Free like freedom is not free like beer

Bitcoiners need the guillotine

Scottish economist and philosopher David Hume said: A Treatise on Human Naturewe don’t know anything about is true can tell us what zero It’s true and we don’t know anything about zero can you tell me what the facts are is truth. The worlds of objective fact and moral truth are completely separate. Hume called it this: is/should problem His argument that descriptive and normative reasoning should be separated is known as follows. Hume’s Guillotine.

Hume’s Guillotine A philosophical razor, a rule of thumb for reasoning about the world. It is a method of cutting off two lines of reasoning that become intertwined. It is a useless debate for one side to argue about what is true and the other side to argue about what should be true. Those people are talking to each other about their past.

More importantly, the guillotine is a tool to reduce bias in our thinking. Left unsupervised, our hopes can corrupt our faith. In other words, it makes us assume that truth is good (naturalistic fallacy) and that good is truth (wishful thinking). There are many people in the Bitcoin industry who are confident about what Bitcoin is. must It can distort your understanding of what Bitcoin is. is. They need to study the guillotine.

Decentralization will never be cheap

One of the harsh but simple truths is that true decentralization is too expensive to become universal. If you believe in the value of decentralization, it is easy to see why you would want it to be universally available. But if you understand how decentralization works, it’s easy to see why it was never possible. The math simply doesn’t allow it.

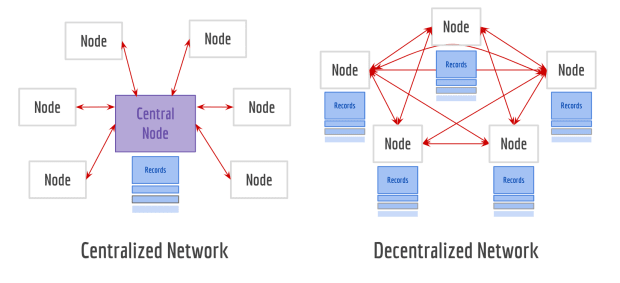

Decentralization is – By definition – Costs more than centralized alternatives. To become decentralized, a network needs more copies of network history (blue squares) and more connections between nodes (red arrows). Coordinating a centralized network is fundamentally cheaper and easier. Depending on the purpose of the network, decentralization may be worth the cost, but it is by no means the cheapest option.

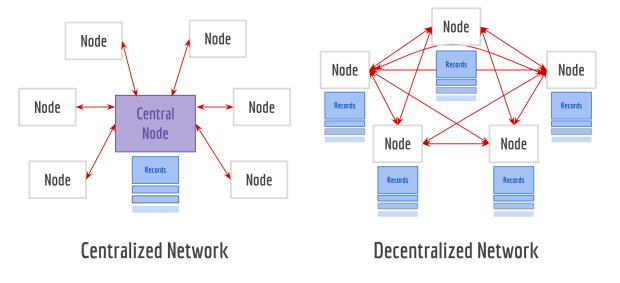

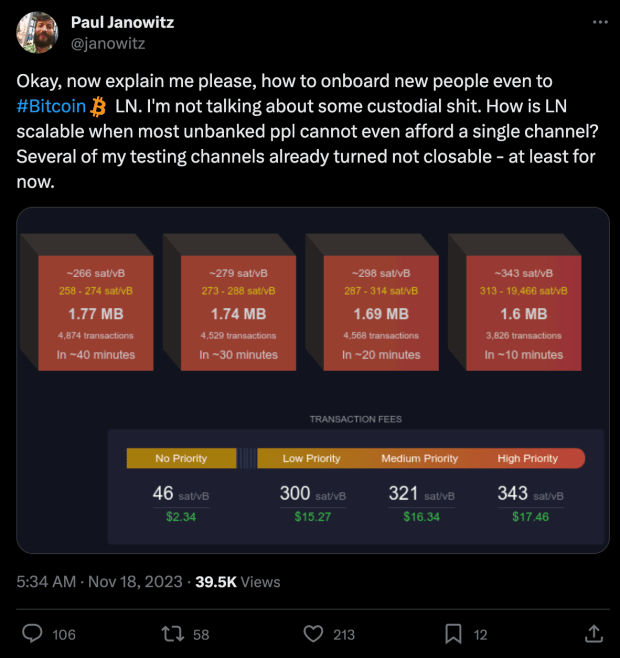

Network operation costs are split between users and validators. The network can limit network activity (making it expensive due to a lack of transactions) or require more work from validators (centralizing the network). Bitcoin limits block sizes to keep network verification costs low. However, this also means that by definition the trading space is limited. Bitcoin transaction fees are expensive by design.

After all, adding more capacity to a network doesn’t make it cheaper for individual users. This is because Bitcoin’s transaction fees are not set by the network, but by users’ willingness to outbid each other in blockspace auctions. You can’t lower transaction fees by increasing capacity because increasing capacity doesn’t change someone’s willingness to pay. Users do not decide whether to pay transaction fees based on how full the block is, but based on how high the fees are.

Bigger blocks would be good news for miners (since there would be room for more paying customers). But there won’t be much change for users. Transaction fees are about the same. The advanced economics term for this counterintuitive result is: Jevons Paradox.

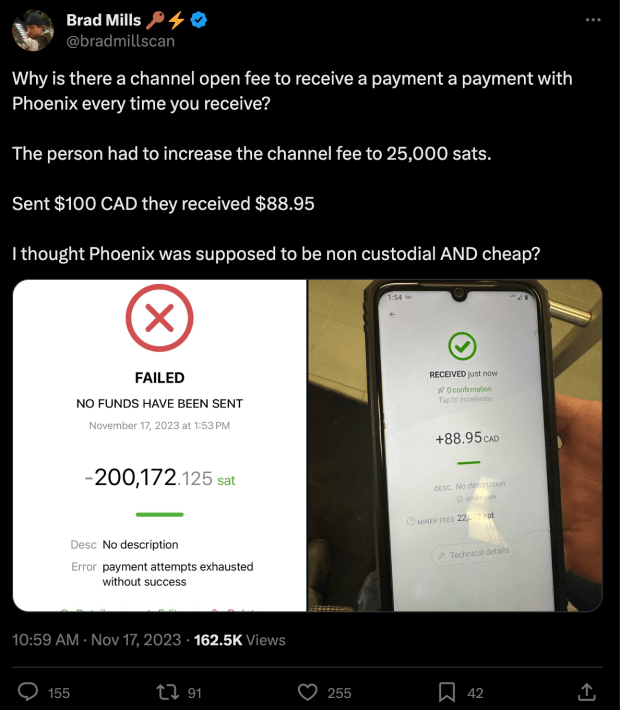

Developing new Layer 2 technologies does not make Bitcoin transactions cheaper. Technologies such as Lightning, Liquid, Fedimint, and Ark expand the performance and flexibility of Bitcoin transactions. But making transactions more useful doesn’t make them cheaper, it just makes them more valuable. As the number of ways to use Bitcoin transactions increases, there is greater demand for the limited available block space. You should expect Layer 2 to perform L1 Bitcoin transactions. more expensiveIt’s not cheap.

it’s okay. Because Bitcoin is not considered cheap. It should be provided for free.

free like freedom

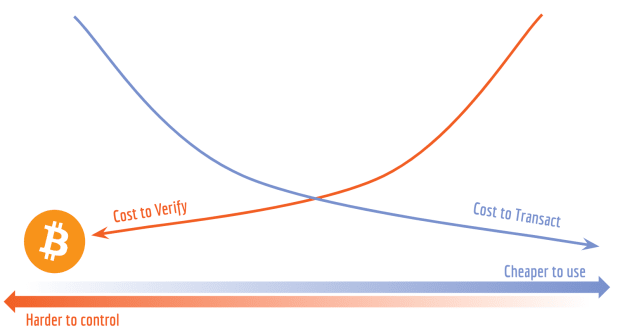

The lure of cheap, decentralized transactions is powerful. This was at the heart of the block size war and is the core value proposition of most altcoin networks today. This is also the driving force behind the widespread but incorrect belief that the Lightning Network will enable universal adoption at Bitcoin scale. The reality is more nuanced. Lightning lowers the cost of using Bitcoin. This is not the same as making Bitcoin cheaper to use.

The fact is that Lightning channels require Bitcoin transactions, and Bitcoin transactions are inevitably expensive. Bitcoin sees ~0.4 million transactions per day. Approximately one transaction/person occurs every 55 years, assuming no one is born or dies while waiting. Although the long-term price of Bitcoin transactions is difficult to predict, it is not difficult to predict that transactions will become rare, either because most people cannot afford them or because most people do not want to trade in the first place.

There are proposals to make channel management cheaper (e.g. channel factories), but since all proposals ultimately hinge on some on-chain anchor transaction, all channels will have to be purchased/rented somehow from someone who can afford the original transaction. Anthony Towns did some interesting analysis and estimated that there is room for around 50,000 entities to be traded directly on-chain. Everyone else must rent management services from one of the on-chain entities. You can use a copy of this spreadsheet to adjust the assumptions and run your own estimates.

Even if you completely ignore opening/closing costs, that doesn’t mean maintaining the channel itself is cost-free. Users need to be online to receive payments or supervise their opponents’ misbehavior. They must periodically pay liquidity providers to ensure that payments sent and received are perfectly balanced or to rebalance the channels. Most importantly, all Bitcoin used to generate Lightning Channel capacity must be online and not in cold storage.

Although the marginal cost of an individual Lightning transaction is very small, the total cost of creating, using, and maintaining a Lightning channel is actually quite high. Bitcoin is represented by Bitcoin because it is the scarcest resource in history. Telling retail users to open their Lightning channels for cheaper deals is like telling them to launch their own satellites for cheaper mobile internet.

To be clear, I believe in the Lightning Network. I don’t think it will force unbanked people to bank. The Lightning Network doesn’t make Bitcoin transactions cheaper, it makes them more powerful. Payment channels only make sense for those who pay enough to justify paying for rationalization. For most people, even owning a single on-chain UTXO would be a privilege of considerable luxury. I do not mean to defend the results as follows. good. It simply is. It exists on the other side Hume’s Guillotine.

Bitcoin is for saving, not spending

The sheer size and continued growth of the stablecoin market is evidence of strong demand for low-cost, disintermediated retail payments. But Bitcoin is not a panacea. Just because low-cost payments are useful doesn’t mean Bitcoin is a useful way to make low-cost payments. Bitcoin was not designed to be cheap. Designed to be extremely durable. These are not the same goals and probably will not be achieved with the same systems.

Even in a world where Bitcoin transactions are somehow cost-free, we still have to do it. yet We expect stablecoins to dominate payments. Why would someone who thinks Bitcoin is precious want to use Bitcoin? If someone thinks Bitcoin is not valuable, why would they spend money on it? Bitcoin is an emergency fund, not a convenience fund. No one should spend money on coffee.

Decentralized networks do not make good retail payment tools. It’s expensive, slow, and unforgiving. Making retail purchases using Bitcoin is like driving to the mall in an M4 Sherman tank. it can cool, But that’s not practical and it’s definitely not normal.

This is a guest post by Knifefight. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.