Zen Ten – The Best Choice for 2024

baona/iStock (Courtesy of Getty Images)

Originally published: December 30, 2023

I have been publishing a Zen Ten list every December since 2008. I pick my favorites and stick with them all year long. There is no transaction.

Before revealing myself In order to recommend new stocks for 2024, a brief review of last year’s recommended stocks is necessary. Table 1 provides further details.

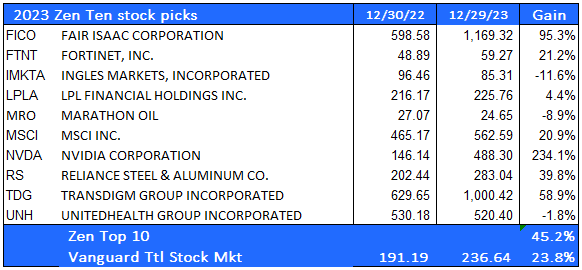

Table 1. Zen Ten performance in 2023

As you can see, my 2023 picks performed (2x better) than the benchmark VTI. I do not pick start and end dates selectively, I use the actual start and end dates for all securities, including VTI, as of the date I publish my listing.

Why you should pay attention to this list

I have been trading and managing money for 30 years. I’m still a stock picker, but that’s all I do now. For my own accounts, my family, and consulting clients who ask me to pick stocks.

I don’t claim to have any special talent for discovering the next Google or Amazon. I don’t have a crystal ball. I’m good at it, but it takes more than skill to get the results I get. You’ll also need a little bit of luck.

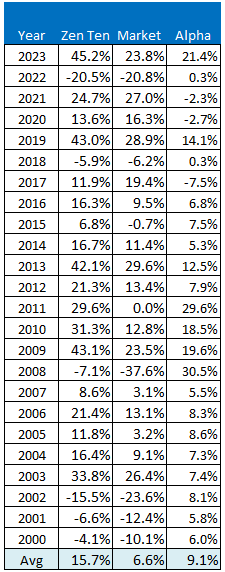

I have beaten the market by an average of 3.7% per year over the past 10 years. Since I started using this list with my clients in 2000, I have outperformed the market by an average of 9.1% per year.

Table 2. My complete record up to 2000

My winning record is not all down to luck. I have a system and it has been working since 2000. The problem, of course, is that any system can stop working at any time without notice. I’ll explain how my system works in a moment, but first, take a look at the results of my choices from 2000 (the first year I used client money) to 2023.

Besides skill and a little hard work, my success in stock picking is due to the rigorous methodology I follow no matter what. I’m not just throwing darts wall street journal Inventory table. There is a method to what I do. But anyone who beats the market repeatedly, as I have done throughout my career, will certainly have some edge. My strength is my methodology.

my methodology

Now let’s move on to the question of how I arrive at the stocks I choose. Over the past decade, I’ve published a list of stocks that I believe will perform solidly over the next 12 months. Finding these stocks is a matter of filtering the world of available stocks using three different criteria. Here is a brief review.

Starting with a universe of 8,000 stocks, we first select stocks that receive a 1 or 2 rating from Zacks Investment Research. This screen is all about earnings: growth, positive surprises, upward revisions, etc. This narrows the list of candidates to about 900.

Next, we cross-reference the Zacks list with Refinitiv’s top-rated stocks. The Refinitiv screen looks for the highest scores in value, quality, revenue growth, and financial stability. This complements the earnings focus of the Zacks screen. The list of candidates who passed both of these screenings has now been reduced to about 400.

Finally, we run the surviving names through StockRover screens and retain only those that score at least 80 points on a 100-point scale for profitability, sustainability and margin of safety. The screen consolidates the opinions of all analysts covering the stock, and over time gives more weight to the analyst who has proven to be the most accurate for each stock.

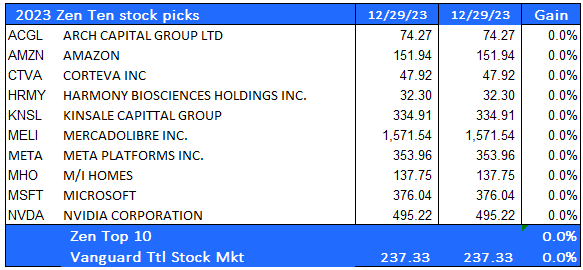

Here are 10 stocks that passed all three screens in 2024:

Table 3. My Top Picks for 2024

The advantage of this three-step screening process is that each screening focuses on a different aspect of what makes a stock attractive. This is a Bayesian approach to stock selection. We start with prior odds (Zacks Ranks has a track record of identifying winning stocks) and further refine the list by adding layers of uncorrelated screening criteria.

I didn’t spend months analyzing financial statements and visiting these companies in person. I’m leaving that to the analyst community. My methodology takes into account the consensus of top analysts and how their earnings estimates have changed over time.

final thoughts

I can be reasonably confident that these are solid companies with solid, growing revenues, and as long as you do your due diligence, they could be strong additions to your watch list. I don’t recommend anyone blindly follow my choices. Always do your own research.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.