Market breadth gains momentum. Don’t fight the market, be careful | Top Advisor Corner

Editor’s note: This week’s Joe Duarte’s Smart Money Trading Strategy Weekly is being produced early due to the Christmas holidays. I wish everyone a great holiday.

Be worried and careful. Stick to the momentum for now.

There are two old sayings in the markets, acknowledged by Wall Street great Marty Zweig: “Don’t fight the Fed, and don’t fight the market momentum.” This is more applicable now than ever. Meanwhile, as Mr. Zweig also likes to say, “I am most worried when I have no worries.”

That’s where I am now. I’m holding on for a long time, but I’m also worried that I’m staying at the party too long. If I stop worrying, I’ll probably go 100% cash. On the other hand, if the market turns big, you might worry that you didn’t sell fast enough.

Optimistic feelings are far away

I don’t want to ruin the holiday spirit. However, attention is drawn to CNN’s greed and fear index exceeding 75. And the recent figure of 80 (December 20, 2023) caught my attention. This is one of several emotion meters I follow, but it’s reliable in that it points out emotional extremes, even if the timing isn’t always useful. However, other sentiment indicators such as the CBOE Volatility Index (VIX, see below) and the CBOE Put/Call Ratio (CPC) are not making as much noise, making it look like the rally still has some momentum.

Of course, much of the current market rally has to do with seasonality, expectations of interest rate cuts in 2024, and the fact that many fund managers underinvested while others shorted stocks in October when a rally was actually likely. As I mentioned here, it becomes clear..

stick to the plan

Periods in the market when prices are off track and rising are usually the final stages before a meaningful decline and are called blowoffs. But it may last longer than anyone expects. So the best approach is to be aware of the situation and plan accordingly.

As I recently explained, one of the important parts of any plan is Your Daily 5 video, focusing on value. In other words, it is an area of the market that has lagged behind the rally. The reason is that it is still an area where discounts are possible.

Meanwhile, any worthwhile trading plan should include the following basic principles:

- Stick with what works. If a position is being held, hold it.

- Profit from overextended sectors.

- Consider a short-term hedge.

- Find value in unfavorable areas that are showing signs of life in the market. and

- Protect your profits with sell stops and continue to increase your profits as the prices of your holdings rise.

Where bonds go, stocks follow. And where there is value, Berkshire will find it.

As I noted last October, the rise in bond yields that pushed the 10-year Treasury (TNX) to 5% was too much, and a reversal would likely be dramatic. Moreover, given the weakness of that period, I also expected a subsequent rally in stocks. So far that’s what we’ve seen.

The US 10-year Treasury yield (TNX) remains below the key 4% level I mentioned. It was quite high. Interestingly, one of the most optimistic reactions to the 4% breakout came from the value sector. You can see this in the stocks of the Vanguard Value ETF (VTV).

Interestingly, VTV’s largest holding is Berkshire Hathaway (BRK/B), which is of course Warren Buffett’s quasi-ETF. What many people often fail to notice about Berkshire is that its holdings are as value-oriented as one can imagine.

For example, Berkshire added heavily to homebuilding stocks a few weeks ago and reported explosive growth in that sector. So is it worth it to a home builder? Oh no, if you look at DR Horton’s P/E ratio, you’ll see that it’s just above 10.6. Compare that to the S&P 500 (SPX), which has a P/E of just over 26, and the answer is clear. I own shares of DHI.

However, you can combine momentum charts with value indicators, as seen in the price charts for SPDR S&P Homebuilders ETF (XHB) and Berkshire. Moreover, it is wise to track what is happening to the prices of these and other highly valued assets and consider options when managing the number of shares you own in any position.

Certainly home builders have come a long way since I featured them back in late September., so integration is expected to happen at any time. But for now, momentum continues to build.

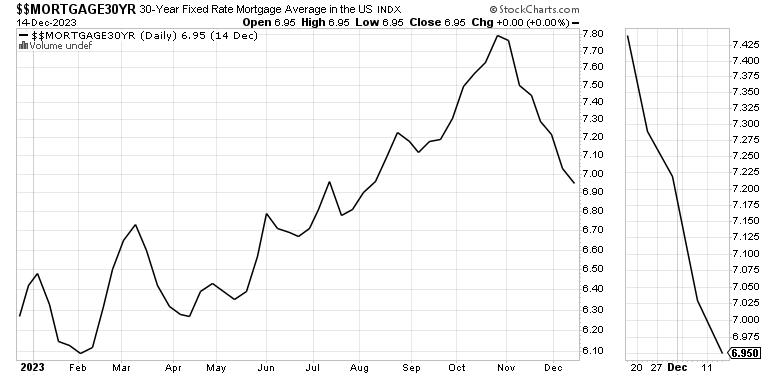

As I mentioned last week, the main impact has been the continued decline in mortgage rates below 7%. As long as mortgages remain below this critical rate, the potential for a moderate decline in homebuilder stocks is likely to remain low until proven otherwise. Meanwhile, the average mortgage rate is approaching a test of its 6.8% level.

Click here to get the bigger picture on homebuilding and real estate stocks. For more buying and selling recommendations for home builders, click below: here.

Brief description of stock delivery

Over the past few weeks, I have been pointing out the upside potential for the global shipping sector. I mentioned the drought in Panama at the beginning. and adverse impacts on the Panama Canal as an important contributor to this potential. Unfortunately, the Red Sea situation, which is linked to the situation in the Middle East, is becoming the cause.

We can see a big move in the SonicShares Global Shipping ETF (BOAT), which has gapped well beyond the bullish trading range I’ve seen in this space over the past week. Unfortunately, rising transportation costs and resulting disruption to global supply chains are likely to lead to inflation.

I recently recommended a shipping stock that just burst. You can check it out with a 2-week free trial of my service here.

Market breadth gains momentum.

The NYSE Advance Decline line (NYAD) is still overbought, but is entering a trading pattern that suggests a large momentum push as it tests recent highs. NYAD continues to trade above its 50-day and 200-day moving averages, which could extend into the end of the year and possibly into January. A reversion to the 20-day moving average is not impossible. The key is whether or not to maintain it. If so, the chances of the uptrend resuming increase.

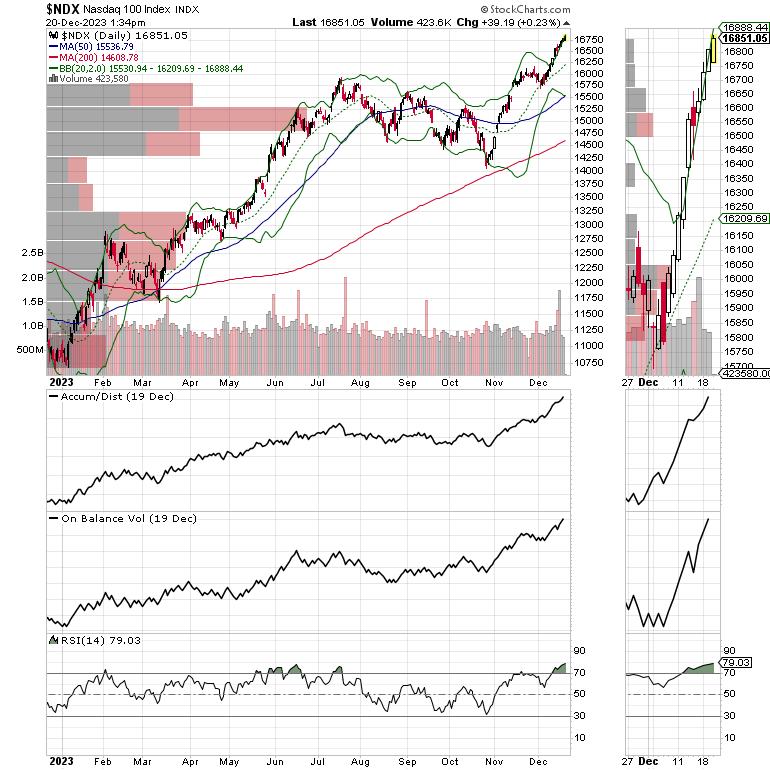

The Nasdaq 100 Index (NDX) rose above 16,000 as short sellers were pressured by upbeat comments from the Federal Reserve. NDX is currently trading outside the upper Bollinger Band, suggesting a near-term correction or consolidation is imminent. With both ADI and OBV rising, overbought conditions may become more likely before consolidation occurs.

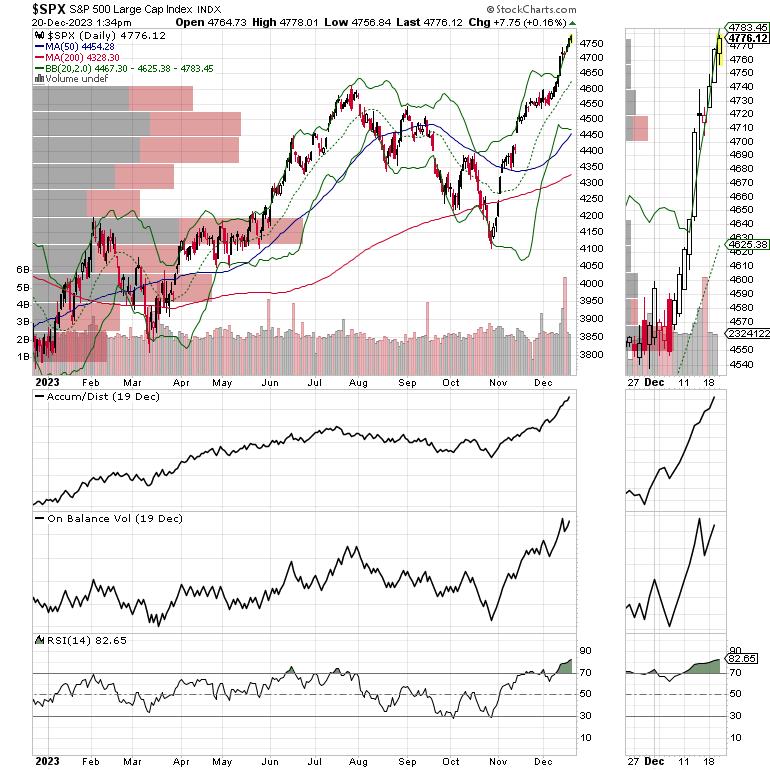

The S&P 500 (SPX) rebounded above 4600 thanks to the Federal Reserve. RSI is well above 70. A sideways move and a return to the 20-day moving average is expected at some point, but momentum continues to build.

VIX remains below 20

The CBOE Volatility Index (VIX) is at 20, indicating strength for the stock. If VIX continues its downward trend, there may be more room for upside.

When the VIX rises, it means traders are buying large amounts of put options. When market makers’ put option trading volume increases, they sell stock index futures to avoid risk. A decline in VIX is optimistic because it leads to fewer put option purchases, which ultimately leads to call purchases. This forces market makers to hedge by buying stock index futures, increasing the probability that stock prices will rise.

To stay up to date on options trading, check out: Options Trading for Beginners, now in its fourth edition. Get your copy now! Now also available in Audible audiobook format!

#1 New Release in Options Trading!

#1 New Release in Options Trading!

good news! I created the NYAD-Complexity – Chaos chart. YD5 video) and a few other favorites revealed. you can find them here.

Joe Duarte

money options

Joe Duarte is a former money manager, active trader, and widely regarded independent stock market analyst since 1987. He has written eight investment books, including bestsellers. Trading options for beginnersRated Benzinga.com’s TOP Options Books of 2018 Now the third edition is out. A book about everything you should know about investing in your 20s and 30s And six other trading books.

A book about everything you should know about investing in your 20s and 30s Can be used on amazon and Barnes & Noble. It was also recommended. Washington Post Currency Color of the Month.

To get Joe’s exclusive stock, options and ETF recommendations in your mailbox every week, visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp..