / BOM: 543333) is India’s leading multi-channel digital automotive marketplace, connecting millions of buyers and sellers through its top-tier platforms.

Its unmatched 95% organic traffic creates best-in-class EBITDA margins by eliminating the high customer acquisition costs typical in digital marketplaces.

Management guides for accelerated revenue momentum and significant margin expansion in OLX through AI-led search tools and new monetization programs.

🇮🇳 Varun Baverage: Expecting Turnaround In H2FY26 (Smartkarma) $

Varun Beverages (NSE: VBL / BOM: 540180) is the second-largest global PepsiCo franchisee, operating a massive distribution network across India and several high-growth international African territories.

Subdued domestic volumes due to prolonged rainfall should revive by H2FY26, driven by an optimistic management outlook and lower-than-average forward valuation multiples.

Future growth will be catalyzed by strategic expansion into alcoholic beverages, increased penetration in rural India, and successful launches in the energy category.

🇮🇳 Bharat Coking Coal IPO – Don’t Go by the Name,Legacy Parent Issues And Century-Old Jharia Mine Fires (Smartkarma) $

New Issue, Old memories: We present reasons why we believe the Bharat Coking Coal Limited (BCCL) (7535956Z IN) IPO could see similar trend as its parent Coal India (NSE: COALINDIA / BOM: 533278)‘s IPO.

We present reason why one should not just go by the company name – “Coking Coal” and the century old coal mine fires at Jharia.

Finally, we discuss on valuation and our view on the same.

🇮🇱 Mobileye: Still A Strong Buy Based On Future Sales Potential (Seeking Alpha) $ 🗃️

🇮🇱 Mobileye Just Dropped $900M On Humanoid Robots—Are They Building The Next Tesla Bot? (Smartkarma) $

In a significant development, Mobileye Global (NASDAQ: MBLY), the Intel-backed autonomous driving technology company, has announced the acquisition of AI-powered robotics startup Mentee Robotics for a total consideration of $900 million.

The transaction, comprising $612 million in cash and approximately 26.2 million shares of stock, is expected to close in the first quarter of 2026.

Mentee Robotics will operate as an independent unit under Mobileye’s umbrella.

🇮🇱 Teva ($TEVA) – Knocking on the door of investment grade (Kontra Investments)

S&P upgrades Teva Pharmaceutical Industries Ltd (NYSE: TEVA) to BB+, putting the pharma giant one notch away from a massive institutional liquidity event.

Shareholders received an early holiday gift on the morning of December 24th. Teva announced that S&P Global Ratings has upgraded its long-term issuer credit rating to BB+ from BB. Simultaneously, Moody’s revised its outlook to Positive.

On the surface, this is a standard credit update. But from a capital markets perspective, Teva has just entered the most critical phase of its corporate rehabilitation. They are now officially a “Rising Star” candidate.

🇿🇦 Thungela Resources: Dividend Expectations Might Leave Investors In The Ash (Seeking Alpha) $ 🗃️

🇵🇱 LIvechat Software SA 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

-

🇵🇱 Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) – Develops & distributes communication software for businesses worldwide. It offers LiveChat, ChatBot, KnowledgeBase & HelpDesk. 🇼 🏷️

🇵🇱 Dino Polska: Setup For Margin Expansion Is Already There (Seeking Alpha) $ 🗃️

🇵🇱 InPost: Time To Sell After Acquisition Stock Price Pop (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇵🇱 MO-BRUK: DCF Valuation (HatedMoats)

A one-off hit has this company priced as broken. But is this permit-moat cash machine undervalued? – DCFriday #006

Date of Analysis: December 27, 2025 – January 2, 2026

Verdict: Undervalued

Current Price Target (Base Case): PLN 451

Price at the Time of Analysing: PLN 330

MO-BRUK J Mokrzycki (WSE: MBR / FRA: 1VX / LON: 0Q9T / OTCMKTS: MBRFF) is a Polish company that can be described as a high-margin, regulatory-privileged hazardous waste processor trading at a discounted valuation after a transient, backward-looking event distorted reported results.

The market is currently mispricing Mo-Bruk as a legally “tainted” waste operator rather than a scarce-permit infrastructure asset that sits at the centre of Poland’s compliance upgrade cycle. The primary source of this mispricing is an optical, backward-looking accounting shock, i.e. the one-off Marszałek-related provision/write-down tied to 2018–2019 environmental fees. While headline net income turned negative (and caused panic), the business’s forward cash-generating engine remains intact. Crucially, the company is exiting a heavy capex phase, which should mechanically lift free cash flow conversion.

🌎 Dlocal (Deep Dive) (TacticzHazel’s Substack)

A highly asymmetric bet on the rise of Emerging Markets.

Dlocal (NASDAQ: DLO), is a company that deserves a lot more attention than it currently gets. It’s fast-growing, has tons of secular and region-specific tailwinds, a strong management-team and a fantastic scalable business model.

One of the things that has led me to put Dlocal high on my deep dive list, is the asymmetric opportunity I believe it provides right now. Downside is limited due to attractive valuation, and the upside potential is huge.

DLocal is well positioned to benefit from the rapid rise of Emerging Markets and their recent growth story shows this.

In this deep dive I will unpack everything you need to know about Dlocal. I cover the most important parts of the business and end with the valuation model.

🌎 Liberty Latin America: Undervaluation Persists With Recent Costa Rica Setback (Seeking Alpha) $ 🗃️

🇦🇷 Argentina repays US financial lifeline as Milei emerges from market crisis (FT) $ 🗃️

🇧🇴 Andean Precious Metals: Major Bank In Canada Echoes A Credibly Optimistic Outlook (Seeking Alpha) $ 🗃️

-

🇧🇴 🇺🇸 Andean Precious Metals Corp (TSE: APM / FRA: 6ZS / OTCMKTS: ANPMF) – Mid-tier precious metals producer. San Bartolomé processing facility in Potosí, Bolivia & Soledad Mountain mine in Kern County, California. 🇼

🇧🇷 StoneCo: Is Its BRL 2.3B Credit Portfolio the Next Big Earnings Lever—or a Hidden Risk? (Smartkarma) $

StoneCo Ltd (NASDAQ: STNE) reported results that reflected operational progress despite a challenging macroeconomic backdrop and intensifying competition in Brazil’s financial technology sector.

Revenue and income from continuing operations rose 16% year over year to BRL 3.6 billion, primarily driven by solid execution in the company’s payments and banking businesses.

Adjusted gross profit increased 12% to BRL 1.6 billion, aligned with total payment volume (TPV) growth of 11%.

🇧🇷 Petrobras Oversupply And Venezuela Fears Trigger Richer Dividend Yields, Despite Risks (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Still The Cleanest Way To Position For Oil Downside — Even After Venezuela (Seeking Alpha) $ 🗃️

🇧🇷 Petróleo Brasileiro S.A. – Petrobras 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Vale: Why Valuation Alone No Longer Makes This An Easy Buy (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Vale: After 10 Years, This Forgotten Metal Could Boost The Company’s Prices (Seeking Alpha) $ 🗃️

-

🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Nu Holdings: The Flywheel Thesis At Fair Value (Seeking Alpha) $ 🗃️

🇧🇷 BrasilAgro’s Cycle Will Improve In FY26, But Is Still Way Behind The Price (Seeking Alpha) $ 🗃️

🇧🇷 Gerdau S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Itaú Unibanco Holding S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇲🇽 Grupo Aeroportuario del Sureste: Assessing New Airports And Venezuelan Market (Seeking Alpha) $ 🗃️

🇵🇦 Copa Holdings: 20 Years Of Widening The Moat (Seeking Alpha) $ 🗃️

🇵🇪 Credicorp: Strong Growth Prospects For 2026 And Beyond (Seeking Alpha) $ 🗃️

-

🌎 Credicorp (NYSE: BAP) – Universal banking, insurance & pension platform, microfinance, investment banking & wealth management. 🇼

🌐 What de-dollarization? US currency set for mild recovery in 2026 (The Asset) 🗃️

Renminbi tipped to remain stable against greenback, gain versus euro and yen

After one of its weakest annual performances in decades, the US dollar is entering 2026 at a crossroads, with expectations of a moderate recovery but with clear divergence across major currencies, particularly the Japanese yen and the Chinese renminbi.

Speaking at a recent UBS event on the global currency outlook, Rohit Arora, head of the bank’s Asia FX and rates strategy, framed 2026 not as a reversal of the dollar’s role but as a normalization following public narratives about de-dollarization in the past year that many investors and critics now consider exaggerated.

“There’s been no convincing evidence of de-dollarization or diversification away from US assets,” Arora says, noting that capital inflows into US markets remain resilient despite last year’s volatility.

UBS expects the US dollar index ( DXY ) to experience a moderate recovery in 2026, anticipating a 2-3% overall gain for the year, which would see the DXY rebound to around the 100 mark by the year’s end. This follows a sharp depreciation of roughly 10% in 2025.

🌐 Brisk fundraising defines capital markets in 2025 (The Asset) 🗃️

G3 bond issuance from Asia, outside of Japan and Australasia, rose 15% to US$268.29 billion in 2025, from US$233.28 billion a year ago. According to data from LSEG, the top four markets – China, South Korea, Hong Kong and Singapore – posted bigger volume, offsetting the declines noted in India and the Philippines.

“We’ve seen a continuing strong recovery in the bond market with the interest rates trending lower. We’ve noted large volume in the investment grade space, which continues to dominate the issuances,” says a senior DCM ( debt capital markets ) banker. “The Reg S market is growing in depth as investors are onshoring into Asia, out of the US and Europe, setting up offices in the region with dedicated Reg S money. At the same time, the liquidity of Asian local investors also just continues to grow.”

🌐 Nebius: Consolidation Is Ending, And The Market Still Looks Asleep (Seeking Alpha) $ 🗃️

🌐 Nebius: The Case For The ‘Neutral’ AI Platform (Seeking Alpha) $ 🗃️

🌐 Nebius: Not Time To Take The Foot Off The Throttle (Seeking Alpha) $ 🗃️

🌐 Nebius: Valuation Has Reset As Bad News Priced In (Upgrade) (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

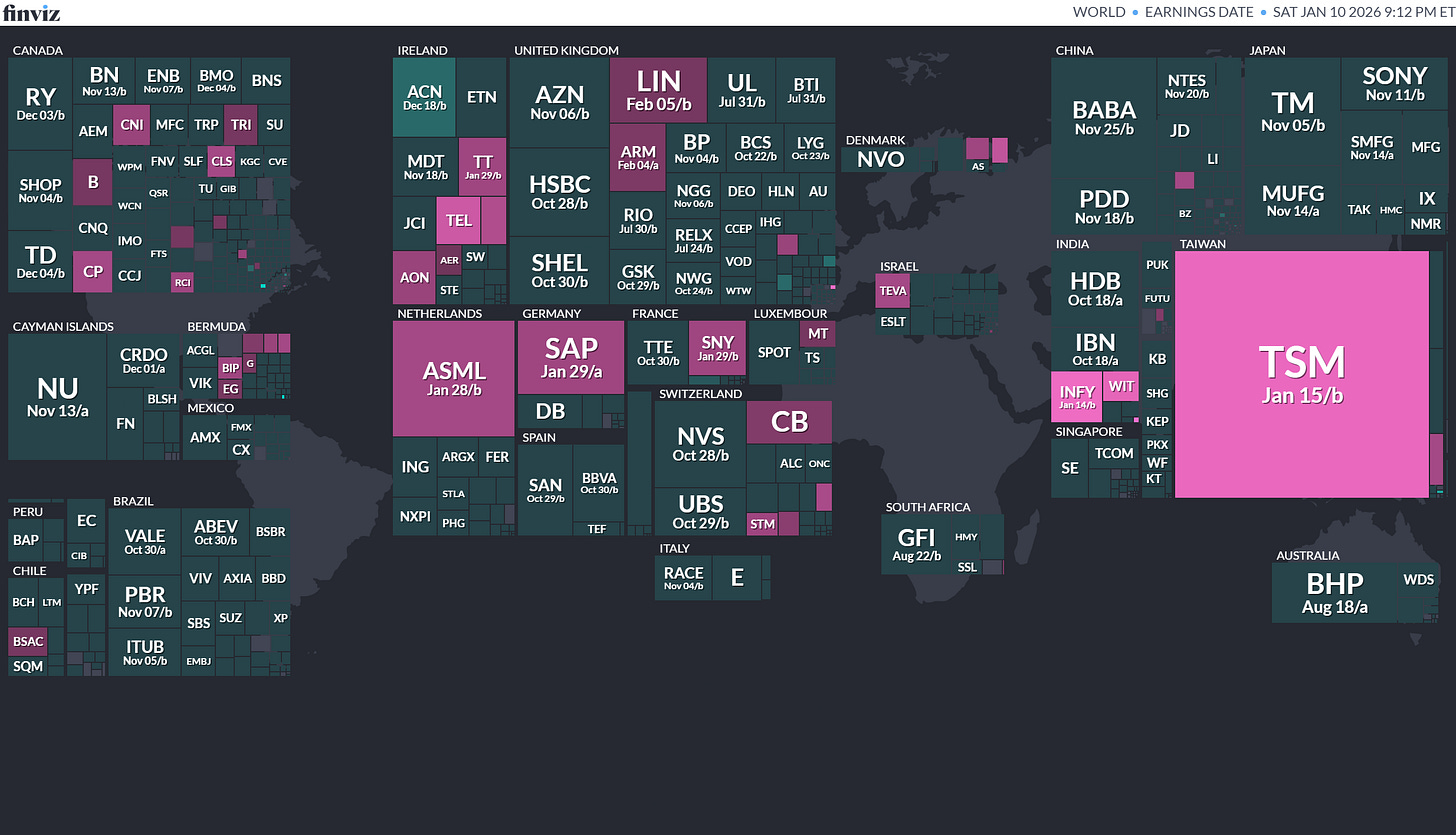

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

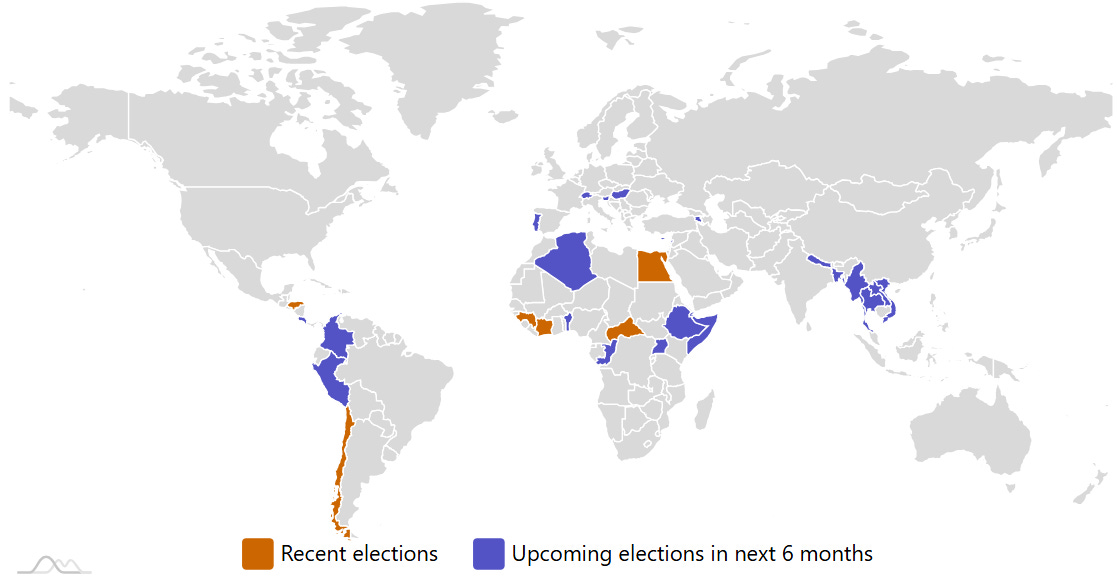

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

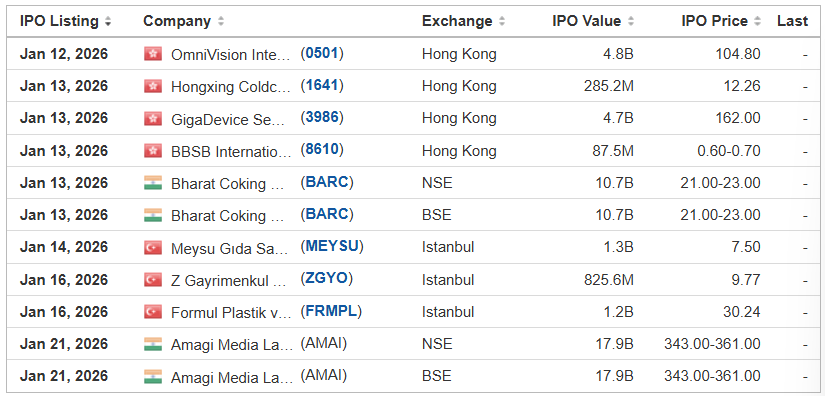

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Atlas Critical Minerals (Uplisting) ATCX A.G.P. (Alliance Global Partners)/Banco Bradesco BBI, 1.2M Shares, $8.00-8.00, $9.6 mil, 1/9/2026 Priced

(Republic of the Marshall Islands)

Note: This is NOT an IPO. This is a NASDAQ uplisting. Atlas Critical Minerals’ stock was quoted for trading on the OTCQB operated by the OTC Markets Group, Inc. under the symbol “JUPGD.” Its last trade on the OTCQB was at $10.50 on Dec. 31, 2025, reflecting its reverse stock split in early December. The company was formerly known as Jupiter Gold Corp.

We are a mining company focused on developing rare earth, titanium and graphite projects in Brazil. Our projects include rare earth and titanium prospects in Goias and Minas Gerais, graphite properties in Minas Gerais, copper and nickel rights in Goias and Piaui, and uranium areas in six states in Brazil. We also have iron ore, gold and quartzite assets.

We are affiliated with Atlas Lithium. Marc Fogassa, our founder, CEO and chairman of the board, is also the CEO and chairman of Atlas Lithium.

Note: Net loss and revenue are in U.S. dollars for the 12 months that ended June 30, 2025.

(Note: Atlas Critical Minerals Corp. upsized its NASDAQ uplisting at pricing – a public offering of 1.2 million shares – and priced the deal at $8.00 – to raise $9.6 million on Thursday night, Jan. 8, 2026. The public offering was upsized at pricing by 50 percent – with the addition of 400,000 shares – from the 800,000 shares in the F-1/A filing – and the deal was priced $2.00 below the $10.00 mid-point of the price range in the prospectus. This public offering was done in connection with the NASDAQ uplisting of Atlas Critical Minerals’ stock from the OTC market. Background: Atlas Critical Minerals filed an F-1/A on Jan. 2, 2026, for its NASDAQ uplisting with these terms – 0.8 million shares (800,000 shares) at a price range of $9.00 to $11.00 – to raise $8 million, if priced at the $10.00 mid-point of its range. The company completed a 1-for-12 reverse stock split on Dec.3, 2025.)

Seahawk Recycling Holdings, Inc. SEAH Cathay Securities, 3.8M Shares, $4.00-6.00, $18.8 mil, 1/12/2026 Week of

(Incorporated in the British Virgin Islands)

Headquartered in Tokyo, Japan, we are an international recycling company dedicated to advancing sustainable material solutions across East Asia and Southeast Asia. As a committed advocate for environmental sustainability, we have devoted ourselves to promoting the development of a low-carbon and zero-waste global green circular economy by engaging in the trading of recyclable resources such as waste paper and scrap metal.

Our operations are structured around two core business segments: waste paper recycling and scrap metal recycling.

Under our waste paper recycling business, we operate across both the domestic Japanese and international markets by trading two main product categories: waste paper and paper pulp. We source waste papers from collection companies in Japan and supply them to recycled pulp mills or trading companies. In parallel, we purchase paper pulps from recycled pulp mills and supply them to paper manufacturers or trading companies. While our waste paper transactions are primarily domestic, our paper pulp exports serve a broad customer base across East Asia and Southeast Asia.

We also conduct cross-border transactions under our waste paper recycling business by procuring waste paper from suppliers in the U.S. and arranging for direct shipments to pulp mills or paper manufacturers in Malaysia.

Our scrap metal recycling business focuses on the trade of dismantled metal wires and old metal appliances such as motors, engines, air conditioners and refrigerators. For old metal appliances, we acquire these materials from collection companies and supply them to smelters or trading companies, while for dismantled metal wires, we purchase processed and dismantled metal wires such as copper wires, aluminum wires, brass wires and iron wires, from dismantling factories, and then sell them to smelters, or trading firms. While the operations under our scrap metal recycling business are primarily concentrated within Japan due to the heavier nature of these materials, we also export a portion of our dismantled metal wires to our customers in East Asia and Southeast Asia.

For export transactions, we manage the full logistics chain from supplier pickup and port delivery to international shipping, allowing us to ensure timely and cost-effective deliveries.

Note: Net income and revenue are for the fiscal year that ended March 31, 2025.

(Note: Seahawk Recycling Holdings, Inc. nearly doubled the size of its small IPO to raise $19 million – up from $10 million originally – according to its F-1/A filing on Jan. 7, 2026. Seahawk Recycling Holdings now plans to offer 3.75 million shares – up from 2.0 million shares originally – at the price range of $4.00 to $6.00 (same price range as in its initial filing) – to raise $18.75 million, according to its F-1/A filing dated Jan. 7, 2026. Background: Seahaawk Recycling Holdings, Inc. filed its F-1 for its small-cap IPO and disclosed the terms: 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its SEC filing on Sept. 25, 2025.)

Green Circle Decarbonize Technology Limited GCDT RBW Capital Partners (A Division of Dawson James)/Spartan Capital Securities, 2.5M Shares, $4.00-4.00, $10.0 mil, 1/13/2026 Tuesday

(Incorporated in the Cayman Islands)

Our mission is to preserve the world through decarbonization technologies. As an advocate of decarbonization, we design, develop, and provide customized energy saving solutions that bring considerable economic benefits to our clients and reduce carbon emissions for a sustainable future.

As carbon emissions continue to build up in the atmosphere at historic levels, the theme of decarbonization has been gaining momentum on the international stage, and companies and governments are facing more pressure than ever to develop and execute a meaningful net-zero strategy, especially after the adoption of the Paris Agreement and the Glasgow Climate Pact in 2015 and 2021, respectively. The Glasgow Climate Pact reaffirms the Paris Agreement Temperature Goal and urges each of the signing countries to take further actions to accelerate the development, deployment, and dissemination of technologies, and the adoption of policies, to transition towards low-emission energy systems.

It is specifically acknowledged in the Paris Agreement that climate change is a common concern of humankind, and accordingly the fight against climate change and the pursuit of decarbonization is not only an imperative agenda of governments or states, but also requires commitment and active participation and contribution by non-state actors such as businesses, financial institutions, educational institutions, and healthcare institutions. We have devised and have been consolidating our corporate mission to research, develop, strategize, and commercialize our decarbonization technology and products that not only bring considerable economic benefits to our clients, but also contribute to the global campaign of decarbonization and ultimately a more sustainable future.

We are a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company without material operations of our own, we conduct our business in Hong Kong through our Operating Subsidiary, Boca International Limited (“Boca International”).

We are a provider of advanced energy saving solutions supported by proprietary phase change thermal energy storage materials and thermal engineering services. Our proprietary technology is a phase change material (“PCM”) thermal energy storage (“TES”) technology. By applying material science and nanotechnology, we have successfully invented and manufactured our PCM which allows temporary storage of excess thermal energy for later use and thereby bridges the gap between energy availability and energy use (“BocaPCM-TES Technology”).

With our industry experience and professional expertise, we have put our BocaPCM-TES Technology into practice and invented our product – “BocaPCM-TES Panel” – a custom-made high-density polyethylene (“HDPE”) plastic encapsulated container fully filled with our PCM solution. Currently, we have developed more than 20 types of PCM, each of which has a unique phase change temperature and TES capacity to accommodate different temperature requirements in various PCM-TES applications. Based on the type of PCM solution filled into the HDPE plastic containers, we are able to manufacture customized BocaPCM-TES Panels with a wide range of operating temperatures from -86°C to +600°C to suit our clients’ needs. Accordingly, our BocaPCM-TES Panels can be utilized in many heating, ventilation, and air conditioning (“HVAC”) and refrigeration applications.

Note: Net loss and revenue are for the year that ended March 31, 2024.

(Note: Green Circle Decarbonize Technology Limited is offering 2.5 million shares at an assumed IPO price of $4.00 to raise $10 million, according to an F-1/A filing dated Nov. 28, 2025. This small IPO intends to list its stock on the NYSE-AmEx. Its book-runner is RBW Capital Partners. Background: Green Circle Decarbonize Technology increased its IPO’s size to 2.5 million shares – up from 2.0 million shares – and kept the assumed IPO price at $4.13 ($4.125) – to raise $10.33 million, according to an F-1/A filing dated Sept. 26, 2024.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 1/19/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

Amatuhi Holdings AMTU Spartan Capital, 1.0M Shares, $5.00-5.00, $5.0 mil, 1/19/2026 Week of

(Incorporated in Delaware)

AMATUHI HOLDINGS, Inc., was incorporated on June 24, 2025, in Delaware to act as the holding company of AMATUHI Inc. AMATUHI Inc. (“AMATUHI”) was incorporated on February 22, 2021, and is an operating company in Japan with the headquarter in Yokohama, Kanagawa, and a branch in Osaka. AMATUHI operates under the “AMANEKU” brand in Japan.

Our company operates group homes in Japan for people with disabilities under the brand name of “AMANEKU.” “AMANEKU” is a “communal living assistance” service based on the “Comprehensive Support for Persons with Disabilities Act” which is implemented based on the self-support benefits provided by the Japanese government under the act. The act supports people who wish to live independently so that they can advance toward their respective goals through communal living in small groups and interaction with the local community.

In the fiscal year that ended March 31, 2025, Amatuhi added 18 group homes and cumulatively operated 29 group homes, according to the prospectus.

AMANEKU provides group homes with Daytime Service Support, which was established as a result of amendments to the Comprehensive Support for Persons with Disabilities Act, that allows for the provision of extensive 24-hour services in response to the increasing aging population and people with disabilities.

Our primary services to the disabled include but are not limited to: Three nutritionally balanced meals daily, counselling and support, assistance with personal care (bathing, dressing, mobility, oral care), medication management, money management, room cleaning, working with medical professionals to provide required medical care and helping our clientele with public assistance, pensions and family matters.

AMANEKU daytime support group homes are mainly two-story buildings with a capacity of 10 residents on each floor. Based on the aging population in Japan, there is a shortage of group homes for people with severe disabilities. Our Company is working to fulfil the needs of the growing disabled population, by providing a number of services to address their needs.

We are reimbursed for the services we provide to disabled people through Japanese government funding issued under the Comprehensive Support for Persons with Disabilities Act.

We are engaged in businesses that support the lives of people with disabilities, including the construction of group homes for people with disabilities and social participation for people with disabilities.

We are specialized in designing, constructing and operating group homes for individuals with disabilities. We also focus on providing supportive living environments, particularly for individuals with significant needs through our Daytime Service Support Type group homes. We are expanding within a market characterized by high demand and insufficient supply, positioning ourselves as a key provider addressing critical social needs related to disability care and housing.

AMATUHI specializes in providing communal living assistance (group homes) as defined under Japan’s “Comprehensive Support Law for Persons with Disabilities.” This is a government-regulated sector where services are funded primarily through social security benefits.

Japan Lifestyle No.1 Investment Limited Partnership directly and indirectly controls approximately 95.0% of the voting power of our outstanding capital stock. As a result, it will have the ability to determine all matters requiring approval by stockholders. In other words, the fund will be able to control any action requiring general stockholder approval, including the election of our Board of Directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger or sale of substantially all of our assets.

If we obtain a listing on the Nasdaq Capital Market, we will be a “controlled company” as defined in Nasdaq Listing Rule 5615(c)(1) because more than 50% of our voting power will be held by a single entity — Japan Lifestyle No.1 Investment Limited Partnership — after the offering.

As a “controlled company,” we will be exempt under Nasdaq listing standards from certain corporate governance requirements that would otherwise apply to companies that are not controlled, including the requirements that:

(i) a majority of the Board of Directors consist of “independent” directors as defined under Nasdaq listing standards,

(ii) we have a nominating and corporate governance committee composed entirely of independent directors with a written committee charter, and

(iii) we have a compensation committee composed entirely of independent directors with a written committee charter.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2025.

(Note: Amatuhi Holdings filed its S-1 for its small IPO on Sept. 12, 2025, and disclosed the terms – 1 million shares at an assumed IPO price of $5.00 – the mid-point of its $4.00-to-$6.00 price range – to raise $5 million. The holding company is incorporated in Delaware. But the company’s business is based in Japan.)

Hartford Creative Group, Inc. (Uplisting) HFUS WestPark Capital, 1.5M Shares, $4.00-4.00, $6.0 mil, 1/19/2026 Week of

Note: This is NOT an IPO. This is a NASDAQ uplisting from the OTC Markets Group – a public offering of 1.5 million shares at an assumed public offering price of $4.00 – to raise $6 million. The last reported sale price of Hartford Creative Group’s stock on the OTC Market was $4.50 on Dec. 12, 2025, according to the prospectus.

(Incorporated in Nevada)

Disclosure: “We currently have three subsidiaries located in the People’s Republic of China (the “PRC” or “China”), and some of our executive officers and directors are located in or have significant ties to China. These ties to China present legal and operational risks to us and our investors, including significant risks related to actions that may be taken by China in the areas of regulatory, liquidity and enforcement, which exist and could affect our current operations and the offering of our securities. For example, if these ties were to cause China to view us as subject to their regulatory authority, China could take actions that could materially hinder or prevent our offering of securities to investors and cause the value of such securities to significantly decline or be worthless.”

Hartford Creative Group, Inc. (“HFUS,” “we,” “us,” or “Company”) specializes in delivering marketing solutions tailored to businesses of small and medium-sized enterprises (SMEs). Our suite of precision marketing services offers cross-media strategies that enable advertisers to effectively target and engage audiences across premier media platforms. We leverage our interconnecting network and keen insights into market demands to develop and implement bespoke marketing initiatives. These initiatives encompass the design, placement, monitoring, and optimization of advertising campaigns.

Navigating the intricate landscape of the modern marketing and sales value chain presents numerous challenges, particularly for enterprises lacking the necessary expertise. Many struggle with creating ample marketing content, devising effective strategies, converting leads, and managing customer relations—tasks made more daunting by the sheer volume of use cases across diverse marketing channels. According to the publication Digital Transformation Market Size, Share, Growth & Trends Analysis Report By Solution, By Deployment, By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 – 2030, the global digital transformation market size was estimated at USD 880.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030. With 1.02 billion internet users and the world’s largest social media population, China’s growing economy, booming technology sector, and thriving e-commerce scene make it one of the most intriguing markets in the world today. Social media has long been one of the most important communication channels in China, with the country having the world’s largest number of social media users at over 983.3 million as of November 2024.

The pent-up demand from social media influencers’ marketing needs on social media apps led the Company to seize the opportunity in providing precise marketing services. As an advertising collaborator of China’s major social media markets, we aim to provide customers with vertical integration services, from early-stage such as advertising video creation, photography and editing, to advertising operation and management on social media apps. Furthermore, we plan to initiate TikTok advertising campaigns overseas and equip our Chinese clientele with the tools to penetrate international markets, including the United States.

We have been committed to building an efficient sales network and mechanism to achieve effective customer coverage and sustainable growth. We seek to maintain mutually beneficial relationships with customers and have gained the trust of many customers across a spectrum of industries, presenting us with further cross-selling and up-selling opportunities. We have built a diversified customer base with a strong willingness to pay. During fiscal year 2025, we have secured advertising service agreements with about 43 customers and received approximately RMB 279.9 million (USD 38.8 million) from these customers. We also entered about 53 supplier contracts for advertising placement and paid RMB 262.6 million (USD 36.4 million) during fiscal year 2025.