Year-End Portfolio Review: 9 Stocks, 6% Above The S&P, And 3 Resolutions

Wirestock

This year, I grew increasingly unsatisfied with the market cap weighting of the S&P index fund (SPY), which is focused heavily on the Magnificent 7, and since I am more experienced at picking stocks than at selecting mutual funds, I decided to return to active management. I made this change over the course of the fall. Here are the results so far:

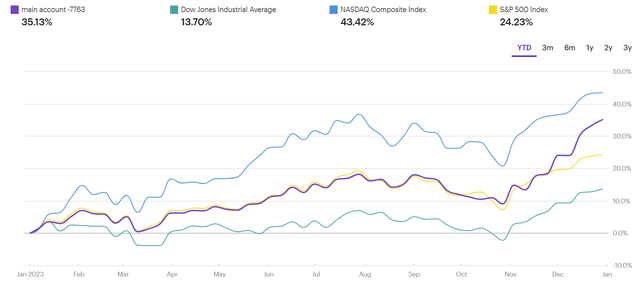

Main Account

etrade

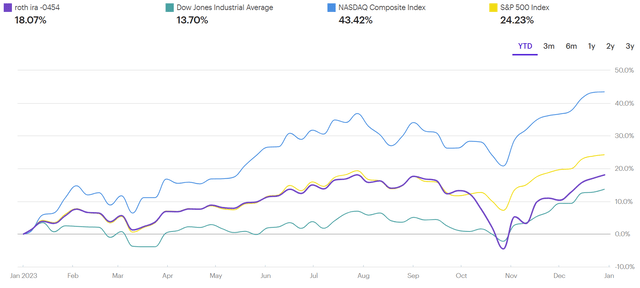

Retirement Account

etrade

Taking the weighted average of these two portfolios (with the main account comprising 66% of the total), I achieved an overall return of 29.33%, beating the S&P 500’s 24.26% return by over 5%.

I didn’t move my money from SPY into individual stocks until September and October, which is why my performance tracked the index until then. As you can see, most of my outperformance came from several holdings which soared in the year-end rally. Here was my portfolio breakdown, as of 12/31/2023:

| Ticker | Nickname | Weight | Return | S&P | vs. S&P | w. divs |

| MRNA | Moderna | 8.3% | -11.0% | 7.1% | -18.1% | -19.6% |

| VFC | V.F. Corporation | 8.2% | 6.7% | 11.2% | -4.6% | -3.8% |

| DIS | Walt Disney | 8.2% | 5.6% | 7.1% | -1.5% | -2.3% |

| PEAK | Healthpeak Properties | 8.2% | 7.6% | 11.2% | -3.6% | 1.4% |

| ABG | Asbury Automotive | 11.1% | 7.5% | 5.5% | 2.1% | 0.6% |

| NICE | NICE | 9.1% | 16.2% | 10.0% | 6.2% | 4.7% |

| RTX | RTX Corporation | 8.9% | 18.0% | 11.2% | 6.8% | 8.6% |

| MAMA | Mama’s Creations | 13.9% | 25.9% | 4.3% | 21.6% | 20.1% |

| USB | U.S. Bancorp | 9.8% | 34.0% | 11.2% | 22.8% | 27.1% |

(‘S&P’ is the index’s return since the date I purchased shares in the relevant company; vs. S&P compares the stock’s return to the index since then, and ‘w. divs’ includes dividends in that comparison.)

In addition to these holdings, which made up 86% of my portfolio, I also had a small amount in bonds (10%) and cash (4%). This basically matches my target allocation, since I am investing for the very long-term and have a relatively high risk tolerance. The portfolio outperformed its index, even while being only 85% invested in equities, and having no exposure to the Magnificent 7, which drove a significant portion of overall gains in the S&P this year. Since I was under-invested in tech stocks, I don’t think that the Nasdaq is a suitable benchmark.

I had some good “beginner’s” luck this fall. Below, I survey my strategy, the results, my thesis for each holdings, and why I sold stakes in BBWI, OTCQX:GTBIF, and BTI. Then I discuss my plans for 2024.

Resolution #1: Sell Less

It is important to conduct “inertia analysis” to see whether or not individual decisions you made improved your results. In my case, my purchases in 2023 were better than holding the S&P, but my sales did not improve my returns.

I sold three positions quickly in the space of the last few months:

| Ticker | Nickname | since sold | Return | S&P | vs. S&P | w. divs |

| BBWI | Bath & Body Works | 47.0% | -11.5% | 4.1% | -15.6% | -15.6% |

| GTBIF | Green Thumb Industries | 7.2% | -5.6% | 11.2% | -12.1% | -12.1% |

| BTI | British American Tobacco | -8.7% | -0.3% | 4.1% | -0.3% | -0.3% |

BBWI: I bought Bath & Body Works because I thought the market was too bearish on their prospects. While many of their stores are in malls, their sales per square foot is very high, their D2C business is growing, and they have very high brand recognition. After they reported Q3 results, the stock was flat, and I sold. Since so many other retail stores had great quarters, I figured that this was a solid sign that BBWI was lagging. I also talked to several friends who all confirmed that BBWI’s brand is deteriorating. But when the company filed Q3 results the following week, shares started a long run up, which hasn’t ended yet. I sold too soon, and lost out on a huge rally. While I think this will end up having been a good decision, it definitely looks like a mistake today.

BTI: I bought BTI on the thesis that its future cash flows were underappreciated, and that the stock had sold off unfairly due to higher interest rates making its dividend yield less attractive. But as I watched shares trade in October and November, I realized that BTI was not responding to interest rate news. In fact, it is slumping because (1) the growth prospects for the legacy cigarette business are bad and getting worse, and (2) the company is burning through the cash that business generates in their quest to win a war for the much less profitable (and increasingly regulated) “next-gen products” (vapes, etc.) business. Shortly after I sold, BTI announced a $31 billion write-down on its brand assets. While BTI may be undervalued, I now think that there is no catalyst to drive up share prices, because there is such a strong secular decline in the industry. I don’t think the dividend is worth tying up capital here, and I expect BTI to underperform.

OTCQX:GTBIF: I bought GTI because of my optimism about the long-term growth of the cannabis industry, but then gradually learned that this may not make GTI a profitable investment. There has been a lively discussion on SeekingAlpha about the fate of cannabis stocks, especially GTI. While this was initially one of my highest-conviction picks, I realized several things after I purchased. First, the rescheduling of marijuana and the removal of the 280e provision, under which cannabis companies cannot deduct their business expenses from taxes, is probably already priced in. If you look at the share price jump which happened after the HHS recommended rescheduling in August (about 40%), and calculate what this meant in terms of GTI’s valuation ratios, I think it shows that the market is already pricing in a ~80% chance of rescheduling. This means that for the next year, owning GTI is basically a binary bet on what the government will do. I do not like binary bets. I then started doing some of my own research on the health effects of cannabis, and learned that about 10% of users develop cannabis use disorder, a percentage similar to that of opioid use. While I agree with the scientific consensus that cannabis has some medical uses and is only moderately harmful, I think the dangers of cannabis use make complete descheduling less likely than people might think. This fear was confirmed when the DEA started allocating additional funding for cannabis research in late October. I think this is evidence that the federal government has reservations about descheduling. The final reason to sell was that I learned that total descheduling and deregulation of interstate marijuana sales will probably lead to a price war, as it has in Canada, destroying industry profit margins. Since GTI has no strong brand or pricing power, this means that the medium-term outlook would be very dim, unless the government loosens up marijuana regulation just enough to allow profitability, but not enough to allow competition. I don’t make bets on binary regulatory decisions, so I sold.

Overall, I’m happy with my sell decisions, since I used the proceeds to buy stronger companies. For these three sales, the average performance since I sold has been 15.2%, whereas the average performance of the companies I purchased with the proceeds was 16.7%. Time will tell if these trades will improve my performance.

In 2024, I resolve to be even more reluctant to sell, since evidence overwhelmingly shows that most investors do worse the more they trade, and since much of my outperformance in 2023 will be lost to capital gains taxes.

Resolution #2: Hold the Winners

Six of my nine current holdings are outperforming the S&P, including dividends, as of 12/31/2023. Of those, three are beating it by more than 5%:

| Ticker | Nickname | Weight | Return | S&P | vs. S&P | w. divs |

| RTX | RTX Corporation | 8.9% | 18.0% | 11.2% | 6.8% | 8.6% |

| MAMA | Mama’s Creations | 13.9% | 25.9% | 4.3% | 21.6% | 20.1% |

| USB | U.S. Bancorp | 9.8% | 34.0% | 11.2% | 22.8% | 27.1% |

USB: I bought U.S. Bancorp because it is widely regarded as one of the best regional banks. It pays a high dividend and has a strong economic moat. It is large enough to benefit from economies of scale, but is not a GSIB, and therefore has less onerous capital requirements than its bigger competitors. And since banks sold off this spring, I was looking for a way to buy into the oversold financial sector. After a 34% gain in only a few months, some are saying that it is “a great time to exit.” But my initial thesis is intact, and with interest rates coming down, I think there is more room to run for USB. It is currently consolidating recent gains at a resistance point around $43, but I don’t think this means that the current bull run is over.

MAMA: MAMA was recommended by SeekingAlpha’s Steven Cress in August based on its strong quant scores. After I did my own bottom-up fundamental analysis of the company this fall, I concluded that it has strong growth prospects and appreciation potential, and I built a large position. That choice has turned out to be a good one. Since buying, I’ve sampled the products with friends and family and been impressed by their quality. And Q3 results beat expectations, and the ongoing reorganization and build-out of the sales team looks poised to turbocharge sales growth in 2024 and beyond. While the near-term prospects for MAMA shares are slightly less exciting after a 20% run-up in December, I remain bullish on the company’s long-term prospects.

RTX: RTX, like USB, was a purchase I made to capitalize on a market overreaction. The stock sold off by almost 30% between July and October after announcing a recall of some of its Pratt & Whitney jet engines. This was a classic case of market overreaction: one of America’s most trusted and entrenched defense contractors has a one-time recall and the market reacts as if the company is permanently impaired. I was lucky to buy close to the bottom, and as the recall has come under control over the last few months, the share price has recovered. The company’s long-term growth trajectory remains intact, and I plan to hold until a higher valuation makes future expected returns significantly lower than they are now.

Overall, I used two different strategies in 2023. First, I bought high-quality businesses with durable economic moats which have seen temporary hiccups, like USB and RTX. One other name I watched in Q4 was ResMed (RMD), which recovered significantly from the lows it hit when investors were panicking about the impact of weight-loss drugs like Ozempic.

Second, I began experimenting with a small-cap growth strategy, focused on highly profitable and fast-growing micro-cap stocks with the potential to become multibaggers. I have my eye on several other potential investments that fit these criteria. To read my coverage of them in 2024, please consider following my account.

In 2024, I remain committed to holding on to these winners.

Resolution #3: Be patient with the rest

| Ticker | Nickname | Weight | Return | S&P | vs. S&P | w. divs |

| MRNA | Moderna | 8.3% | -11.0% | 7.1% | -18.1% | -19.6% |

| VFC | V.F. Corporation | 8.2% | 6.7% | 11.2% | -4.6% | -3.8% |

| DIS | Walt Disney | 8.2% | 5.6% | 7.1% | -1.5% | -2.3% |

| PEAK | Healthpeak Properties | 8.2% | 7.6% | 11.2% | -3.6% | 1.4% |

| ABG | Asbury Automotive | 11.1% | 7.5% | 5.5% | 2.1% | 0.6% |

| NICE | NICE | 9.1% | 16.2% | 10.0% | 6.2% | 4.7% |

While it’s tempting to get frustrated and sell companies which have not outperformed, I remain convinced that these holdings still offer the potential for outsized returns in 2024, and I’m holding on to them until they reach my price targets or new results invalidate my initial investment theses.

NICE: NICE, an Israeli customer service center software provider, is a AI and cloud technology play. Call centers are a mission-critical function for most companies, and NICE’s cloud-based call center software incorporates AI to improve efficiency, providing a strong value proposition to its customers. They are a market leader in this space, and shares jumped after Q3 results showed YOY growth of over 20%. I remain convinced that this is one of the more attractive applications for cloud computing and AI. But I’m also keeping an eye on competition from AWS (AMZN), as well as NICE’s valuation.

ABG: Asbury Automotive continues taking market share. I wrote up my thesis for the investment on SeekingAlpha here, and I remain convinced that the market is missing the point with this company. While car sales are important, ABG’s strength comes from the fact that it has excellent back-end operations which give it above-average profitability, enabling the company to continually take market share. As the auto industry normalizes over the next few years, I remain optimistic that investors will realize that ABG’s growth story remains intact, and re-rate the stock accordingly. I decided to buy ABG instead of Lithia Motors (LAD), because I believe it’s a superior business and will outperform in the long term. But over the last few months, LAD’s cheaper starting valuation led it to significantly outperform ABG.

PEAK: I bought PEAK because it is trading at a historically large discount to its NAV, has a very high dividend yield (nearly 6%), and its clients are mostly large, dependable medical and pharma companies. Today, REITs remain one of the cheapest parts of the market. PEAK has some exposure to commercial real estate and San Francisco, both of which give me cause for concern. But I think that these risks are more than priced in at current levels, and rate cuts in 2024 are likely to make REITs a good investment.

DIS: I bought Disney because I Bob Iger would be able to turn the ship around. Despite all the hype and talk about this stock in Q4, this basic thesis remains intact. Q3 results beat expectations, and Iger’s plan makes sense to me. He hasn’t announced all of his plans, which is a good move given that he wants to keep options open for future asset sales. At the same time, I’ve realized just how much less profitable streaming will be than cable. I think Iger can continue to improve Disney’s profitability in 2024, but I remain unconvinced that Disney is a good long-term investment beyond the turn-around.

VFC: Another turn-around play is V.F. Corporation, which owns Vans, The North Face, and numerous other lifestyle brands. The new CEO, Bracken Darrell, is working to cut costs, right the ship at Vans, and slim down VFC’s portfolio of brands. Nothing has really happened yet. Management withdrew 2024 guidance, which I think makes sense given that they are not trying to maximize short-term results right now. They cut the dividend, which makes sense given VFC’s high debt load. And two activist investors bought shares, outlining theses basically similar to mine: VFC has a strong portfolio of brands which, if managed well, can regain some of their former glory. I held on as shares dropped from $18 to below $14 twice, and was rewarded when they bounced back to $18 each time. This thesis will require more time to play out.

MRNA: The same is true for Moderna, my biggest loser this year. MRNA was the reason that my retirement account underperformed the S&P. I bought in around $110 and promptly watched the stock drop to almost $60 as they revised COVID guidance down. This undoubtedly increased the company’s value. But it was largely irrelevant to my thesis, which is that Moderna’s pipeline of drugs will translate into a large, stable revenue stream in the next 3-5 years. In fact, there was good news this fall about MRNA’s pipeline. MRNA gets very high marks from its employees and has excellent internal processes. I think many COVID investors probably sold their shares in 2023. Now, patience is required as the company transitions into a new era.

Overall, most of my holdings have basically tracked the S&P in Q4. And for most of these businesses, nothing has fundamentally changed. My investment theses remain intact, and it’s simply a matter of waiting.

2024 Plan: patience and balance

In 2024, my first priority is being patient with my current holdings. I’ve adopted the following rules:

- boredom is not a reason to sell.

- do not sell because your investing philosophy changed.

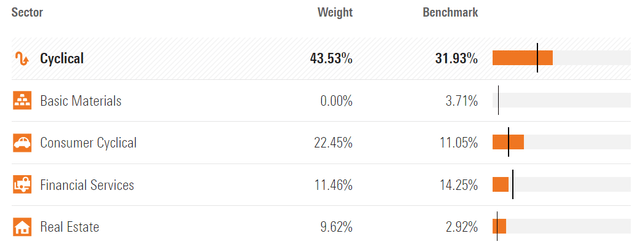

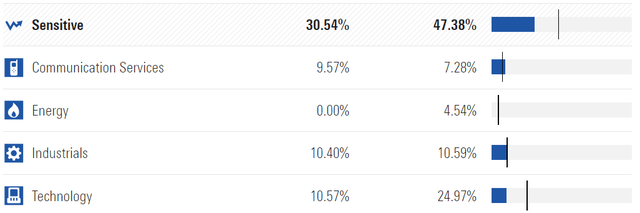

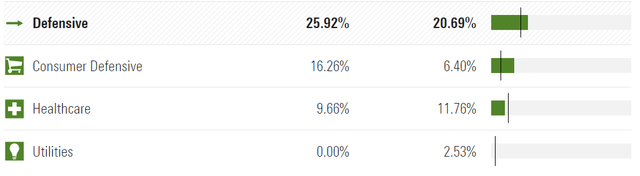

With available cash and additional savings, I plan to (1) buy more small-cap growth stocks and (2) rebalance my portfolio to mirror my benchmark asset allocation more closely. Since I don’t think I have an edge in predicting the direction of the macroeconomy or, therefore, in making sector allocation bets, I hope to mirror the overall allocation of my benchmark.

morningstar

morningstar

morningstar

I find consumer stocks easier to evaluate, and this fall I opened big positions in MAMA and ABG. In 2024, I will be looking elsewhere. I am currently assessing micro-cap opportunities in technology and energy, and should be writing about them here soon.

In 2024, I resolve to stick to the plan – holding my existing positions unless I have a strong fundamental reason to sell, and rebalancing the overall portfolio to avoid making an unintentional macro bet. Over the next few years, as I sell some of my current holdings, I will also be looking to increase my portfolio to around 20 stocks.

What to watch

I’m uncertain about the outlook for equities in 2024 (as is everyone else, unless they’re lying to you). Will VFC, DIS, and MRNA start to turn around? Will falling interest rates benefit PEAK and USB? Will growth at RTX, NICE, ABG, and MAMA meet expectations? I’ll look forward to following the results and discussing them with all of you

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.