A week ago: NIFTY in uncharted territory; Adopt a simple approach to the market | India analysis

After consolidating throughout the week, the market continued its upward trend and closed at another all-time high. In four of the last five sessions, the market has been seen consolidating and holding within limited corrective retracements. However, it found support at the short-term 20-day MA and rebounded from there. On a weekly basis, the market consolidated from the previous week but was slightly higher this time. The scope of transactions has also expanded. The index has fluctuated in a range of 479.60 points over the past five days. Finally, the benchmark index closed with a net gain of 183.75 points (+0.85%).

From a technical perspective, the market is once again at a critical crossroads. Options data suggests the market may have opened itself up more room to rise. However, the overall structure of the chart suggests that the index is significantly overextended and continues to be prone to profit taking and vulnerability from current levels. With ongoing trends remaining strong, the only way to approach these markets is to continue tracking/following the trend while effectively tracking your stop loss. Volatility also rose slightly. India Vix rose 3.72% to 13.10.

Next week looks set to get off to a steady start with markets once again entering uncharted territory. The 21950 and 22185 levels are expected to act as potential resistance. Support exists at the 21745 and 21580 levels.

Weekly RSI is 77.15. Still slightly overbought. RSI also broke the high on the 14th, but remains neutral, showing no difference compared to the price. The weekly MACD is bullish and remains above its signal line.

A candle with a long lower shadow has appeared. The previous candle for this was a top or a doji. After a sustained rise, these candles continue to have the potential to delay the trend at any point. However, candles on the same width are never traded in isolation and should always be sought for confirmation.

Analysis of patterns on weekly charts shows that Nifty continues to extend the breakout. The index broke out of the rising channel when it crossed the 20800 level. This breakout continues to push the market higher. But at the same time, Nifty remains overextended on the charts. The nearest pattern support is 21000, and the 20-week MA is 1679 points below the current level of 20215. The 50-week MA is 19112. That’s a good 2792 points at current levels. Since the nearest pattern support stands nearly 900 points from current levels, any mean reversion move is significant to that extent.

Overall, how to approach the market from now on is pretty simple. There is no question of selling the market or going against the trend. However, given the overextended nature of the market, it is of utmost importance to effectively track stop losses in a way that the majority of your profits are protected. New purchases should be made defensively. Going forward, sectors such as FMCG, pharmaceuticals, etc. are expected to perform well. A very selective approach is recommended during the day while controlling leverage exposure.

Next week’s sector analysis

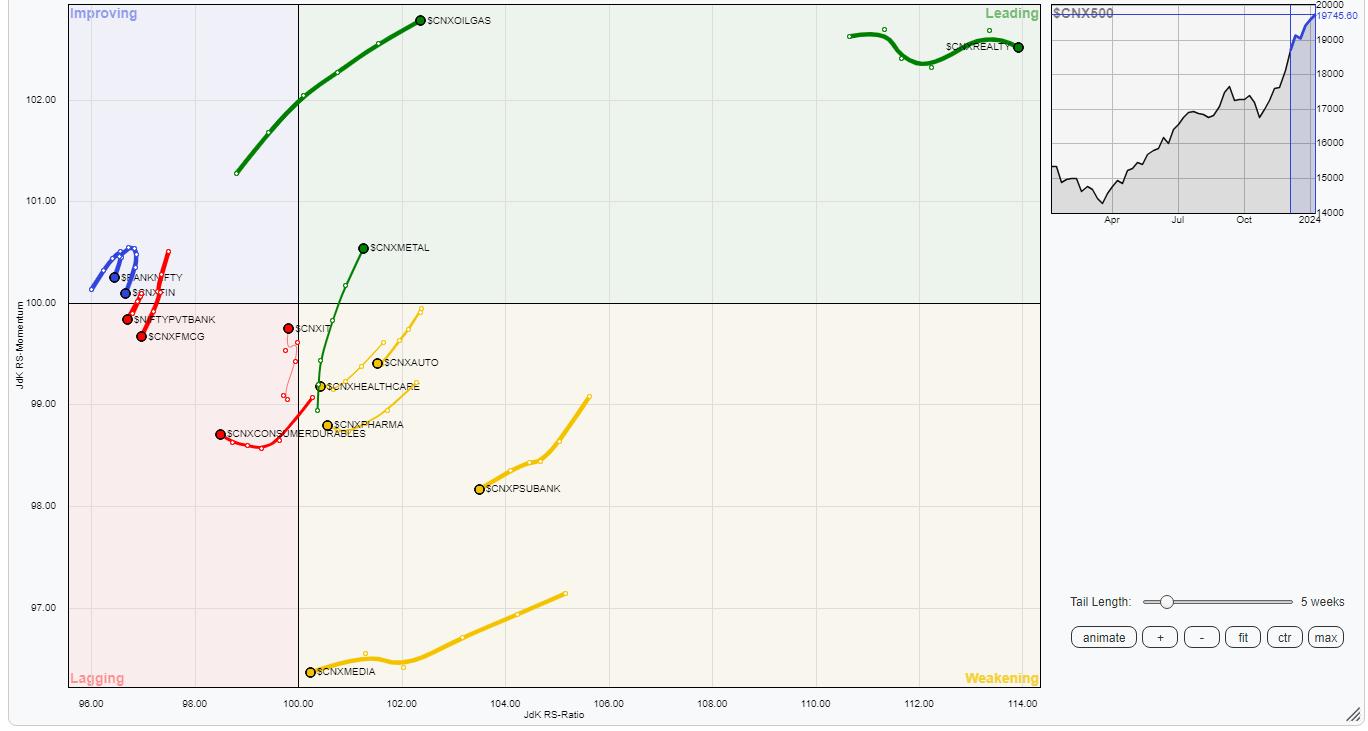

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

Relative Rotation Graph (RRG) shows that Nifty Energy, Commodities, Realty, PSE and Metal Index are firmly within the leading quadrant. The infrastructure index is also in quadrant 1. These groups are likely to continue to outperform the broader market.

Nifty Media, PSU Bank, Pharma and Auto Indices continue to decline, staying within the weakening quadrant. Although the individual performance of these groups can be seen, their relative performance may take a backseat. The MidCap 100 Index shows significant improvement in relative momentum while remaining within the bearish quadrant.

The IT index remains within the lagging quadrant, showing significant improvement in relative momentum. On the other hand, Nifty Consumption and FMCG underperformed relative to the broader market and entered the lagging quadrant.

Nifty Bank and Services Sector indices are within the improving quadrant. But they appear to be giving up relative momentum.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more