APA Corporation Stock: Acquisition of Callon Petroleum Creates Overall Win (NASDAQ:APA)

Igor Alexeyev

proposition

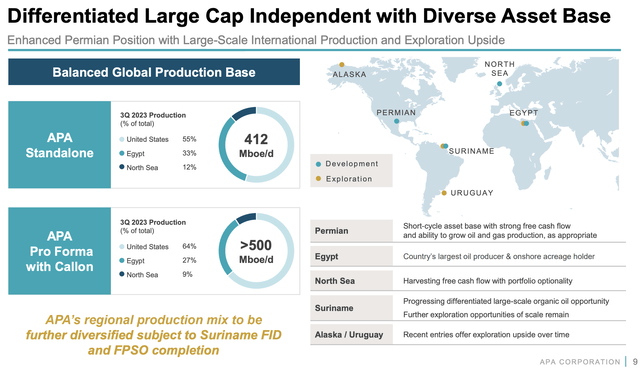

what (NASDAQ:APA) announced that it has agreed to acquire Callon Petroleum (CPE) in an all-stock transaction for approximately $4.5 billion. APA fell 7.35% following the announcement, closing at $34.05 per share. This deal benefits APA. Increase total production to over 500 MBOE/d, with 64% of production produced in the United States.

This deal certainly makes APA a bigger company, but bigger isn’t always better. In this article, we will look at how this transaction affects APA’s realized price and operating costs by BOE. We will also determine whether the selling following this announcement presents a buying opportunity.

Company status

APA is an independent oil producer with a little bit of everything. We own onshore oil, NGL, and natural gas production facilities in the Permian Basin in the United States. Egypt. We also produce on the North Sea coast of England.

The big, shiny object the company is currently developing is located in Suriname. Suriname is a small country located in northeastern South America. APA holds a 50% interest in Block 58 and a 45% interest in Block 53, off the coast of Suriname.

APA Investor Presentation

APA has partnered with French company Total Energy (OTCPK:TOTZF) to explore and develop potential oil deposits located in the block. The two companies hope to emulate the success seen in neighboring Guyana (developed by Exxon (XOM) and Hess Corporation), which is several years ahead of the production curve.

Highlights of the transaction

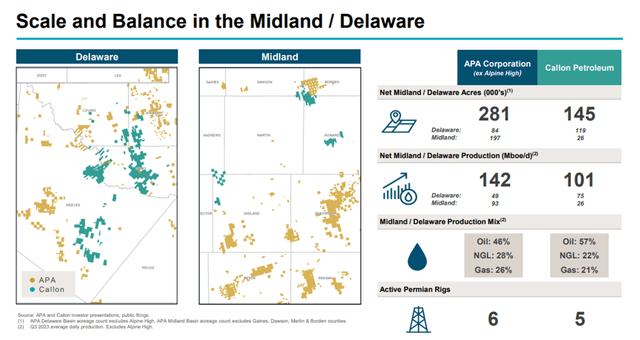

APA increases Permian area by about 50% while folding Callon. Most of this acreage (82%) is in the Delaware Basin in Reeves and Ward counties. This has the advantage of pushing APA’s production profile towards a predominantly US orientation.

In my previous article about APA in May, I discussed how APA was generally undervalued on a BOE basis compared to other producers. I believe Egyptian assets are viewed as liabilities by investors despite their high oil content. Part of this deal may focus on attempting to dilute its Egyptian assets to achieve multiples in line with its Permian peers. If successful, this would be a very cost-effective method of multiple expansion.

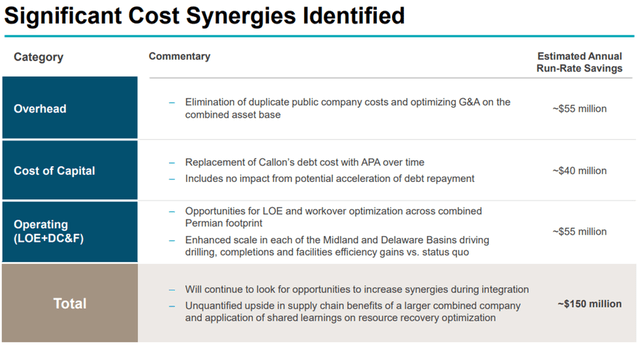

There is also an operational aspect to this deal. There are also expectations that the merger of the two companies will improve efficiency and capabilities. The key operational benefits advertised by APA are the continued benefits of more efficient equipment use and economies of scale. As a result of this transaction, APA expects to realize $110 million in annual operating synergies. Year to date in 2023, APA has recorded EBITDAX of $3.9 billion. So these synergies will increase EBITDAX by approximately 1.5%.

APA also plans to reduce capital costs. It is targeting savings of $40 million in connection with achieving better terms on Callon’s debt. The reduction in debt-related costs translates into an increase in earnings of $0.10 per share.

APA Investor Presentation

One complaint I might make is that this combination doesn’t produce much geological synergy. The two companies only have a few select locations where they share property lines. Having neighbors to create a good working mix improves drilling aspects and operational efficiency. APA has high operating costs per BOE compared to its peers, and I’d like to see it focus on unlocking more 3-mile laterals to lower that number. This long aspect is key to maximizing output for each dollar spent.

APA Investor Presentation

It gets better in the Permian, and the economy overall gets a little better.

Overall, APA doesn’t have outstanding operating statistics compared to other large-cap stocks. With oil spread accounting for only 37% of total production, the Permian realized price is $41.19/BOE. Additionally, operating costs are relatively high at $14.40/BOE. The table below summarizes the third quarter operating performance of several large Permian producers. All information is derived from the company’s 10th quarter report.

| 3rd quarter realized price | 3rd quarter operating expenses | |

| DVN | $46.92/BOE | $12.19/BOE |

| canine | $54.37/BOE | $10.51/BOE |

| PXD | $52.13/BOE | $11.58/BOE |

| APA (Permian only) | $41.19/BOE | $14.40/BOE |

| CPE | $54.50/BOE | $14.30/BOE |

APA differs slightly from this group in that it holds offshore assets. Margins are significantly improved due to the high oil content of our Egyptian and North Sea assets. The advantage of a CPE acquisition is that these assets have essentially the same realized price per APA and per BOE due to higher oil production cuts. CPE achieves this while lowering operating costs per BOE and will dilute the value of the combined company. The overall impact will be higher margins for APA going forward.

The table below compares the entire APA portfolio to CPE.

| 3rd quarter realized price | 3rd quarter operating expenses | |

| What (all) | $54.82/BOE | $15.64/BOE |

| CPE | $54.50/BOE | $14.30/BOE |

Debt maturities have become more complex

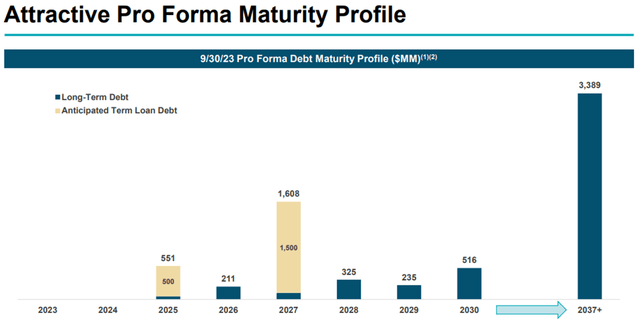

Prior to this deal, one of my favorite aspects of the APA was the spacing and manageable amount of annual maturities over the 2025-2030 period. I considered this important as this is a theoretical ramp-up period for our operations in Suriname.

Suriname is a 200MBOE/d project that will be a landmark addition to APA. It would be a mistake to let debt maturity get in the way of this. Debt currently maturing in 2027 has increased from $100 million to $1.6 billion. This is not the kind of problem a company wants to solve when it comes to working with Suriname. This is probably a minor quibble in the grand scheme of things since it can be refinanced. But I’m not a fan of this idea.

APA Investor Presentation

danger

Energy prices limped to the finish line in 2023 and continue to weaken in the first weeks of 2024. If these conditions do not improve, FCF will likely suffer in the first quarter and beyond. However, with the 7.5% price decline seen on Thursday, it is believed that a significant amount of price risk has been removed from the stock.

APA also accounts for a significant portion of natural gas production. This is not expected to provide much help to the sector until late 2024 or early 2025, when LNG exports begin to increase. I expect this part of the portfolio to continue to underperform in the near term.

Finally, a prolonged decline in oil prices will put pressure on Suriname’s FID. Because this project is less economical due to low energy prices. I see WTI prices in the $75-$80 per barrel range in the long term, so I think this is not an immediate risk, but could emerge as a result of the global economic crisis.

conclusion

There are pros and cons to the CPE acquisition, so let’s review them.

1. An increased proportion of U.S.-based production provides opportunities for multiple expansion as foreign assets become diluted by larger companies.

2. Significant cost savings can be realized by increasing Permian production by 50%. Economies of scale will be realized, reducing annual operating costs by approximately $110 million.

3. Save $40 million per year related to capital costs using APA debt financing.

4. Geological synergies are generally low due to insufficient surrounding area. This does not improve the 3-mile lateral reserve to help reduce costs.

5. Debt maturity cycles are not as attractive as they used to be. The additional maturity of $1.5 billion due in 2027 is inadequate for Suriname’s potential upside period.

Overall, I think this acquisition is a win because the pros outweigh the cons. We maintain a Buy rating on our long-term growth position, with the price reverting to $0.13 per share from our previous Buy rating.