Prediction: This Iconic Stock Will Cut Its Dividend in 2026

The 1,140% dividend surge is coming to an end.

For 15 years, Starbucks‘ (sub 1.46%) Dividend growth could not be stopped. In 2010, in the shadow of the Great Recession, it issued its first dividend of $0.05 per share, which doubled in less than three years. By 2025, dividends have increased by 1,140%, and someone who invested $1,000 the day before the first dividend in April 2010 will now enjoy a 28% return on costs each year.

That’s a great income, but unfortunately this dividend growth is very likely in the past. As a shareholder, it is painful to say this. However, I believe Starbucks’ dividend growth will come to an abrupt halt later this year, as the company typically announces dividend increases in October.

There is a sign here.

Image source: Getty Images.

Starbucks’ dividend growth has increased significantly in recent years.

From 2010 to 2020, the company increased its dividend by an average of 24.5% per year. However, starting in 2021, dividend growth has slowed sharply, as you can see below.

| year | quarterly payments | Annual dividend increase |

|---|---|---|

| 2021 | $0.49 per share | 8.9% |

| 2022 | $0.53 per share | 8.2% |

| 2023 | $0.57 per share | 7.5% |

| 2024 | $0.61 per share | 7% |

| 2025 | $0.62 per share | 1.6% |

Data sources: Author calculations and Yahoo! financial resources.

Slowing dividend growth on its own might not tell us much. The slowdown may not even be this drastic. After all, I recently argued that: coca cola Dividend growth may soon recover after several years of slowdown. However, Starbucks’ token dividend increase in 2025 comes with some worrying fundamentals.

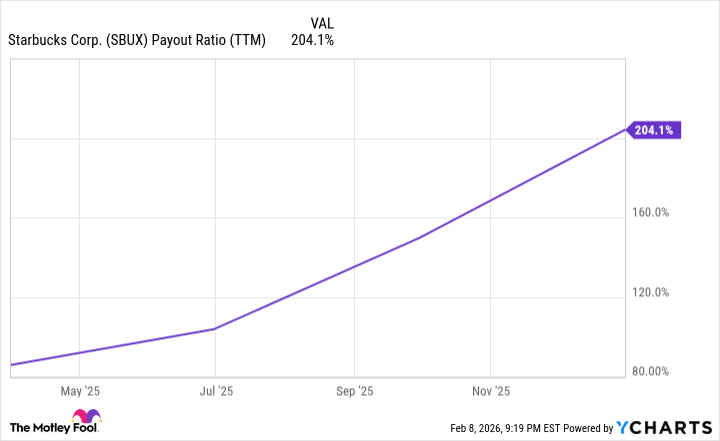

2. Starbucks’ dividend payout ratio is soaring

Take a look at what’s happened to the payout ratio (the percentage of net profits a company spends as dividends) over the past year.

Data from YCharts.

As you can see, we are now over 200%. This means you’re spending more than twice as much in dividends than you are receiving in net income.

Although it’s not clear, this is a big warning sign. Cash from operations can provide better insight into the sustainability of the dividend. Because that indicator shows how much money is left after the company pays salaries, maintains lights, and pays all other operating expenses.

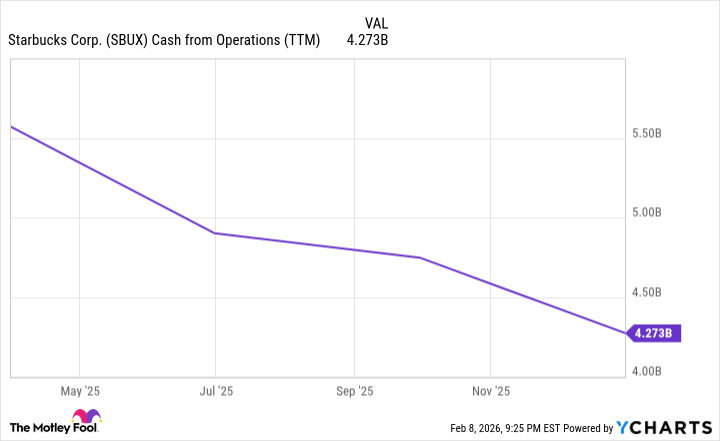

3. Operating cash flow is plummeting

Starbucks’ operating cash flow has fallen from about $5.6 billion a year ago to less than $4.3 billion today.

Data from YCharts.

Typically, I like to share buyback numbers to see if the dividend may be more sustainable than it appears due to the reduced share count. However, Starbucks has not made a single stock buyback since 2024, and its employee stock investment plan, which allows employees to purchase stock at a 5% discount after 90 days of employment, is actually increasing the number of shares issued and diluting the stock price. The effect may be modest, but it doesn’t help companies that are holding on to their dividends by their fingernails.

today’s change

(-1.46%) $-1.44

current price

$97.54

Key data points

market capitalization

$113 billion

work range

$97.45 – $99.67

52 week range

$75.50 – $117.46

volume

266K

average volume

9.8M

gross profit

15.73%

dividend yield

2.48%

And speaking of stock buybacks, Starbucks’ stock price fell in 2022 when then-CEO Howard Schultz suspended the company’s buyback program, saying it needed cash to invest in operations. Because buybacks don’t have the same prestige as consistently increasing dividends, a dividend cut is likely to hit the stock much harder because there is no “repurchase king” or “repurchase aristocrat.”

CEO Brian Niccol may succeed in his mission to turn Starbucks around, but the stock is more likely to experience some near-term trouble before that day comes. This is one stock that investors who prioritize profits should avoid.