SPY receives support but financials are strong | RRG chart

key

gist

- SPY is testing short-term support. It may be interrupted.

- Next support in the 455 region

- In the financial sector, daily and weekly RRGs are back in sync.

- All banks within major quadrants

happy new year!!! (I think it’s still allowed on the 5th day..)

Before we dive into sector rotations, let’s kick off the new year with a quick look at the state of SPY.

Is SPY hitting the pause button?

As you know, I mostly use weekly charts, but the chart above is a daily chart of SPY. Because I want to highlight the fact that the market is currently holding, or testing if you will, a short-term support level around 467. -468.

Looking at the hourly chart, one could argue that it is breaking support areas. The final ruling will be made clear by the end of the day today (Friday the 5th).

A negative divergence penciled in on the RSI in the chart above indicates a pause or setback is imminent.

If this breakthrough actually materializes, I see support in the 455 area as the first possible target. As support holds and we bounce, we may see a small H&S formation. Either way, the fact that all of this is happening just above high overhead resistance around 480 may limit upside potential in the near term.

This is very evident in the weekly chart above, where the horizontal resistance that occurred in early 2022 and the rising resistance line that marks the upper boundary of the channel combine to create a double resistance.

Overall, it appears that at least a minor disruption or pause to digest the recent rally is imminent.

sector rotation

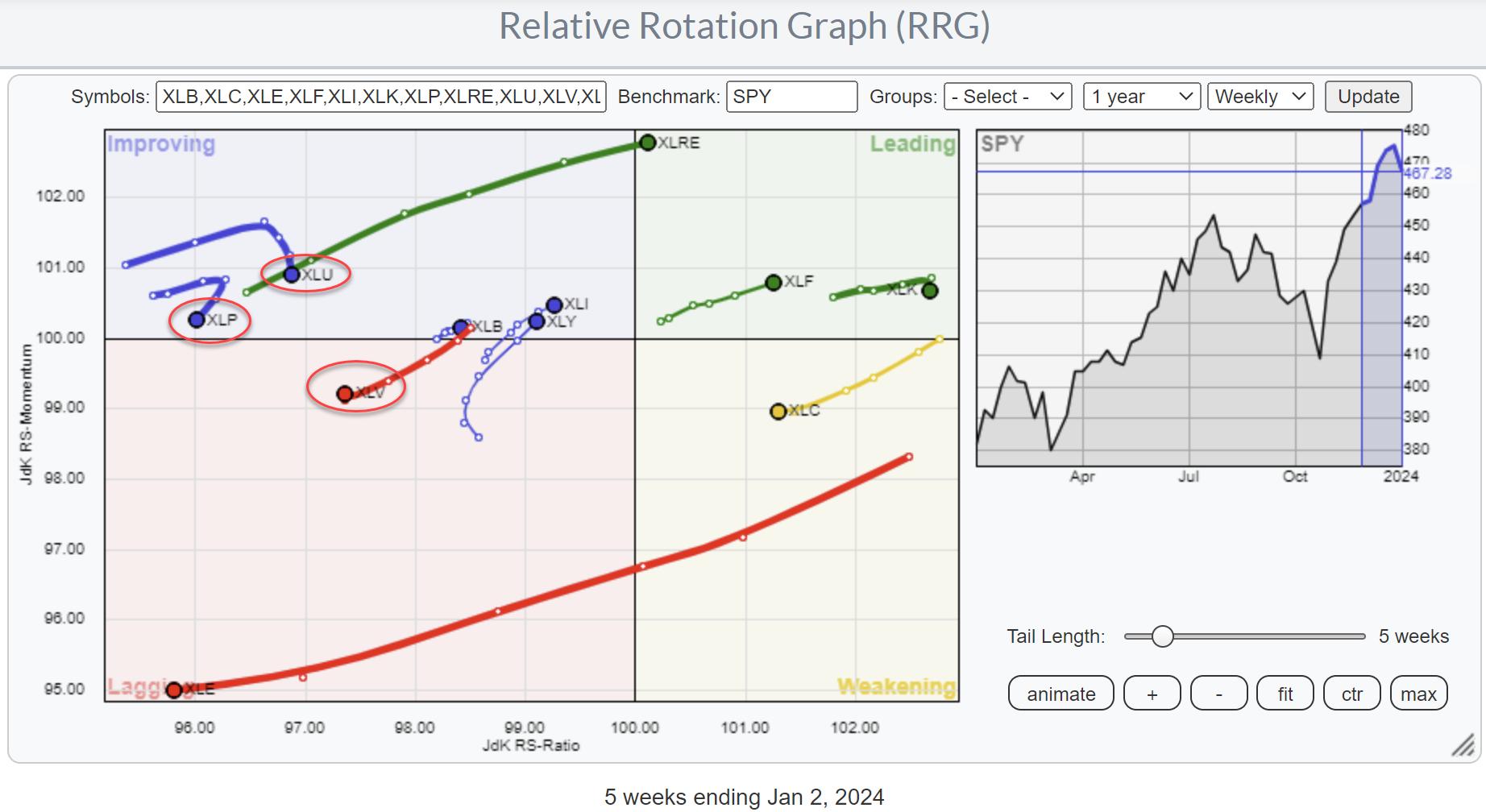

As can be seen in the RRG above, long-term sector rotations still favor a positive outlook for SPY. three defense divisions; Necessities, utilities and healthcare are on the left side of the graph and move in the direction of negative RRG. This is a cycle that typically characterizes bull markets, as investors prefer aggressive sectors.

A notable rotation is the opposing movement of real estate (XLRE) and energy (XLE). But the sector I want to highlight here is finance (XLF).

In the weekly RRG, the XLF tail is inside the leading quadrant and pointing further towards the strong RRG.

On the daily chart, the XLF tail inside the bearish quadrant has already curled back and is now heading back into the leading quadrant. This causes the daily rotation to re-synchronize with the weekly rotation. This is generally a strong signal for further improvement for SPY.

finance

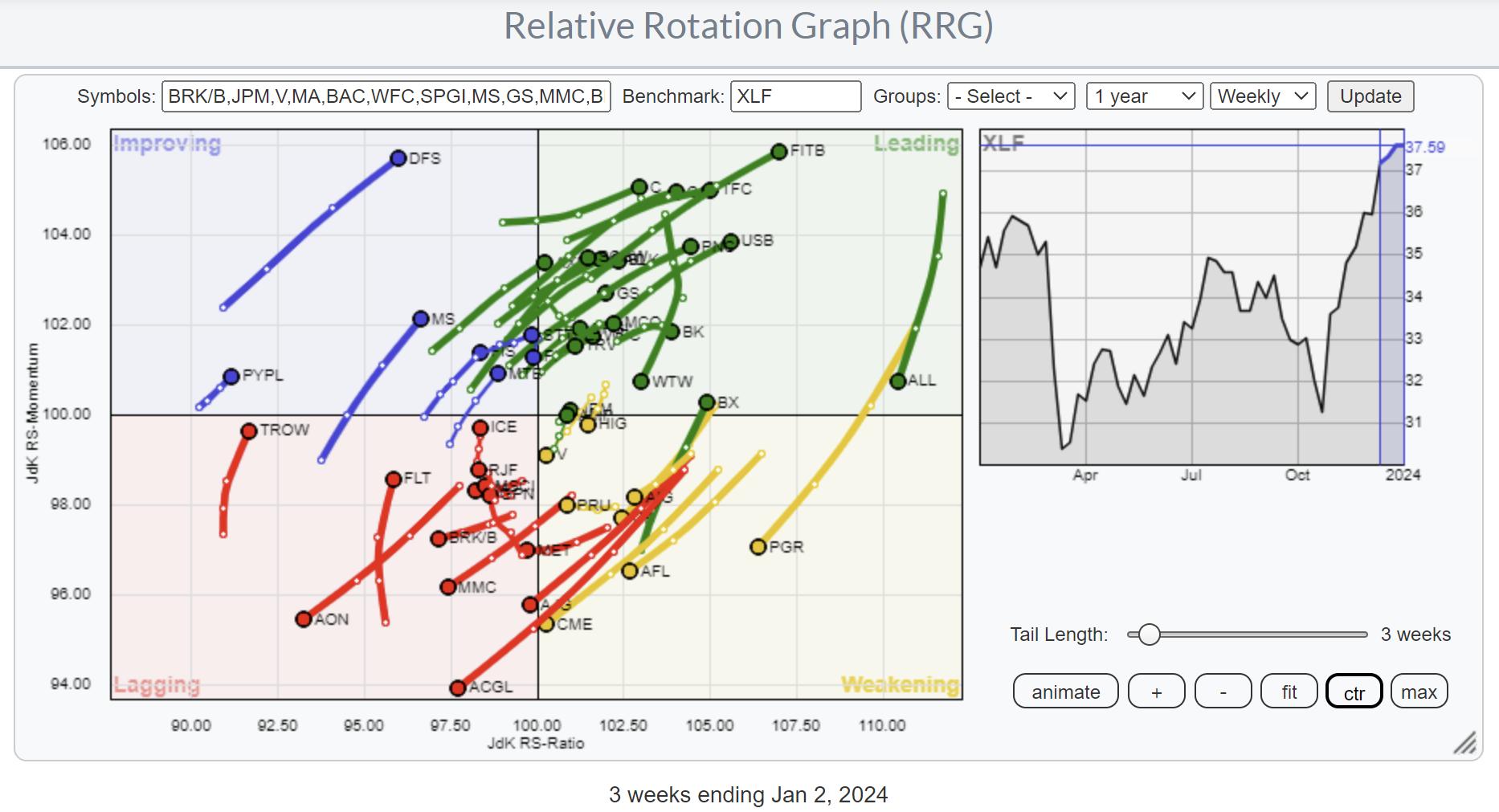

To find individual stocks within a financial sector, you can import a predefined RRG with all members of the XLF.

A quick way to identify industries within the financial sector that have potentially interesting stocks is to sort the table under RRG in the “Industry” column (just click on the top of the column) and look at the quadrant colors. The table above shows that all banks are within the leading quadrant. When you click on the line of an individual stock, the tail of the RRG will be highlighted. You can use the arrows (up/DN) to explore individual tails to better process them and find names to display on the price chart.

#Be on guard, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more