Abbott Laboratories Stock: Why I Agree with Wall Street (NYSE:ABT)

miscellaneous photos

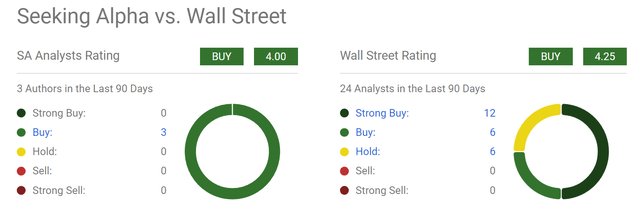

ABT Stock: Wall Street Loves It

Readers of our articles know that we are contrarian investors and typically bet against Wall Street ratings. However, Abbott Laboratories (New York Stock Exchange: ABT) stock, we found ourselves in agreement With Wall Street. More specifically, the chart below summarizes the current sentiment on ABT stock from Wall Street analysts (and Seeking Alpha writers). As you can see, Wall Street analysts have a ‘Strong Buy’ rating on the stock, with 12 out of 24 analysts giving this rating in the last 90 days. The total rating is 4.25. Seeking Alpha writers’ reviews are somewhat less enthusiastic, but the overall score of 4.0 means it’s a solid buy.

pursue alpha

In the remainder of this article, we’ll look at why we rate the stock a Buy. Of course, stocks It does face some risks and profit headwinds (more on that in the last section), but I would argue that A) these risks are relatively minor compared to the upside, and B) it is already well compensated by the discounted stock valuation.

ABT Stock: Awesome Business at a Discount

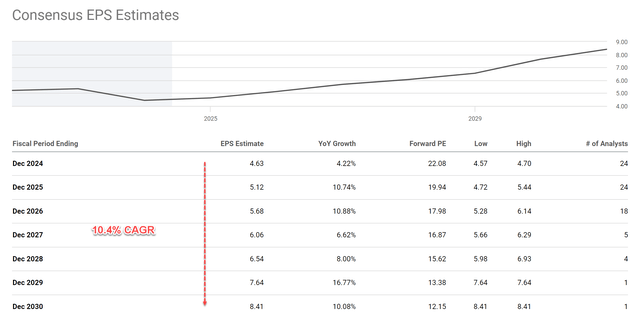

Let’s start with the growth outlook and growth catalysts. The chart below shows consensus EPS estimates for ABT stock over the next six years. Analysts forecast ABT’s EPS to grow at a compound annual growth rate (“CAGR”) of 10.4% over the next six years. This implies an EPS increase from $4.63 in fiscal 2024 to approximately $8.41 by fiscal 2030.

pursue alpha

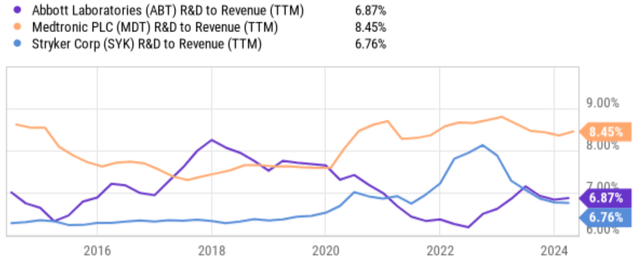

Given the unique strengths of ABT’s business model, I am very optimistic about its growth prospects. In my opinion, the two key factors that set ABT apart from other healthcare product companies are its diverse product lineup and its focus on innovation. Unlike many of its peers that focus on specific sectors such as pharmaceuticals or medical devices, ABT boasts a diverse portfolio across diagnostics, medical devices, pharmaceuticals and nutrition. This proliferation mitigates risk by reducing reliance on the success of a single product or therapeutic area. ABT also continues to invest heavily in research and development (see the next chart below). This enables a steady pipeline of new products and technologies and allows ABT to stay ahead of the curve in a rapidly evolving healthcare environment.

This combination of strong current lineup and pipeline means ABT is well-positioned for long-term growth and has many revenue drivers. Some notable examples we consider include diabetes management products, electrophysiology, neuromodulation, and structural heart segments.

The company also launched several new products, including Amplatzer, Amulet, Navitor, TriClip, and AVEIR. Given the company’s past performance, we are optimistic about the success of these new products. Finally, we believe FreeStyle Libre is a strong driver for our long-term growth curve. This popular blood sugar monitoring system is, in our opinion, one of the most successful assets in diabetes treatment. It is also ABT’s most profitable product, accounting for about 15% of the company’s sales. FreeStyle Libre has enjoyed solid growth. (First quarter 2024 sales increased by more than 22% compared to the same period last year. Given its user base and unique features, this momentum is expected to continue.

pursue alpha

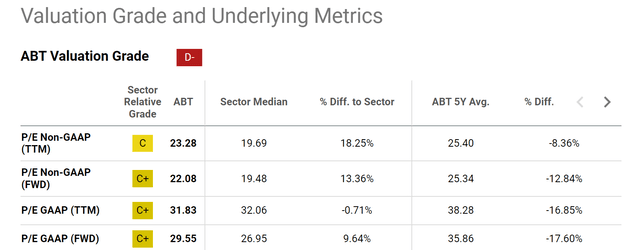

Despite solid growth prospects, the stock appears at a discount. Recalling the chart above, ABT’s forward P/E ratio is around 22x and is expected to decline rapidly as EPS grows (to 12.15x by 2030). Of course, the current 22x FWD may seem a bit off-putting when compared to the segment median (about 19.5x). However, we believe the premium is justified given the strength of the business. Given the differentiating factors just mentioned, we think it makes more sense to compare the current P/E to its own historical average. This represents a significant discount of approximately 13% in terms of FWD non-GAAP P/E.

Next, we will better contextualize the valuation compared to the broader market.

pursue alpha

ABT Stock: Valuation Rating and Expected Returns

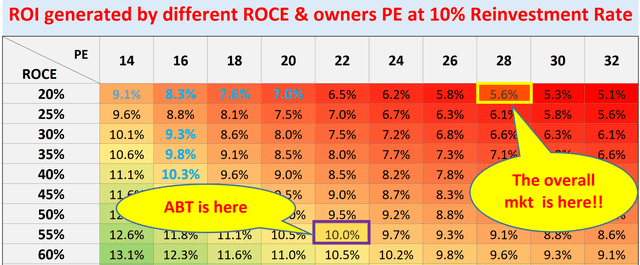

The following chart shows valuations (and expected returns) in the current situation for the overall market. The concepts behind this chart are explained in detail in this free blog article. The key concepts involved here are Return on Capital Employed (ROCE) and Return on Owners Earnings (“OEY”), summarized below.

- Long-term ROI for a business owner is simply determined by two factors: A) the price paid to purchase the business and B) the growth rate of the business (which reflects its quality and moat).

- More specifically, Part A is determined by the Owner’s Earnings Yield (“OEY”) at the time we purchase the business. Part B is determined by ROCE and RR (reinvestment rate) over the long term.

- That is, long-term ROI = OEY + growth rate = OEY + ROCE*reinvestment rate

- For ABT, we are approximating OEY with an earnings yield that is on the conservative side. At current FY1 P/E of 22x, ABT delivers ~5% OEY.

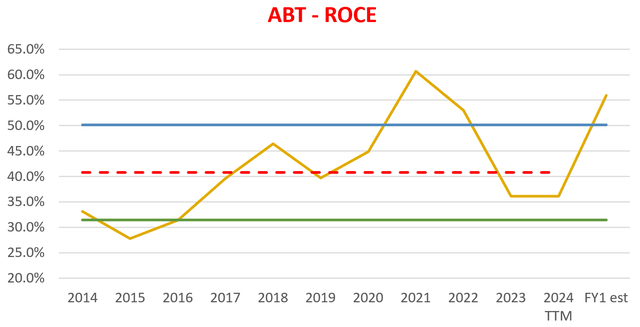

Meanwhile, ABT has maintained an average ROCE of around 41% over the long term (see second chart below), compared to around 20% for the overall market. Meanwhile, the overall market is also priced at a higher P/E (as of this writing, the SP500 is priced at around 28x P/E). Given its excellent ROCE and low P/E multiple, ABT’s annual total return potential is expected to be close to double digits compared to the mid-single digits for the overall market.

author author

Other Risks and Final Thoughts

In terms of downside risks, ABT shares many common risks with its healthcare industry peers. First, both ABT and its competitors face the challenge of navigating an ever-evolving regulatory environment for drugs and medical devices. Regulatory hurdles may delay product approval and hinder sales growth (e.g., FDA regulations). Both ABT and its colleagues must also contend with ongoing pressures on health care costs. In addition to being a business issue, it is often considered a sensitive political issue. These pressures could lead to price controls and reduced refunds.

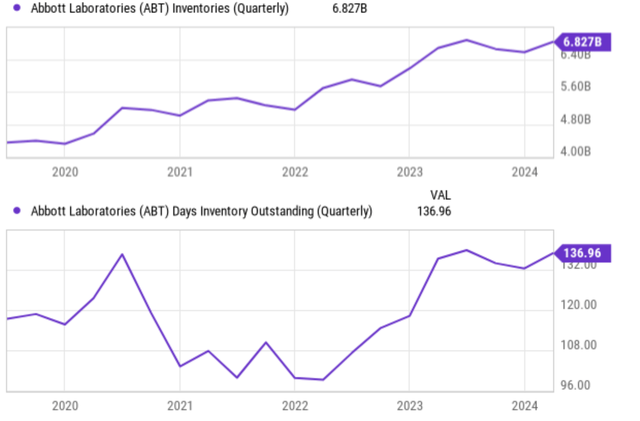

Although there are some risks associated with ABT. The first relates to continued weakness in the diagnostics segment, where sales continue to decline due to lower demand for Abbott’s COVID-19 test kits. Longer term, we believe this is only a temporary headwind and an expected problem. We assume that no investor seriously expected demand to continue at the levels seen during the pandemic. Inventory is another sign of concern, as you can see in the chart below, both in terms of dollar amount and days of inventory outstanding. This increase in inventory could increase cost pressures and balance sheet risk in the near term.

pursue alpha

Overall, our verdict is that the positives outweigh the negatives. We believe ABT is an attractive opportunity for investors seeking long-term total return. Analysts predict EPS to grow steadily at a CAGR of over 10% over the next few years. We agree with this strong outlook given its diversified business model and strong new product pipeline. Moreover, ABT’s current P/E ratio is significantly below its historical average, suggesting that the stock may be undervalued. The combination of strong growth potential, high ROCE, and discounted valuation allows ABT to deliver market-beating returns.