Accelerate growth through innovation and strategic expansion

Corporate executives face significant pressure to achieve results despite market challenges. Implementing automation provides a quick solution that can improve the efficiency and productivity of departments across your organization.

Automation has emerged as a transformative force reshaping industries and societies around the world. Businesses around the world are embracing automation because it helps them save time, money, and resources while improving the quality of their products and services.

By integrating smart technologies into everyday tasks, automation is changing the way work is done in industries such as manufacturing, healthcare, and transportation.

In the exciting world of automation, ABB India stands out as a leader. They are a global technology company dedicated to making society and industry better using innovative solutions that combine software, electricity, robotics, and more.

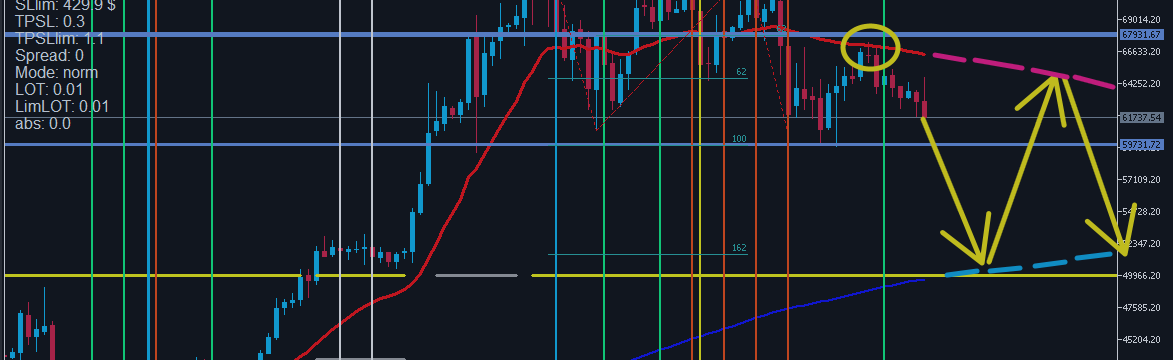

Note: If you want to learn candlestick and chart trading from scratch, here are some of the best books available on Amazon! Get the book now!

ABB India’s goal is to push technology to its limits, taking performance to new heights. They are leading the way in building smart factories, efficient energy systems, and cutting-edge infrastructure that make life easier for everyone.

The company’s stock has performed very well over the past year, returning nearly 100%. Looking at a longer period of three years, the stock has achieved multibagger returns of nearly 360%.

Let’s take an in-depth look into the world of ABB India and look at its business segments, financial performance and future prospects. Let’s take a closer look at how ABB India’s innovative solutions are transforming industries, empowering businesses and shaping the future of automation.

Join us as we uncover the complexities of ABB India’s operations, analyze its financial health, and examine its vision for the future.

ABB India Corporate Overview

ABB India It is a world-renowned technology company that is leading the development of society and industry toward a more productive and sustainable tomorrow. ABB continuously advances technological areas to improve performance by integrating products and software in the areas of electrification, robotics, automation and motion.

Building on a remarkable heritage spanning more than 130 years, ABB’s performance is driven by approximately 105,000 skilled employees in more than 100 countries.

ABB India’s Business Units

ABB India operates through a decentralized operating model. The 19 business units are grouped into four business areas: Electrification, Motion, Process Automation, Robotics and Individual Automation.

Daejeon

In the field of electrification, ABB offers a comprehensive range of products, digital solutions and services aimed at powering the world in a safe, intelligent and sustainable way.

These products include a variety of solutions including electric vehicle (EV) infrastructure, modular substations, distribution automation, power protection, wiring accessories, switchgear, enclosures, cabling, and sensing and control systems.

The significant growth of this segment is attributed to favorable business environment and tailored strategic approach to effectively serve the market through right channels and product offerings. As a result of these efforts, ABB’s electrification business expanded significantly in 2023 and gained market share.

During fiscal 2023, the segment contributed 39% of total revenue, significantly impacting ABB’s overall performance and reaffirming its position as a key driver of growth within the company.

work out

ABB’s Motion division plays a pivotal role in driving the world’s progress. As a leading supplier of drives and motors globally, the company offers its customers a comprehensive range of electric motors, generators, drives and related services.

ABB also offers integrated digital. powertrain Through our solutions, we help our customers save energy every day and contribute to a low-carbon future. Meeting a wide range of automation requirements across the transportation, infrastructure, discrete and process industries, ABB leverages domain expertise and cutting-edge technologies to improve performance, safety and reliability.

In fiscal 2023, the Motion business delivered strong performance as trends in urbanization and industrialization increase, leading to higher levels of energy consumption.

In fiscal 2023, this segment accounted for approximately 36% of total sales, highlighting its significant contribution to ABB’s overall profits.

Process Automation

ABB’s Process Automation division helps customers manage the world’s largest and most complex industrial infrastructure, creating a future of safe, intelligent and sustainable operations. ABB provides industry-specific integrated control systems, software, as well as measurement and analysis solutions and services through a wide range of automation, electrification and digital solutions tailored to process and hybrid industries.

The Process Automation segment delivered strong performance throughout the year, driven by new opportunities across a variety of sectors. These sectors include city gas distribution, terminal automation, life sciences, metals and mining, and the cement industry. In fiscal 2023, this segment accounted for 21% of total sales.

Robotics and individual automation

ABB’s Robotics and Discrete Automation business unit helps companies increase resilience, flexibility and efficiency with a suite of value-added solutions in robotics, machinery and factory automation.

ABB’s commitment to innovation focuses on pioneering advances in artificial intelligence, creating a dynamic ecosystem of digital partnerships, and expanding production and research capabilities.

In fiscal 2023, this segment accounted for approximately 4% of total revenue.

Finance of ABB India

In 2023, ABB India witnessed significant growth in its revenue, surging 22% to reach ₹10,446 crore compared to ₹8,567.53 crore in 2022. Analyzing four years from 2020 to 2023, the company recorded its revenue at a compound annual growth rate (CAGR) of 21.52%.

At the same time, there was a notable increase in net profit, which increased by 22% from Rs 1,256.1 billion in 2022 to Rs 1,248.18 million in 2023. Cumulative net profit over the four years from 2020 to 2023 recorded a CAGR of 75.62%.

In CY23, ABB India maintained favorable financial metrics with return on equity (ROE) of 22.82% and return on invested capital (ROCE) of 30.39%.

ABB India’s future plans

Increase proportion of high-growth segments to improve margins

ABB’s business distribution is divided into domestic business (85%) and exports (15%). Within the domestic sector, approximately 50-55% comes from core industries such as cement and steel, while the remaining 40-45% comes from emerging, high-growth sectors.

Importantly, ABB’s dominance in the electrification and motion segment allows the company to charge premium prices. ABB’s business mix is expected to shift, prioritizing high-growth and high-margin segments to maintain a double-digit profit after tax (PAT) margin trajectory.

Expansion into high-growth areas

ABB India is entering high-growth sectors such as electrification and motion, targeting both domestic and export markets. The company is actively investing in automation of its existing shop floors to improve productivity.

Additionally, ABB has recently established a large-scale gas insulated switchgear (GIS) plant in line with market trends favoring GIS switchgear in the medium voltage sector. This strategic move highlights ABB’s commitment to technological innovation and adaptability to market dynamics.

We are well positioned to leverage energy efficiency efforts.

ABB India is poised to reap the rewards of increasing emphasis on energy efficiency within government infrastructure projects to encourage uptake of cutting-edge technologies. ABB is actively supporting companies to strengthen their energy efficiency measures, based on a 10-point action plan released last year.

Strategically, ABB is making targeted investments focused on energy conservation efforts across key industries, including chemicals, oil and gas, steel, aluminum and cement.

In particular, major companies in the oil and gas sector have invested 40% of their cash flow in ambitious energy transition plans with the goal of reducing fossil fuel production by 40% and integrating renewable energy sources.

conclusion

ABB India’s innovative solutions and strategic initiatives position us strongly for future growth. With a focus on high-growth segments, energy efficiency and automation, the company is well aligned with market trends. With strong finances and a proven track record, ABB India is poised for continued success.

What are your thoughts on ABB India’s future outlook and its role in driving automation and sustainability across industries?

Written by Nalin Surya

By leveraging the Stock Screener, Stock Heatmap, Portfolio Backtesting and Stock Comparison tools on the Trade Brains portal, investors have access to comprehensive tools to identify the best stocks, stay updated and informed with stock market news. invest.

Start your stock market journey now!

Want to learn stock market trading and investing? Check out exclusive stock market courses from FinGrad, a learning initiative from Trade Brains. You can sign up for free courses and webinars from FinGrad and start your trading career today. Sign up now!!