A week ago: NIFTY is disrupted at severe levels. Stay beyond this point as needed to extend the movement | India analysis

The markets once again had an extensive week. But this time it ended near the top. Nifty had multiple sessions on four of the five days. The last trading day of the week saw the Nifty swing wildly before closing near its highs. The scope of transactions has also become wider. The index moved 611 points in the last session. But volatility took a backseat. India VIX fell 7.69% on a weekly basis to 13.05. Nifty closed one level higher than the immediate resistance point. The headline index ended the week with a net weekly gain of 90.50 points (+0.37%).

The week was set to end on a negative note if the markets hadn’t risen higher on Friday. From a technical perspective, Nifty has been resisting the 100-DMA located at 24709 for the past few days. Following the massive bounce witnessed by Nifty from lower levels, the index closed a notch above this important resistance level. For this uptrend to extend itself, Nifty needs to remain above the 24700 level. A slip below this point would again bring Nifty back inside the wide 24400-24700 trading range. Failure to hold above the 24700 mark will extend the market consolidation period. However, the longer Nifty stays above 24700, the more likely this uptrend is to extend.

Next week is expected to start quietly with the 24790 and 25000 levels acting as resistance points. Support is provided at the 24590 and 24400 levels. The trading range will continue to be wider than usual.

Weekly RSI is 56.37. It is neutral and does not show any difference in price. The weekly MACD is bearish and remains below its signal line.

Analysis of patterns on weekly charts shows that Nifty has gone through a brutal process of mean reversion. The index was 16% above its 50-week MA at some point. During the recent sharp corrective move, Nifty retested this level. It then gained support and made a strong technical pullback. The support found by the market at the 50-week MA strengthens the reliability of this level as one of the important pattern supports for the market. On the daily time frame, Nifty attempted to break above the 100-DMA level after resisting for several days.

The market may attempt to resume the technical downtrend that began with the bounce from the 50-week MA level. For this, it is important for Nifty to remain above the 24700 level. It is also important to note that a decline below the 27400 level could pull the market back into a sideways range. Volatility is once again towards the lower end of the range. Volatility is likely to spike next week. Investors are advised to continue investing in relatively stronger stocks and sectors. Rather than blindly chasing rising stocks, you should invest appropriately in industries whose relative strength is strong or improving. While protecting profits at higher levels, a cautious outlook is advised for next week.

Next week’s sector analysis

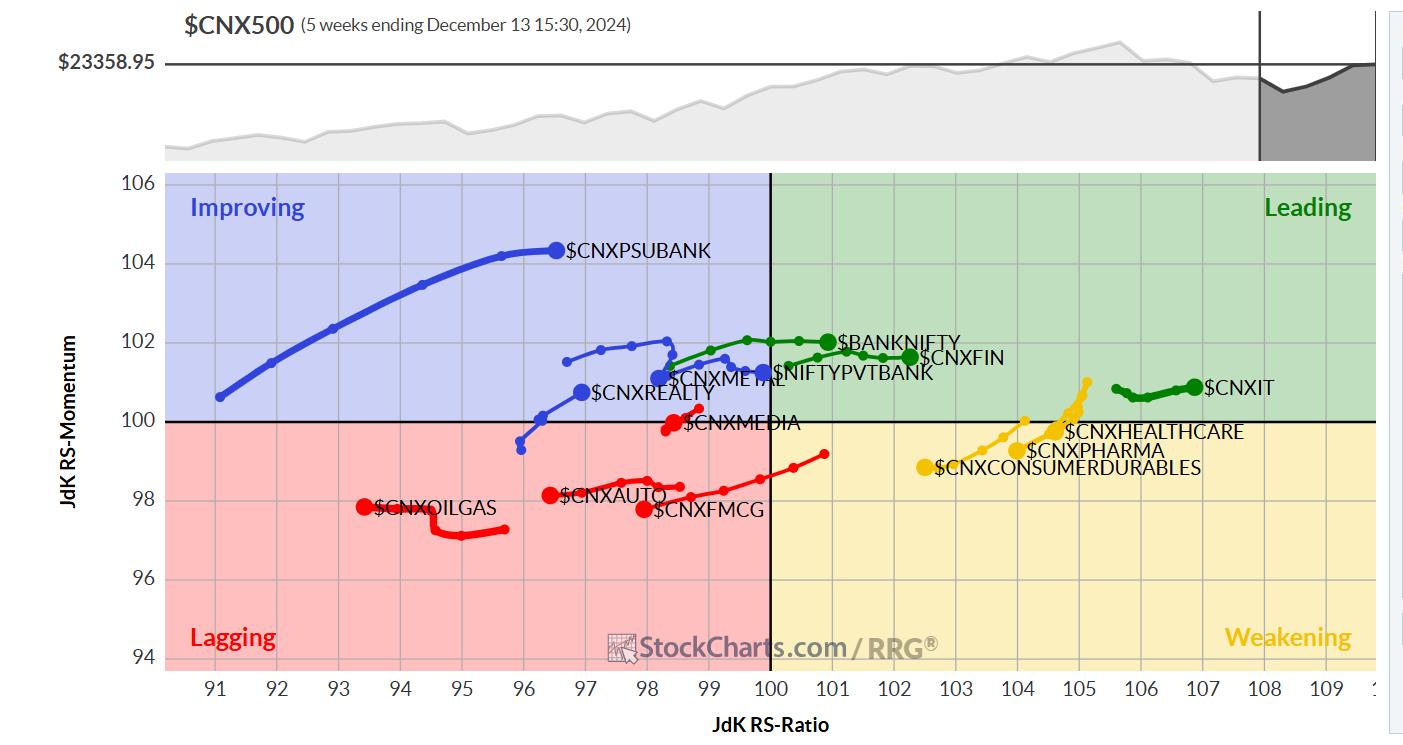

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents more than 95% of the free float market capitalization of all listed stocks.

The Relative Rotation Graph (RRG) shows that there is no significant change in sectoral settings. Nifty Bank, Financial Services, Private Banks and IT indices are within the first quadrant. These groups are relatively likely to outperform the broader market.

Pharma and Midcap 100 indices are within the bearish quadrant. These sectors are likely to see a continued slowdown in their relative performance.

FMCG, Energy, Media, Automotive, Energy and Infrastructure indices are within the major quadrants. These groups may underperform relative to the broader Nifty 500 index.

The PSU Bank index continues to rotate solidly within the improving quadrant. Real estate and metals indices are also in the improving quadrant, with these groups likely to improve their relative performance compared to the broader market.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter (now in its 18th year of publication), one of the most accurate “daily/weekly market forecasts” in India. Learn more