Investing in 2024: 3 promising opportunities to watch | chart watcher

key

gist

- The stock market ended 2023 in a slump despite inflation concerns.

- Small-cap stocks and emerging markets are moving out of trading ranges, so look for value plays in these asset groups.

- Bitcoin has soared and this trend is likely to continue in 2024.

The last trading day of the year has arrived. Now is the time to relax, get ready for the new year, reflect on stock market trends, and set investment goals for 2024.

2023 has been a particularly difficult year for investors. At the beginning of the year, investors were concerned about an economic recession caused by high interest rates, there were strong concerns about inflation, and we also experienced a regional banking crisis. The way the situation has developed has raised concerns, especially with regard to the Middle East conflict, but things have turned around in the last quarter and the year has ended on a positive note.

interest rate

Treasury yields fell about 1 percentage point after reaching levels not seen since 2007. This helped the sluggish bond market, which finally showed signs of life. The weekly chart of the iShares 20+ Year Treasury (TLT) below shows that the bond still needs to move higher to confirm its upward trend. A break above the first resistance level at TLT’s previous high at 105.50 would be a more convincing signal. However, it is encouraging to see that iShares 20+ Year Treasury (TLT) is trading above its 50-week simple moving average. (SMA).

Chart 1. Weekly chart of TLT. Bond prices benefited from falling Treasury yields. Despite TLT trading above its 50-week simple moving average, a break above 105.50 confirms the upward trend. Chart source: StockCharts.com. For educational purposes.

At the last Federal Reserve meeting, Chairman Jerome Powell said a rate cut could occur before inflation reaches the 2% target. This was enough to send investors flocking to the stock, especially in the AI space. Investors are confident that a few large technology stocks will make great strides in AI technology. Affectionately known as the Magnificent Seven, these stocks have driven most of the stock market rise.

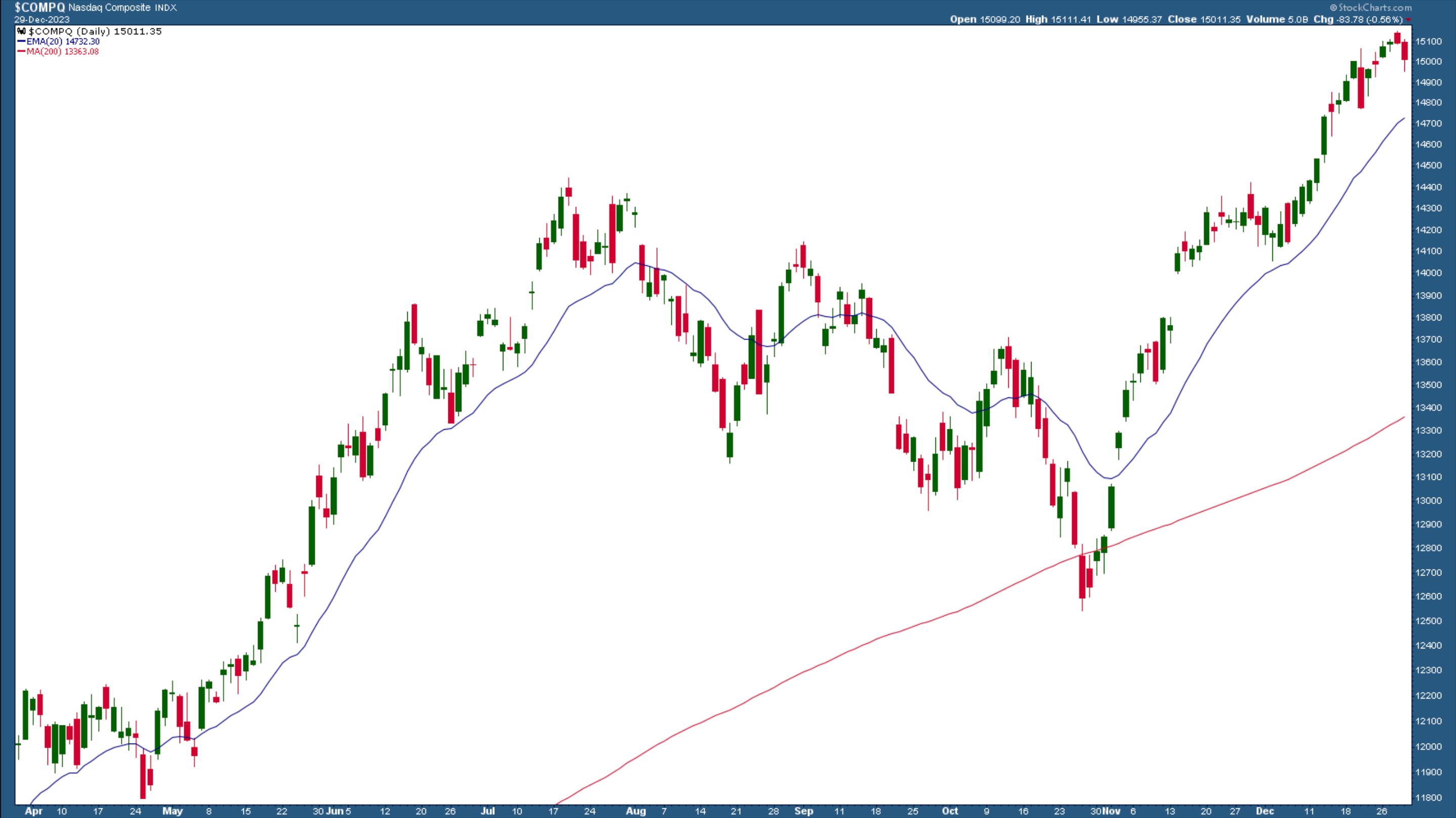

The stock market ended the year with a bang, with the Dow Jones Industrial Average ($INDU) up 13.7% this year, the S&P 500 ($SPX) up 24%, and the Nasdaq Composite up 43.6% (see daily chart below). . ), the clear winner of the three broad indices.

Chart 2. Daily chart of the Nasdaq Composite Index. AI euphoria led to a spectacular rise in the Nasdaq Composite Index, which had the largest gain of the three composite indexes. Chart source: StockCharts.com. For educational purposes.

Given all the positive data, the stock market is expected to continue rising in 2024. The Santa Claus rally is on track, which means a year-end boost. Expectations for revenue and earnings are high, and the market has priced in a rate cut. However, there are other sectors of the stock market that investors can benefit from in 2024.

trade the world

Next year will be a record-breaking election year, with more than half of the world’s population heading to the polls. This is a reminder that investors can benefit from international stocks. As you can see in the iShares MSCI Emerging Markets ex China ETF (EMXC) chart below, emerging markets outside of China have been on the rise so far. After trending downward for most of 2022 and then sideways for most of 2023, emerging markets are starting to break out of a trading range. Their price action is similar to that of U.S. small-cap stocks, another area to watch in 2024.

Chart 3. Daily chart of ISHARES MSCI EMERGING MARKETS EX CHINA ETF. Emerging markets have had a difficult 2023, but are staying out of their trading range. Chart source: StockCharts.com. For educational purposes.

The three countries performing well in 2023 are India, Japan and Mexico. These three markets could continue to rise, but if other emerging markets start to show signs of catching up with these three, there could be good value to be found here.

If you plan to invest outside the US, follow the US dollar closely. Although the US dollar has weakened, it is still relatively high. A weaker dollar means easier financial conditions, but it also benefits developing countries. The bigger question is whether the US dollar will maintain its 200-day SMA or fall below it.

Bitcoin

Bitcoin price plummeted in 2022. It reached a high of 69,355 in October 2021 before falling to a low of 14,925 in November 2022. Rising interest rates, the Sam Bankman-Fried scandal, the FTX collapse, and regulatory crackdowns have taken a toll on cryptocurrencies. price. Afterwards, Bitcoin soared and hit a 52-week high of 45,260. Some of these moves may be related to possible regulatory approval for a spot Bitcoin ETF, which would open the door to a larger investment pool.

Based on the Bitcoin vs. US Dollar ($BTCUSD) weekly chart below, the cryptocurrency could rise further. After breaking above $30,000, there was no turning back until it reached a 52-week high of $45,260. The cryptocurrency has now plateaued and is forming a pennant.

Chart 4. Weekly chart of Bitcoin against the US dollar. A break above the pennant formation could push $BTCUSD to an all-time high of $69,355.

A breakout above the pennant formation could see Bitcoin move 42.6% higher by the length of the flagpole. That means it rises to $61,275, near its all-time high. If it continues to rise, Bitcoin has the potential to hit new all-time highs. Of course, things could go the other way. Bitcoin could fall below the pennant formation and fall below the $30,000 level.

conclusion

AI growth, emerging markets, and Bitcoin are three areas to watch in 2024. Before 2023 ends and the new year begins, it’s a good idea to set your investment goals for 2024. That means looking at large-cap technology, small-cap stocks, bonds, emerging markets, and Bitcoin, and be prepared to sell underperforming assets and add assets that may be interesting to your portfolio.

As small-cap stocks and emerging markets (excluding China) move out of their trading range and interest rates fall, financials and other small-cap stocks will likely do well in 2024, as will bonds and emerging markets. A lot will depend on how elections around the world play out. Geopolitical tensions may increase, which may impact supply chains and trade restrictions. This can cause volatility in stocks, so it’s a good idea to add uncorrelated asset classes like Bitcoin or gold to your portfolio. It is always good to have a healthy balance of different asset groups.

If there is one word that summarizes the investment strategy for 2024, it would be diversification. And finally, it is important to review last year’s trading resolutions..

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.