A week ago: NIFTY observes both gradual peaks and higher levels of consolidation. Tread carefully | India Analysis

The market continued to trade in line with expectations. Because Friday was a trade holiday, the trading week was short. mahasivratri. Over four trading sessions, the market remained choppy and failed to make any clear, convincing moves during the modest week-to-week gains. Trading ranges also remained narrow. The index fluctuated within a defined 301.30 point trading range while showing no directional bias for the most part. Volatility has also decreased. India VIX fell 10.65% to 13.61. Although there was no significant overall gain, the headline index closed with a net weekly gain of 154.80 points (+0.69%).

As we head into a new week, markets still tend to consolidate at higher levels. Options data continues to show resistance forming just above current levels. It is likely that the market will show gradual developments, but at the same time there will be a tendency to seek profits at higher levels. A sustained rise is almost impossible and will happen only if Nifty can achieve above 22600 levels. This ensures strong vigilance at higher levels. It is important not only to identify relatively strong opportunities, but also to continue to protect interests at a higher level.

Chasing trends must be done very carefully and with strict protective measures in place. Next week is likely to see quiet trading once again. The 22600 and 22750 levels are likely to act as resistance levels. Support lies lower at the 22230 and 22050 levels.

Weekly RSI is 74.52. It remains in a slightly overbought area. It also remains neutral and does not show any difference in price. The weekly MACD remains bullish and remains above its signal line.

Small life-sized candles appeared. This indicates a lack of confidence and indecisiveness among market participants at current levels.

Pattern analysis of the weekly charts shows that Nifty is continuing well, advancing the break achieved above the 20800 level. After breaking through the rising channel, the index continued to rise and reached a new high. The band has become wider. This expansion is likely to lead to a break in the trend and some consolidation in the market.

However, there are no signs in the chart to suggest that corrective action will occur. However, the technical structure of the chart shows that the market is taking a breather. The current uptrend may not remain intact or reverse immediately, but Nifty certainly appears to be trending towards some degree of consolidation at higher levels. We must continue to follow trends and look for stocks that are improving or showing strong relative strength, while placing equal importance on protecting profits at higher levels. It is highly recommended that you continue to follow the trend, while at the same time maintaining your overall leverage position at a reasonable level so that you can effectively follow a trailing stop. A cautious outlook is advised this week.

Next week’s sector analysis

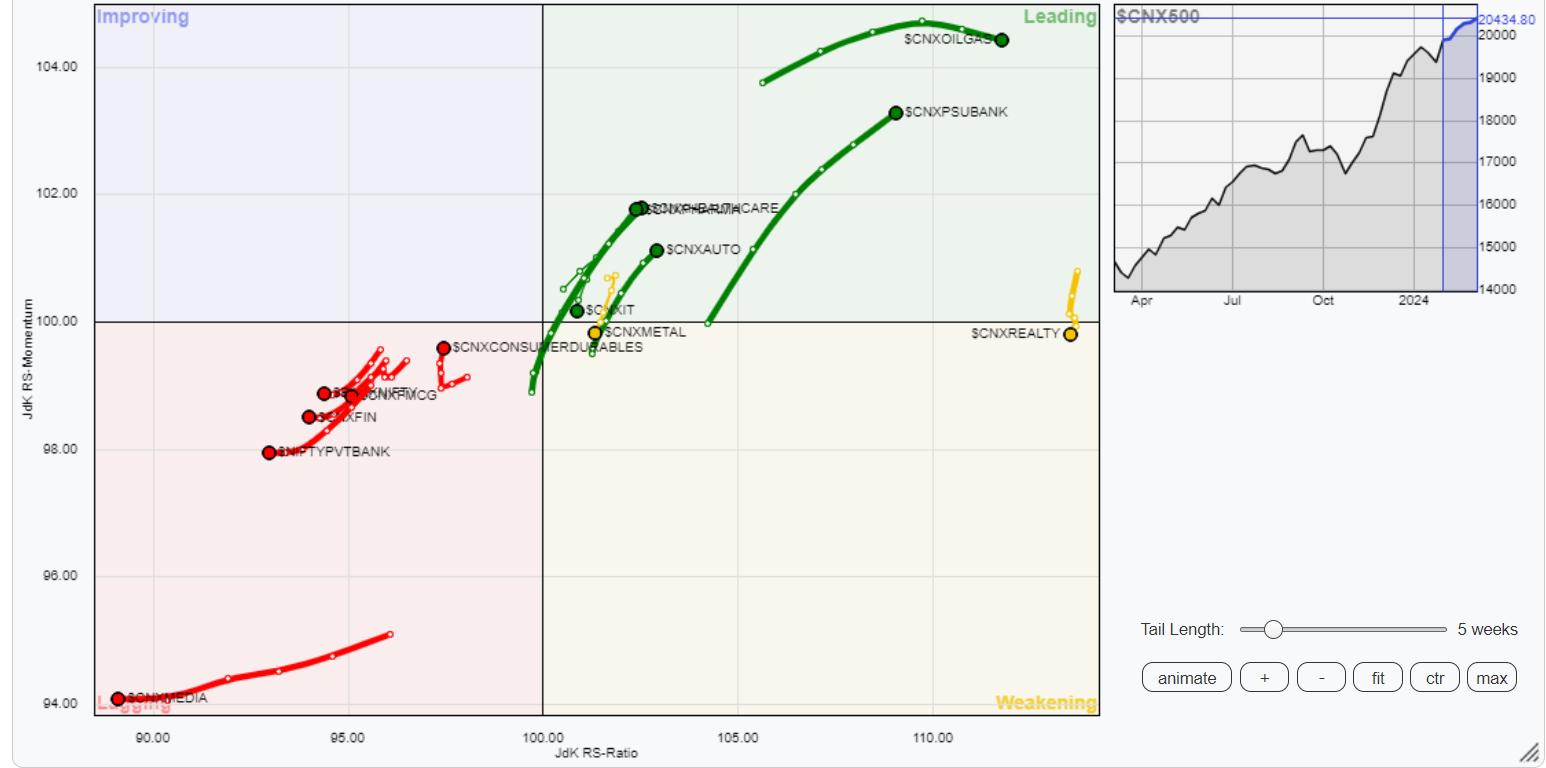

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

The Relative Rotation Graph (RRG) shows the relative momentum of the Nifty IT, Commodities and PSE groups slowing down compared to the broader market as they remain in the leading quadrant. Apart from this, PSU Banking, Pharmaceuticals, Infrastructure and Automobile indices are within the leading quadrant and may continue to outperform the broader market relative to the broader market.

Real estate indices are back in the bearish quadrant and so are metals indices. These two sectors may also see their relative performance slowing down with the Nifty Midcap 100 index in the bearish quadrant, but individually they may continue to outperform.

Nifty FMCG, Financial Services, Service Sector Index, Banknifty and Media continue to languish in the lagging quadrant. The consumption index is also in the lagging quadrant, but relative momentum appears to be improving.

There are no sectors inside the improvement quadrant.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more