Riskified: Strong Growth Outlook, Negative Margins Still a Concern (NYSE:RSKD)

Jay Yuno

outline

exposed to risk (New York Stock Exchange: RSKD) is a software-as-a-service company specializing in fraud and chargeback prevention technology, especially in the e-commerce sector.

RSKD’s historical revenue growth has been solid, growing in the double-digit range. But the final margin is Minus, the loss has expanded. These losses were primarily due to increased SG&A expenses. In the third quarter of 2023, sales continued to grow significantly due to the successful implementation of the market entry strategy, and net loss improved thanks to effective SG&A expense management.

Going forward, the expected growth of e-commerce and the increase in e-commerce fraud cases are expected to have a positive impact on RSKD’s future growth prospects. However, ongoing uncertainty due to inflation led management to lower its 2023 revenue guidance. Given these mixed outlooks and the potential for single-digit upside in the stock price, I recommend a Hold rating on RSKD. At this point.

past financial performance

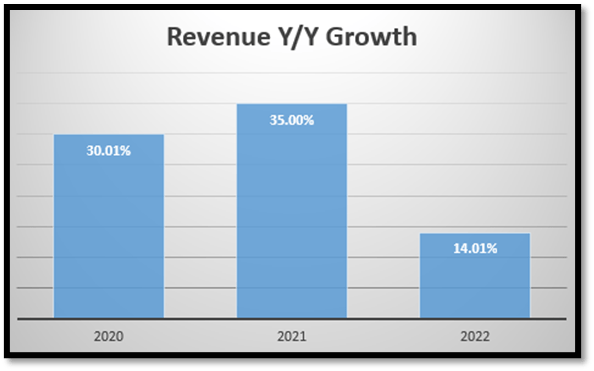

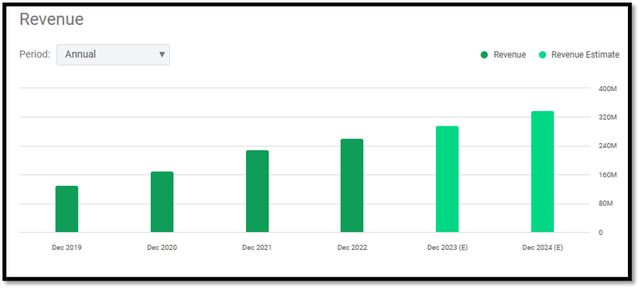

From 2020 to 2022, RSKD’s revenue growth will grow significantly and be in the double digit range. 2020 and 2022 saw growth in the 30% range, with e-commerce segment sales increasing due to COVID-19. This benefited RSKD, which provides e-commerce risk management solutions. In 2022, the growth rate slowed to ~14.01%. We believe the slowdown in sales growth in 2022 is related to RSKD’s strategic decisions and focus on improving profitability by reducing overall costs. Accordingly, management decided to delay hiring. However, management does not expect the hiring slowdown to have a negative impact on growth prospects in the long term.

author chart

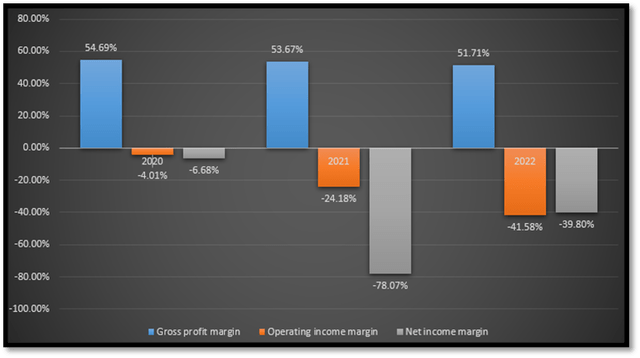

When analyzing RSKD’s margins, it becomes clear that it is ultimately unprofitable. As of 2022, both operating profit and net profit margin are in negative territory. This is a stark contrast compared to 2020, when the loss rate was in the single digits. Next, let’s take a closer look at P&L to understand what’s driving the losses deeper into the red.

author chart

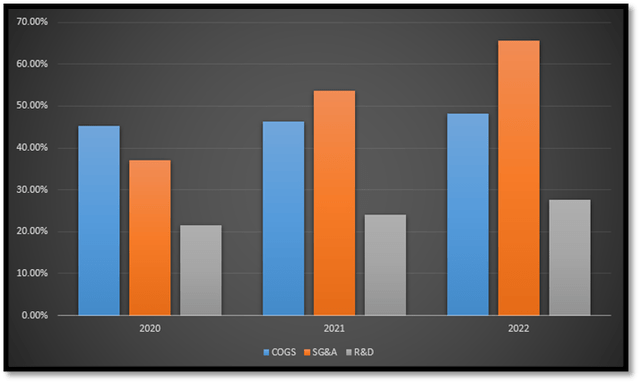

According to the following chart I created, it is clear that the main driver of costs is SG&A. In 2020, it only accounted for about 37.11% of total sales, but it surged to about 65.73% in 2022. This significant increase in SG&A was driven by the need to drive revenue growth, which is common in emerging technology companies like RSKD. In terms of cost of sales and R&D, it has been fairly stable over the past three years.

author chart

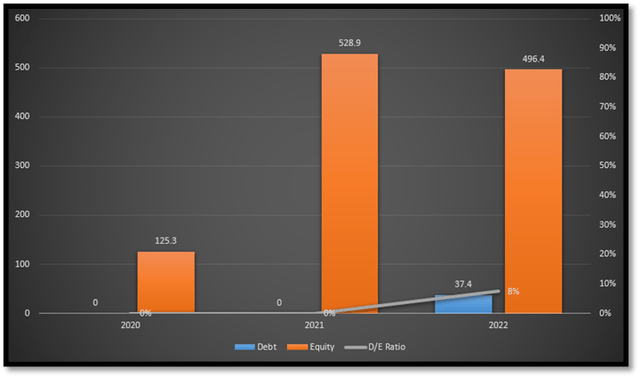

If margins are negative, it is important to look at the level of debt on the balance sheet. This will give you an idea of your current liquidity and solvency situation. Looking at the following chart, it is clear that the debt-to-equity ratio (D/E) is very low, in the single-digit range. However, we see that debt will increase slightly in 2022, pushing D/E up to ~8%.

author chart

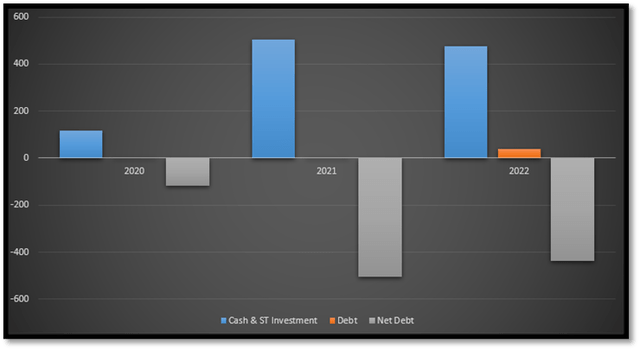

Although looking at debt alongside negative margins may be nerve-wracking, we believe examining net debt can give us a clearer picture of RSKD’s financial health. Net debt is defined as total cash and short-term (ST) investments minus total debt. Looking at the following chart, it is clear that RSKD has enough liquid cash to cover its debt levels. Therefore, no problems due to debt are expected to arise.

author chart

RSKD’s 3Q23 Revenue Analysis

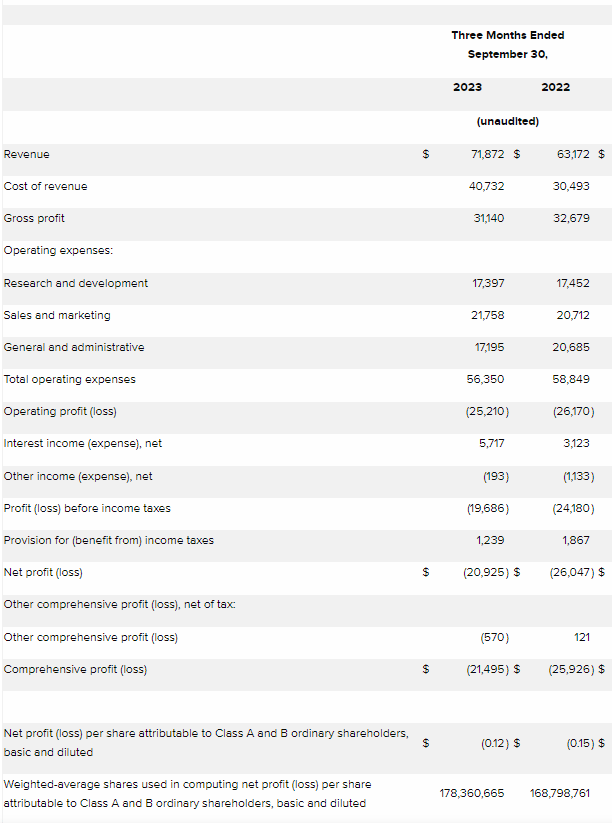

In the third quarter of ’23, RSKD reported revenue growth of approximately 14% year-over-year, driven by the successful execution of its go-to-market strategy. RSKD has been successful in adding new sellers, retaining and upselling existing sellers, and expanding its market share.

Looking at margins in the third quarter of 2023, it is clear that both operating profit and net profit margin have improved, with both declining. In the third quarter of 2023, operating profit margin improved by ~6% to minus 35%. Net profit margin improved from ~12% to minus 29%.

We noticed a slight decline in gross margin in the third quarter of ’23. This occurred due to a significant fraud incident reported by one of the largest sellers. However, management believes and states that it does not expect this event to have an impact on subsequent quarters. Therefore, we expect gross margin to return to normal levels in the coming quarters.

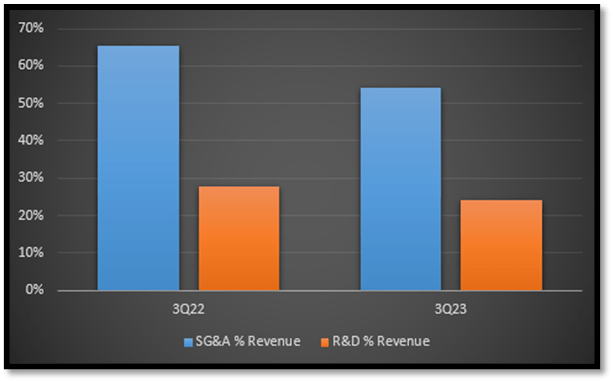

author chart

Margin improvement is due to efficient SG&A expense management. The ratio of SG&A to total revenue in the third quarter of 2023 decreased from 66% in the second quarter to 54% year-on-year. This represents an improvement in SG&A costs of approximately 12%. On the other hand, R&D has not been sacrificed to improve margins, which is especially important for emerging technology companies specializing in software solutions.

author chart IR at risk

Strong e-commerce growth will support RSKD’s future growth

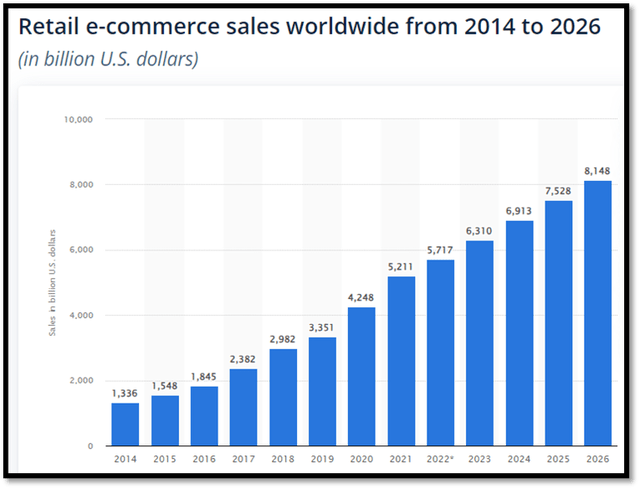

Global e-commerce sales reached ~$5.7 trillion in 2022 and are expected to reach ~$8.1 trillion by 2026. This represents a CAGR of ~14.9% (2014-2026) and is expected to continue growing until 2026. 2026. This strong double-digit growth in the global e-commerce market will bolster future revenues for RSKD, which sells e-commerce risk management software solutions such as fraud and chargeback prevention technologies.

politician

As e-commerce sales increase, e-commerce fraud is expected to increase as well. Statistics released by Mastercard show that e-commerce fraud is on the rise globally. In 2022, losses reached a whopping $41 million and are expected to continue to rise and exceed $48 million through 2023. Of all countries in the world, North America (NA) has the highest levels of e-commerce fraud. ~42% of all e-commerce fraud globally.

According to the following quote from Aglika Dotcheva, RSKD’s CFO: The United States is RSKD’s largest region. Therefore, the expected increase in e-commerce sales is expected to increase the demand for RSKD solutions as fraud incidents increase in the United States.

Quote: “Finally, we also saw revenue growth in all regions. Third quarter sales in the United States, our largest region, increased 9% year over year.”

Inflation still casts a shadow and uncertainty.

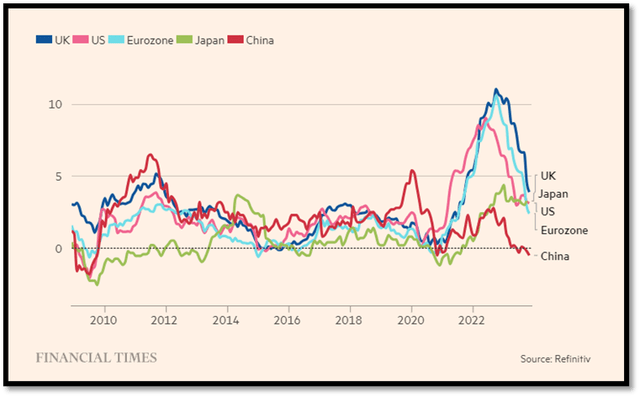

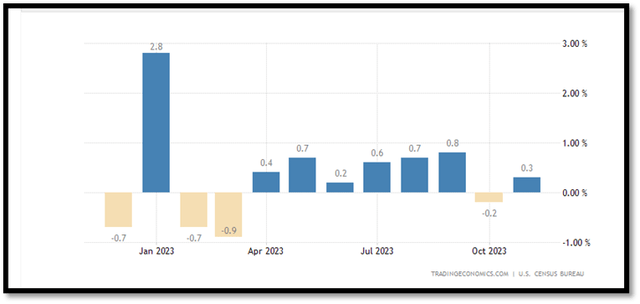

The global inflation chart shows a clear trend of cooling inflation. As a result, this reduction in inflation strengthened retail spending. The second chart shows clear signs that U.S. retail spending is increasing starting in April 2023, with the exception of October 2023. This was partly due to a strike by the United Auto Workers, which affected automobile supply. An improvement in retail spending is likely to benefit RSKD as it supports e-commerce sales, improving RSKD’s growth prospects.

However, it is important to note that while inflation has cooled significantly since the 2022 surge, it is still exceeding the target rate of ~2% in many countries. This situation continues to cause macroeconomic uncertainty around the world as markets remain uncertain about when inflation, a key factor in determining the direction of central bank interest rates, will stabilize.

Financial Times trade economics

The updated guidance reflects the uncertain macro environment.

Due to uncertainty caused by inflation exceeding the central bank’s target interest rate, RSKD updated its guidance for 2023. Previously, sales were between $298 and $303 million, but this was revised to between $297 and $300 million.

On the EBITDA side, it was revised from negative $17 million to negative $12 million to negative $14.5 million to negative $12.5 million. I welcome this EBITDA adjustment. This is because it demonstrates management’s confidence in cost management initiatives and a commitment to driving margin improvement.

Comparable Valuations

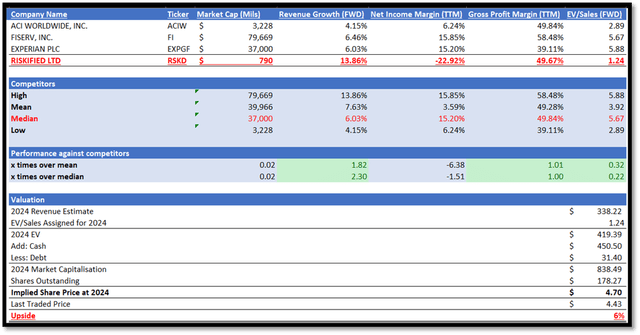

Before we proceed, I want to clarify the comparable companies listed in my valuation model. RSKD operates in the application software industry and specializes in fraud and chargeback prevention software technology, but the three competitors I identified also offer online transaction security, fraud detection, and risk management solutions, making them more suitable for comparison.

First of all, it is clear that RSKD is much smaller than its competitors. Its market capitalization is ~$790 million, while the median market capitalization of its competitors is ~$37 billion. In terms of size, RSKD is only 2% of the median of its competitors. Although it is small in size, its future growth prospects are twice as high as those of its competitors. RSKD’s growth projection is ~13.86%, while its competitors’ median is ~6.03%. However, it is common for smaller companies to grow faster because they have an easier comparative year, also known as the base effect.

When it comes to profitability, it’s a different story. Of all the companies listed, RSKD is the only one to report a net loss, the drivers of which have been discussed in depth earlier. However, in terms of gross profit margin, RSKD is in line with the median of its competitors.

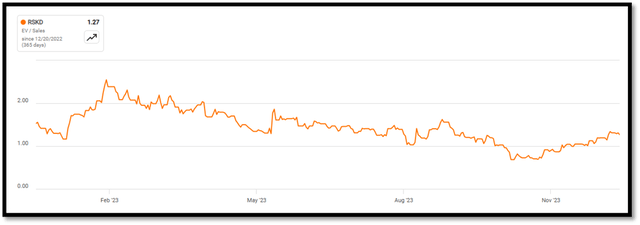

Due to the net loss, RSKD currently trades at 1.24x forward EV/sales, while its peers trade at 5.67x. Looking at RSKD’s average EV/Sales for the year, it is consistent with its current forward EV/Sales. Therefore, we believe the risk of current EV/Sales being overvalued or undervalued is low. With these supporting factors, I believe that the EV/sales market allocated to RSKD is fair and just.

I applied an EV/Sales of 1.24x to my 2024 market revenue estimate and have a target price of ~$4.70 for RSKD. This represents a modest upside potential of ~6% and lacks a margin of safety in my opinion. Therefore, I recommend a Hold rating for RSKD.

Author’s evaluation model pursue alpha pursue alpha

Upside Risk to My Hold Rating

I think inflation could be a catalyst for RSKD’s share price to rise. In my analysis of RSKD, I noted that its margins were in negative territory and were primarily driven by SG&A. As inflation cools further, SG&A costs also fall, which ultimately leads to margin expansion. Additionally, management is taking proactive steps to manage our current cost situation. If margins are better than expected, the stock price could rise.

Second, as discussed above, revenue guidance has been updated due to uncertainty due to inflation. Again, if inflation cools more than expected and future earnings are higher than expected, stock prices will rise.

conclusion

In conclusion, RSKD’s historical financial performance is mixed. Sales are growing solidly in the double-digit range, but a slowdown is felt in 2022 due to management’s focus on profitability. It also reported that its net loss worsened due to increased SG&A expenses, but management expressed its commitment to strengthening its net profit margin. In the third quarter of ’23, RSKD continued to record strong sales growth. At the same time, margins are improving through SG&A expense management.

Going forward, we expect the expected growth in the global e-commerce market to drive demand for RSKD solutions, supporting a positive growth outlook. Additionally, with the growth of the e-commerce market, global e-commerce fraud is also increasing. I believe this will also drive demand for RSKD products.

Inflation has cooled from its 2022 peak but still exceeds the central bank’s target interest rate. So it is throwing doubt and uncertainty into the market. Accordingly, management has lowered its 2023 revenue guidance to better reflect the current market outlook.

When we conducted a comparable valuation, we found that RSKD was lagging behind its peers in terms of net income but outperforming them in terms of growth prospects. Our current EV/Sales ratio is below the median of our competitors, reflecting our net loss situation. Additionally, the current EV/Sales ratio is also consistent with historical averages. These factors therefore support my belief that the current valuation assigned by the general market is justified. We recommend a Hold rating for RSKD at this time due to the lack of margin of safety at the target price.