BINC ETF: Newly Launched Active Bond ETF (NYSEARCA:BINC)

spencer flat

In recent months, I have become more optimistic about the bond outlook. Especially since the Federal Reserve has signaled that it has reached record high interest rates and the market is expecting a policy rate cut in 2024.

I met Black Rock Flexible Income ETF (NYSEARCA: Pink) while screening bond funds with high returns in 2023 to find funds that can perform well in 2024.

The BINC ETF is a newly launched active ETF from BlackRock with flexible mandates that allow star managers to invest in a variety of bond sectors such as CLOs and emerging market bonds. Over its short history so far, BINC has outperformed its peers by betting on outperforming sectors such as CLOs. However, given its reliance on star managers for differentiated sector bets, I would hesitate to recommend BINC without more data.

Fund Overview

The BlackRock Flexible Income ETF is a newly launched active bond ETF managed by BlackRock’s star bond portfolio manager, Rick Rieder, who was named a Morningstar Outstanding Portfolio Manager of 2023.

strategy

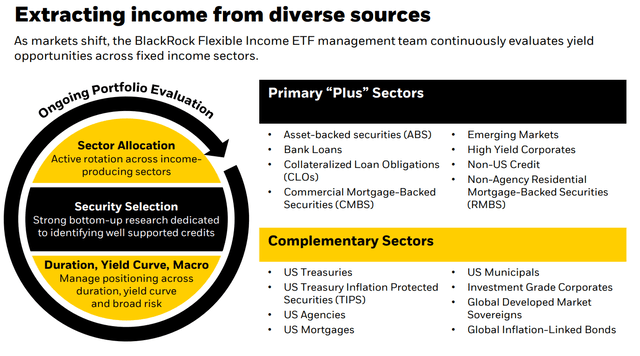

The BINC ETF is designed to maximize returns by providing exposure to hard-to-access fixed income sectors and leveraging the experience of the BlackRock investment team led by Mr. Rieder (Figure 1).

Figure 1 – BINC overview (blackrock.com)

The BINC ETF actively rotates across income-producing sectors, with major weightings in asset-backed securities (“ABS”), bank loans, collateralized loan obligations (“CLOs”), commercial mortgage-backed securities (“CMBS”), and emerging markets. do. , high-yield bonds and non-agency residential mortgage-backed securities (“RMBS”). BINC ETF can also invest in other complimentary sectors such as Treasury bonds and Agency MBS.

In fact, the BINC ETF is provided by Mr. ETF Wrapper. This is a fixed income hedge fund managed by Rieder. The BINC ETF currently holds $490 million in assets and charges a net expense ratio of 0.40% after fees until June 2025.

portfolio holdings

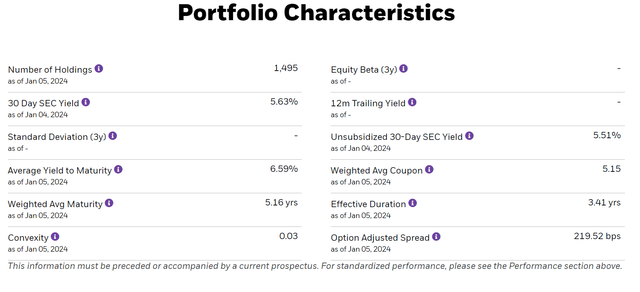

Figure 2 shows BINC’s overall portfolio characteristics. BINC ETF currently holds approximately 1,500 securities with a portfolio shelf life of 3.4 years.

Figure 2 – BINC Portfolio Characteristics (blackrock.com)

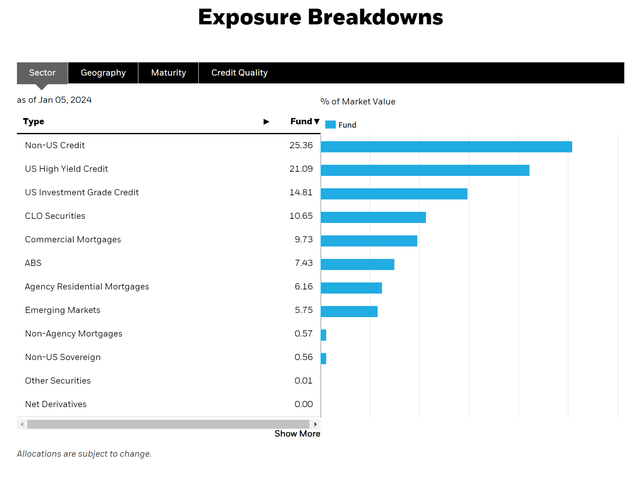

In terms of sector allocation, the BINC ETF allocates 25.4% of its portfolio to non-U.S. credit, 21.1% to U.S. high-yield credit, 14.8% to U.S. investment grade credit, 10.7% to CLOs, and 9.7% to CLOs. Assign . Commercial Mortgages (Figure 3)

Figure 3 – BINC sector allocation (blackrock.com)

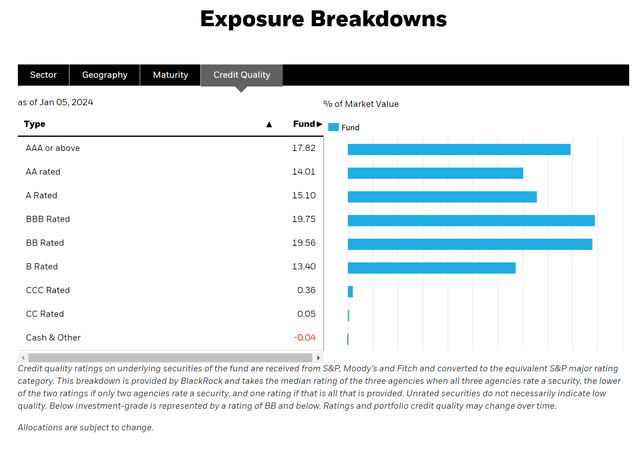

In terms of credit quality, the BINC ETF appears to be primarily investment grade, with securities rated BBB to AAA making up 66.7% of the portfolio, while non-investment grade credit (rated BB or lower) makes up 33.4% (Figure 4).

Figure 4 – BINC Credit Allocation (blackrock.com)

However, judging by BINC’s purview, BINC ETFs are designed to be ‘agile’ and take advantage of opportunities as they arise, so investors should be prepared to see significantly higher turnover and movement in the fund’s sectors and credit allocations.

Distribution and yield

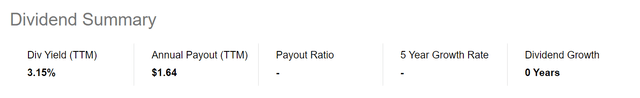

According to Seeking Alpha, the BINC ETF paid a monthly dividend with a trailing yield of 3.2% (Figure 5).

Figure 5 – BINC Distribution Returns (Look for alpha)

However, since the BINC ETF is just getting started, we believe these return calculations can be misleading. operation of Since it is May 2023, one year’s worth of distributions have not been paid. Looking at actual distributions paid, we see that BINC ETF had an average monthly distribution of $0.206, plus a special distribution of $0.398 per share declared in December (Figure 6).

Figure 6 – BINC actual distribution (blackrock.com)

Therefore, BINC’s distribution yield is close to ~5%. For the record, the BINC ETF’s 30-day SEC yield is 5.6%.

report

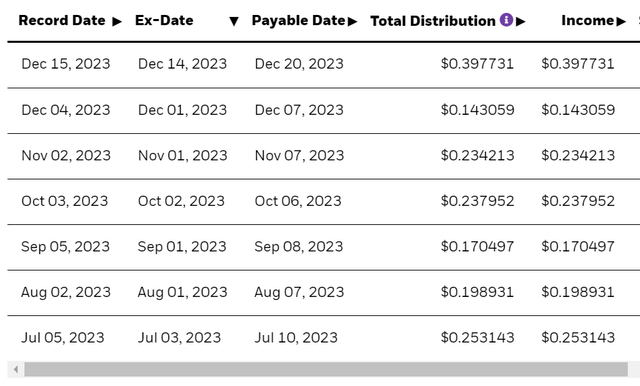

Since the BINC ETF was only launched on May 19, 2023, there isn’t much historical performance to analyze. However, due to its limited history, the BINC ETF has been strong since its inception, with the BINC ETF returning 6.4% compared to 2.3% for the iShares Core US Aggregate Bond ETF (AGG) and 2.9% for Pimco’s Active Bond ETF (BOND) (Figure 7). .

Figure 7 – BINC has had strong performance since its inception. (Look for alpha)

Surprisingly, BINC saw minimal declines during the June-October bond market crash, while AGG and BOND both saw significant declines.

Why are bonds a good buy?

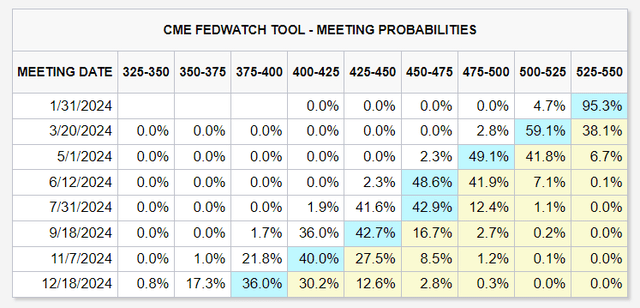

As I’ve written in several recent articles, at the December FOMC press conference, Federal Reserve Chairman Jerome Powell said the Fed is “likely to be at or near the highest rates of this cycle” and that investors expect policy rates to fall in 2024. You are betting. Generally an increase in bonds.

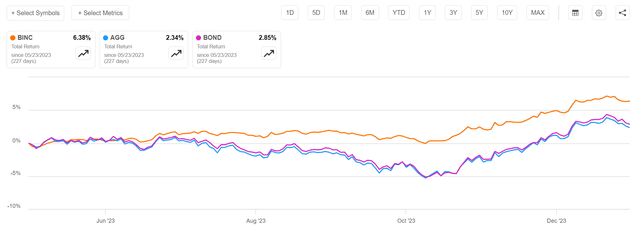

In fact, looking at the federal funds futures market, traders are betting that interest rate cuts will begin as early as March, with six cuts likely to be priced in through 2024 (Figure 8).

Figure 8 – Traders Priced 6 Rate Cuts. (CME)

Although expectations seem aggressive compared to the Fed’s forecast of three rate cuts in the December Economic Outlook Summary, we believe the BINC ETF will perform well in the coming quarters as the Fed’s dovish stance is a tailwind for bonds.

Risks for BINC

However, BINC ETF is not without risks. In general, I am hesitant to invest in rock star managers. Because they rely on single individuals to make differentiated macro ‘calls’ to generate superior performance.

The ‘swinging for the fences’ approach is inherently unsustainable, as discussed by Howard Marks in his recent article titled “Fewer Losers and More Winners?” BINC’s star-manager approach can lead to large changes, which can lead to volatility in returns. As Mr. Marks pointed out, “Most investors who aim for top decile performance end up self-defeating.”

Mr. Rieder is currently Morningstar’s 2023 Person of the Year Award for Outstanding Portfolio Manager, but history is full of high-profile managers who underperform.

You may feel more comfortable investing with a proven investment process or team of managers instead of a single star manager. Because that’s where you can repeat great performance more often.

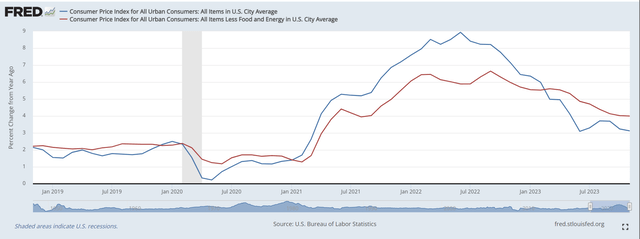

Another risk for BINC is that if market expectations of a ‘soft landing’ are incorrect and inflation returns, the Fed may be forced to start raising interest rates again, which could put pressure on bond investments. Headline CPI inflation is easing to 3.1% year-on-year in November, but core inflation is showing more rigidity, hovering around 4% (Figure 9).

Figure 9 – Core inflation may become more robust and recover. (St. Louis Fed)

conclusion

BlackRock Flexible Income ETF is a recently launched actively managed ETF managed by star manager Rick Rieder. BINC aims to provide exposure to the hard-to-access fixed income sector and is essentially a fixed income hedge fund.

To date, BINC has achieved impressive returns over its short history, outperforming peer active bond funds such as the Pimco Active Bond ETF. However, because BINC relies on its star managers to make differentiated macro ‘calls’ to select outperforming sectors, it is hesitant to recommend funds without more performance data to analyze. I like BINC ETF holding We plan to re-evaluate the fund in future quarters.