TAN: It could shine and then burn out

Remotevfx/iStock via Getty Images

Invesco Solar ETF (NYSEARCA: Tan) is one of the ETFs I’ve been following for several years, and I’ve come to consider it one of my favorite ETFs in the alternative energy sector. Got a hold rating from me, but that’s similar. Saying that it’s warm when the sun comes out. Ask anyone in Ottawa this time of year about South Florida, where I live.

My point is that when it comes to ETF security ratings, especially ones like these that have skyrocketed in price and continue to be saddled with controversial issues, a “hold” rating only speaks part of the story. So here’s the story (it’s my story, anyway).

Opinions about TAN and the solar industry have been all over the map forever, but I think we can tie them all together. It may not please everyone, but you can give it a try! that much The bottom line for me is that TAN should be viewed in terms of whether it is a political, Wall Street “football” that improves lives and delights the soul, or who is a waste of money and effort. You talk. To me, that’s what makes the market. As for TAN, while it can be a great trading tool at times, it is not something you can hold long-term in the near future.

So I rate TAN… well, that’s a tough one. Because it depends on how you interpret what the evaluation means. Because as long as the market rewards “risky” industries like solar, TAN has a chance to rise another 25%, perhaps to the $65 region, before hitting a three-year wall of resistance in the form of an extreme bearish price pattern. .

Can I now hold it in my portfolio for tactical purposes? yes. Is it high enough on my watchlist compared to other “risky” industries and sectors in terms of reward potential and major loss risk (on an individual basis)? no. That puts it on hold.

What are the downside risks? I always ask this before doing anything. For TAN, it should hit a lower low than the last time it fell. Because that’s what it usually does, and there’s risk in some parts of the stock market when a recession is coming and government debt is too high. There may come a day when incentives to “go green” are lowered or exhausted. In terms of price, looking three to six months out, we see $41 in the best case, and more likely $27 to $32 if momentum returns.

Harnessing the Potential of Volatility ETFs

However, like many niche/industry ETFs like this, the investment process consists of two parts.

1. Decide if it’s worth pursuing for a potential investment (my answer has been yes since the beginning of 2008).

2. If it’s on your “watch list,” determine what would prompt me to put it in my portfolio. In the case of TAN, it is purely viewed as a ‘rental, not an ownership’ position. That is, it is almost always a tactical position, unless conditions arise that allow you to own it for at least 12 months.

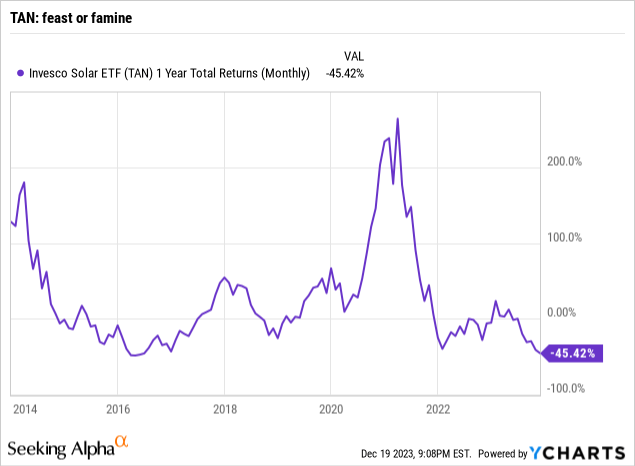

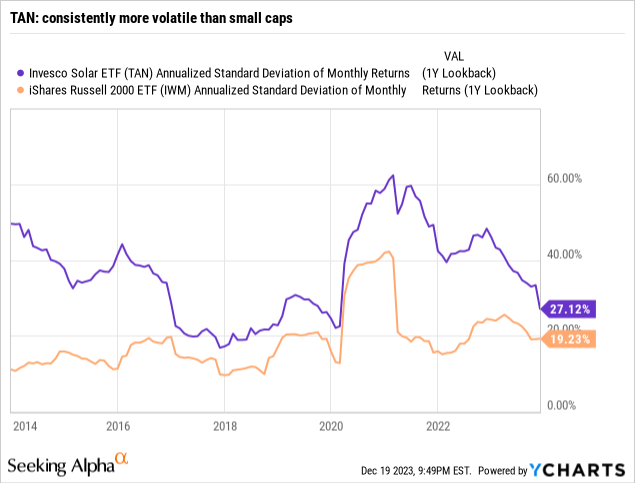

This is precisely why I came to that conclusion some time ago. This is a chart showing one-year returns (monthly intervals) going back 10 years. This is a prime example of volatility. It gained over 250% in 12 months and then halved.

And let’s be honest, sometimes two opposing scenarios occur very close together chronologically. So when looking at TANs in the current investment climate (pardon the pun), the first item on the investor checklist is “rent, not own.” The annual 10-year return is approximately 5.5%. But does that average character mean I’ll avoid it? There is absolutely no explosive upside potential.

Solar industry issues

Raymond James Managing Director Pavel Molchanov recently said:

“I know it may seem surprising, but solar installations in 2023 are actually at record levels globally, including records in the U.S. So it’s not a capacity issue. In some cases it’s more a margin issue, and of course for stocks that’s distinct from fundamentals. It’s also a question of valuation, so stocks can fall even when fundamental business trends are actually rising.”

This is a barrier to establishing long-term relationships with industries like this. Last October, TAN fell 7% in one day (worse on a Friday!) when one of its top holdings said it would not meet its revenue and earnings estimates due to work cancellations and delays. The project caused frustration.

“Setback” may also be TAN’s middle name. Because like a sports team that is forever rebuilding, this industry has had a yoke on its shoulders for as long as I can remember. This stems in part from the belief among some in the investment market that solar companies can persist as long as significant government subsidies continue. And more and more people are saying that solar, wind and other long-term solutions to address climate change, while valuable, will not reach the level of complementing America’s fossil fuel-centric energy policy. And elsewhere too.

Notable ETF Features and Features

I like TAN’s focused personality. Of the 53 stocks in total, four make up 37% of assets, with the top 10 holding just over 60%. This is a $1.5 billion whole life ETF, but the risks inherent in this business include the fact that these companies are very small. TAN’s weighted average market capitalization is less than $3.5 billion.

However, the current portfolio sells for less than 11x trailing earnings and approximately 1x trailing earnings. This is a standout statistic for investors hungry for valuation-driven ideas. The portfolio’s expected five-year earnings growth rate is over 20%, so on paper, TAN is a steal. But this assumes that many things will go right and that some will be decided by regulators and government agencies. While the recent Cop28 deal is certainly positive, investors in this industry tend to “shoot first and ask questions later” on both the pros and cons. Again, the short-term upside goal is within reach, but what happens next? The “resistance” on the chart here is burdensome. That said, if it passes, it will be a sign that long-term sentiment is finally changing. We’ll see.

TAN’s global nature could also help if the recent decline in the US dollar turns bearish. 42% of the portfolio is outside the United States, spread across Europe and Asia, and includes all solar technologies (crystalline and thin-film photovoltaic solar and solar thermal), the entire value chain (raw materials, installers, financing) and related technologies. Solar equipment (power inverters and encapsulation).

Stocks eligible for TAN are then grouped into pure play and mid-play buckets. Companies with solar as their primary business are pure play companies (i.e., at least two-thirds of their revenue comes from that business), while midsize companies have multiple business lines but solar accounts for at least one-third of their revenue. Portfolio allocations are tilted toward pure-play companies, and ETFs are rebalanced quarterly.

Setting the Sun on TAN (Final Thoughts)

As per the chart, the above-mentioned price range implies a 25% upside potential and a 40% downside potential over a period of 3-6 months. And the rough part of it all? Both are expected to occur in the second or third quarter of 2024.

So is it buy, hold or sell? Considering it’s in the middle of its trading range, roughly between $40 and $65, it reaches a Hold rating. However, I would strongly encourage anyone reading this to pay more attention to everything other than the final evaluation. Context is everything, and investors ultimately have to answer for themselves.