Why AstraZeneca’s acquisition of Gracell Biotechnologies is a win-win (NASDAQ:GRCL)

tipping pad

Chinese biotechnology company Gracell Biotechnologies Inc. (NASDAQ:GRCL) is ending the year on a strong note, up almost 360% this year. But the party may not last long.

Coincidentally, it is being acquired by the following company: British-Swedish pharmaceutical company AstraZeneca PLC (NASDAQ:AZN) is currently best known for its COVID-19 vaccine. Before this news broke, the stock was already up 190% this year, and has since risen another 60%, now hitting a 2023 high.

Price Chart (Alpha Exploration)

Now that the stock price has risen a lot, the first question is whether there is still a trading opportunity for GRCL. The second question is what the acquisition means for AstraZeneca going forward.

There are very few trading opportunities at GRCL.

The deal values Gracell Biotechnologies, which is developing cancer treatments, at $1.2 billion. It is divided into price per share. $2 per share ($10 per ADS) will be paid in cash, plus $0.3 per share ($1.5 per ADS) if regulatory milestones are achieved. AstraZeneca plans to pay $1 billion in cash when the transaction is completed by the end of the first quarter of 2024.

As I write, the price of GRCL has already risen to USD $9.92, which is very close to the USD $10 that AstraZeneca will pay, so the profit to be made now is less than 1%. It’s almost a given that the price will go to exactly $10, but if the price moves, there may be a trading opportunity for the stock. Of course, if there is a counteroffer at a higher price, GRCL could go higher, but this is just speculation for now.

Impact of this transaction on GRCL

On the surface, the acquisition price seems a bit disappointing, as the company was valued at $19 per share when it listed in January 2021. But AstraZeneca’s offer is significantly higher than the previous high of $6.1 reached this year. It also represents a 62% premium to the closing price before the offer price was announced.

Moreover, GRCL is currently sponsored by a leading cancer treatment provider, and the company expects to support its research. AstraZeneca can also provide access to target markets. Additionally, given that the U.S. Food and Drug Administration (FDA) recently followed up on reports of malignancies in patients receiving CART-T cell therapy offered by GRCL, we’re guessing now might be a good time to sell out.

AstraZeneca gains momentum in China

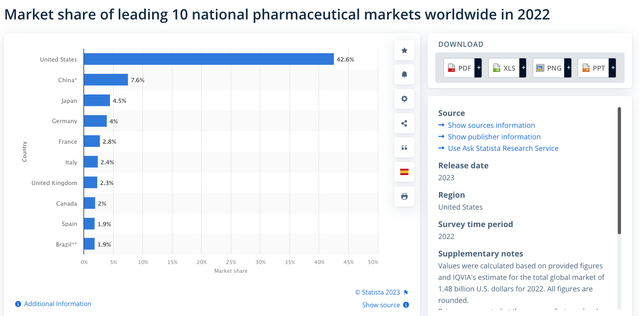

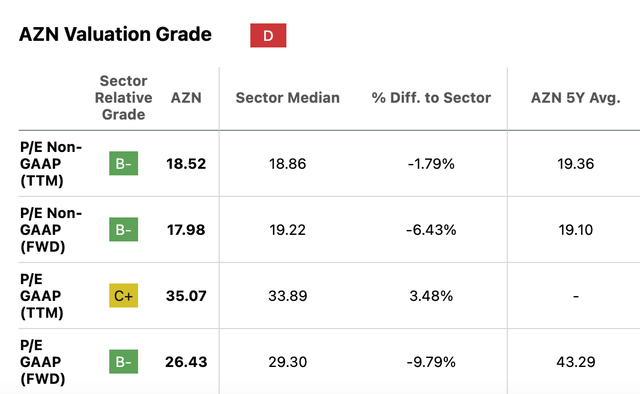

AstraZeneca will expand its oncology portfolio, which is core to the company, given that it accounted for more than 37% of the company’s revenue in the first nine months of this year (“9M 2023”). This acquisition made it possible to enter the Chinese market. As far as pharmaceutical market size is concerned, the United States is far ahead of all other countries (see chart below), but China is still the second largest market.

politician

China already accounts for a significant 13.6% share of AstraZeneca’s revenue, but the company recently expressed optimism about the market, which may suggest its share will increase in the future. In an outlook released alongside its half-year earnings update, the company specifically upgraded its outlook for China to “low to mid-single digit” growth, in line with its expectations for total revenue at the time. “Low single-digit growth rate”

The deal also needs to be seen in context with the progress AstraZeneca has recently made in China. Last month, it signed an exclusive license agreement for obesity treatment with Shanghai-based Eccogene.

In recent months, key treatments such as cancer treatment Imfinzi, which accounts for more than 9% of the company’s sales, have also received approval in China. Similarly, Soliris, for certain neurological diseases, is also part of AstraZeneca’s rare disease portfolio and has received national approval. Additionally, this treatment contributed a notable 7.2% to the company’s revenue in September 2023.

limited financial impact

However, the acquisition hasn’t changed prices much, which isn’t surprising at all. Typically, the acquirer’s stock falls on such news. However, this is a relatively small acquisition for the company, or what we call a “top-up” acquisition.

The cash payout for Gracell represents just 21% of AstraZeneca’s cash and cash equivalents as of September 30, 2023. Additionally, as a pre-revenue company, we do not expect any impact on sales at this time. However, for now, the company’s profits will decline, with a loss of US$68.1 million over the next twelve months (TTM). However, even this is only 1.15% of AZN TTM profit.

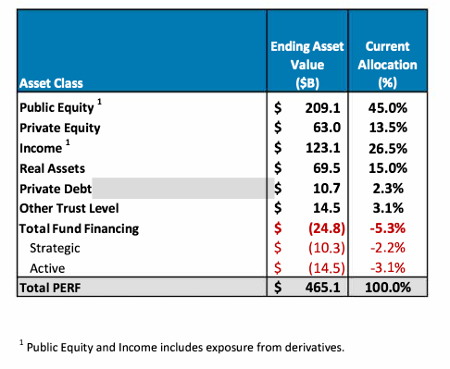

After that, the stock’s TTM P/E will not be significantly affected as it will rise from the current level of 35.1x to 35.3x. Looking at the stock in terms of all other market multiples, it still looks attractive compared to its five-year average (see table below). In its latest update, the company upgraded its outlook for both revenue and earnings, which is positive for AstraZeneca.

pursue alpha

In summary

It’s clear that the latest developments are more important to Gracell Biotechnologies stock than AstraZeneca. And that was to be expected. GRCL is a pre-earnings company, so the purchase price is significantly higher than the pre-announcement trading price.

The price is still below the IPO price, but still looks fair compared to where it has been trading over the past year. The acquisition also places GRCL within the purview of a leading oncology company, which could be mutually beneficial for both companies. However, with shares of Gracell Biotechnologies Inc. rising almost to acquisition price, there is little trading opportunity here. So I’ll put GRCL on hold.

Through this contract, AstraZeneca will further advance into the Chinese market, the second largest pharmaceutical market after the United States. AstraZeneca is already making full-fledged inroads into China through pharmaceutical cooperation and approval.

Costs to the company are also limited, and the stock price hasn’t moved much since the announcement. Even taking into account the impact of GRCL, the company’s cash position and profits will continue to look strong. The TTM P/E rises slightly following the latest financials for both companies, but not enough to change the outlook for AstraZeneca in any way. I gave it a Buy rating last time I checked and I am maintaining it. In conclusion, it is a win-win for both companies at the moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.