A week ago: NIFTY is likely to continue consolidating. Relative performance can be viewed here | India analysis

A previous technical note asserted that while the overall trend remains the same, the market may continue to consolidate. Based on our analysis, the market continued to consolidate and remain in a broad but defined trading range. The trading range last week was 422 points. Nifty oscillated in this range before ending the week on a positive note. Volatility continued to move back. The headline index closed with a net weekly gain of 172 points (+0.78%).

Volatility continued to decline slightly. India Vix fell 1.64% to 14.97. From a technical perspective, the market continues to remain range-bound. The current technical structure suggests that even if the market moves higher and makes gradual highs, it may take time for a runaway move to occur. At the lower end, the support level has been pushed up to 21700, which keeps Nifty within the defined 700-point trading range. Options data suggests that unless 22500 is comprehensively cleared, a runaway sustained uptrend is unlikely and the market will continue to look for profit-taking pressure at higher levels.

Next week is the expiration week for the monthly derivative series. Movements may continue to be influenced by expiration-driven activity. A steady start is expected for this week, but Nifty may face resistance at 22300 and 22470 levels. Support is provided at the 22000 and 21800 levels.

Weekly RSI is 72.55. It remains slightly overbought. RSI remains neutral and shows no price differential. Weekly MACD is bullish and hovering above the signal line. The histogram is narrowing, indicating that upward momentum may be slowing.

Pattern analysis shows that the channel breakout achieved by Nifty above 20800 remains intact. The index currently appears to be consolidating at higher levels as it continues to hit record highs. In the process, support for Nifty was pushed up to 21700 level. Any corrective action is expected to be supported. The band is wider than usual. This means that the index may continue to hit record highs, but it may take some time before it surges.

Overall, it is more likely that Nifty will continue to consolidate higher while undercurrents remain vibrant and intact. Now is the time to increase stock specificity in your approach. Additionally, as incremental moves increase, you should focus on protecting your interests at higher levels. You need to stay very selective and make fresh purchases. Volatility is expected to rise above current levels. It is best to approach the next week with caution and caution.

Next week’s sector analysis

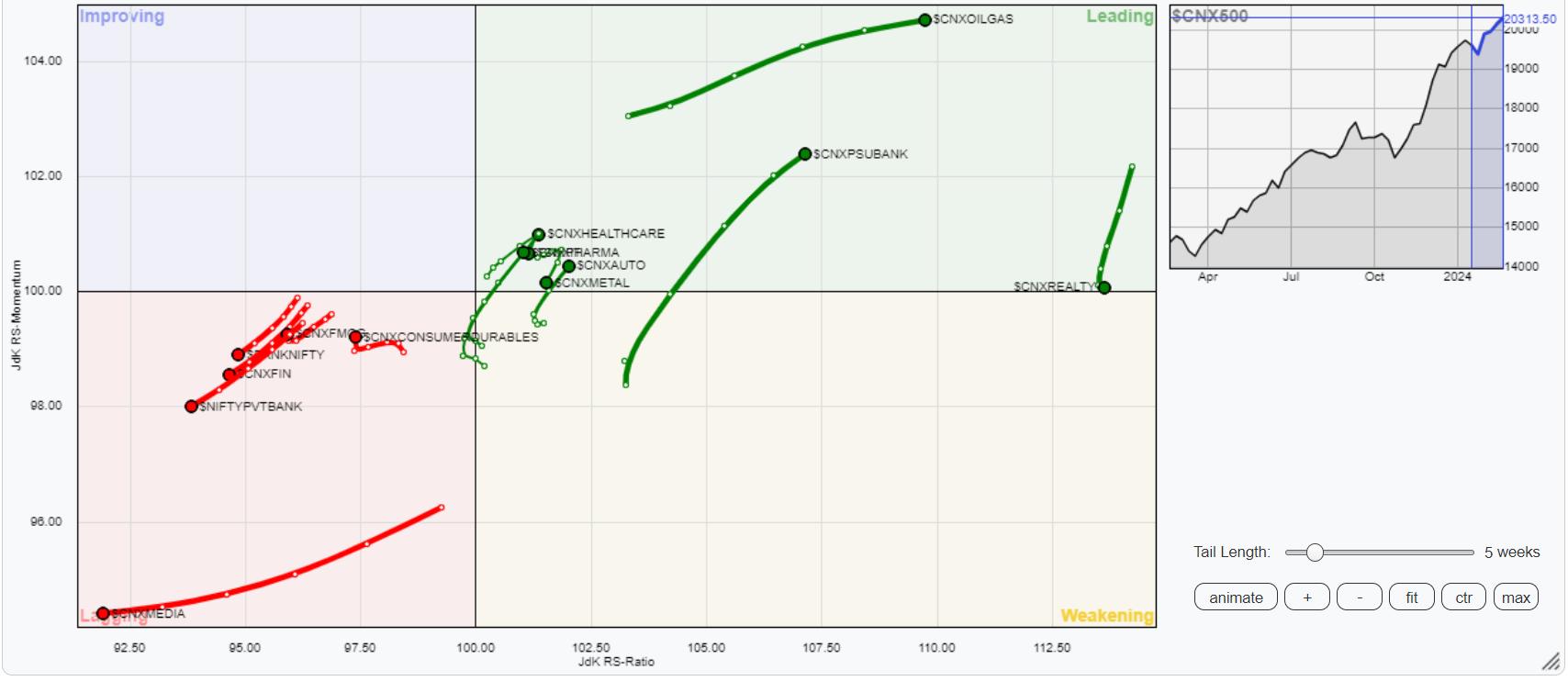

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

Relative Rotation Graph (RRG) shows Nifty Pharma and Auto indices rolling inside the major quadrants. Apart from this, Nifty Energy, Realty, IT, Infrastructure, Metal and PSU Bank indices are also within the leading quadrant. These groups will continue to outperform the broader Nifty 500 index comparatively.

Nifty Midcap 100 index remains within the bearish quadrant.

Nifty FMCG and consumption indices are within the lagging quadrant. However, momentum relative to the broader market appears to be improving. Apart from this, Nifty Financial Services, Services Sector, Banknifty and Media indices continue to languish in the lagging quadrant. These four groups may continue to underperform relative to the broader market.

There are no exponents inside the improvement quadrant.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more