BlackRock TCP Capital: Should we lock in this 12.8% return in 2024? (NASDAQ:TCPC)

LeoPatrizi/iStock via Getty Images

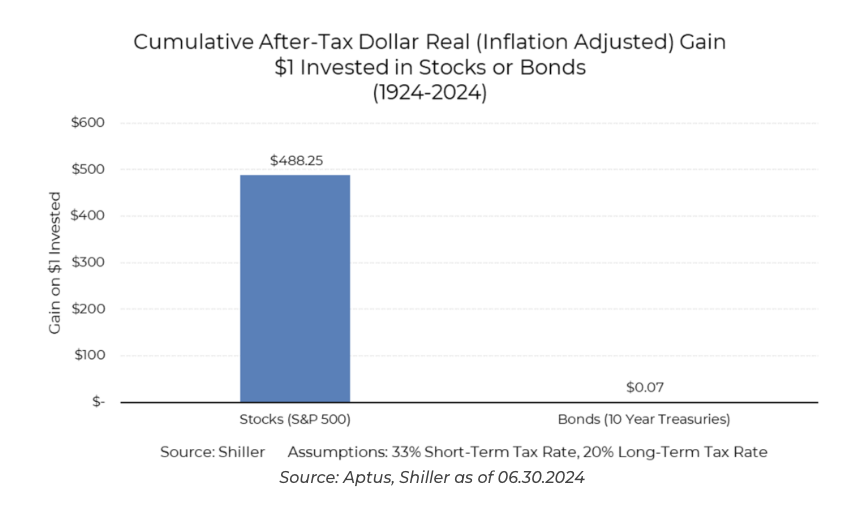

Business development companies performed well in 2023, with the VanEck BDC Income ETF (BIZD) up 25% year over year on a total return basis. The U.S. economy continues to record healthy GDP numbers and low unemployment. Up to 5.25%~5.50%. This established the golden age of private credit. BlackRock TCP Capital (NASDAQ:TCPC) has faced more headwinds, with its common stock up 2.25% on a total return basis this year, reflecting two consecutive quarters of declining net asset value compared to a broader decline in NAV since 2021. This is the same as TCPC. Lastly, quarterly cash dividends were declared. $0.34 per share, the annualized dividend yield was unchanged sequentially at 11.8%. A special dividend of $0.25 per share will also be paid.

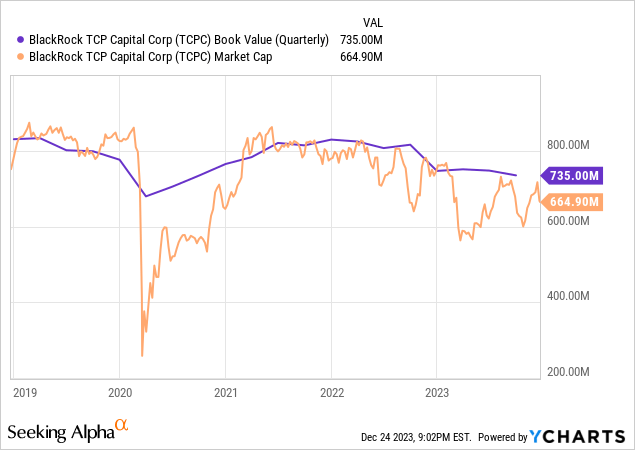

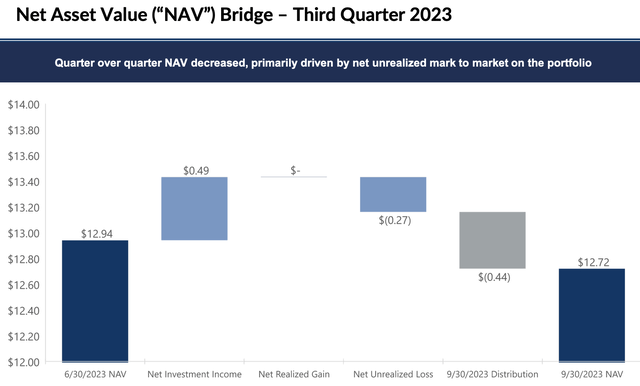

TCPC’s Fiscal Year 2023 NAV for the third quarter was $735 million. $12.72 per week, which was down 10% year over year and down 22 cents per share sequentially. The continued decline signals uncertainty and has caused the common shares to trade at a 10% discount to NAV. This discount persisted despite a $50 million share buyback plan that did not purchase any shares of TCPC during the third quarter, despite the discount to NAV and investment grade.BBB-“I received a credit rating from Fitch.

pitch rating

TCPC offers income investors a double-digit dividend yield on an investment-grade balance sheet, but its weak NAV has led to stagnant total investment returns this year. For certain investors, dividends are all that matters to protect their principal investment, which forms a secondary objective. Some BDCs can achieve both goals, making TCPC a less attractive buy.

Credit underwriting quality and in-kind payment

BlackRock TCP Capital November 2023 Fact Sheet

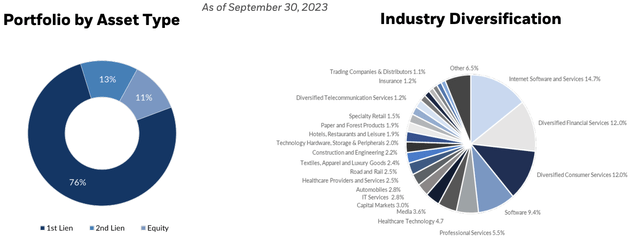

TCPC, headquartered in Santa Monica, focuses on senior secured loans to mid-sized businesses. At the end of the third quarter, the fair value of the entire portfolio across 143 portfolio companies was $1.6 billion. This leaves 76% invested in first lien senior secured debt, 13% second lien exposure and approximately 11% of the portfolio allocated to equities. The credit portfolio achieved a weighted average effective return of 14.1%, an increase of 280 basis points from 11.3% in the year-ago quarter. Additionally, 95% consisted of floating rate loans.

BlackRock TCP Capital Fiscal Third Quarter 2023 Form 10-Q

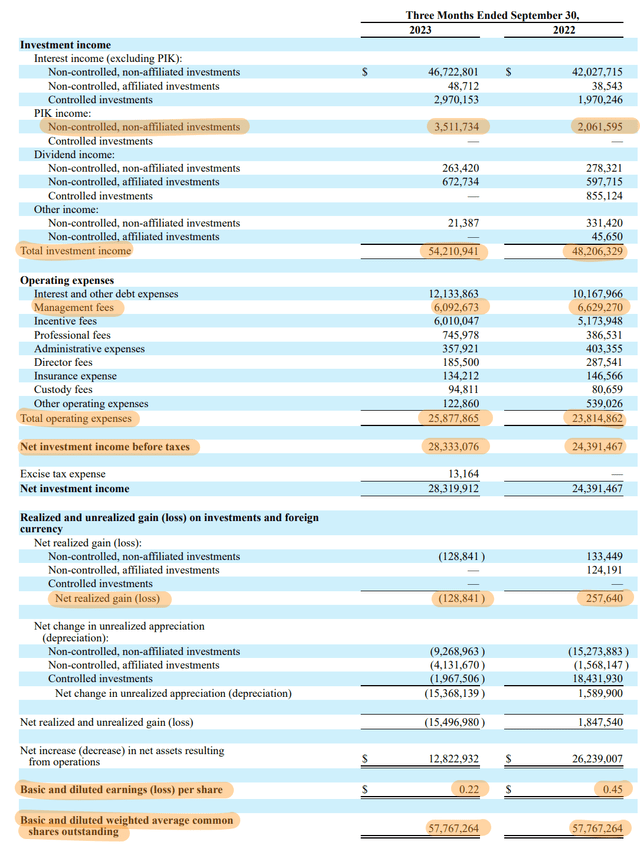

Total investment income for the third quarter was $54.2 million, up 12.4% year-over-year and beating consensus estimates by $1.55 million as TCPC’s floating rate positioning helped boost interest income. In-kind paid income of $3.5 million represented 6.48% of total investment income, an increase of 220 basis points from 4.28% in the year-ago comparison. Loans to three portfolio companies (1.1% of total investments at fair value) were outstanding at the end of the third quarter. These non-accruals accounted for 1.7% of the cost portfolio.

| Company (non-accrual) | loan type | fair value |

| Plate Newco 1 Limited (Avanti) | subordinated loan | – |

| Wheel, LLC (PerchHQ) | First Lien Incremental Term Loan | $14,859,476 |

| CIBT Solutions, Inc. | Second lien term loan | $2,199,522 |

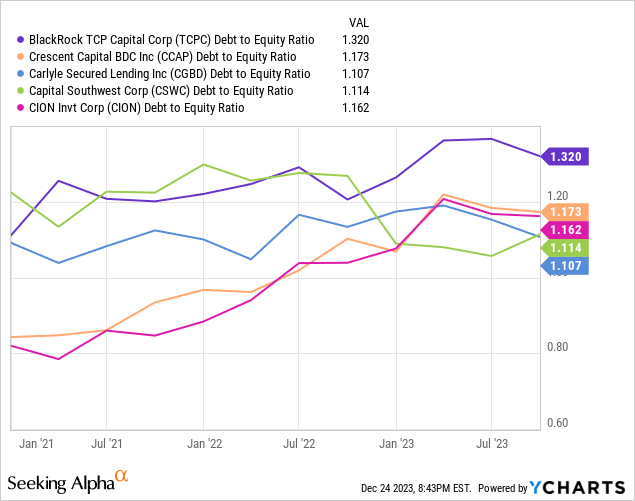

Reduced net asset value, leverage and interest rates

The NAV decline was driven by unrealized markdowns of $0.27 per share on six positions. This is against net investment income, which rose 17% year over year to $0.49 per share, achieving base dividend coverage of 144%. An increase in PIK income could mean higher loan non-accruals in future quarters, with non-accrual loans a year ago representing just 0.3% of TCPC’s portfolio on a fair value basis. TCPC also has a higher debt-to-equity ratio than its BDC peers closest to its market cap, but 1.3x is still generally a comfortable level.

BlackRock TCP Capital Fiscal 2023 Third Quarter Investor Presentation

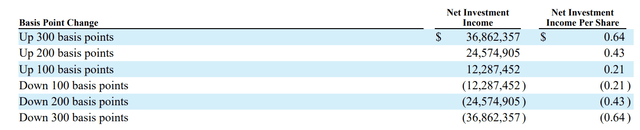

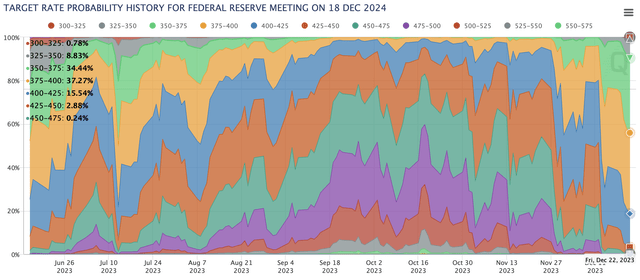

TCPC plans to merge with BlackRock Capital Investments (BKCC), another BDC linked to BlackRock (BLK), early next year. The consolidated entity will benefit from reduced operating costs and lower basic management fees. Any recovery in NAV in the fourth quarter will depend on whether TCPC decides to pay another special dividend. 2024 offers a significant step change in the current economic zeitgeist. The Fed’s December dotplot showed three rate cuts of at least 75 basis points next year, which would dampen net investment income growth for BDCs.

BlackRock TCP Capital Fiscal Third Quarter 2023 Form 10-Q

Market expectations are for a rate cut of 150 basis points, with the benchmark interest rate next year likely to fall to 3.75% to 4.00% by the end of 2024, according to the CME FedWatch tool.

CME FedWatch Tool

Of course, it is not 100% certain that an interest rate cut will occur next year. The current global shipping disruption at the Panama Canal and Suez Canal could put inflationary pressures if it persists for more than a quarter. TCPC is pending. I would like to consider a long position if the NAV per share starts to increase.