Emerging Market Links + The Week Ahead (January 2, 2024)

Nikkei Asia has reported that China’s spy agency is now watching for doomsayers, noting a recent post from an intelligence agency suggesting that even “those who explain the situation of China’s waning economy using objective facts and figures could come under pressure…” But leave it to Zero Hedge to report the article and put it more bluntly with this headline: China’s Spy Agencies Now Targeting The Country’s Economic Pessimists.

Meanwhile, the right leaning Brownstone Institute has a interesting piece calling out the hypocrisy of ESG by noting how SE Asia delivery platform stock “Grab Holdings Limited (NASDAQ: GRAB)’s business model is inherently not great for the safety of its drivers and the public… To make a buck, the drivers for Grab (and its competitors) have to be brave and aggressive on the road. Some are real daredevils – the Evel Knievels of Southeast Asia – as we (Myself included…) have personally witnessed…” And Grab is not yet profitable. But they have a detailed and glossy ESG report (74 pages with 5 pages dedicated to road safety…) which Brownstone critically dissects…

Finally, fund focused posts (containing links to EM funds having good commentary and noting the latest dates for such documentation to be posted) will only be emailed to paid subscribers, but will be linked to in these Monday posts. Partially pay walled posts compiling potential stock picks from other sources will be emailed – I am not sure yet if these will be weekly posts just yet.

$ = behind a paywall / 🗃️ = Archived article

🌐 EM Fund Stock Picks & Country Commentaries (December 28, 2023) $

Seafarer Capital Partners on finding EM stock picks, Baillie Gifford on SE Asia (+stock mentions), Van Eck Mexico trip report (+two stocks), Namibia stocks, fund docs mostly updated to November, etc.

🌐 Emerging Market Stock Picks, Tweets & Podcasts (December 2023) Partially $

Look beyond Chinese growth stocks, small & midsized Indian infrastructure + railway stock picks, Canada listed mining stocks focused on Latin America, up-and-coming helium-LNG stock, etc.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China drafts rules to tighten limits on monetization for online games (Caixin) $ Chinese gaming stocks regain some ground as Beijing softens rhetoric (FT) $

China is tightening the limits on the monetization of online games with new draft rules that could cut profits of domestic gaming companies, sending shares of Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) and NetEase (NASDAQ: NTES)., the country’s two largest publishers, tumbling.

Online games must impose limits on how much players can top up their accounts for in-game spending irrespective of their age and issue pop-up alerts for “irrational consumption behaviors,” according to the draft rules published Friday by the National Press and Publication Administration (NPPA). Details about the maximum top-up amount were not given.

🇨🇳 Chinese gaming firms unveil share buybacks after regulatory move unnerves investors (Reuters)

A slew of smaller Chinese gaming companies have announced share buybacks – plans seen as an attempt to reassure investors after the market was spooked by regulatory moves to clamp down on consumer spending on games.

That sent shares in gaming companies plunging and as of Monday evening eight companies had unveiled plans to buy back shares worth up to 780 million yuan ($110 million) combined, citing confidence in China’s gaming industry and the need to protect investors.

Among them, Shanghai-listed G-bits Network Technology Xiamen (SHA: 603444) saw its shares end up 2% on Tuesday but has lost 11% since the draft rules were published. Shenzhen-listed Perfect World Co (SHE: 002624) dropped 2% and has tumbled 16% since then.

🇨🇳 In Depth: China’s cloud giants seek profits abroad as domestic margins dwindle (Caixin) $

Cloud computing has become a new battleground in the China-U.S. fight for tech dominance.

China’s biggest cloud service providers, including units from Alibaba, Tencent and Huawei, are betting big on overseas expansion as profits dwindle in their saturated home market.

But as Chinese competitors push overseas, they are encroaching on the territory of global players such as U.S. giants Microsoft and Amazon, which dominate many markets around the world.

🇨🇳 Mynd.ai turns new page with completion of U.S. backdoor listing (Bamboo Works)

The former education business of gaming company NetDragon Websoft (HKG: 0777 / FRA: 3ND) hopes to entice investors with its rollout of software services next year for its classroom-based educational hardware panels

Mynd.ai (NYSEAMERICAN: MYND) has completed its listing on the NYSE American, taking over the publicly traded shell of a company that was wiped out by China’s education crackdown of 2021

The company’s main asset is the former education business of gaming company NetDragon, including an educational panel hardware unit and complementary software services

🇨🇳 Autohome looks for new mileage in used cars (Bamboo Works)

The company is preparing to offer used car dealer memberships, and hopes they will ultimately match the current 30% of its revenue that comes from new car dealer memberships

Autohome (NYSE: ATHM) is expanding its membership services to include used car dealers, and is also preparing a major expansion of its TTP used car trading platform

The company has opened 20 experience-oriented “Autohome Space” centers since launching the chain in September last year, including 17 in the last three months

🇨🇳 China’s ‘Amazon’ gets more animated with purchase from Tencent (Bamboo Works)

With a quarter of China’s online readers as customers, e-book giant China Literature (HKG: 0772 / FRA: C2X) announced it is buying its parent’s comics and animation unit

China Literature’s acquisition of Tencent’s comics and animation unit brings all of the latter’s long-form print and filmed entertainment assets under one roof

Tencent has been unloading loss-making businesses amid an ongoing crackdown on anti-competitive practices in China’s tech sector

🇨🇳 Dada Nexus (DADA.OQ) – Leading Chinese On-Demand Retail Platform Accelerates on Significant Runway (Pyramids and Pagodas)

A JD.com (NASDAQ: JD) subsidiary with growing economies of scale, unlocking growth potential at distressed valuations

Currently, we have established a trading position in Dada Nexus (NASDAQ: DADA) with average in-price of USD 3.12. Our target for the stock is to double to above USD 6.00. However, our view is that the stock could trade higher, on par with its peers as it demonstrates sustainable profitability structure.

🇨🇳 Nike challenger Anta faces fresh rivals in Chinese sportswear race (FT) $

🇨🇳 Shenzhou Intl (2313 HK): Nike Guidance Cut Presents An Opportunity (Smart Karma) $

Nike (NYSE: NKE) reported 2QFY24 results last week with a guidance cut, as the company cut FY24 full-year sales guidance to around +1%, compared to +mid-single-digit in the previous guidance.

Shenzhou International (HKG: 2313) saw its stock drop by 8% the following day, given that Nike is Shenzhou’s most important customer, making up 30% of Shenzhou’s sales.

Nike’s inventory is down another 14% yoy, and down high-single-digit compared to the previous quarter 1QFY24.

🇨🇳 Xtep makes big leap with takeover of Wolverine joint venture (Bamboo Works)

The sports shoe maker will buy out its joint venture that holds rights to the Saucony and Merrell brands in China

Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) will buy out its Wolverine China joint venture, whose Saucony brand running shoes turned profitable in the first half of this year

Strong third-quarter results failed to boost the company’s stock, as investors remain cautious about China’s sportswear market

🇨🇳 Haier Smart Home finds bargain in commercial refrigeration acquisition (Bamboo Works)

One year after becoming a blue-chip stock, the home appliance maker announced it will buy the commercial refrigeration business of U.S.-based Carrier Global Corp (NYSE: CARR).

Haier Smart Home (HKG: 6690 / SHA: 600690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) has agreed to acquire Carrier Global’s commercial refrigeration business for $640 million, translating to a relatively low price-to-earnings (P/E) valuation of 11

As a veteran of overseas acquisitions, the appliance maker will be looking to improve Carrier Commercial Refrigeration’s market-lagging performance

🇨🇳 Sinopharm Group (1099.HK) – Performance Pressure May Continue Until 2024H1 (Smart Karma) $

Sinopharm (HKG: 1099 / FRA: X2S1 / OTCMKTS: SHTDY)’s 23Q1-Q3 results were below expectations. The main reason for weak performance was due to the anti-corruption campaign, which led to profound and rapid changes in fundamentals and policy end.

In Q4, the impact of anti-corruption would weaken and traditional distribution business would recover. So, 23Q4 performance should be better than Q3, but 23H2 performance would still be worse than 23H1.

We lowered our forecast for 2023 – Revenue and net profit could achieve single-digit growth. Due to the high base in 23H1, growth in 24H1 could still be under pressure.

🇨🇳 Shrinking wealth manager Puyi finds big benefactor in insurance broker Fanhua (Bamboo Works)

Separate shareholder groups from the two publicly traded companies will each acquire a majority stake in the other through an equity swap

An equity swap will give a group of Fanhua (NASDAQ: FANH) shareholders 77% of wealth management firm Puyi (NASDAQ: PUYI), and a Puyi shareholder group 50.1% of Fanhua

The deal comes as Puyi struggles with shrinking revenue and ongoing losses

🇲🇴 Melco Resorts: Best Dice Roll In The Gaming Sector For 2024 (Seeking Alpha) $

Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) shares have been negatively impacted by its significant debt burden.

CEO Lawrence Ho has expanded the company’s footprint in Asia through debt, but faced challenges in Russia and Japan.

Despite the debt concerns, Melco Resorts is experiencing a strong revenue recovery in Macau and Manila, making it a potential investment opportunity.

🇰🇷 Kum Yang: Announces Its Shares Will Be Listed on the US Stock Market Through ADRs (Douglas Research Insights) $

On 27 December, Kumyang Co Ltd (KRX: 001570) announced that its shares will be listed on the US stock market in the form of DRs, resulting in its shares rising by 11.7%.

The listing of Kum Yang ADRs is likely to have a short-term positive impact on its share price as this is likely to reduce free float of local common shares.

Nonetheless, over the next 6-12 months, we expect Kum Yang’s share price to trade much lower (30% or more) as its shares are highly overvalued.

🇰🇷 Namyang Dairy Products: Long Legal Dispute to Be Finally Decided by Supreme Court in January 2024 (Douglas Research Insights) $

The Korean Supreme Court’s ruling on the stock transfer lawsuit between Hahn & Company private equity fund and Namyang Dairy Products Co (KRX: 003920)‘s Chairman Hong Won-Sik is confirmed for 4 January 2024.

The expectation of Hahn & Co winning this legal dispute has positively impacted the share price of Namyang Dairy Products.

The higher probability scenario is for the Korean Supreme Court to rule in favor of Hahn & Co, agreeing with the decisions of the two lower courts in Korea.

🇹🇼 Media IC Monitor: Himax Showing Relative Display Strength Thanks to Auto Exposure; CES Event Ahead (Smart Karma) $

Himax Technologies (NASDAQ: HIMX) shares have performed relatively well during December but have still significantly underperformed other fabless Media IC names over the last six months.

Comparing results data across all names, Himax has exhibited relative strength in Display IC revenue thanks to its strong position supplying automakers with automotive display technology.

Himax will be speaking at Nomura’s CES 2024 event and presenting its new edge AI camera products; This creates potential for positive news flow within two weeks.

🇹🇼 Silergy (6415.TT): Chinese Analog IC Could Raise up Prices by About 15%. (Smart Karma) $

A recent news report speculates that Analog Devices (NASDAQ: ADI) is planning to raise prices by ~20%.

Silergy (TPE: 6415 / OTCMKTS: SLEGF) is reportedly considering a price increase of over 15% in the Chinese market.

We believe that now is a good time to invest in Silergy.

🇸🇬 Grab Holdings (GRAB US) – Risks and Rewards in 2024 (Smart Karma) $

Grab Holdings Limited (NASDAQ: GRAB) looks set to move toward cashflow breakeven in 2H2024 having hit adjusted EBITDA breakeven in 3Q2023 as it successfully struck a delicate balance between growth and profitability.

The sale of 75% of Tokopedia by GoTo Gojek Tokopedia (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF) may mean more intense competition in Indonesia as it focuses on online delivery services but Grab is well-positioned to deal with this.

2024 will see the potential completion of the Transcab deal plus a potential acquisition in food delivery increasing scale and competitiveness. Valuations are attractive relative to growth and financial position.

🇸🇬 TDCX: Poor Visibility Into Near-Term Performance (Seeking Alpha) $

Note: TDCX (NYSE: TDCX) is a digital customer experience solutions provider.

TDCX continues to face growth headwinds and revenue decline, with no signs of recovery.

The reliance on its top client is dragging down the entire business and impacting growth.

Poor visibility into near-term performance and potential structural issues raise concerns about TDCX’s long-term growth profile.

🇮🇩 Indonesia’s Bank Mandiri ‘strikes back’ at fintech rivals (Nikkei Asia) $

Surging downloads and use of its two-year-old digital banking apps are boosting the confidence of Indonesia’s top lender Bank Mandiri (IDX: BMRI / FRA: PQ9 / OTCMKTS: PPERF) as fintech players try to retain existing customers while looking for more among the country’s large unbanked population, the bank’s president director told Nikkei Asia.

Darmawan Junaidi said that when he assumed his role in October 2020 at Indonesia’s largest lender by assets, both financial technology experts and customers had undermined the ability of traditional banks like Mandiri to stay abreast of digitalization in the financial sector.

🇧🇦 🇷🇸 Adriatic Metals: Excellent Reserve Update Significantly Extends The Mine Life (Seeking Alpha) $

(Bosnia & Serbia focused) Adriatic Metals Plc (LON: ADT1 / FRA: 3FNA / OTCMKTS: ADTLF) released a reserve update with excellent grades.

The reserve update adds 8 years to the mine life and increased the NPV by about 45%, with potential for further resource updates in the future.

We are still just a month from the first concentrate production.

🇦🇷 🇱🇺 Adecoagro: Stock Has Strong Growth Potential In 2024 (Seeking Alpha) $

Adecoagro Sa (NYSE: AGRO) is a South American agricultural and industrial company with a low valuation and strong expected growth for 2024.

The company’s business segments are expected to experience long-term steady growth.

Adecoagro is benefitting from an increase in farmland, favorable sugar prices, and the El Nino weather pattern, which has been conducive for productive crop yields.

🇧🇷 Valid Solucoes: A Super Cheap Brazilian Small-Cap Reaping The Benefits Of A Turnaround (Seeking Alpha) $

Note: The Company provides security printing services to financial institutions, telecommunication companies, state governments, and public agencies.

Valid Soluções (BVMF: VLID3 / OTCMKTS: VSSPY), a Brazilian multinational company, has seen its shares surge by 145% on the Ibovespa (Brazilian stock market) this year.

Recent strategic initiatives include a capital structure transformation and operational focus on three primary verticals: Identification (ID), Payments, and Mobile.

The company achieved notable improvements in EBITDA margin and overall profitability through a series of strategic acquisitions and divestitures, optimizing its business operations.

Despite substantial share appreciation, Valid’s ADRs are deemed undervalued according to the Graham model, incorporating a significant margin of safety even when considering the Brazil equity premium risk.

Valid ADR, accessible to global investors, trades on Pink Sheets, presenting liquidity and information challenges.

🇧🇷 Atlas Lithium: Progress Has Been Made (Rating Upgrade) (Seeking Alpha) $

Atlas Lithium Corporation (NASDAQ: ATLX) has secured $50 million in investments and is set to begin production next year.

The company operates in Brazil and has two key projects: the Minas Gerais Lithium Project and the Northeastern Brazil Lithium Project.

The demand for lithium is expected to steadily increase, and ATLX is well-positioned to be a major supplier in the Brazilian market.

🇧🇷 Atlas Lithium Corporation: Almost Set For Commercial-Scale Production In 2024 (Seeking Alpha) $

Atlas Lithium Corporation (NASDAQ: ATLX) has experienced a surge in its stock price due to growing global demand for lithium and increased resource mobilization for its Brazilian mines.

The company has secured funding for its first lithium production, which is scheduled for Q4 2024, and aims to produce at least 300,000 tons of battery-grade spodumene concentrate per year by 2025.

Atlas Lithium has formed strategic partnerships with Chinese firms Chengxin Lithium Group (SHE: 002240) and Sichuan Yahua Industrial Group (SHE: 002497), who are key suppliers of lithium hydroxide to EV companies such as Tesla.

🇧🇷 Multiplan Empreendimentos: A Great Bet On Brazilian Malls, But Beware Of Valuations (Seeking Alpha) $

Multiplan Empreendimentos Imobiliaris SA (BVMF: MULT3) is a Brazilian real estate development company specializing in shopping malls with a substantial portfolio spread across seven states in Brazil.

The company shows post-pandemic recovery, with good operating results and excellent cash generation, and appears to have its indebtedness under control.

The shopping center sector in Brazil has experienced significant growth, but challenges such as macroeconomic factors and e-commerce competition could impact Multiplan’s operating margins.

Despite retail sector slowdown, Multiplan’s Q3 2023 results show revenue growth, with same-store sales up 8% and an impressive 96.1% occupancy rate.

Multiplan’s valuation analysis, considering historical ratios, suggests its shares might be overvalued, with an intrinsic value of $11.63.

🇧🇷 Vitru Grows Market But Returns Remain Muted (Seeking Alpha) $

See: Vitru Limited (NASDAQ: VTRU): Positive Momentum for Brazil’s Leading Distance Learning Higher Education Provider

Vitru Limited (NASDAQ: VTRU) provides distance education courses in Brazil and has a hybrid approach combining online courses with periodic in-person meetings.

The company has a broad footprint with over 2,400 hubs in Brazil and operates in a large and distributed market.

While Vitru has made acquisitions and grown revenue and operating income, there are risks including ongoing long-term currency depreciation and political volatility in Brazil.

My discounted cash flow analysis indicates the stock may be fully valued at its present level, so I’m on Hold for Vitru Limited shares.

$ = behind a paywall

🇨🇳 Analysis: China’s spy agency now watches for doomsayers (Nikkei Asia) & China’s Spy Agencies Now Targeting The Country’s Economic Pessimists (Zero Hedge)

China’s leadership earlier this month held its annual conference to set economic policies for the coming year, but it was the intelligence agency that first reported what was decided there in detail.

Among the takeaways is this: A structural shift in China’s economic policy planning is likely taking place.

The recent post hinting at a possible crackdown suggests that even those who explain the situation of China’s waning economy using objective facts and figures could come under pressure. In the worst-case scenario, they risk being detained if they say too much.

Now when researchers and Chinese bureaucrats above a certain level meet foreign nationals they are subjected to a strict screening process and monitored for fear they might leak information.

🇨🇳 EM by EM #36: What Goldman got wrong about China in 2023 (Smart Karma) $

Main conclusions up-front: It’s getting harder to disentangle politics from price movements in China, with the government becoming more involved in the equity market.

In stark contrast to their U.S. counterparts, Chinese banks are grappling with the weight of growing savings from consumers and businesses.

This surge is impacting their profitability, while the real estate sector’s challenges continue to linger.

🇨🇳 Foreign investors unwind $33bn bet on China growth rebound (FT) $

🌏 2023: Year of the great recovery for Asia casinos (GGRAsia)

🌐 Will emerging market equities play catch-up? (FT) $

🌐 ESG, DEI, and the Rise of Fake Reporting (Brownstone Institute)

Many Asian companies are ensnared in the ESG compliance system because they are listed on Western financial exchanges. One such company is the Singapore-based ‘superapp’ Grab Holdings Limited (NASDAQ: GRAB), listed on the Nasdaq.

Grab’s business model is inherently not great for the safety of its drivers and the public. Grab uses routing and other technology to match riders with deliveries and to minimise both wait time for drivers and delivery times to customers. Scheduling is highly efficient because of the technology, which is to say that drivers are on tight schedules with razor-thin commissions.

To make a buck, the drivers for Grab (and its competitors) have to be brave and aggressive on the road. Some are real daredevils – the Evel Knievels of Southeast Asia – as we have personally witnessed. Not only that, but there is stiff competition in each of the markets in which Grab operates. Grab itself says that 72% of its five million drivers do double duty, performing both food deliveries and ride-hailing services.

The part of the report on road safety is of special interest, since Southeast Asia’s roads have a deservedly deadly reputation for motorcyclists, and much of the mayhem is provided by the delivery drivers themselves. For example, one study in Malaysia reported that 70% of food delivery motorcyclists drivers broke traffic rules during delivery, and the kinds of violations covered the waterfront: illegal stopping, running red lights, talking on the phone while riding, riding in the wrong direction, and making illegal U-turns. The statistics on crashes involving these drivers make for grim reading.

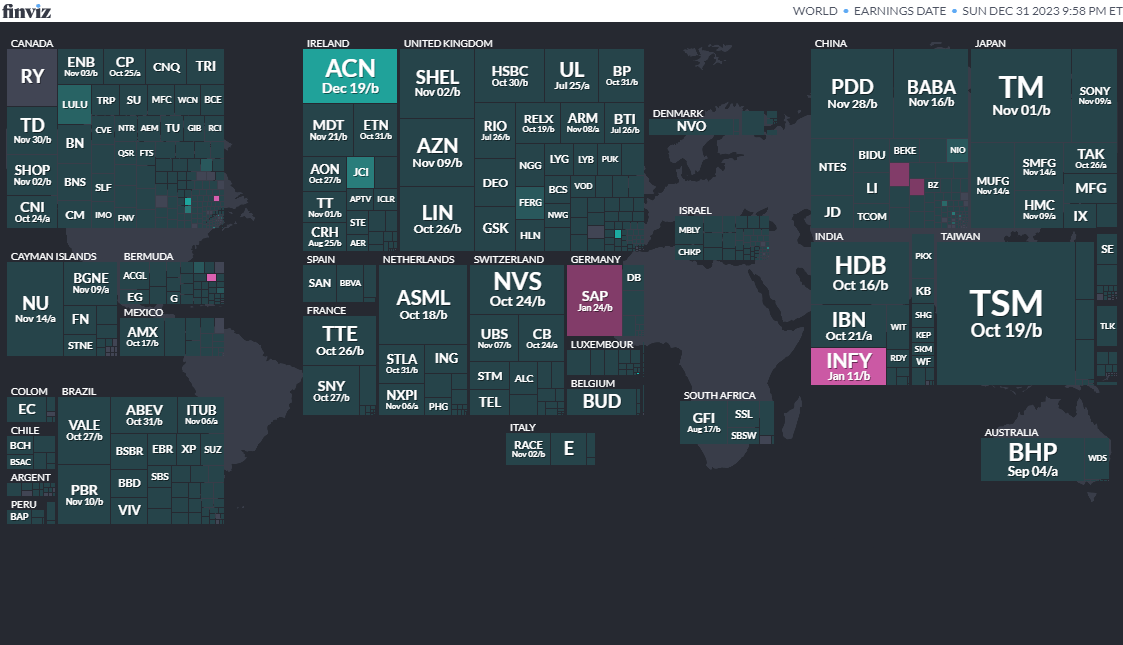

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

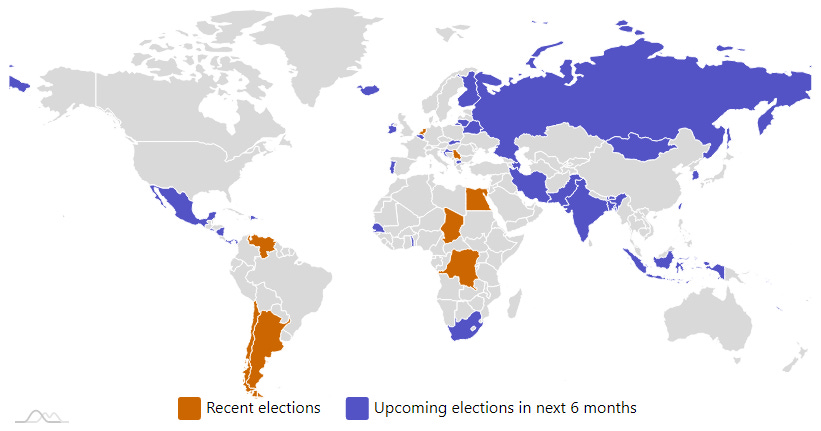

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Bangladesh Bangladeshi National Parliament Jan 7, 2024 (d) Confirmed Dec 30, 2018

-

Taiwan Taiwanese Legislative Yuan Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Taiwan Taiwanese Presidency Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024