Level Manager: Description – Trading Strategy – January 7, 2024

Level Manager product link >

level manager investment expert (trading panel) is a tool designed to help traders optimize their trades and maximize profits from manual trading. The panel allows you to open trades based on specific distances between orders and prices and manage your positions using the Stop Tracking/Tracking Items/Tracking Target features. And other useful features.

Key features list

crisis management

- maximum: When a certain price level is reached, close all trades and exit the program.

- lower limit: Similar to ‘maximum price’, but this is when trading in a falling market.

- profit block: Once the specified profit level is reached, close all transactions and end the program.

- cut off loss: Terminate all trades and programs when a defined loss level is reached.

- Stop when level: End the program after the first trade reaches an even (neither profit nor loss) position.

- trail stop: Modify ‘cutoff loss’ to an adjustable trailing value based on P&L (realized + unrealized) values.

Position and order management

- Panel supports stop and limit Put your order on hold.

- Trailing Stop: Applies in all directions based on the break-even point.

- 1-Lagging Entries: Move pending orders along the market price by distance.

- Close the position when the specified profit is reached.

- Maximum Number of Items: Defines the total number of item orders (levels) in the grid.

- buy level:

- Lagging Entries: If the market is trading more than 2 levels above the highest buy order, move all buy orders up one level.

- Lagging Target: If the market is trading more than two levels below the lowest sell order, move all sell orders one level down.

- sell level:

- Lagging Entries: If the market is trading more than two levels below the lowest sell order, move all sell orders down one level.

- Lagging Target: Move all buy orders up one level if the market is trading more than two levels above the highest buy order.

Graphics panel features

- Main panel – Contains tabbed menus for setting up and using features.

- Line Features – Mark the starting line on the chart, price , Order type and lot size .

- Show Open Positions and Orders – The feature displays: opening line, prevent loss, Benefit from additional useful information.

- Context menu – even if you’re an expert, you can change your order settings.

- Order and symbol information (market statistics and location)

HOW EXPERT “LEVELS MANAGER” WORKS

introduction:

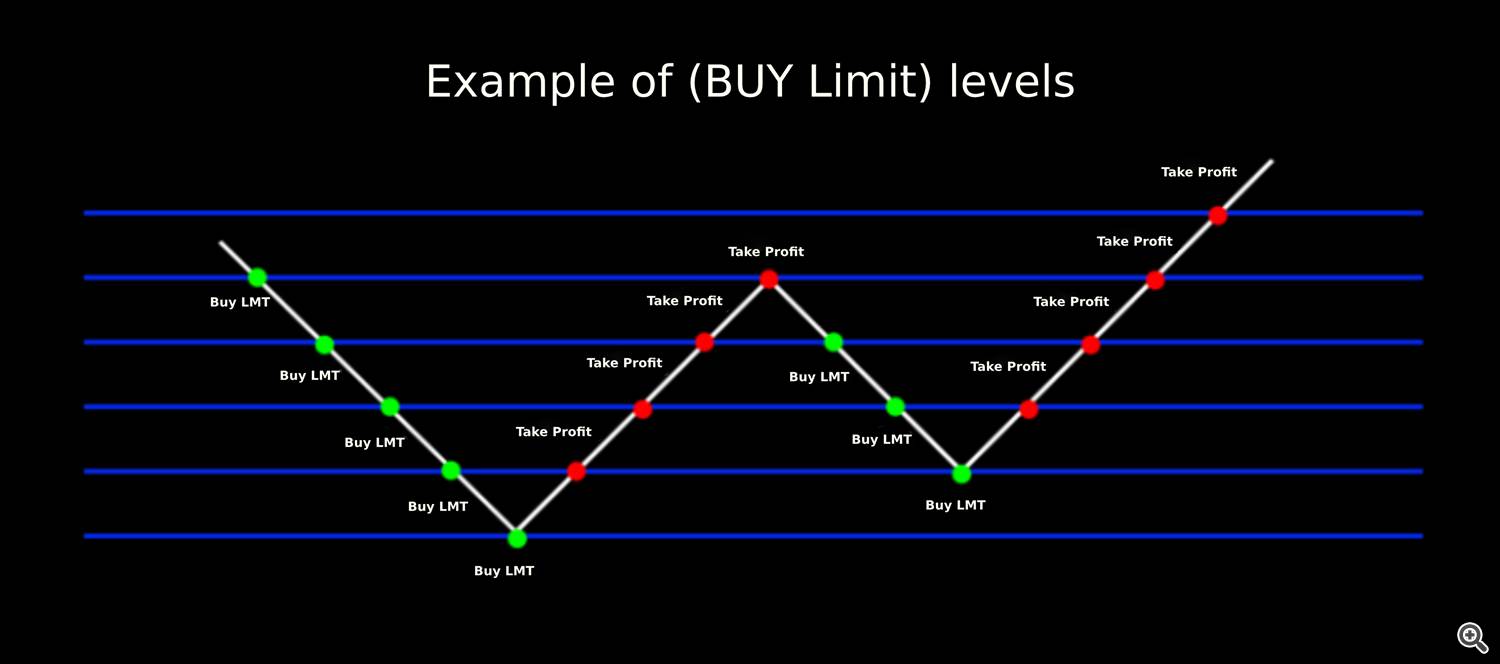

level manager This is a panel designed to help traders implement grid trading strategies. level Trading is a popular trading technique where orders are placed on set intervals, or “grids”, above and below the current market price. When the market moves, orders are filled and profits are generated from the resulting price changes. level manager Simplifies the level trading process by automatically placing and managing trades based on user-defined parameters. with level manager, traders can easily execute complex grid trading strategies accurately and efficiently. This article provides an overview of: level manager Provides applicable features and instructions for installation, configuration, and use. By the end of this article, users will have a comprehensive understanding of: level manager How to use it effectively to execute successful level trades.

installation:

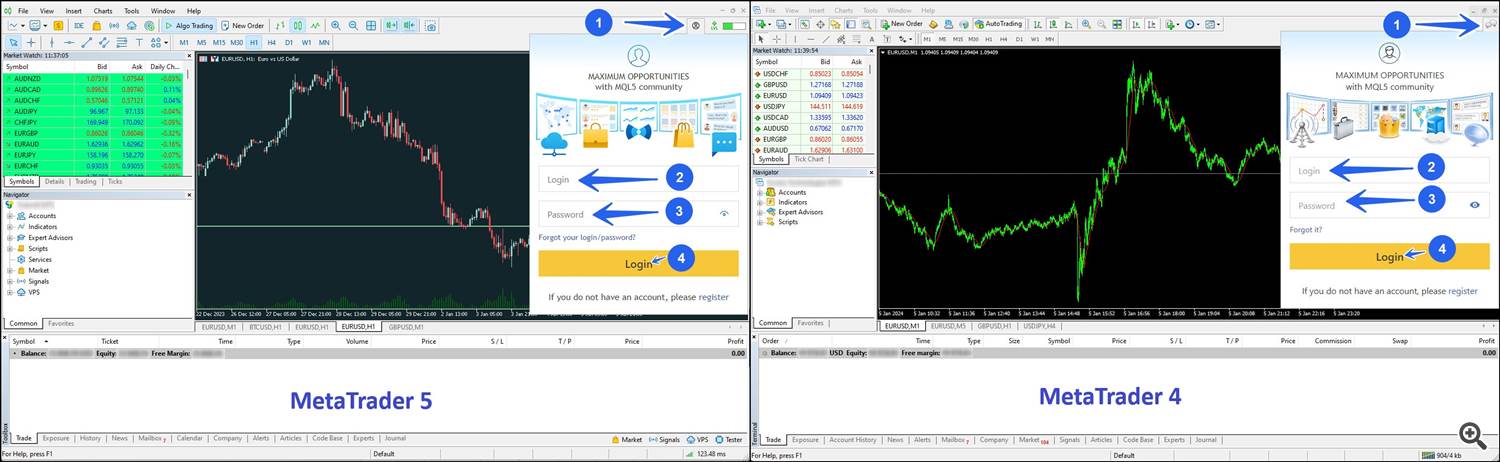

Getting started level manager It’s a simple process. Below is a step-by-step guide on how to install the utility and run it on MT4/5 platforms.

To download the application from the market, you need to enter your MQL5 account data into the MetaTrader platform. Open your MetaTrader 4 or 5 platform and from the top menu equipment – setting – Community tab, Community In the tab, populate the MQL5 Account Login and Password fields.

Download level manager MT4 App:

- at terminal window, open market – purchase Click the tab and click Install.

- The application will be downloaded to a folder. torture – market .

If you encounter any problems during the installation process, you are welcome to contact us…

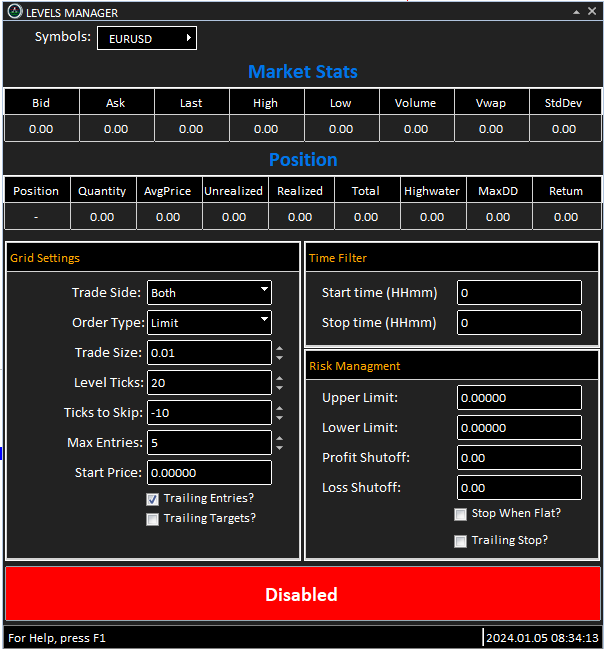

use level manager:

To access level manager In the panel, go to the Navigator tab>Expert Advice>Markets>.level manager. Before choosing a symbol, make sure Metatrader is connected to your data provider. After checking the connection, select the symbol at the top. level manager panel. This will start streaming market statistics for your chosen instrument and allow you to start trading. level manager.

level manager It offers a variety of custom parameters that allow you to adjust your settings to suit your specific trading needs. An overview of the main parameters and their functions follows:

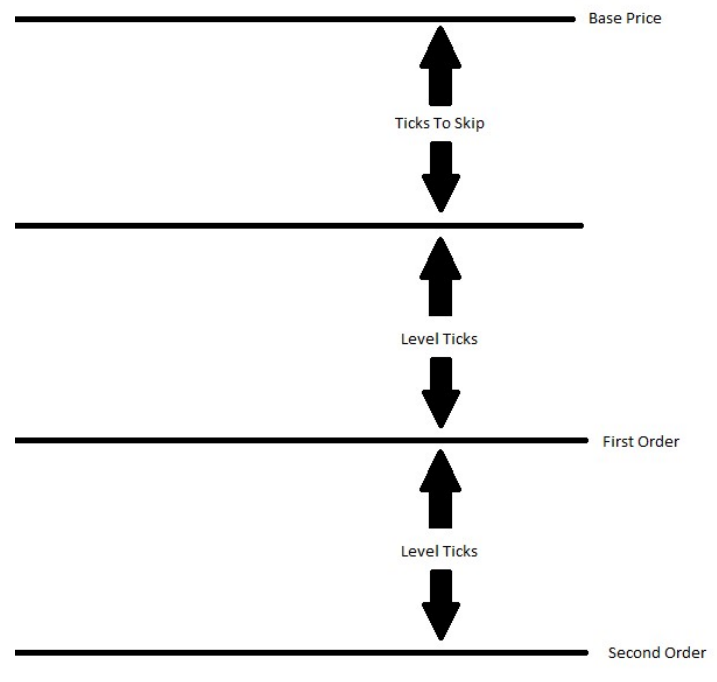

1. Ticks to skip, level ticks, starting price and trade size:

To create a grid, you must first select a base price using the ‘Start price’ parameter. You can set it to a specific price or leave it at 0 to use the current market price.

The ‘ticks to skip’ parameter determines the number of ticks to be subtracted from the base price of a buy order or added to the base price of a sell order.

The ‘level tick’ parameter determines the distance between each level.

For buy orders, the program issues orders in ‘level ticks’ below the base price, and for sell orders, orders are placed in ‘level ticks’ above the base price.

The ‘Deal Size’ parameter controls the number of contracts purchased or sold at each level. These parameters can be easily adjusted during live trading, allowing you to change the grid in real time as needed.

The ‘Max Entries’ parameter indicates the total number of entry orders (level).

2. Trailing items and trailing objects:

The ‘Track Items’ and ‘Track Targets’ options allow you to automatically move your orders up or down based on market movements. For buy levels, the ‘Track Entry’ option moves all buy orders one level up when the market is trading two levels above the highest buy order, while the ‘Track Target’ option moves all sell orders one level below the highest buy order. Move it to . The market trades at least two levels below the lowest sell order.

For sell levels, the ‘Track Entry’ option moves all sell orders one level down when the market is trading two or more levels below the lowest sell order, while the ‘Track Target’ option moves all sell orders two levels below the lowest sell order. When trading below this, move all buy orders up one level. The market trades more than two levels above the highest buy order.

3. Risk management:

The ‘Risk Management’ section of the Level Manager allows you to manage your risk by setting trading limits.

The ‘ceiling price’ parameter specifies the price level at which all trades will be cleared and the program will end.

The ‘Lower Limit’ parameter works similarly but applies to trading in falling markets. The ‘Profit Cutoff’ parameter specifies the profit level at which all trades will be closed and the program will be terminated.

The ‘Cut-Loss’ parameter specifies the loss level at which all trades will be terminated and the program will be terminated.

If you select the ‘Stop when level’ option, the first position will be entered and the program will end after the level position has been reached.

A ‘Trail Stop’ option that tracks a hidden stop loss based on the break-even point for that direction (buy/sell).

You can fine-tune it by adjusting these parameters. level manager Tailored to your specific trading strategy and goals.

conclusion:

uses level manager: Access the level manager via the MT4/5 interface and select your trading symbol. The panel provides real-time market statistics to enable instant trading.

Customizable parameters:

Ticks to skip, level ticks, starting price, trade size: Adjustable settings for defining grid structure and order placement.

Maximum number of items: Sets the total entry order capacity for the grid.

What follows and what: Dynamic order adjustments based on market changes.

Crisis Management: Configurable parameters for comprehensive trade risk control

By utilizing the Level Manager, traders can adjust their strategies to different market conditions to ensure optimal performance and risk mitigation. This manual serves as a guide to effectively utilizing Level Manager for successful trading results.