Should you buy Nu Holdings stock when it’s under $18?

Latin America’s big banks are growing rapidly.

Over the past few decades, banking in the United States has become digital. The same transition is currently taking place in Latin America, and one company is leading the way. Now Holdings (no +1.59%). The digital banking mobile app is disrupting stodgy legacy institutions in Brazil and Mexico and now has more than 100 million customers, more than all the banks in the United States.

Although the stock has surged over the past year, it is still trading below $18 as of this writing on January 20, 2026. So can you buy it right now?

today’s change

(1.59%)$0.27

current price

$17.24

Key data points

market capitalization

$81 billion

work range

$17.07 – $17.54

52 week range

$9.01 – $18.37

volume

70M

average volume

37M

Increase revenue, reduce cost per customer

Given the aggressive and punitive business models of traditional banks in countries such as Mexico and Brazil, Nu Bank has been able to easily attract customers with its digital-only banking solutions. Rather than charging high fees for cash withdrawals, making customers wait in line for hours at branches, and utilizing frustratingly slow technology solutions, Nu Bank built a customer-friendly banking app.

Naturally, this has led to widespread adoption of financial services products. It currently has 110 million customers in Brazil and 13 million in Mexico, with the latter growing exponentially. Colombia is also widely adopted, but its smaller economy makes it less important to Nu Holdings’ business.

At the same time, while adding a huge number of customers, Nu Bank is increasing its revenue per customer while reducing its cost per customer. The average revenue per active customer in Mexico is currently $12.50 as of the most recent quarter, compared to $5.20 in 2021. As scale increased, the cost per customer increased from $3 to $1.

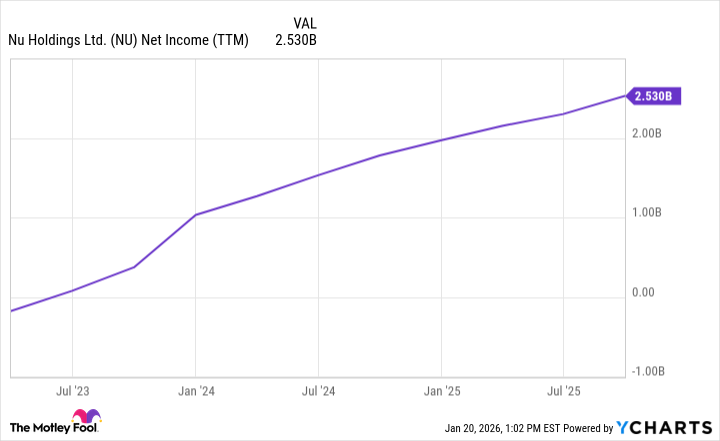

This dynamic, which is also happening in Brazil, is why Nu Holdings’ net income has grown from breakeven to $2.5 billion over the past three years.

Image source: Getty Images.

Many new markets to address

Nu Bank currently has over 100 million customers, but operates in only three Latin American countries: Brazil, Mexico, and Colombia. Although these are the largest countries in the region by population, they are still out of business with many other markets as the larger region’s total population exceeds 600 million and growing.

Management has hinted that it will soon enter new markets such as Chile, Argentina and Peru. We also recently applied for a banking license in the United States, which will allow us to provide cross-border services to immigrants in the region and help them connect with friends and family back home.

Overall, Nu Bank has a long runway to significantly increase revenue per customer and customer base in Brazil, Mexico, and Colombia, as well as expansion into new markets in North and South America. This offers tremendous growth potential for the business over the next decade.

NU Net Margin (TTM) data from YCharts

Should I buy New Holdings stock today?

Nu Holdings currently trades with a market capitalization of $81 billion and a price-to-earnings ratio (P/E) of 32.4, based on trailing net income of $2.5 billion.

While it’s expensive for a bank stock, it could be cheap for investors who hold on for the next 10 years. Nu Holdings has the opportunity to significantly increase revenue through new customer acquisition and additional financial services, such as credit cards. At the same time, you are lowering your cost per customer, which will help increase your profit margins.

It wouldn’t be surprising if Nu Holdings was generating $10 billion in annual net income five years from now, especially if it cuts back on spending on key customer acquisitions. This gives the stock a P/E of 8 based on the current price, which seems cheap even for the next five years.

Don’t think New Holdings is a stock to avoid after rising nearly 50% over the past year. The current stock price is below $18, which still looks cheap for long-term investors.