The sudden shift in Ethereum staking is draining billions of dollars from exchanges and into new corporate elites.

By the end of 2025, a corner of the market that most Ethereum traders rarely look at has built up positions large enough to matter to everyone else.

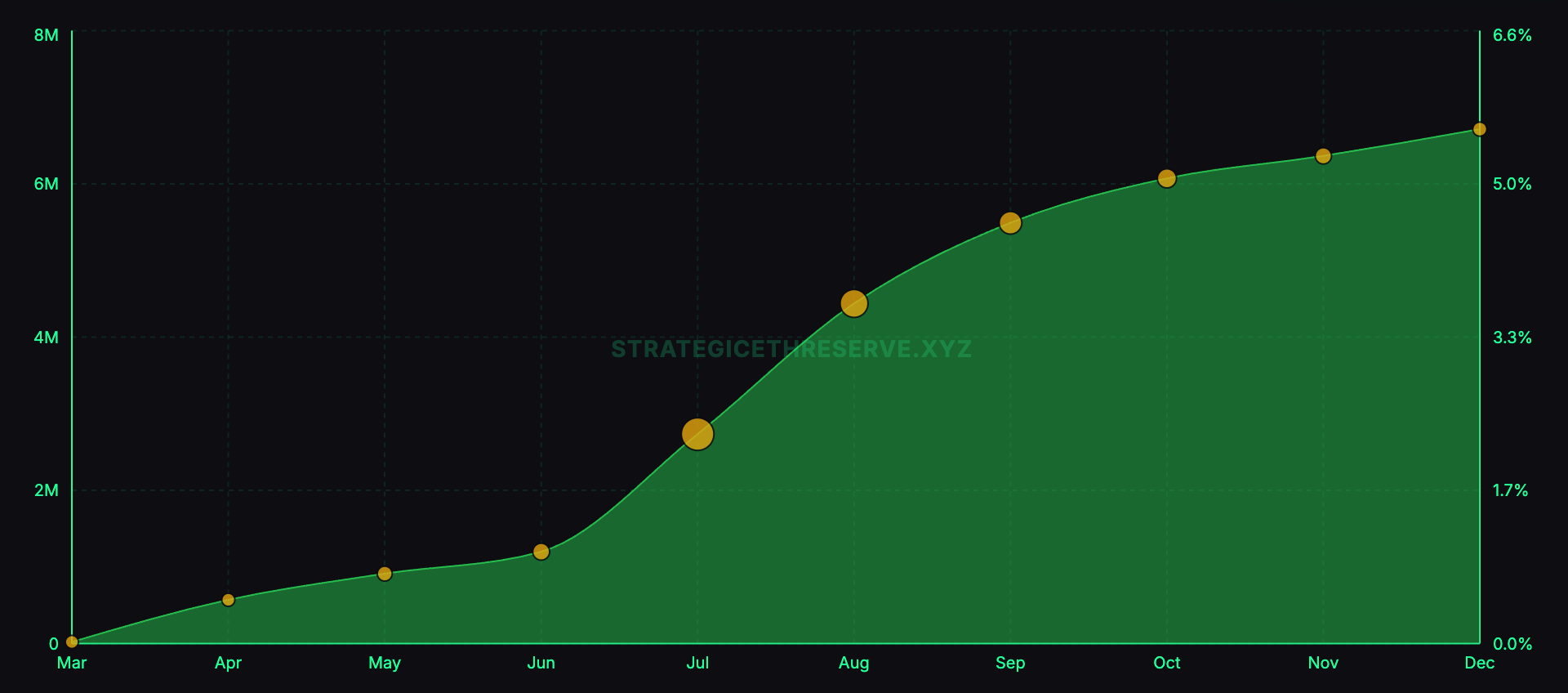

According to Everstake’s annual Ethereum staking report, public companies’ “digital asset holdings” held roughly 6.5 to 7 million ETH as of December, or more than 5.5% of circulating supply.

The numbers are staggering, but the more important part is why these companies chose ETH in the first place.

Bitcoin’s corporate-financial playbook is built around scarcity and reflexivity. That is, you buy a coin, let the market revalue the stock wrapper at a premium, and then issue stock to buy more coins.

Ethereum adds a second bridge that Bitcoin cannot. Once you earn ETH, you can stake it. This means you can earn protocol-based rewards in return for helping secure the network. Everstake frames financial style operators that reward streaming with around 3% APY.

Corporate ETH treasuries are trying to become a listing vehicle that holds ETH, earns additional ETH through staking, and convinces equity investors to pay for exposure to that package. The main bet is that wrappers will be able to compound their underlying holdings over time and that public markets will fund the growth phase when sentiment is good.

Basic Mechanism of Staking

Ethereum operates on a proof-of-stake basis. Instead of miners competing with computers and electricity, Ethereum uses “validators” who lock ETH as collateral and run software that proposes and proves blocks.

If a validator performs a task correctly, they receive a reward paid by the protocol. If you go offline or make a wrong move, you may lose part of your rewards, or in worse cases, you may lose part of your locked ETH through slashing.

Staking is attractive to institutions because the rewards are built into the protocol rather than dependent on lending assets to borrowers. There is still operational risk involved, but this is weakened by the fact that the key revenue source is the network itself.

According to a report by Everstake, approximately 36.08 million ETH was staked by the end of 2025, equivalent to 29.3% of supply and a net increase of over 1.8 million ETH per year.

This is important for government bonds because it shows that staking has become a large, established market rather than a niche activity.

ETH Financial Flywheel: Premium Financing and Protocol Yields

Everstake outlines two levers that finance firms are trying to pull.

The first is mNAV arbitrage. If a company’s shares are trading at a premium to the market value of the underlying asset, it can issue new shares and use the proceeds to buy more ETH.

If the premium is large enough, it can increase existing shareholders’ ETH per share even after dilution. This is because investors are effectively paying more per unit of Ethereum exposure than it would cost to acquire ETH directly.

The loop operates as long as premiums are maintained and capital markets are open.

The second lever is staking your rewards. Once ETH is held, companies can stake it and receive additional ETH over time.

Everstake structures the staking segment at around 3% APY, and the key is that the marginal cost is low once the infrastructure is in place. It is a treasury that wants stakes to compound on a token-by-token basis rather than simply riding price increases.

The strategy for Treasury staking is simple. Premiums fund growth when markets are bullish, while staking creates steady accumulation when markets are quieter.

Both mechanisms aim for the same result: more ETH per week.

Three Financial Staking Playbooks

Everstake’s report focuses the sector on three large holders and assigns them a role in each story.

BitMine is estimated to hold around 4 million ETH, a figure that dominates Everstake’s “hockey stick” charts. Everstake also says BitMine is moving toward staking on a much larger scale, including plans for its own validator infrastructure and the disclosure that “hundreds of thousands of ETH” have been staked through third-party infrastructure by the end of December 2025.

SharpLink Gaming holds approximately 860,000 ETH staked as part of an active financial approach where staking rewards are treated as operating income and maintained on the balance sheet.

The Ether Machine holds approximately 496,000 ETH, 100% staked. Everstake cites a reported net return of 1,350 ETH over a specific period as evidence of what a “fully staked” model looks like.

These numbers are evidence that the strategy is becoming institutionalized. This is no small experiment for a company. Their positions are large enough that staking venues, operating posture, disclosure practices, and risk controls are part of the product.

Where Institutions Stake and Why “Compliance Staking” Exists

The most practical insight from Everstake’s report is that staking is split into lanes.

Retail businesses often stake through exchanges for simplicity, while DeFi-based users seek liquidity and composability through liquid staking tokens.

Institutions often want something closer to traditional separation of operations: defined roles, multiple operators, auditability, and a structure that fits existing compliance expectations. Everstake points to Liquid Collective as a compliance-oriented staking solution and uses the liquid staking token LsETH as a proxy for institutional migration.

The report said LsETH has grown from about 105,000 ETH to about 300,000 ETH and links this growth to outflows of Coinbase exchange balances, a sign that large holders are moving away from exchange management while still preferring “enterprise-grade” staking structures.

Add exchange snapshots to reinforce the point. According to Everstake, Coinbase’s stake decreased by about 1.5 million ETH, from 10.17% to 5.54%, while Binance’s stake increased from 2.02 million ETH to 3.14 million ETH, with its share increasing from 5.95% to 8.82%.

These numbers are less a verdict on the two venues and more as evidence that staking distributions change meaningfully when large players change locations.

For finance companies, the staking lane problem is structural.

When a strategy relies on staking rewards to support compounding, operator diversification, significant protection, downtime risk, custody architecture, and reporting practices become core parts of the investment case rather than back-office details.

Rails Beneath Trading: Stablecoins and Tokenized Treasury Bonds

Everstake does not treat corporate treasury as an independent phenomenon, but links it to stablecoin liquidity and tokenized treasury issuance, which are the institutional drivers of Ethereum in 2025.

As for stablecoins, Everstake said the total stablecoin supply across the network has surpassed $300 billion, with Ethereum L1 and L2 holding 61% to 62%, or about $184 billion. There is an argument to be made that Ethereum’s security and settlement depth continues to attract an on-chain dollar base that institutions actually use.

In tokenized government bonds, Everstake said the market is approaching $10 billion and Ethereum’s ecosystem share is around 57%. It features Ethereum L1 as a security anchor from major issuers and cites products such as BlackRock’s BUIDL and Franklin Templeton’s Tokenized Currency Fund.

This context is important for Treasury bond trading.

Public companies seeking to justify long-term ETH positions and staking programs need a narrative that goes beyond cryptocurrency speculation.

Tokenized cash and tokenized Treasury bonds are easier to defend against structural adoption than most other on-chain categories, and this growth makes it simpler to explain why ledger-securing assets are important in the long term.

Risks that could break the Ethereum staking model

Everstake includes warnings about concentration and related failures.

The report cites a Prysm client outage in December 2025, saying that validator participation dropped to around 75% and 248 blocks were missed, and uses this event to argue that client crowding could lead to network-wide vulnerabilities.

These risks become more significant when large public treasuries are consolidated with similar infrastructure choices. Because your staking decisions can affect your concentration. It is also important because staking returns are only clean when operations are resilient.

Downtime, misconfigurations, and slashing may sound abstract to businesses, but they are as much a part of business as staking.

The second risk is capital markets. Because mNAV arbitrage is only a good mechanism when the market is strong. If the equity premium is compressed, equity issuance becomes dilutive rather than accretive and the loop stops operating.

Staking returns do not solve this problem on their own. Because returns are incremental and equity financing is the engine of growth.

The third risk is governance and regulation.

Treasury companies operate within a disclosure and custody regime that can be tightened quickly. The strategy depends on maintaining a structure acceptable to auditors, boards, and regulators, especially if staking becomes a significant contributor to reported earnings.

The ETH Treasury Exchange is built on the simple proposition of accumulating ETH, staking it to increase your holdings in tokens, and using open market access to scale faster than your private balance sheet.

Whether it survives as a durable category depends on two measurable things. That is, how well these companies operate staking without creating hidden vulnerabilities, and how consistently the asset wrapper can maintain the premium that makes the funding loop work.