Emerging Market Links + The Week Ahead (December 18, 2023)

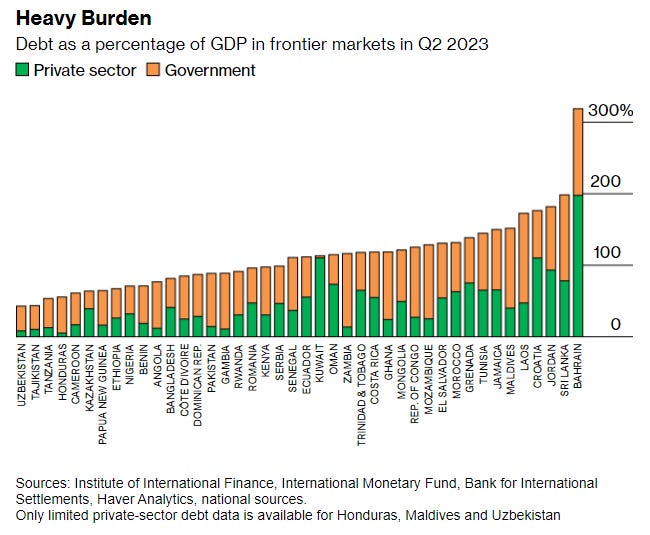

Bloomberg has noted how Wall Street had encouraged nations in Africa, Latin America and Asia to borrow for decades, but now persistent high rates could cause a 2024 reckoning for frontier markets in particular.

In fact, so-called frontier markets will have to repay about $200 billion in bonds and other loans in 2024 with bonds issued by Bolivia, Ethiopia, Tunisia, and a dozen other countries either already in default or trading at levels that suggest investors are bracing for them to miss payments.

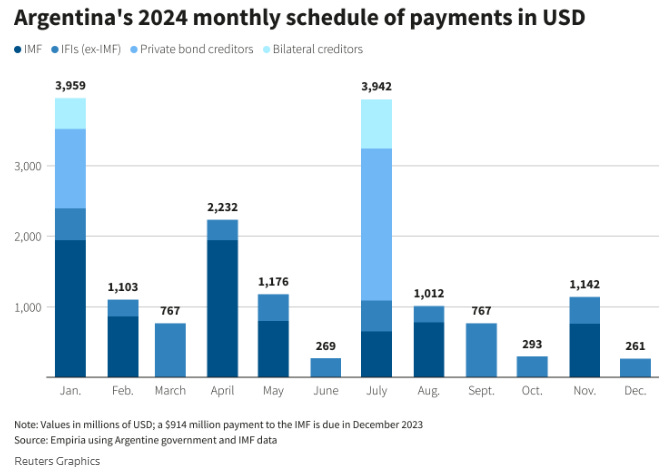

In Argentina, newly elected Javier Milei is facing $400 billion ‘debt bomb’ with some $16 billion in debt payments coming due next year. But as mentioned in a post last week which covered a podcast skeptical of Milei, the only real solution for “odious debts” in places like Argentina is either default or reforming the UN, multilateral banks, and other such Western controlled institutions by changing legal frameworks or shifting alliances-legal frameworks, etc. towards the BRICs (e.g. Russia, China, etc.).

However, Argentina under Milei is probably not going to be the first country to force some sort of change or reckoning when it comes to foreign debt.

$ = behind a paywall / 🗃️ = Archived article

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 ZKH Group IPO falls flat as investors worry over slowing growth (Bamboo Works)

The provider of maintenance, repair and operations (MRO) products reported its revenue contracted in the third quarter, ending several years of growth

ZKH Group (NYSE: ZKH) raised $62 million in one of the biggest IPOs by a Chinese company in New York this year, though its shares priced weakly and ended flat on their first trading day

The company is valued ahead of many of its global peers, which could pressure its shares as its growth shows signs of slowing sharply

🇨🇳 Hello Group courts investors with big bottom-line gains (Bamboo Works)

The dating app has moved past its pandemic legacy and earlier regulatory woes with strong gains in its third-quarter profit and margins

Hello Group (NASDAQ: MOMO)’s profit rose 21% in the third quarter, as its profit margin increased 3.7 percentage points to 22.4%

Revenue and monthly paying users continued to decline for its Momo and Tantan dating apps, but it reported strong gains for its newer apps

🇨🇳 Agora COO leaves, but no one cares. Does that point to bigger problems? (Bamboo Works)

The real-time engagement technology provider announced the executive shuffle two weeks after reporting its revenue contracted for a seventh consecutive quarter

Agora (NASDAQ: API) said its COO will leave the company less than three years after joining, as it tries to stabilize its business after nearly two years of revenue contraction

The company said the recent rapid takeoff of AI could give rise to a new generation of apps using its real-time engagement technology

🇨🇳 Trip.com (TCOM US, 9961 HK): Revenue 30% Above Pre-COVID Level (Smart Karma) $

Travelers increased by 75% YoY and traveling spending increased by 144% YoY in China in 9M2023.

Trip.com (NASDAQ: TCOM)’s total revenue rose by 31% in 3Q23 over 3Q19 before COVID.

We conclude an upside of 33% and a price target of US$43.70.

🇨🇳 China Tourism Group (601888 CH, BUY, TP: CNY106): How to Catch a Falling Knife (Smart Karma) $

China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) share price has plunged by 63% despite solid 9M23 profits growth and cash flushed balance sheet

Underlying fundamentals is solid, Chinese people still buying duty free goods, albeit tilting towards value than decadence purchases

CTG is cheap relative to its own history on all valuation metrics (PE, P/Book, P/FCF) and many technical indicators suggest it is in OVERSOLD territory

🇨🇳 Poly Development plans $279 million share buyback to shore up price (Caixin) $

The stock of Poly Development and Holdings Group Co. Ltd. (SHA: 600048) jumped 7.6% Tuesday after the leading developer unveiled an up to 2-billion-yuan

($279 million) share buyback aimed at arresting its sliding equity price.Shares of Poly Development closed at 10.34 yuan in Shanghai Tuesday, compared with 9.61 yuan at Monday’s closing. The stock has nearly halved from the 18.59-yuan peak in April 2022 after the persistent downturn in the property market.

🇨🇳 (KE Holdings Inc. (BEKE US, BUY, TP US$24.5) TP Change): Policy Stimulus Drive up near Term Sales (Smart Karma) $

KE Holdings (NYSE: BEKE)

Beijing and Shanghai laid out long waited stimulus policies on property market, include 1) lower property down payments ratio; 2) lower mortgage loan rate;

3) lower recognition standard for ordinary home. The key is to encourage households to add leverage.

We treat the financial stimulus as one-off positive shock to the home transaction markets in the two cities, especially benefiting 1Q24 sales for Beike due to…

🇨🇳 GSK on hunt for drug deals in China (FT)

UK pharma group says country’s chemistry prowess makes it a good source of molecules

Chief commercial officer Luke Miels told the Financial Times that the company was working on further deals with Chinese companies after it signed a licensing agreement in October worth up to $1.5bn for a cancer drug developed by Hansoh Pharmaceutical Group Company (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF).

The same month, GSK plc (NYSE: GSK) agreed a $3bn distribution deal for its shingles vaccine with China’s Chongqing Zhifei Biological Product Co. (SHE: 300122), which may be expanded to cover its new vaccine that protects against the common respiratory syncytial virus, if it is approved by Chinese regulators.

🇨🇳 WuXi Bio prescribes share buyback to relieve revenue pain (Bamboo Works)

The pharma services provider has shocked investors with a steep downward revision of its earnings outlook, slashing its full-year revenue growth forecast to just 10% from an initial 30% and predicting a profit drop

After its shares plunged more than 30% in a week, Wuxi Biologics‘ (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) announced a buyback of 10% of its shares, saying the battered price did not reflect the company’s value or business prospects

The company blamed the weaker revenue outlook on a financing slowdown in the biopharma industry and regulatory delays in launching star drugs

🇨🇳 Graphex: A Lesson In Protectionism (Seeking Alpha) $

We hold both on and offshore positions in miners / refiners of ores / metals designated as “critical” to renewable energy; some have done very well, others not.

I recently filled a gap in that portfolio with an investment in Graphex Group (NYSEAMERICAN: GRFX), a processor of specialized graphite required in electric vehicle batteries.

However, I soon sold the stock having learned that, as a US-based “Foreign Entity of Concern”, tax credits may not be available to buyers of EV’s containing their material.

Relative to geopolitical tensions, issues of globalism versus protectionism have accentuated the need for due diligence to be an ongoing discipline.

🇨🇳 DPC Dash: Impressive Growth But Small Profits (Seeking Alpha) $

Domino’s Pizza, Inc. (NYSE: DPZ)‘s master franchise in China, DPC Dash (HKG: 1405 / FRA: X12), has seen a 24% increase in its stock since its IPO debut in March at the Hong Kong Stock Exchange.

Capitalising on China’s fast growing food delivery market, the company has seen robust growth in H1 2023, expanded operating margins and even reported net profits.

However, its market multiples are way ahead of its peers and its still small profits detract from its attractiveness.

🇰🇷 Foreign Investors Allowed to Begin Buying Korean Stocks Without Prior Authorization on 14 December (Smart Karma) $

On 13 December, the FSS announced that foreign investors will be allowed to start purchasing Korean stocks without prior authorization starting this week.

The revised Capital Market Act will start to be implemented on 14 December repealing the time consuming and inconvenient pre-registration system for foreign investors.

As a result of the Korean government making this change regulatory change, one of the beneficiaries is likely to be Interactive Brokers Group, Inc (NASDAQ: IBKR).

🇰🇷 2024 High Conviction: (KT&G – Likely To Announce Cigarette Price Hikes in 2H24) (Smart Karma) $

KT&G is a high conviction pick in 2024. We believe KT&G Corp (KRX: 033780) is likely to announce cigarette price hikes in 2H 2024.

Three major reasons include a) no cigarette price hikes in nearly 9 years, b) Korean legislative election will be in April 2024, and c) reduce government tax revenue shortfall.

We believe that the Korean government could raise cigarette prices to about 7,000 won to 8,000 won per pack from current price of 4,500 won.

🇸🇬 Year in Review: 5 Best-Performing Stocks of 2023 (The Smart Investor)

🇮🇳 Interglobe Aviation (INDIGO IN | SELL | TP: INR2,513): Not Worth a King’s Ransom (Smart Karma) $

Interglobe Aviation Ltd (NSE: INDIGO / BOM: 539448) has turnaround and is on path to achieve record profits in FY2024 on strong demand, stable FX and lower jet fuel prices

However, engine problems will hurt capacity deployment in 4QFY24 and FY2025, and the engine manufacturer has been very vague and unreliable in presenting its remedial plans

Share price near all-time high and valuations (PE, EV/EBITDAR) are expensive compared to global LCCs. TP of INR2,513 (14% DOWNSIDE) pegged to 15x FY2025 PE (top-end LCC cycle)

🇮🇳 2024 High Conviction Idea: IDFCBK IN: Best-In-Class Midsize Bank in India; Long-Term Performance (Smart Karma) $

IDFC First Bank Limited (NSE: IDFCFIRSTB / BOM: 539437) has built a banking franchise that holds the best promise among the mid-sized banks in India for long-run outperformance.

A high-yielding and retail-oriented loan book, track record of pristine asset quality, superior funding profile boosting best-in-class retail deposit base, and incrementally improving unit economics.

We value the stock as a long-term Buy, with 35% upside in near-term, as the bank continues to realize the benefits of its increasing scale on its earnings profile.

🇮🇱 Ituran: Strong Fundamentals And Growth Momentum Make The Company A Buy (Seeking Alpha) $

Ituran Location and Control Ltd (NASDAQ: ITRN) has solid financial metrics and growing subscriber growth, making it a good long-term investment with an enticing risk/reward ratio.

The company has a strong financial position with low debt and a stable current ratio, indicating no liquidity issues.

Ituran has improved its efficiency and profitability in recent years, with a high return on invested capital and a competitive advantage over its competitors.

🇸🇦 Roving Around Riyadh – A Look into a Kingdom Forging its Future Through Reform (Part 2) (Pyramids and Pagodas)

This is the final piece concluding a two-part Series covering Desertfox’s recent trip to Riyadh, during which he gained interesting insights into how Saudi Arabia’s soft power push translated to real life experience working with the Saudi public sector, how this might benefit a Hong Kong-listed proxy, and the notable rise of Chinese automakers on the Kingdom’s streets.

In Part 2 of this series, we look at how Saudi consumer habits translate into retail real estate in the FCMG space and how one European player is cornering the Kingdom’s vast food delivery market. Also in this instalment, we delve into the mechanics of investing in the Saudi stock exchange and an exciting new ETF that could offer exposure to this emerging market.

Currently, the convenience store market in Saudi Arabia is predominantly occupied by privately owned or locally listed companies such as Abdullah Al Othaim (TADAWUL: 4001), which interestingly was 21x oversubscribed when it first listed in 2008.

On the contrary, the Hong Kong Stock Exchange successfully debuted the CSOP Saudi Arabia ETF (HKG: 2830 / 82830), marking Asia’s first ETF tracking the Tadawul. The product is composed of 57 Saudi stock constituents with market capitalization totalling over USD 270 million. HK/China investors can now gain exposure to Saudi Aramco or Saudi Arabian Oil Co (TADAWUL: 2222), Saudi National Bank (TADAWUL: 1180) and Abdullah Al Othaim (TADAWUL: 4001) in HKD/CNY

🇹🇷 Reysaş Logistics: A Very Speculative Buy Opportunity (Seeking Alpha) $

Reysas Tasimacilik ve Lojistik Ticaret (IST: RYSAS / OTCMKTS: RYSKF) is a Turkish multi-mode logistics provider.

The company offers a range of services including car transport, fuel transport, forwarding, storage, and international transport.

The stock is currently trading at a lower valuation compared to peers and there is potential for share price appreciation.

🌍 Musk’s Starlink Breaks Through Bureaucracy and Corruption in Africa (The Epoch Times)

Officially, Starlink is available in only seven of Africa’s 54 countries: Benin, Kenya, Malawi, Mozambique, Nigeria, Rwanda, and Zambia. Another 25 are scheduled to go online in 2024.

For decades, the data needed to access the internet in Africa has been controlled by just a few multinational mobile telecommunications corporations, including South Africa’s MTN Group (JSE: MTN) and Vodacom (JSE: VOD / OTCMKTS: VODAF / VDMCY), and Kenya’s Safaricom (NSE: SCOM).

South Africa, the nation in which Mr. Musk was born, is potentially the continent’s most lucrative telecom market. It’s also one of those trying to obstruct Starlink.

🇿🇦 Lesaka: Turnaround Offers Opportunity (Seeking Alpha) $

Lesaka Technologies (NASDAQ: LSAK) is a South African fintech offering solutions to both merchants and consumers.

The company may be at an inflection point as a turnaround has succeeded in restoring the business to profitability and both its merchant and consumer arms are delivering growth.

The share price has recently pulled back significantly, and I believe the current price offers a favorable entry point.

Monetization of a non-core stake in an Indian fintech company may provide additional upside.

🇵🇱 InPost: Delivering Growth (Seeking Alpha) $

InPost (AMS: INPST / LON: 0A6K / FRA: 669) is a delivery company with a strategy centered on automated parcel lockers.

InPost has established itself as the clear market leader in Poland using this model and is now trying to replicate this success throughout Western Europe.

InPost is already profitable and the cash flows from Poland should be enough to fully fund the expansion drive.

If InPost even just partially succeeds in replicating its Polish performance in Western Europe, then the current share price would look cheap indeed.

🇵🇱 Text SA: Where’s the moat? (Compounding Quality)

Last week (Text SA: Another Compounding Machine), you learned that Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) makes money from selling B2B subscriptions for managing online business communications.

A positive thing? Almost all its revenue is recurring in nature.

Today, you’ll learn more about the company’s management team, moat, and its key risks.

🌎 Ternium: Outlook Solid After Boosting Stake In Brazilian Steelmaker (Seeking Alpha) $

Ternium S.A. (NYSE: TX) is Luxembourg headquartered.

Ternium steel shipments boomed 28% yoy in Q3 after taking a controlling interest in Brazilian steelmaker Usiminas.

The company has expanded market share in Mexico and Brazil and is seeing steel prices bottoming out finally, although the positive impact to net income may not hit until Q124.

Ternium consensus revenue estimates for 2024 have been revised upwards by 20% in the past three months.

EPS is expected to rise 40% in 2024, implying a forward P/E ratio of 4.8.

🇦🇷 Loma Negra: A Speculative Play On Argentinian Income Recovery (Rating Upgrade) (Seeking Alpha) $

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE: LOMA), the largest cement manufacturer in Argentina, has seen its operating income fall due to price repression and currency depreciation.

The company’s profitability might be explained by real estate prices in Argentina, which have been in a downward trend since 2017-18.

Despite the current challenges, LOMA has strong financials and the potential for income growth, making it an opportunity for investors.

🇦🇷 🇲🇽 Vista Continues To Offer Margin Of Safety And Is A Buy (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) is one of the largest producers and largest exporter of Argentinian shale oil from the Vaca Muerta basin.

The company has seen huge price appreciation in recent years, but I believe it still offers a margin of safety compared to its earnings potential.

The main reason for this is that the company has a very low breakeven cost, of only $27 per barrel, assuming variable SG&A and maintenance CAPEX.

🇧🇷 Localiza, Brazil’s Car Rental Leader, Gears Up For A Bright 2024 (Seeking Alpha) $

Localiza Rent a Car SA (BVMF: RENT3 / OTCMKTS: LZRFY) is Brazil’s largest car rental company, holding a dominant market position and enjoying favorable terms from car manufacturers.

Serving individual customers, fleet partners, app drivers, and garage owners, Localiza employs technology for efficient operations.

Localiza’s recent quarter showcased a robust financial performance, with a 57% YoY increase in accounting profit and positive trends in adjusted net income and EBITDA.

Despite challenges like high interest rates and leverage, Localiza’s strategic initiatives, including fleet renewal and productivity focus, position it for positive outcomes.

Anticipating interest rate cuts, fleet renewal, and synergy gains, Localiza presents an attractive investment opportunity with favorable valuation multiples and international expansion plans.

🇧🇷 Braskem: Special Situations Trade With 100% Upside Potential (Seeking Alpha) $

Braskem (NYSE: BAK) is the largest plastic producer in the Western Hemisphere. The company has been a takeover target for the last few years.

In November, Abu Dhabi National Oil Company offered BRL37.29 per share. That means 100% upside potential from the current stock prices.

The political and industry tailwinds are more supportive of the deal’s completion than ever. PBR’s CEO expects the deal to take place in 1Q24.

Braskem has $3.68 billion cash and, in the next three years, must pay $658 million debt. In other words, it has adequate liquidity to handle any complication until the takeover is complete.

This is a short-term idea based on a special situation. It requires strict and proactive risk management. My verdict is a buy rating.

🇧🇷 Engie Brasil: A Defensive Stock Losing Luster (Seeking Alpha) $

Engie Brasil Energia (BVMF: EGIE3 / FRA: 7TE1 / OTCMKTS: EGIEY) operates in electricity generation, transmission, and gas transportation, creating a resilient business model.

The company exhibits consistent growth in net revenue, EBITDA, and net profit, maintaining strong profitability ratios.

Q3 2023 faced hurdles, including a revenue decline and lower volumes from complementary sources, impacting EBITDA.

Engie Brasil has a robust history of dividend distribution, targeting a minimum of 55% of adjusted net profit, making it an attractive income stock.

Despite being a defensive asset, a neutral stance is maintained due to concerns about a slightly stretched stock valuation and the potential for greater appreciation in other companies like Eletrobras.

🇧🇷 Ultrapar: It Seems Time To Move On (Rating Downgrade) (Seeking Alpha) $

Ultrapar Participaçoes (NYSE: UGP)‘s gross margin in its fuel distribution segment improved in Q3 due to Petrobras (NYSE: PBR)‘ new price policy.

The company now seems to be fairly valued, in line with my previous valuation.

Ultragaz and Ultracargo could provide additional upside for Ultrapar as they account for a growing portion of total EBITDA, but that may not be enough to create an upside.

The stock has seen a 40% return since July and more than 100% YTD, the timing seems right for investors to start taking profits.

🇵🇦 Bladex Is Still A Lopsided Bet On Latin American Growth (Seeking Alpha) $

Foreign Trade Bank of Latin America or Banco Latinoamericano (NYSE: BLX) is a Panamanian bank with Latin American central banks as its primary depositors.

BLX has experienced recent outperformance due to more lending and higher interest rates, leading to higher net interest income.

The bank’s profitability in the future will depend on global interest rates and the growth of the Latin American economy. Still, it is currently priced to yield 10% even in the worst-case scenario.

$ = behind a paywall

🌐 Debt Crisis: Poorest Nations Owe Trillions in High Interest-Rate World (Bloomberg)

Wall Street encouraged nations in Africa, Latin America and Asia to borrow. Now persistent high rates could spur a 2024 reckoning.

A debt crisis is brewing across the developing world as a decade of borrowing catches up with the world’s poorest countries. In 2024 these nations, known to rich-world investors as “frontier markets,” will have to repay about $200 billion in bonds and other loans. The bonds issued by Bolivia, Ethiopia, Tunisia and a dozen other countries are either already in default or are trading at levels that suggest investors are bracing for them to miss payments.

🌏 10 investment ideas for 2024 (Singapore Business Review)

Anticipating the volatility in public markets in 2024 due to prolonged periods of rising interests, experts make a compelling proposition to invest in private and alternative assets. Some investors already see this as a strategic move to sidestep the more obvious jitters.

In terms of markets in the private capital space, Indonesia and Thailand stand out, said (Alta’s head of Private Capital Markets, Muzahir) Degani.

🇨🇳 West’s love for Shein and Temu drives ecommerce boom for air freighters (FT)

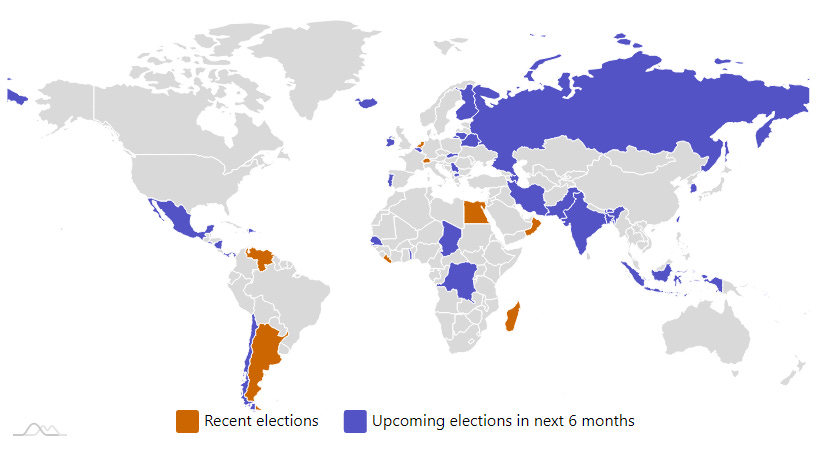

🇮🇩 Indonesia votes in 2 months: A primer on the world’s largest one-day election (Benar News)

In two months, Indonesia, the world’s third-largest democracy, will hold the biggest single-day election on the planet.

Indonesians will be voting for their next president and vice president, and they’ll also be electing representatives to both houses of the national parliament as well as members of bicameral provincial legislatures. This will all unfold on Feb. 14, 2024, across a vast archipelago of more than 18,000 islands.

🇮🇳 India’s booming stock market (FT)

🇦🇷 Argentina’s Milei needs to deactivate $400 bln ‘debt bomb’ (Reuters)

The country’s total sovereign debt exceeds $400 billion, some $110 billion of which is owed to the International Monetary Fund and to holders of restructured, privately-held eurobonds.

With central bank reserves in the red by more than $10 billion and little chance of tapping the market, the country has some $16 billion in debt payments coming due next year.

🇧🇷 Brazil passes long-awaited tax reform (FT) $

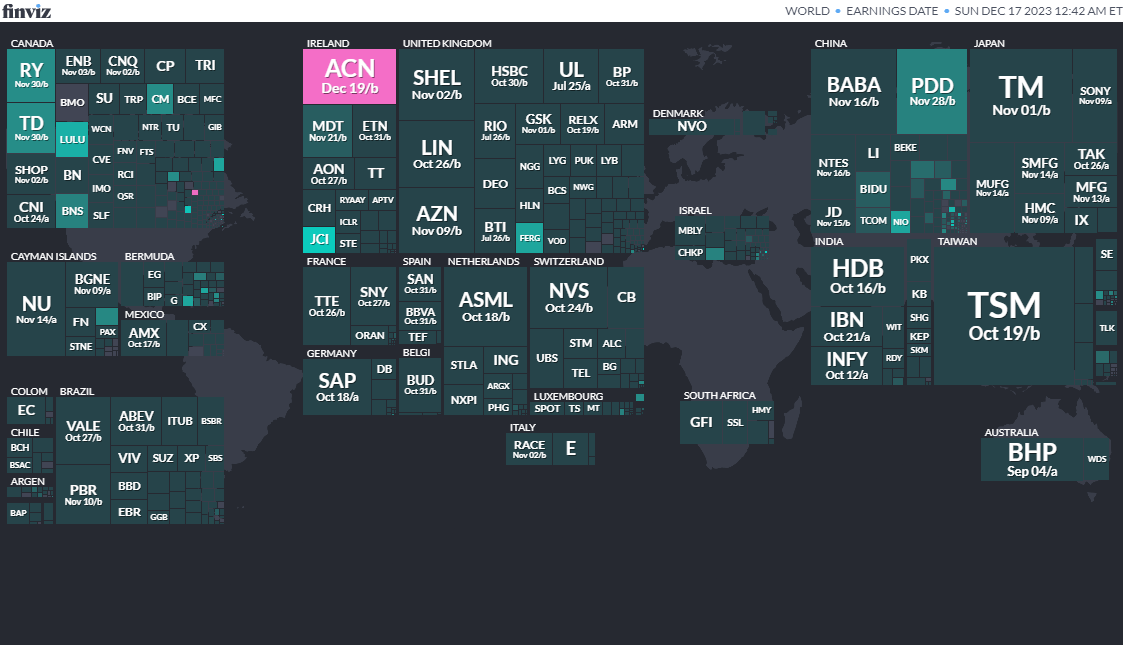

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

ChileReferendumDec 17, 2023