EM Fund Stock Recommendations and Country Commentary (December 20, 2023)

Some quick actions for this week:

-

Here is a link to 2024 forecasts covering emerging markets from various asset managers.

-

several Singapore listed stocks It has been the subject of recent broker notes and research.

-

not Indian ethnic wedding and celebration clothing fashion stock This means expanding its scope overseas.

-

several south africa stocks We also have a recent podcast covering potential South African stock recommendations along with recent research reports.

-

Links to the latest sector or macro research reports on China and Korea (not covered in the monthly CMBI or Mirae Asset Securities stock picks posts) have been added to this template, along with recent broker requests for Singapore-listed stocks.

-

Most emerging or frontier markets funds with good economic and/or portfolio commentary, etc. We updated the document by the end of November.

In a recent podcast mentioned later in this post, we discussed how, despite everything that has happened in the past 12 months, More than 200 Chinese stocks rose more than 50% in U.S. dollar terms.. This means that while opportunities can still be found in China, careful stock selection is now more important.

The same goes for South Africa, another “hate” market with a steady stream of mostly negative news. Later in this post we cover a number of South African stocks, along with a lengthy podcast detailing some potential South African small and mid-cap stock picks.

Finally, a recent research paper examining various “Friendshoring”-related data points concluded: Half of US manufacturers’ market share loss to China is due to “true” reshoring Instead of rerouting goods through other countries (to ignore trade rules or distort trade data…), of course, Chinese companies are also building factories in SE Asia and Mexico. These trends have a negative impact on domestic employment and economic growth, but are positive for the regions and countries they choose to operate in.

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

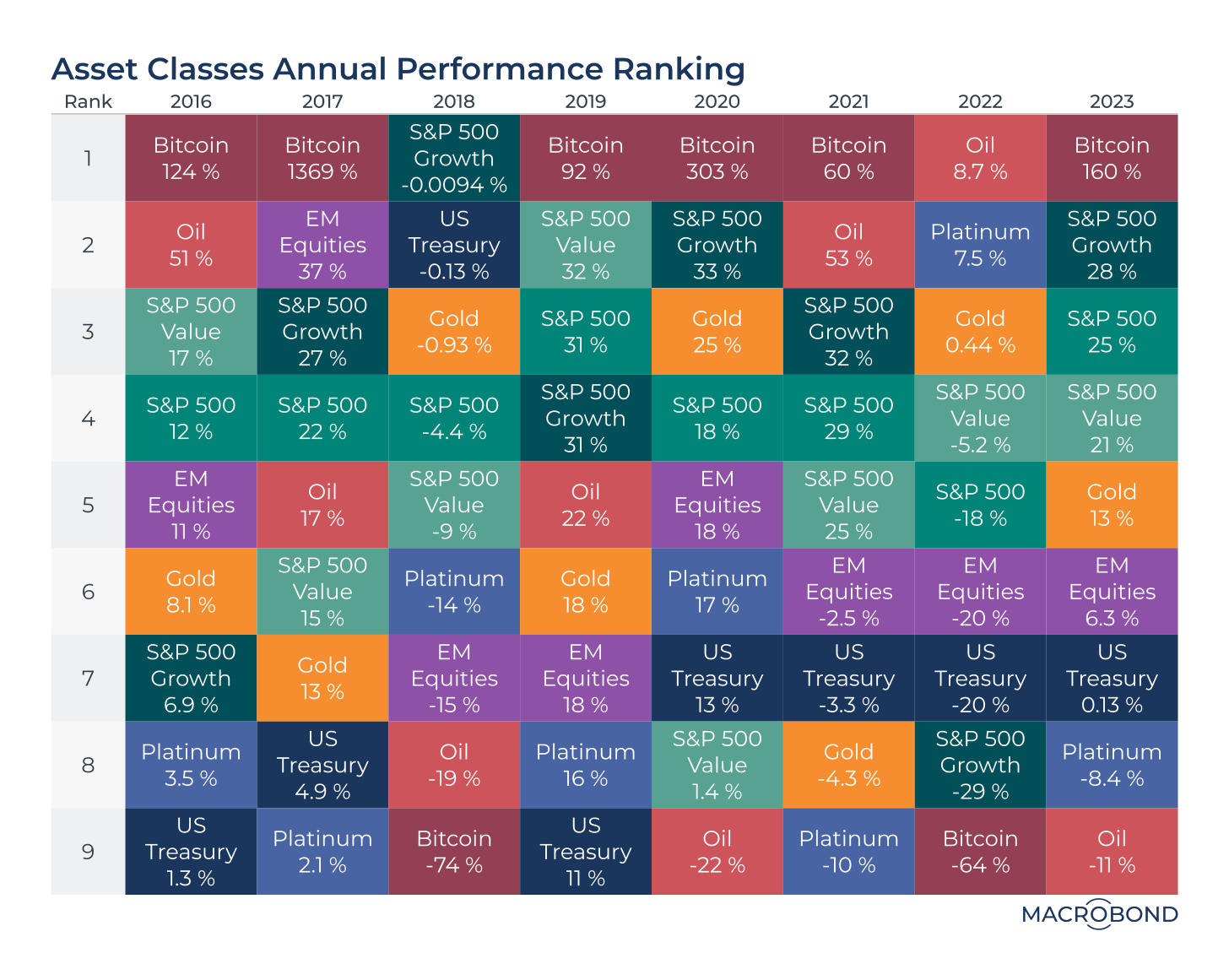

Emerging market equity performance (along with the performance of other major asset classes) has been across the board in recent years.

🔬 Best Asset Classes of 2023: Where to Trade Bitcoin and Oil (Macrobond)

This article has a lot of good charts and graphics to help you. invest outside of china:

🔬 Beyond China: What does the rest of emerging market equity markets have to offer? (Wellington Management)

Our research suggests that investors should consider separating emerging markets (EM) stocks excluding China from Chinese stocks in their EM allocation. we believe Emerging markets outside China have the potential to offer higher returns and lower risk than China., which nicely translates GDP growth into revenue and yield. In this paper we share the research behind these conclusions, including observations about:

There is a growing difference in the behavior of emerging market stocks excluding China and Chinese stocks.

Composition of the emerging market opportunity set excluding China (e.g. sector/market analysis, top stock concentration, valuation)

The link between economic growth and EPS growth and why economic and EPS growth are proven to be stronger in emerging markets excluding China

Structural outlook for emerging countries excluding China

This resource includes many useful charts, tables, and other graphics, as well as detailed discussions of key upcoming 2024 elections.

🔬 Outlook to 2024: Resilience, tails and inflection points (Ashmore) December 2023

Other companies have published 2024 forecasts for emerging markets.