How to build a resilient forex trading portfolio? – My Deal – December 27, 2023

How to Build a Diverse and Profitable Forex Trading Portfolio for Traders of All Experience Levels

introduction:

The foreign exchange market, or foreign exchange, is a global market that offers a wide range of trading opportunities for traders of all experience levels. However, due to the high volatility, it is important to manage risk effectively. The core strategy of this management is to build a well-diversified trading portfolio.

In this blog, we will look at a comprehensive approach to building a Forex trading portfolio, highlighting the relevance of correlation analysis and de-correlation strategies.

Diversification between different types of trading systems

A well-diversified trading portfolio should include a combination of different types of trading systems. This helps mitigate risk by exposing you to a variety of market strategies and approaches.

Some examples of forex trading systems include:

- trend system It is based on the idea that prices tend to move in one direction over long periods of time.

- inversion system This is based on the idea that if price moves too far, it tends to revert to the mean.

- scalping system Focus on generating small short-term profits.

- arbitrage system It is based on buying and selling assets in various markets to make a profit.

By incorporating different types of trading systems into their portfolio, traders can reduce their exposure to losses and increase their chances of making profits.

Diversification between different currency pairs

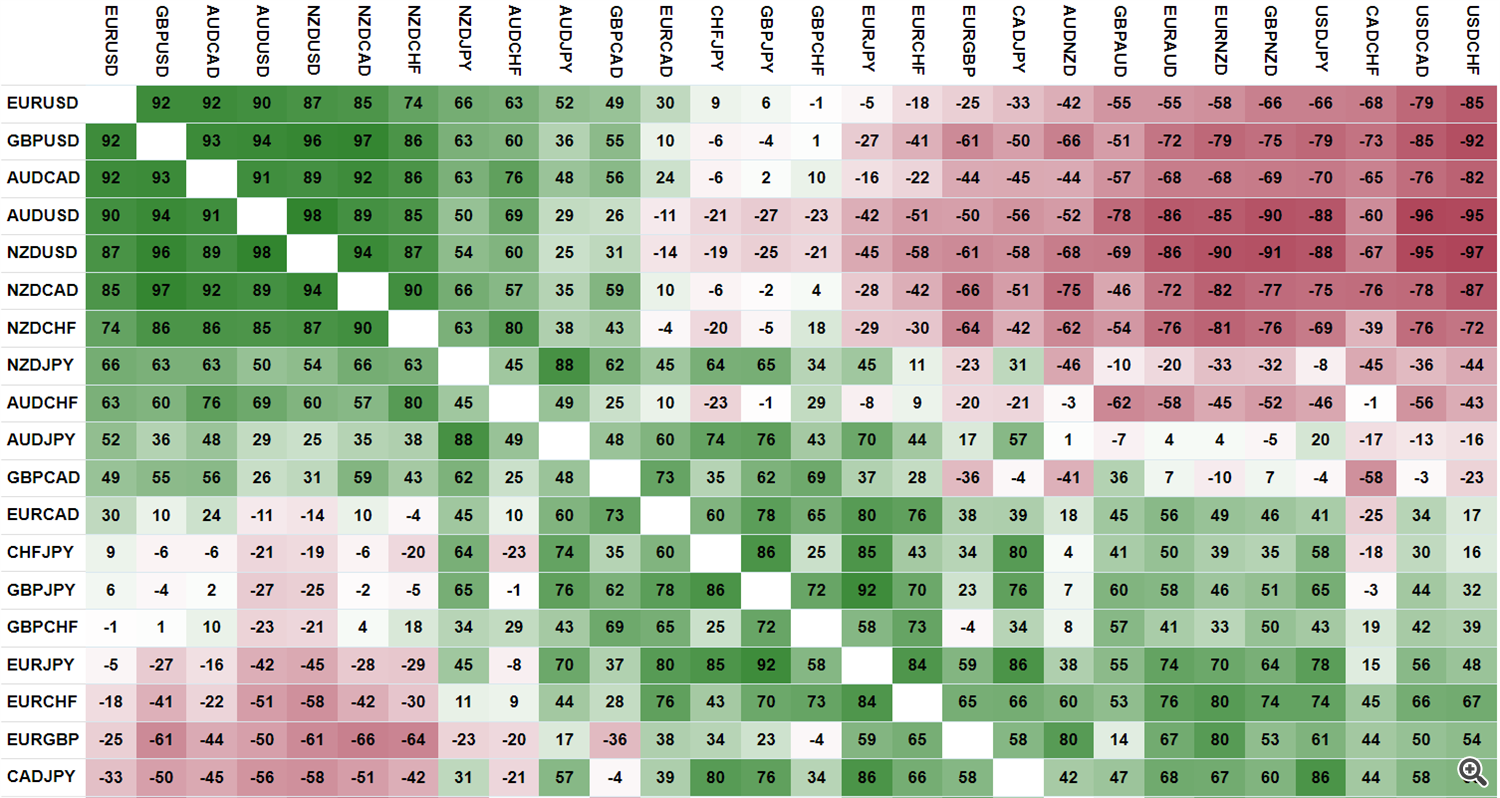

Another way to diversify your forex trading portfolio is to include a variety of currency pairs. This helps reduce the risk of correlation, which occurs when two assets move in the same direction.

Correlation between currency pairs can be measured using a scale from -100 to 100. Here, 0 indicates no correlation, -100 indicates a completely negative correlation, and 100 indicates a completely positive correlation.

Traders should look for currency pairs that have a low correlation with each other. This helps reduce the risk of losses in one currency pair being passed on to other currency pairs in your portfolio.

Application of correlation and decorrelation

To apply correlation and anti-correlation in building a trading portfolio, traders must follow these steps:

- Identify the trading system you want to use.

- Assess the correlation between the currency pairs you want to trade.

- Choose currency pairs with low loss correlation.

conclusion

Building a diverse and profitable forex trading portfolio is an important strategy for traders of all experience levels. By integrating different types of trading systems and currency pairs, traders can reduce risk and increase their chances of making profits.