Starbucks (SBUX): $10,000 Investment Grows to Over $1 Million in 1992 – Repeatable

Monticello

introduction

Now it’s time to discuss stocks that have never been discussed on Seeking Alpha or anywhere else.

As you can already tell from the title, the company Starbucks Corporation (NASDAQ:SBUX)A company I avoided because of me I never really liked consumer stocks, which turned out to be a big mistake!

I think my dislike of coffee and fancy drinks also played a small role.

That said, many people like SBUX and have made huge profits from it.

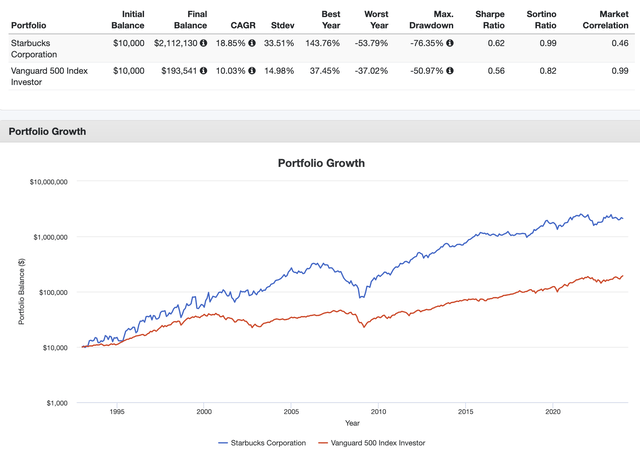

Investors who invested $10,000 in Starbucks on the last trading day of 1992 now have $2.1 million invested, including dividends.

Portfolio Visualization Tool

These tremendous returns were delivered through a compound annual growth rate of 18.6% during this period, significantly outpacing the S&P 500’s 10.0% return.

Even when adjusting for volatility, stocks Better than market risk-adjusted returns (Sharpe/Sortino ratio).

In this article, we’ll focus on how Starbucks is growing, what its operating environment will be like, and why Starbucks is still a great stock to build significant wealth from. After all, optimistic titles are not clickbait.

So let’s get started!

Regaining your confidence can reap huge benefits

Since October 2003, SBUX has returned 13.8%. This is lower than the long-term annual total return of 18.6%, but still enough to create significant wealth.

Some examples include:

- If you find an investment that will return 13.8% per year over the next 10 years, you could turn $10,000 into $36,400.

- If you hold this investment for 20 years, the amount would be $132,700.

- If you keep this investment for 40 years, you could earn $1.8 million!

Even better:

- You can generate much higher returns by identifying potentially high-flying stocks and purchasing them below their “fair” value.

- If you find a 15% CAGR opportunity, it only takes 32.94 years to turn $10,000 into $1 million. Again, 32.94 years may seem like a lot. But $10,000 is not a small amount. In our country, we don’t even buy entry-level models from Japanese/Korean car companies.

- $20,000 turns into $1 million after achieving a 15% return in 28 years.

All this to say, on paper, becoming rich is easy. Very easily.

It’s harder to find good opportunities and put real money to work.

This is where Starbucks comes into play.

What I like about Starbucks is that they are seeing high growth at very attractive prices.

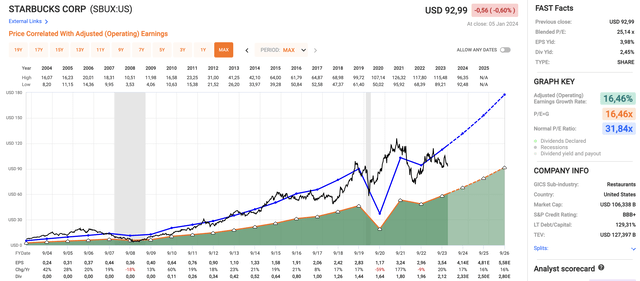

Using the data in the chart below, SBUX is expected to grow its EPS by 17% in FY2024 and by 16% in FY2025 and FY2026.

Back in 2003, SBUX’s standardized valuation was 31.8x. These figures are fully justified by high growth.

However, despite forecasts for continued double-digit EPS growth, the company currently trades for a blended P/E ratio of just 25.1x.

FAST graph

Based on the following figures:

- Purely theoretically, if the stock’s valuation converts to 31.8x, it could generate annual returns of 28.5% through FY2026. Again, this is purely theoretical.

- However, even a multiple of 24 times higher than current value could imply a 17% annual return going forward.

Simply put, if SBUX can demonstrate that it is still a strong performer, and if we can understand why it has underperformed since the pandemic, it could be argued that it presents a very attractive opportunity for long-term dividend growth.

But before we get into that, let’s look at the dividends.

SBUX Dividends

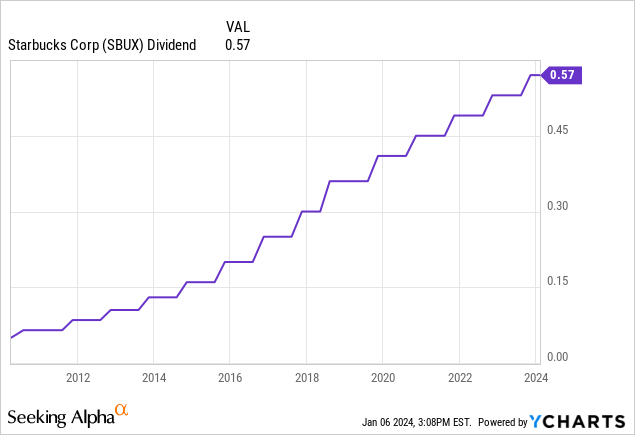

One of the most attractive aspects of SBUX is its dividend. The current quarterly dividend is $0.57 per share, giving a yield of 2.5%.

- The S&P 500 yields 1.4%.

- Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) yields 1.9%.

On September 20, 2023, Starbucks raised its dividend by 7.5%. The five-year dividend compound annual growth rate (CAGR) is 10.4%.

This year, the company is expected to generate $4.14 in EPS, which is a very healthy number with an earnings payout ratio of 55%.

Even better, its net leverage ratio is less than 2.0x EBITDA and its credit rating is BBB+, one notch below the A range.

The company has increased its dividend every year since its founding in 2010.

So let’s take a closer look at the bigger picture and see how sustainable the company’s growth is.

Despite headwinds, SBUX is poised for strong growth

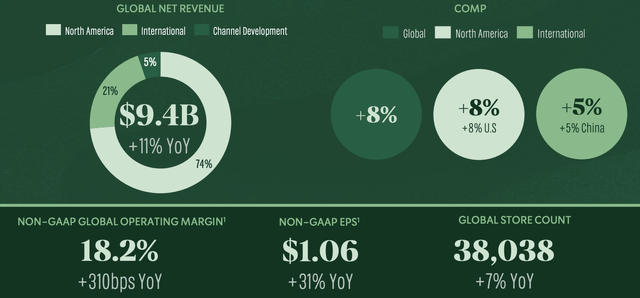

In its most recent quarter, the fourth quarter of 2023, the company experienced strong growth, with consolidated revenue increasing 9% to $9.4 billion.

The U.S. business achieved record average weekly sales, driving comparable store sales growth of 8% globally.

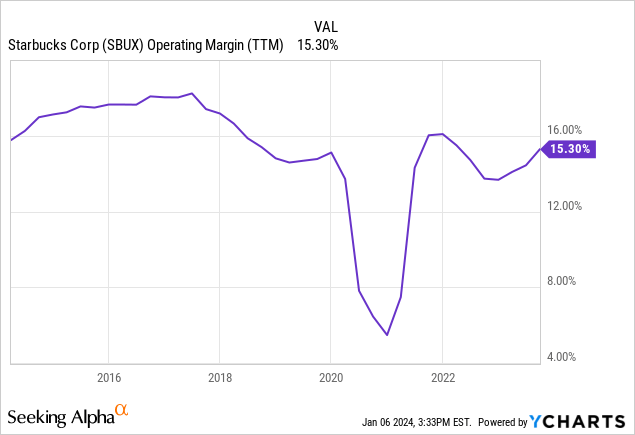

Consolidated operating profit margin in the fourth quarter increased 310 basis points to 18.2%, exceeding expectations.

Starbucks Corporation

The International segment achieved fourth quarter revenue of $2 billion, an 11% increase over the previous year.

China played an important role, contributing to double-digit growth and exceeding 20,000 stores. Fourth quarter China sales recorded double-digit growth, driven by new stores and 5% comparable store sales growth.

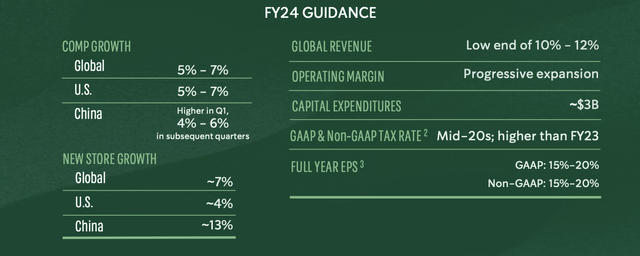

In its 4Q23 earnings call, the company provided strategic and optimistic guidance for fiscal 2024. The company expects global comparable sales growth in the range of 5% to 7%, reflecting a shift from prior year guidance of 7% to 9%.

U.S. comparable-store sales are expected to grow between 5% and 7% in fiscal 2023, with strong growth of 9%.

The company expects consolidated revenue growth in fiscal 2024 to be in the range of 10-12%, albeit at the lower end of the range.

Starbucks Corporation

While this guidance is good, the company’s lower-than-expected comparable store sales guidance is a result of economic headwinds.

At the Morgan Stanley Global Consumer and Retail Conference last month, the company detailed some of these headwinds.

For example, the company acknowledged that China’s recovery has been slower than expected, reflecting broader economic difficulties. While expressing confidence in the long-term strength of the Chinese market, the immediate future appears unstable and the promotional environment is likely to improve further.

This is not surprising, as China’s economy is under enormous pressure.

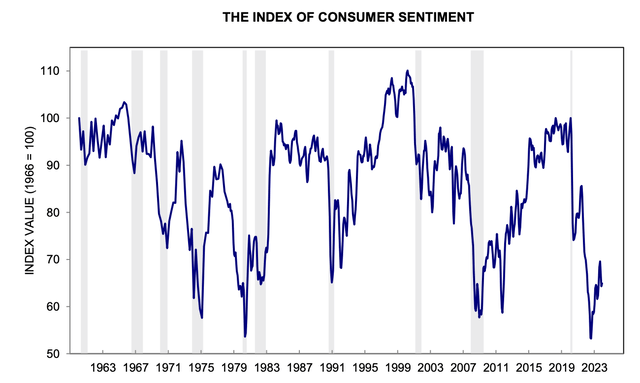

Additionally, consumer confidence in the United States is:

University of Michigan

Additionally, geopolitical tensions and conflicts in certain international markets also pose challenges.

The Company recognized the impact of geopolitical dynamics on its operations, particularly in conflict-affected regions. This adds an element of unpredictability to your international expansion strategy, especially as some countries are hit by boycotts (for lack of a better word) by certain political groups.

Moreover, while the supply chain has improved, the company has experienced disruptions and challenges.

The need to continuously optimize supply chain processes continues to be emphasized, especially with the introduction of new equipment and technologies.

The good news is that operating margins have stabilized in 2024 as the company sees ‘gradual expansion’.

Against this backdrop, SBUX is investing heavily in growth, which will allow it to capitalize on both margin and revenue growth the moment cyclical issues begin to dissipate.

For example, at the same conference, the company noted its success in its current pace of digital execution and that its approach to digital transformation is changing.

This includes more frequent releases, with meetings every six weeks to assess progress and plan future developments.

Starbucks aims to drive more business to its stores by leveraging its existing customer base of more than 300 million people worldwide, including 75 million Starbucks Rewards members.

The company also actively partners with major industry players, including Microsoft (MSFT), Apple (AAPL), Delta (DAL), and Amazon (AMZN).

fox business

These partnerships are strategic in enhancing the digital experience, delivering concrete benefits to customers and increasing the value proposition for Starbucks loyalty.

In addition, we are working on new partnerships in other areas.

Another thing I’m excited about (which may lead to more frequent visits to stores) is that SBUX sees untapped potential in the PM slot, especially in the beverage and food sectors.

The company aims to offer targeted and innovative products during PM hours by leveraging its existing store space and capacity to meet customer needs.

Essentially, the company sees growth opportunities in both beverage and food sales during the afternoon, with a focus on personalization, digital engagement and attachment to beverages.

I wouldn’t compare it to McDonald’s (MCD), which serves all-day breakfast, but it seems like a very promising development.

So far, the company has observed high attachment rates, especially in the U.S., with two out of five customers attaching food to their orders.

But there’s more!

The company sees significant potential in international markets, especially in regions such as Latin America, continental Europe, Southeast Asia, India, the Middle East and Africa.

We focus on building a global network through digital solutions and entering various markets where coffee culture is growing.

With regard to the aforementioned developments in China, despite the country’s current difficulties and slow pace of recovery, the Company views this as an important market with long-term growth prospects.

Premium brands Starbucks and Reserve are well-received and have room to expand further in the city.

Starbucks Corporation

Speaking of headwinds, the company is also actively addressing the supply chain issues I mentioned in the article.

The company operates a $3 billion productivity program, 70% of which is allocated outside the store, providing opportunities for continuous improvement and cost efficiencies.

This includes supply chain management, procurement and service optimization globally.

conclusion

All things considered, there is a reason why SBUX is trading below its historical “normal” valuation.

- Economic growth is weakening and consumers are in a difficult situation.

- We are still experiencing supply disruptions and margin pressures.

- Strikes due to labor issues and the geopolitical situation do not help either.

However, the company’s growth expectations are high. 2024 may be a somewhat disappointing year, but we’re still talking about high EPS growth expectations.

Additionally, investments in growth should keep future growth high and increase customer satisfaction.

Therefore, I believe the company will continue to grow its dividend and enjoy high capital gains, making it a great long-term investment.

I’m significantly underweight consumer stocks, so I’m considering buying some for my portfolio this year.

As the title suggests, I have high hopes for SBUX and believe it will continue to generate tremendous wealth for shareholders for many years to come.