Intel Vs. AMD: Intel to Win in 2024 (NASDAQ:INTC)

Ugurhan

this month, Intel Corporation (NASDAQ:INTC) and Advanced Micro Devices, Inc. (AMD) revealed its AI capabilities and plans for 2024. Both companies held AI events last week: AI at INTC Events Anywhere And AMD’s AI event advancement. We think AMD’s presentation is more attractive in terms of surprise components than INTC’s, and the stock price movements around each event confirm this. AMD stock has outperformed INTC by ~10% over the past three months due to post-events and chatter about the MI300 series. We continue to prefer INTC over AMD in 2024. We believe the former is better positioned to outperform expectations as the PC and server/data center fully addressable markets (“TAM”) rebound.

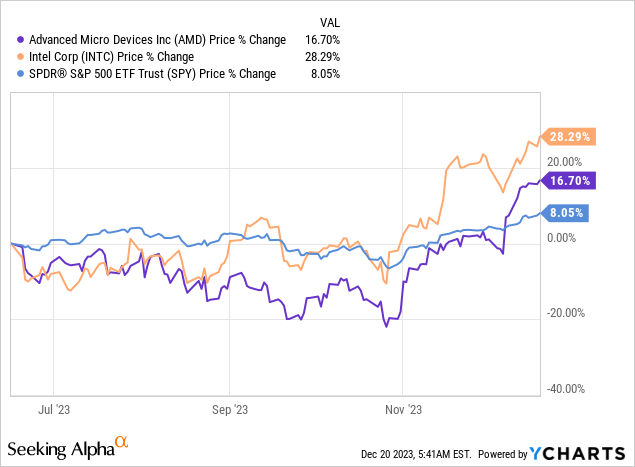

Below is a summary of the stock performance of AMD and INTC against the SPDR® S&P 500 ETF Trust (SPY) over the past six months.

Y chart

The highlight of the AMD event was the MI300 series. We think the MI300X will win over a few customers, but we don’t expect it to enjoy the traction of the Nvidia (NVDA) H100 in sales. As demand continues to exceed supply in the AI accelerator market, we believe AMD’s MI300 series is making noise due to Nvidia’s shortage. We believe NVDA products will continue to be the industry choice. We also believe that INTC has an edge in data center sales over AMD. That’s because the latter MI300 marks the first time the company has created a GPU chipset and bound it to a single system. AMD has $2 billion in orders from Taiwan Semiconductor (TSM), but is more cautious about whether the company can deliver all of its orders and exceed its guidelines.

At this event, INTC showcased its Gaudi 3 accelerator and new laptop and desktop chips, demonstrating its ability to build an AI-centric ecosystem. We saw INTC stock react less ecstatically than AMD’s stock following the event. Because there was little room for surprise. Management has shown investors that the company is on track to meet Moore’s Law and achieve its process roadmap. We’re also having a lot of conversations about the competitiveness of the server market. INTC has launched Emerald Rapid, its latest generation of Xeon server CPUs that compete with AMD’s Geona server CPUs.

In terms of core count, the latter surpasses the former, but in terms of performance gains, I think the stage is not set yet. We believe the overall PC and server/data center market rebound next year will help improve sales for both INTC and AMD, especially after this year’s PC downturn. We estimate that PC TAM will rebound approximately 5-8% Y/Y in 2024. We believe AMD will continue to gain share over INTC, but we believe the pace of share growth has moderated significantly compared to two to three years ago. INTC’s share of the market now appears to be stabilizing.

Additionally, we expect the risk profile for AMD to be higher in 2024, as AI revisions are expected sometime next year as supply catches up with demand. NVDA will be the main guide for this modification. Once the shortage issues are resolved and the market adjusts, it seems unlikely that AMD will experience any real AI demand.

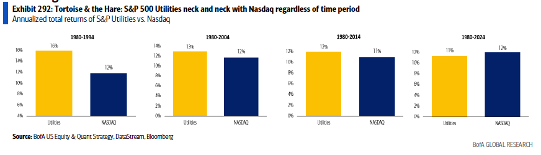

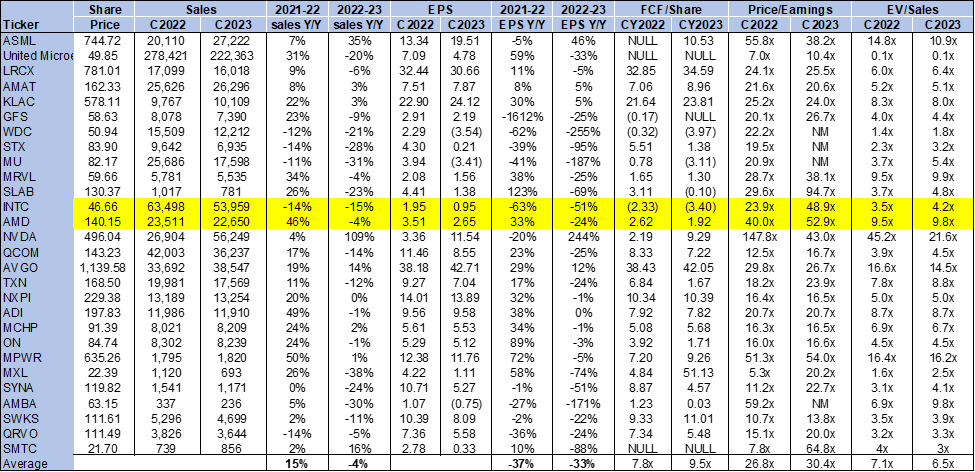

evaluation

In our opinion, INTC is evaluated more fairly compared to AMD. INTC stock is trading at 4.2x EV/C2023 sales compared to AMD’s 9.8x, and the peer group average is 6.5x. On a P/E basis, INTC is trading at 48.9x C2023 EPS $0.95, while AMD is trading at 52.9x C2023 EPS $2.65 compared to the peer group average of 30.4x. We think INTC has a better chance of seeing a surprise upside than AMD. I think INTC is in a better position than AMD, especially after last week’s post-AI events. Additionally, we believe AMD’s higher multiple is not justified at current levels. While the company’s presentation was impressive, we advise investors to be careful not to get too excited too early when they see a turnaround to profits.

The following chart outlines AMD and INTC ratings relative to their peer group averages.

TSP

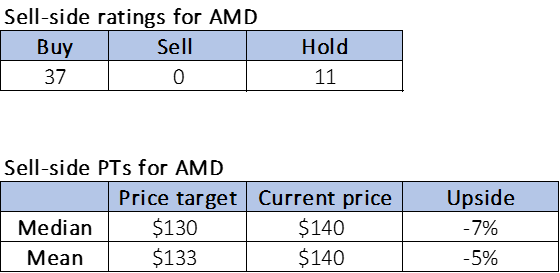

Wall Street Rumors

Wall Street Prefers AMD Over INTC Of the 48 analysts covering AMD, 37 have a Buy rating and the rest have a Hold rating. Below is a summary of Wall Street’s views on the stock.

TSP

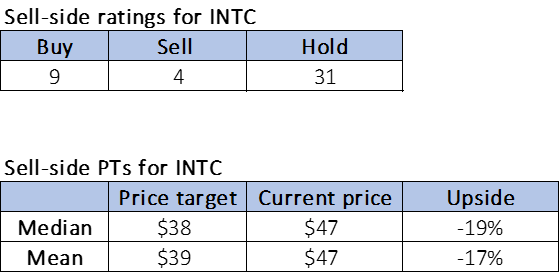

Meanwhile, out of 44 analysts covering INTC, 9 have a buy rating, 31 have a hold rating, and 9 have a sell rating. We think Wall Street continues to push expectations for AMD as the next NVDA, but we don’t see this coming to fruition. We think INTC will be able to beat expectations more comfortably in the first half of ’24.

The following chart outlines Wall Street sentiment toward INTC.

TSP

What to do with stocks?

We think Intel Corporation is better positioned to outperform Advanced Micro Devices, Inc. from a fundamental standpoint. Both stocks rallied following the event as investor confidence in AI demand increased, but INTC’s upside potential was greater. We recognize that investor confidence in AMD’s MI300 series could push the stock higher in the near term, but we believe INTC is a safer investment in the medium to long term as the company remains on track to achieve its five-process roadmap. . Chip after 4 years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.