Shifting Gears for the Future: Strategic Drive for Allison Transmission (NYSE:ALSN)

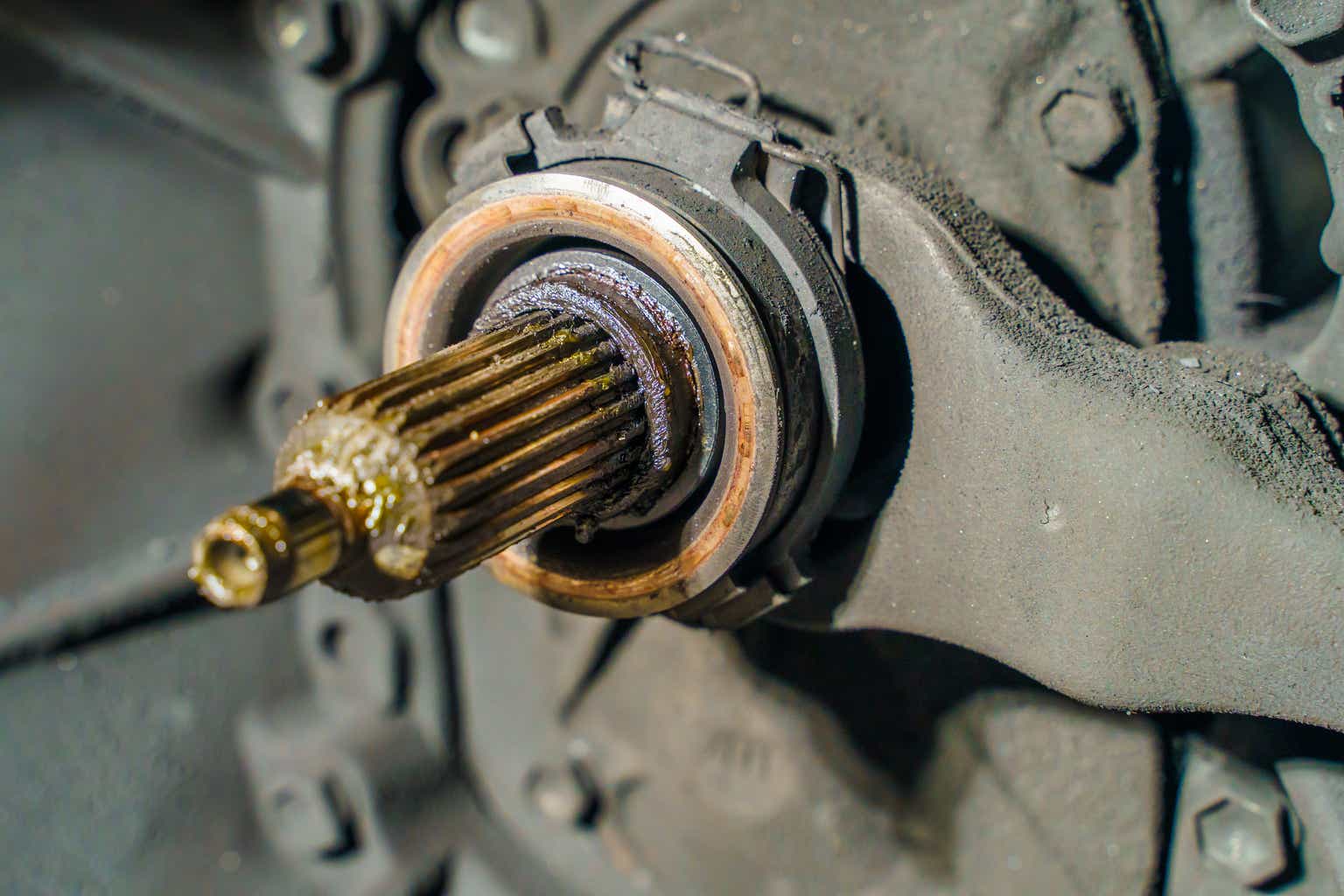

Warut Wetsanarut/iStock (via Getty Images)

proposition

Allison Transmission (New York Stock Exchange:ALSN) stands out as a potentially undervalued investment in the auto parts industry due to its strategic diversification into electric and hybrid technologies and strong financial performance. The company’s strong total Margin and significant revenue growth, combined with a forward-looking approach that adapts to evolving market trends, makes a compelling case for long-term growth and market leadership potential.

introduction

Allison Transmission is a renowned manufacturer of automatic transmissions primarily for commercial vehicles. They specialize in designing and manufacturing transmissions for trucks, buses, off-road vehicles, and military vehicles. The company is known for innovation and reliability in the field of medium-duty transmissions, and its products are widely used in a variety of industries, including transportation, construction, and defense. Allison’s automatic transmissions are especially prized for their durability, efficiency and ability to handle heavy loads, making them a popular choice in sectors where ruggedness and reliability are required. Vehicle performance.

financial performance

|

Quarter End |

2023-09-30 |

2023-06-30 |

2023-03-31 |

2022-12-31 |

2022-09-30 |

|

revenue |

736 |

783 |

741 |

718 |

710 |

|

Sales growth rate (YoY) |

3.66% |

17.92% |

9.45% |

11.49% |

25.22% |

|

revenue cost |

379 |

402 |

380 |

380 |

382 |

|

total profit |

357 |

381 |

361 |

338 |

328 |

|

Sales, General and Administration |

86 |

92 |

87 |

97 |

78 |

|

operating costs |

135 |

139 |

131 |

146 |

125 |

|

operating profit |

222 |

242 |

230 |

192 |

203 |

|

Net Income |

158 |

175 |

170 |

141 |

139 |

|

operating profit margin |

30.16% |

30.91% |

31.04% |

26.74% |

28.59% |

Source: Seeking Alpha (retrieved December 31, 2023). Multi-million dollar financing.

According to Allison Transmission’s third quarter 2023 earnings release, two notable trends in its financial performance are:

Strong Quarterly Performance Increases Sales: Allison Transmission achieved net sales of $736 million, up 4% year-over-year. This growth came despite initial challenges due to supply chain constraints and OEM closures in July. The company gained momentum at the end of the quarter, with August and September seeing higher sales than the previous months. These trends indicate resilience and a strong recovery in market demand following the initial disruption.

Significant Growth in Net Income and EPS: The company reported a 14% increase in net income and a 21% increase in diluted earnings per share (EPS), reaching $1.76. This growth outpaced revenue growth and highlighted our efficient operational management and successful strategies for pricing and cost management. This trend reflects the company’s ability to improve profitability even in a difficult economic environment.

The fundamental elements of this trend include effective management of supply chain issues, strategic price increases, and robust demand in specific market segments such as:

-

North American highways. This includes commercial trucks for road transport in North America. These trucks are designed for efficiency and comfort, which are critical on long-distance routes. Allison Transmission’s products in this segment focus on fuel efficiency and reduced maintenance costs.

-

Level 8 job. These are the heaviest trucks (GVWR over 33,000 pounds) used for certain jobs, such as construction or waste management. Allison’s transmissions in this category are built for heavy-duty use, providing durability and reliable power.

-

Medium truck. These trucks, which fall into the Class 6-7 range (GVWR 19,501 to 33,000 pounds), have a variety of uses such as delivery and service. It balances urban mobility with significant cargo capacity. Allison focuses on smooth operation and fuel efficiency in these truck transmissions.

The company’s efforts to diversify its product portfolio, including conventional and electric propulsion solutions, also played a role. The Electric Propulsion Solutions category represents a new wave of powertrain technologies focused on electric vehicles (EVs). Electric propulsion uses battery-powered electric motors instead of internal combustion engines. These systems are known to be more efficient, have lower emissions and have lower maintenance requirements compared to traditional ICE systems. Allison Transmission has expanded its product line to include electric propulsion solutions such as electric axles and hybrid systems.

future

On its earnings call, Allison Transmission highlighted several new and changed services and products the company plans to offer in the future. These include:

Allison announced a partnership with Mack Trucks for compressed natural gas (CNG)-powered Granite model trucks. This represents a move to support alternative fuel sources that may appeal to customers looking to reduce their carbon emissions or manage their fuel costs.

The eGen Flex system is an electric hybrid propulsion solution with the ability to switch to engine-off mode in specific areas using geofencing technology. The system was recently selected by the public transit system in Brownsville, Texas, indicating growing interest in hybrid technology in public transportation.

The launch of the eGen Power 85S, a fully electric e-axle for minibuses and light trucks, demonstrates Allison’s commitment to electric propulsion. This product is designed to meet the requirements of compact vehicle applications, expanding Allison’s footprint in the electric vehicle market.

These initiatives are beneficial to Allison Transmission’s business for several reasons:

By offering products that support alternative fuels and electric propulsion, Allison can reach a broader customer base, including those transitioning to green technologies. This diversification will help the company expand into emerging markets and reduce its dependence on the traditional internal combustion engine market.

By providing cutting-edge technological solutions such as electric axles and hybrid systems, Allison has established itself as a leader in innovation. This can strengthen the company’s reputation and competitive advantage in an industry that is rapidly evolving towards electrification.

Increasing environmental regulations and increasing global demand for reduced emissions are driving the demand for vehicles with a lower environmental impact. Allison’s new products align with these regulatory trends and market demands to increase sales and market share.

Investments in electric and hybrid technologies open up new revenue streams for Allison. As the adoption of electric vehicles accelerates, companies can leverage this change to potentially deliver significant long-term revenue growth.

Overall, these new services and changed offerings are strategic moves by Allison Transmission to stay ahead of the curve in a changing industry and position the company for continued profitability and growth in a future where electric and hybrid vehicles are expected to play a dominant role.

challenge

It is important to identify and monitor key risks that could challenge Allison Transmission’s optimistic outlook, especially as it considers its strategic shift toward new services and changed products. The main risks for the positive papers presented are:

One of the key risks is the rate of adoption of electric and hybrid technologies in the market. If the transition to these technologies progresses more slowly than expected or if customer preferences strongly favor conventional combustion engines, Allison’s investments in electric and hybrid solutions may not yield expected returns in the near term.

Developing new technologies such as electric axles and hybrid systems requires significant research and development. There is always the risk of encountering unexpected technical issues, which may result in delays or increased costs.

Additionally, the electric and hybrid vehicle market is increasingly competitive with numerous existing and emerging players. Allison must continue to innovate and deliver competitive products to maintain and grow market share.

Moreover, changes in environmental regulations and government policies regarding vehicle emissions and fuel types may have a significant impact on Allison’s business. Adverse policy or regulatory changes may have a negative effect on the demand for our new products.

evaluation

|

metric system |

allison transmission |

industry average |

S&P 500 Median |

|

Trailing P/S |

1.75 |

0.86 |

2.63 |

|

Lagging P/E |

8.26 |

16.89 |

25.22 |

|

gross profit |

0.48 |

0.18 |

0.41 |

|

Quarterly sales growth rate (YoY) |

0.2 |

0.45 |

0.04 |

|

Quarterly Profit Growth Rate (YoY) |

1.17 |

0.07 |

0.04 |

Source: Yahoo Finance. The industry median is calculated using data provided by 14 mid-sized companies in the automotive parts industry. Data were retrieved on December 31, 2023.

Allison Transmission’s trailing P/E ratio of 8.26 is significantly below the industry and S&P 500 medians, indicating potential undervaluation, especially considering its solid earnings and growth prospects. Allison demonstrates exceptional operating efficiency and revenue generation with a gross margin of 0.48, well above the peer and S&P 500 medians. The company’s year-over-year quarterly earnings growth rate of 1.17 is well above the industry and S&P 500 averages, reflecting strong financial strength that is not fully reflected in its stock price. Allison’s move toward electric and hybrid propulsion technologies positions it well for future market trends and new opportunities in green transportation, factors that are not yet fully reflected in the market. Allison’s large transmission innovations and expansion into new technology areas such as electric axles and hybrid systems suggest long-term growth potential that is undervalued at the current stock price.

With these statistics, I expect the P/S and P/E ratios to be close to the S&P 500 median.

conclusion

Based on my analysis, I am bullish on Allison Transmission. The company’s strategic shift toward electric and hybrid technologies aligns well with future industry trends, indicating long-term growth potential. However, the current low P/E ratio and high gross margins suggest that the market may not fully recognize this potential, presenting an opportunity for investors. Although risks such as market adoption rates and competition in the electric vehicle sector need to be monitored, Allison’s strong financial performance and innovative approach provide a solid foundation for optimism.