Ashtead Group Stock: Gaining Share of Large Project Deal Flow (OTCPK:ASHTY)

ArtistGNDPhoto

summary

I’m following up on our coverage of Ashtead Group (OTCPK:ASHTY), once again emphasizing a Buy rating as ASHTY continues to show that it has found deals on large-scale projects. This was a very optimistic indicator for the long term. In my opinion, this is a trend considering the nature of the project. This post was written to update my thoughts on business and stocks. I reiterate my previous Buy rating on ASHTY as I remain bullish on ASTHY’s long-term growth potential and scale. The recent disclosure that ASHTY has accounted for 30% of large project deal flow is very positive, and while this means margins will experience a near-term headwind, we see this as a transitional headwind that will ease over time.

investment thesis

Second quarter performance continues to show positive growth There was traction, as ASHTY reported 13% revenue growth, in line with consensus estimates. Underlying the 13% growth was rental revenue growth of 11% y/y in constant currency. I will focus on the US segment as the US represents the majority of AHT’s business (95% of FY23 EBITDA). In the U.S., rental-only sales increased 13%, the general tools business increased 13% year-over-year, and the specialty business increased 14% year-over-year. This means that sales growth was driven by strength across business segments. Profitability in terms of EBITDA also performed well, with a margin of 47.1%, consistent with guidance.

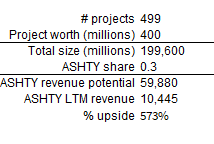

From a long-term perspective, we believe ASHTY’s growth prospects remain very favorable as deal flow from mega projects remains healthy. Management emphasized its optimism about the construction outlook, citing a robust construction pipeline led by onshoring and reshoring. The growth of technology-related construction such as aviation and renewable energy shows a positive trend for the East India industry. For better context, it was mentioned that there are 499 mega projects (projects worth more than $400 million) that have started or are scheduled to start by April 2024, and ASHTY has already won 30% of these deals to date. If readers don’t understand how big this disclosure is, consider that the total deal size is $200 billion and ASHTY has secured up to $60 billion worth of revenue potential. This ~$60 billion is nearly six times the size of ASHTY’s current revenues. Of course, growth will spread over the next 2 to 10 years, but this only means that the runway for growth is long. If ASHTY gets a larger share of the deal, the amount of growth will be much higher. Additionally, my calculations assume that all projects are worth $400 million, which is clearly not the case from a mathematical standpoint, since that’s what megaprojects are worth. At least 400 million dollars.

self calculation

As previously indicated, we have expressed confidence that we will double our overall market share for these projects and exceed this with approximately a 30% share of all combined projects currently underway.

Again, our internal definition of a large project is one that costs more than $400 million. We included all projects meeting this definition where construction is underway or scheduled to begin by April 2024. 2Q24 performance announcement call

Regarding margins, we expect there to be some near-term headwinds followed by a period of continued margin expansion. In the short term, margins are expected to continue to face headwinds due to early delivery of equipment and lower utilization rates due to the early stages of large projects. It takes time to increase utilization as a project progresses, so these headwinds are almost like mixing and timing issues. In terms of cadence, this utilization headwind will probably persist for another year or so as management sees an increase over four to five quarters for larger projects. The combination of recovery in utilization rates and supply chain improvements is expected to drive margin expansion in 2H25. For the supply chain in particular, recent data demonstrates that recovery is on track, with OEMs now delivering equipment more than 95% of the time, compared to 60% two years ago.

Let’s go back two years and say OEMs were getting less than 60% in terms of time and volume. Last year they averaged over 75%, 80% throughout the year and improved towards the end. And this year it has increased by more than 95%. 2Q24 performance announcement call

To fund such large-scale projects, ASHTY will need a strong balance sheet, which it has as of 2Q24. The company ended the quarter with net debt of approximately $7 billion, which is approximately 1.6 times net debt to EBITDA. I think ASHTY is in a very comfortable position considering that its net debt to EBITDA profile is after ASHTY CAPEX jumped from $2 billion a few years ago to $4.5 billion in the last 12 months. Considering that large-scale projects are in ramp-up mode (deploying additional construction equipment), CAPEX is naturally higher. However, as ASHTY moves forward with these projects, CAPEX should gradually decrease, which means more cash flow for ASHTY to reduce its debt levels.

evaluation

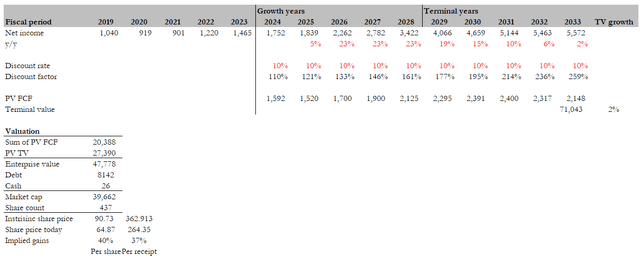

self calculation

My target price for ASHTY based on my DCF model is $90.73. Changes to my DCF model include downward revisions to FY24 and FY25 net income. This is because we expect margins to face headwinds from an increase in large projects (according to management, these headwinds will begin to ease 4-5 quarters from now in 2H25). That said, in conjunction with my positive comments about ASHTY’s stake and revenue potential for these large projects, I have increased my revenue growth expectations for the growth year to the low 20s instead of 20%. I bring readers’ attention to the ASHTY growth years between FY12 and FY19. During this period, net profit increased eightfold, implying a CAGR of 34%. So my 23% assumption is not valid. My terminal assumption is still the same: revenue growth will eventually decline to the level of inflation.

danger

Scaling up large projects may take much longer than expected, which could continue to drag down margins in the near term. Impatient short-term investors are likely to sell stocks and reinvest only when margins rise. This means that short-term valuations and stock prices can be bound by a range, which can be an opportunity cost for investors.

conclusion

I reiterate my previous Buy rating on ASHTY as ASHTY continues to gain share in large-scale project transactions. ASHTY’s recent disclosure that it has secured 30% of projects valued at more than $400 million, with total revenue potential of approximately $60 billion, indicates strong long-term growth potential. Notwithstanding the short-term margin headwinds resulting from initial project delivery and utilization issues, I view these challenges as transitional and expect them to gradually ease over time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.