I am building a global real estate empire and increasing returns by 12%

concentrate

Co-authored by: Treading Softly

My first job was at McDonald’s. There I learned some very basic fundamentals of customer service. I worked there for three years and completed almost every task starting from taking orders. They even cook food at the cash register and perform various maintenance tasks around the property. I distinctly remember there was one old maintenance guy who would always come and work on the broken ice cream and milkshake machines. That’s right. Even back then, the machines never performed as expected.

He only worked one or two days a week. He seemed to pick his time and show up when he wanted to fix it and then leave. Every time we ask the store owner why he puts up with this ugly old man. He replied that he did whatever he wanted, that he was one of the only people who could fix the machine, and that he did it solely for his own pleasure. As you can see, this old man owned large properties around the city, rented out several houses, and had a strong source of income. He came to fix machines just as a way to keep himself busy, not because he needed the income from his job, but because he enjoyed working on machines, and apparently most weeks and months he didn’t even want to cash his paycheck.

When it comes to the market, you no longer need capital to own a variety of houses or properties or to become a real estate developer. In the 70s, 80s, and even 90s, many people tried to become real estate moguls by taking on debt or using leverage.

Today I want to look at how you can build a global real estate empire from the comfort of your home without spending billions of dollars.

Let’s jump in!

global portfolio

When interest rates rise, the market sells REITs. Now that the market believes interest rates have peaked or are close to peaking, we’ve seen REIT prices rise again.

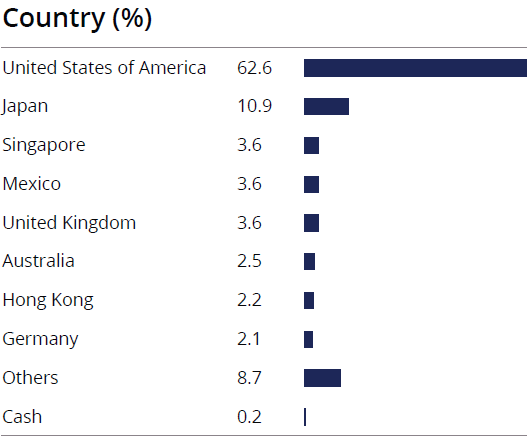

abrdn global premier real estate fund (AWP) is a CEF focused on global REITs with a yield of 12.4%. U.S. REITs make up the largest portion of the portfolio, while non-U.S. REITs make up 37% of the portfolio. source

AWP Fact Sheet

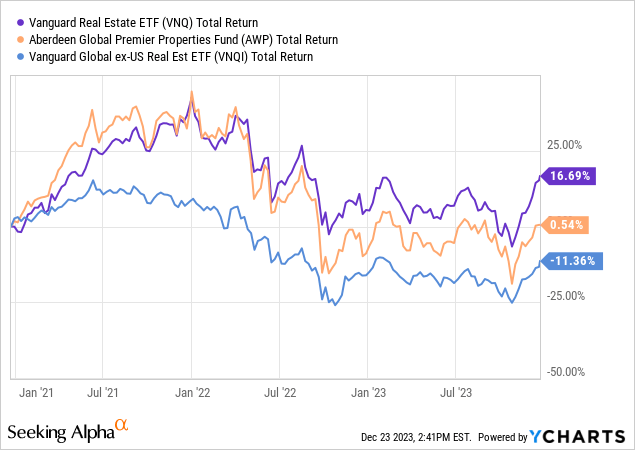

This often provides international exposure to U.S.-centric portfolios. Given the strength of the U.S. dollar and the overall performance of the U.S. economy, this international exposure has had a negative impact. AWPPerformance compared to other U.S.-focused funds

Looking at ETFs, the US-focused Vanguard Real Estate ETF (VNQ) outperformed the Vanguard Global ex-US Real Estate ETF (VNQI).

AWP’s results are somewhere in the middle. This makes sense because, with moderate leverage, approximately two-thirds are US and one-third are non-US.

Many investors will look at AWP and compare it to VNQ. “It’s underperforming! Sell, sell, sell!” they shout. It completely ignores the fact that you are comparing apples and oranges.

One of the main reasons for purchasing a fund is to gain diversified exposure to asset classes that you might not otherwise have in your portfolio. This is an important part of diversification. AWP has been putting a lot of negative pressure on European holdings like Vonovia SE (OTCPK:VONOY) as real estate markets across Europe have suffered much like what happened in the US during the financial crisis. Prices plummeted, dividends were cut, and investment returns were poor. Do you know what GFC is in the United States? Now is a great time to buy U.S. REITs.

AWP’s strategy to combine U.S. and non-U.S. REITs allows a relatively strong portion of the portfolio to fund dividends. When considering whether dividends on a CEF are sustainable, it is important to understand that the CEF pays out both the income it receives and capital gains. No investment portfolio provides uniform returns. Sometimes the profits may be high and other times there may be no profits at all for several years. CEF managers set dividends at a level they believe is sustainable over the long term.

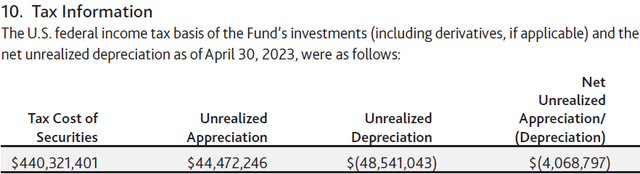

Just like your portfolio or any other portfolio, you will have investments that go up and down at certain times. When you look at “NAV,” you can see the net unrealized change in the value of all the holdings in your portfolio. Below is page 22 of AWP’s semi-annual report.

AWP Semi-Annual Report

AWP had unrealized profits of just under $44.5 million but unrealized losses of $48.5 million. Some holdings are up and some are down. As with selling a portfolio, management has the option to sell the instrument realizing a loss or realizing a profit.

There are signs that European real estate is bottoming out and U.S. REITs are buoyed by the prospect of the Federal Reserve pulling back on interest rate hikes. This creates conditions for both sides of the AWP portfolio to see positive momentum, something we haven’t seen since the COVID-19 recovery, which was also the last time AWP traded below $4.

conclusion

I’ve learned that the best time to buy something is when no one else thinks it’s a good time to buy it. The saying “Buy cheap and sell expensive” is the same. Unfortunately, many investors fail to outperform the market simply by “buying high and selling low.” They buy what they think other people are already buying, and then sell when they see other people selling. Typically, these investors end up arriving a day late and thousands of dollars behind. This is why when I developed my own unique income method, I designed it to have different goals than the lemmings on the market. I’m not blindly chasing capital gains. I am controlling the part of the equation that I can control: how much income I will receive.

When I retire, the last thing I want to do is work so I can pay my bills. I want you to have an income-generating investment empire that can pay for your retirement. Then hopefully you can work to earn money, not because you need the cash like that old man. Many people would love the opportunity to say that they don’t have to go to work because they need the money, but because they choose to do so, it will revolutionize the way they approach things at work. . Likewise, having more income and less stress will revolutionize your retirement. This is completely possible through my income method.

This is the beauty of my income method. This is the beauty of income investing.