As we approach the end of the year, inflation data brightens the holiday spirit | MEM edge

Markets received a holiday gift today after the Commerce Department reported that underlying inflationary pressures continue to slow. This will result in increased spending which will benefit the overall economy, giving households more income at their disposal. News of declining inflation sets the stage for interest rates to continue to fall, with a Federal Reserve rate cut expected as early as March. This is good news for individual sectors as well as the wider market, some of which stand to benefit the most against this backdrop.

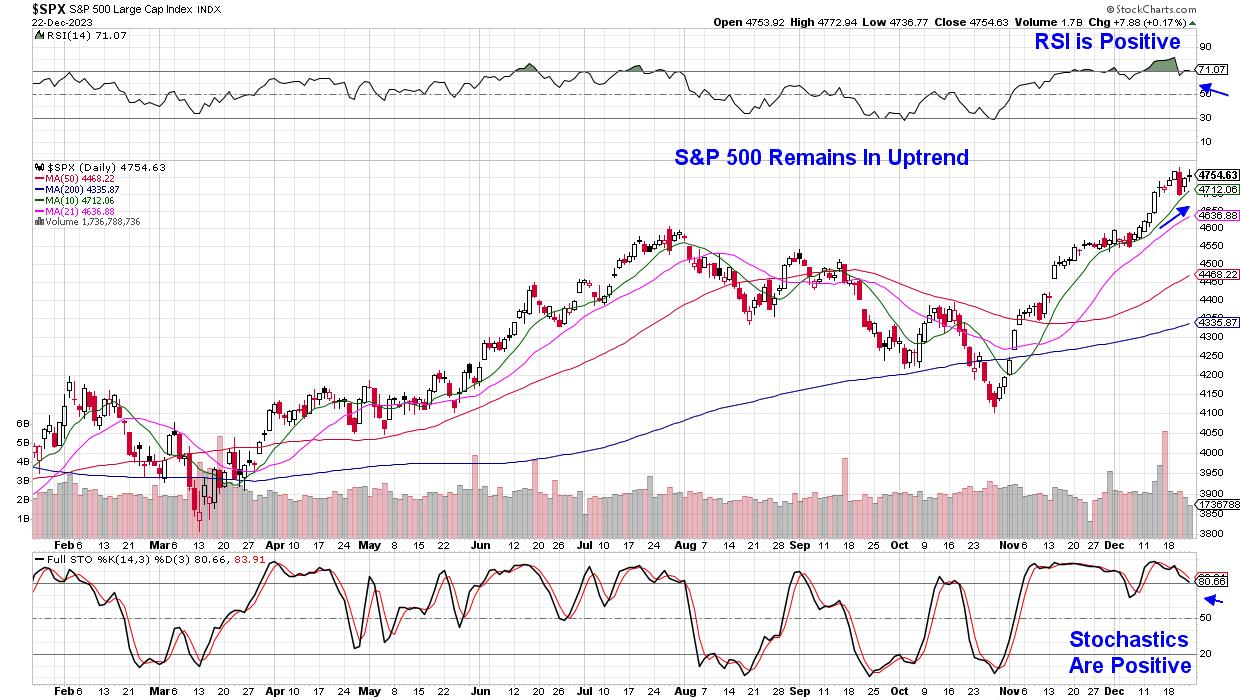

S&P 500 Index Daily Chart ($SPX)

S&P 500 Index Daily Chart ($SPX)

Among the sectors that will benefit most from a rise in the stock market as interest rates continue to fall, there are several sectors in the financial sector that are already showing signs of growth. A prime example is brokerage Charles Schwab (SCWB), which recently reported that total client assets increased 12% year-over-year in the month of November. This increase occurs as investor confidence in the market expands and individuals invest their money.

Charles Schwab Corp. (SCHW) daily chart

Charles Schwab Corp. (SCHW) daily chart

Following news of an increase in customers, the stock price broke through the base with heavy trading. Since then, SCHW has retreated to the uptrending 10-day moving average and found support. With both RSI and MACD in positive territory, the stock is poised to trade higher.

As the market reaches its highest level at the beginning of the year, portfolio values are rising, and asset management companies are also benefiting from the increase in assets under management (AUM). Blackrock (BLK), one of the largest asset managers, is poised to break out of the flag formation following a five-month fundamental breakout earlier this month. The company is getting closer to approving a new Bitcoin ETF, which has drawn positive attention to this 2.5% yielder. Volume above $820 would be quite bullish for BLK.

Blackrock (BLK) daily chart

Blackrock (BLK) daily chart

Other financial stocks, including banking stocks, are also continuing their upward trend. Subscribers to my MEM Edge report were alerted to a new upward trend in mid-November when I added two local banks to my recommended holding list. Both stocks have posted double-digit returns, but have turned to key support this week as stocks prepare for another rally. You can use this link here to access these stocks and others that may be trading higher in the current bullish environment. Your four-week trial will give you detailed information on twice-weekly reports and stock-picking ideas, as well as extensive market insights you won’t find anywhere else. Weekly sentiment developments on stocks and markets also delivered straight to your inbox.

We hope you have a fantastic holiday weekend!

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more