Dividend Defense of AGNC Investments (NASDAQ:AGNC)

lighthouse movie

AGNC(NASDAQ:AGNC) invests heavily in institutional MBS and TBA mortgage assets through hedging and purchasing low-interest bonds to manage risks from interest rate volatility. When defining each, the first institutional MBS is:

“Agency MBS has been created. When residential mortgage loans that meet the agency’s underwriting guidelines are securitized into pass-through securities. “Investors in pass-through securities receive interest less the principal and interest on the underlying loan, as well as service fees and guarantee fees.”

Second, a TBA mortgage position is defined as “a transaction (TBA) that effectively enters into an agreement to buy or sell mortgage-backed securities (MBS) on a specific date.”

Articles we and others have written on Seeking Alpha about AGNC and the accompanying interest rate environment have generated considerable enthusiasm on both sides, with some strongly advocating investment in this business model while others strongly condemn it. Both sides have their merits in sparking debate. our intention This article follows our past beliefs: AGNC: Upcoming investment turning point; A place to think about the present and the future. Our interest is what signals high dividends flash. Is it a warning or a green signal in disguise? Like the walls that soccer players build to protect their goal from direct kicks, we hope this will provide reasonable protection for goalkeepers (investors) and allow for fair valuation. But before we set that wall, it’s important to note that it includes a significant amount of input from management centered around factual market assessments for which we don’t have direct access to data. We must take their word for it.

marketplace

In the case of AGNC, investors sometimes seem confused by the relatively complex landscape of this business model. At least we did. In the best light, it’s cruel. Therefore, our first order of business is to include an online location for charts/graphs of the important relationships that management appears to be concerned about. Start with a bulleted list.

- 10-year Treasury bond yield.

- 5-year maturity government bond yield.

- Agency MBS spreads are compared to Treasury yields.

- Bloomberg Long-Term Treasury Index.

- Highly rated corporate debt instruments.

Also we Links and references from others are welcome..

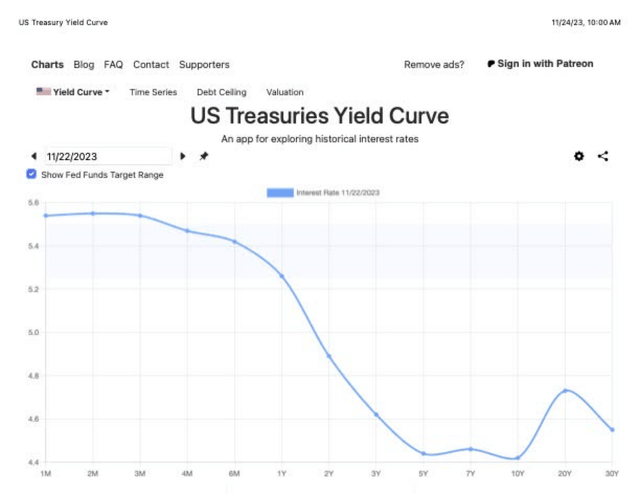

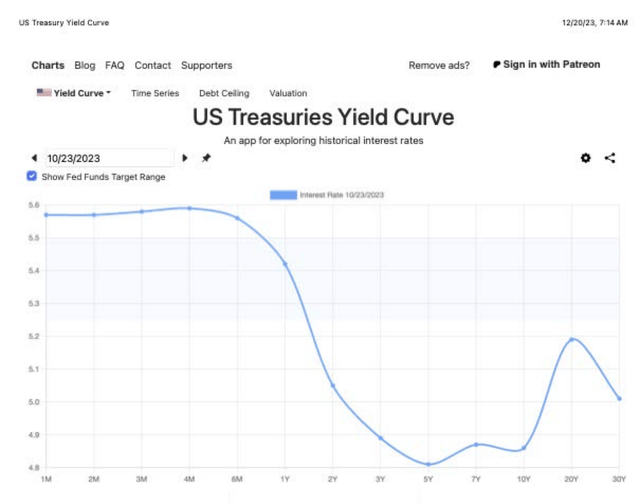

A daily yield curve link can be found at U.S. Treasury Yield Curve. Here’s a sample graph:

us treasury bonds

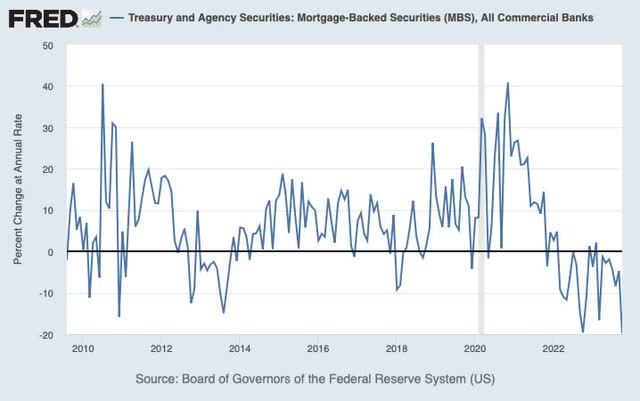

Below is a graph of institutional MBS and government bonds.

fred

For those of you who have access to Bloomberg’s Long Treasury Bond Index, clicking on this link will open the graph. The symbol is LUTLTRUU: IND. News organizations typically lock down data from non-subscribers. We are non-subscribers.

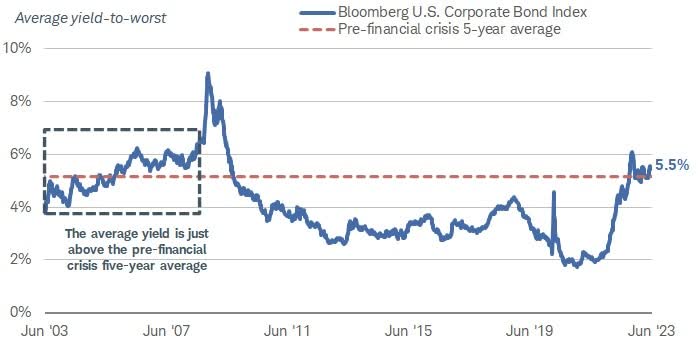

Next, Schwab’s Investment Grade Corp. Includes Bonds graph.

Schwab

Once again, we welcome additional source references, data that we deem important, for investors to view directly.

Management’s Opinion

Once you have a basic understanding, the next task is to clearly summarize management’s opinions on the market. “Treasury markets continue to undergo a historic multi-year pricing event,” management said.

Regarding institutional MBS, management commented:

- “In environments like this, where Treasury prices suddenly fall and markets struggle to find a new equilibrium, institutional MBS typically underperform ().”

- After a challenging period, “investment opportunities in agency MBS, both on an unleveraged and leveraged basis, remain optimistic.”

- Over the past six months, the spread between institutional MBS and a blended portfolio of 5-year and 10-year Treasury bonds has ranged from 150 to 195 basis points.

- MBS said “Higher than higher rated corporate debt instruments.”

Regarding finances, management commented:

- “To put this movement in context, the increase in 10-year Treasury yields over the past three years is Second largest ever For such a short period of time. “Percentage-wise, the Treasury market has never experienced anything like this.”

- Compared to Treasuries, agency MBS spreads have “widened by 20 to 25 basis points.”

- Unleveraged MBS yield 7% with full backing from the federal government.

- The yield on MBS is at least 150 basis points higher than the yield on all government bonds.

- The latest move to raise Treasury rates began early in the quarter due to the growing fiscal deficit.

Next, regarding the Bloomberg Long Treasury Bond Index, management added:

- “The Bloomberg Long Treasury Bond Index, which tracks maturities of 10 years or more, has experienced a total return loss of close to 50% over the past 2.5 years. loss is the same what Experienced by S&P 500 After the dot-com crash of 2000.”

- Bearish bond sentiment “accelerated late in the quarter following a hawkish message from the Federal Reserve . . .”

And finally, the yields on higher-rated corporate bonds are substantially lower than Agency MBS on an unlevered basis. This will shock investors With regard to opportunities for more profitable returns and dividends.

Management also said five- to 10-year Treasury yields rose 45 basis points and 73 basis points after the September FOMC meeting with the Federal Reserve made it clear that interest rates would remain higher for a longer period of time. The bass remains unchanged.

When using the word brutal, the environment is understated. Investors must ask questions. Why invest?

quarterly performance

Amid this frenzy, AGNC reported mixed results. The results are as follows:

- The equal value was lost by $1.02 due to interest rate volatility and wider spreads.

- Despite the sharp drop, leverage is still at 7.8. asset value.

- $3.6 billion in cash.

- Dollar roll earnings, excluding catch-up amortization, were $0.65 per share. (Decreased by $0.02 quarter-over-quarter due to higher borrowing costs.) This represents cash generated from assets.

- We added a hedge at 10% of the curve. (“70% of our hedged portfolio’s duration dollars are at the 7+ year mark on the yield curve, and approximately 50% of the duration is from Treasury-based hedges.”)

Management also pointed out, “Agency MBS is very favorable. Spreads are separated from government bonds and corporates due to supply and demand technical factors that are expected to ease over time.” A detailed discussion of management’s position on MBS follows.

“This is particularly noteworthy considering that the fundamentals of Agency MBS have never looked as attractive as they do today. Organic agency supply is minimal, prepayment risk is largely decentralized to fiat, and the repo market for Agency MBS is deep and liquid. Spreads are as follows: “As of now, we believe investors in Agency MBS will be well compensated for the increased interest rate volatility in the near term.”

Regarding other interest rate spreads, management noted that the CDX IG spread is a 15-year average. However, historical differences in spreads have weakened valuations.

Opinions on Dividends

Let’s go into the horse’s mouth for an explanation of dividends starting next.

“As I have stated several times, one of the key factors evaluated when setting dividends is the economic return expected to be earned by the portfolio at the current MBS valuation level. .”

“Put another way, as of the end of the third quarter, we needed to earn a 16% return on our total tangible equity base of $6.9 billion to meet all operating expenses and dividend obligations. … The leveraged return on agency MBS on a coupon basis is convex. Excluding rebalancing costs, it’s in the mid to low 20s range.”

“And due to the resulting decline in tangible net book value per share and stock price, The dividend yield on our common stock has increased noticeably..”

Management does not expect to cut the dividend, as investments are still generating high levels of cash.

interest rate position

For investors, we felt it would be helpful to include a graph of the interest rate curve for the last day of the quarter, the announcement date, the earnings date, and the most recent date.

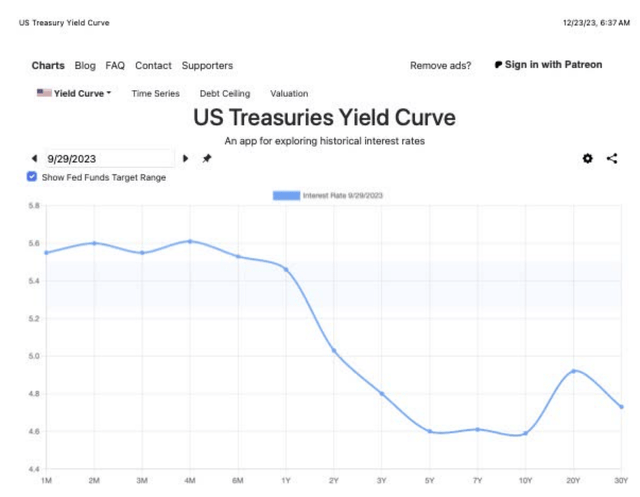

We start with the graph on 9/29, the last day of the quarter.

us treasury bonds

Following the 10/23 graph, management posted an asset value warning that day.

us treasury bonds

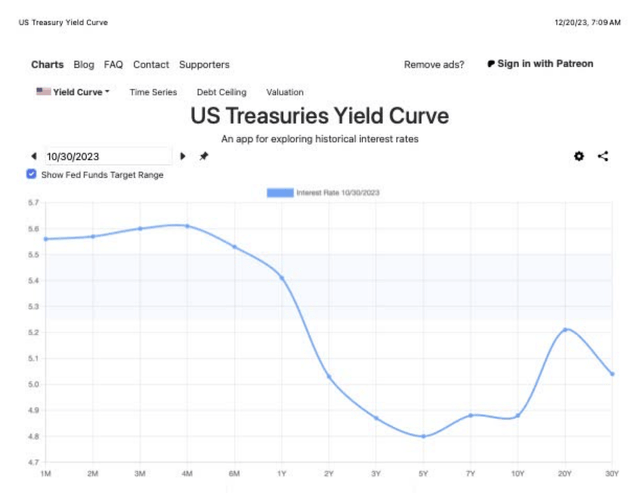

Now this is the 10/30 graph, which is the earnings reporting date.

us treasury bonds

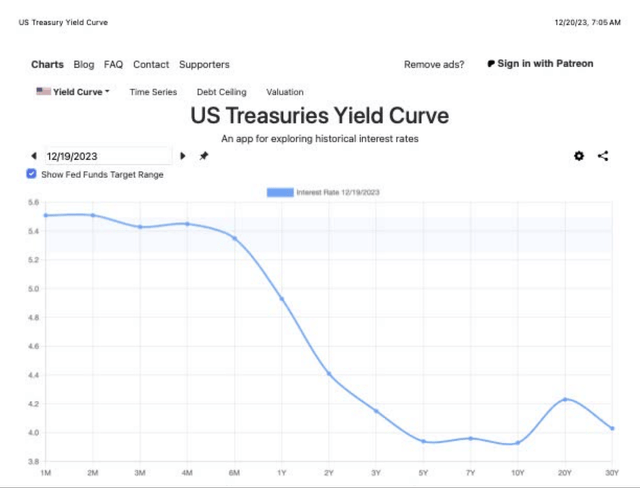

Lastly, this is the 12/19 graph.

us treasury bonds

Overall, the steep rise in long-term interest rates continued through the third quarter through October. Since the report, the numbers have flattened considerably. The stock price rose from $6 to $10 each.

danger

In our view, a government shutdown scheduled for early next year will add similar risks to September. The last factor significantly increased volatility. Expect the same again. The House passed a short-term continuation resolution in mid-November with this caveat. In January, the Senate will receive a dozen budget bills, including guidance that it will negotiate changes, but they must be accompanied by a revenue-neutral approach. This will not be taken kindly by the Senate. This is also the Senate’s only option. The House will not pass unlimited spending. The other side of this budget challenge will be better spending controls and deficit reduction, which is a positive step forward.

Our final concern is the lack of understanding at what level of volatility AGNC may fold.” We don’t know. There are limitations that exist in every business and this is no exception.

Nonetheless, we rate AGNC a high-yield buy and believe it won’t be cut anytime soon. Even if the value is low, the asset returns the same amount of cash regardless of its valuation. Stock prices move with asset valuations, but cash dividends do not. We have very large positions, mostly $10. There are several short calls on our position at $11. Hedged defenses and consistent cash flow provide investors (goalkeepers) with the necessary protection.