Actively Managed ETFs: Growing at the Sacrifice of Mutual Funds and Passive ETFs

deepblue4you/iStock via Getty Images

In the world of exchange-traded products (ETPs), “passive” exchange-traded funds (ETFs), products that track broad and/or diverse securities indices, collectively have attracted over $9 trillion in assets under management (AUM) by 2022. . However, 2023 will see “active” ETPs as per the trend. Our team of investment managers is growing by leaps and bounds, dynamically selecting and rebalancing allocations to publicly available funds.

global trends

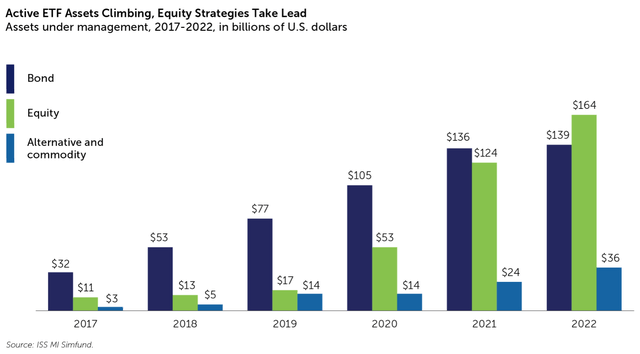

Talk about “active” ETFs (or simply “active products”) and the name Cathie Woods, whose company launched the Ark Fund series, may come to mind for the casual follower of market news. Each fund follows a specific theme and is managed using proprietary methodologies that are not linked to any index. However, the fact is that prior to this activity, issuers of bond-specific products/strategies primarily used active ETF structures. Issued. However, between 2017 and 2022, this trend will showed a clear change:

Source: ISS Insights

Active products ended 2022 with a five-year growth rate. 580% And stock-focused active products are at the forefront. Considering that active ETPs compete directly with mutual funds, $11.3 trillion There is plenty of room for growth in AUM as of the end of 2022.

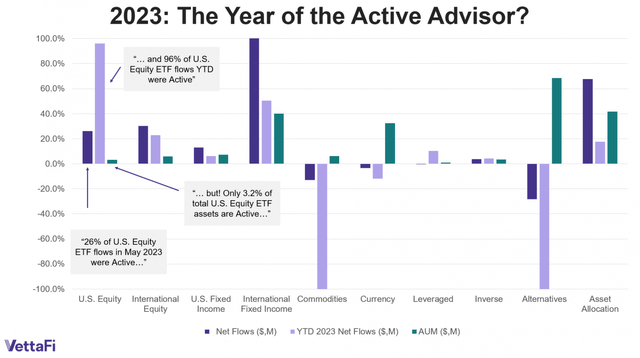

It was confirmed that it accounts for more than 96% of U.S. stock ETFs as of the half year of 2023. inflow I was interested in active products.

Source: ETFTrends.com, VettaFI

Nonetheless, they accounted for only 3.2% of total U.S. equity ETF AUM, suggesting another aspect of growth.

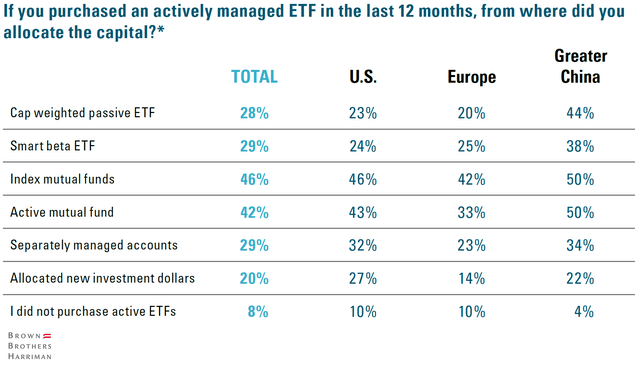

In this year’s Brown Brothers Harriman Global ETF Survey of 325 professional investors, more than 42% of respondents said they would reduce their index mutual fund holdings in favor of holding positions in active products.

Source: Brown Brothers Harriman

Overall, reported adoption rates were highest among respondents in the “Greater China” region, likely emphasizing the idea that Asian investors are generally more receptive to new ideas and asset classes than European (and even American) investors.

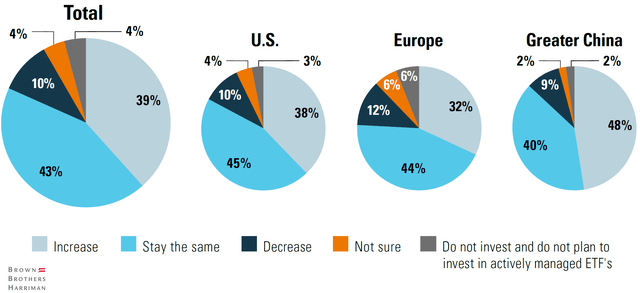

Overall, 76% of European respondents and 88% of Greater China respondents said they would increase or maintain their holdings in active products.

Source: Brown Brothers Harriman

American respondents were in the middle at 83%.

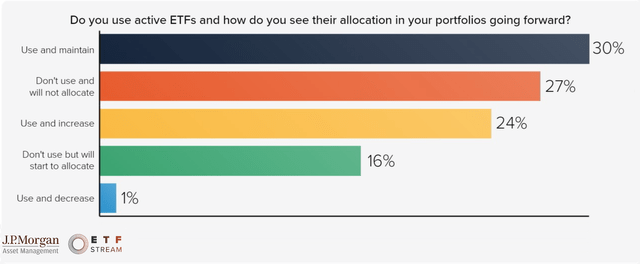

These results are largely resilient to survey pool size. For example, industry publication ETF Stream partnered with JP Morgan Asset Management to survey 66 professional investors in Europe about their outlook. 70% of respondents reported that they plan to continue allocating capital to active products that they currently use and maintain, currently use and grow, or begin allocating capital to active products in 2024.

Source: JP Morgan Asset Management, ETF Stream

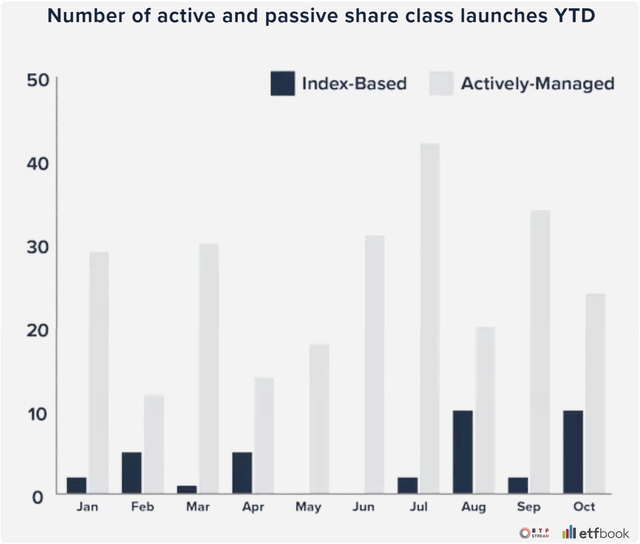

For active issuers, Europe has emerged as a battleground for attention. As of the end of the third quarter of 2023, data from ETFbook shows that the number of active ETPs launched continues to outpace the number of index-based ETPs launched throughout the year.

Source: ETFBook, ETF Stream

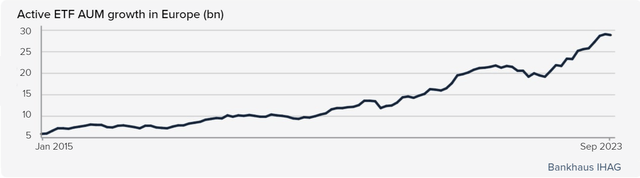

“Active” ETPs listed in Europe saw their AUM increase five-fold from $6.1 billion to over $29 billion in the third quarter of 2015.

Source: Bankhaus IHAG

As of the end of November, total global AUM of active products was reported to have reached US$700.4 billion, a 44% year-on-year (YoY) increase. At Year Till Date (YTD), equity-focused active products recorded net inflows of $111.96 billion, an increase of nearly 45% compared to the same period in 2022. Bond-focused active products recorded net inflows of $54.34 billion YTD. 158% increase Same period in 2022.

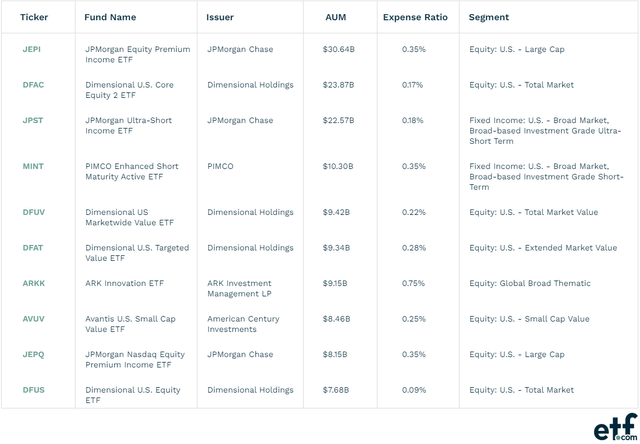

As of November, there were 2,383 active products from 415 providers, listed on 36 exchanges in 27 countries around the world. As of this writing, the majority of these products (worth just over $520 billion) are focused on the United States.

Source: ETF.com

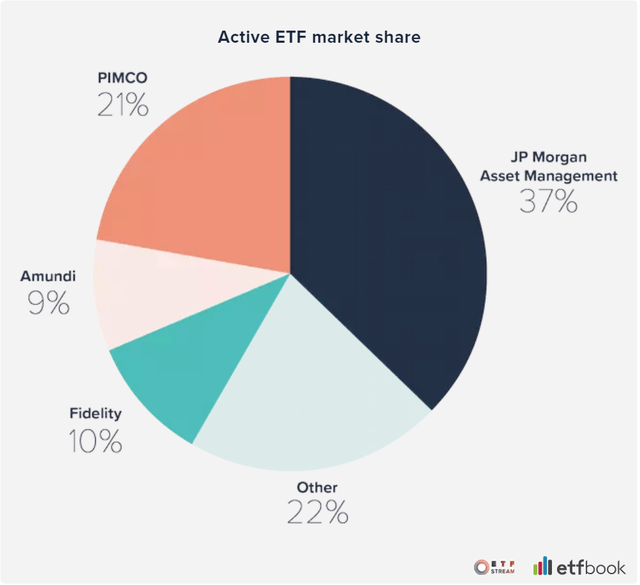

JPMorgan Equity Premium Income ETF (JEPI) and PIMCO Enhanced Short Maturity Active ETF (MINT) each represent two of the largest growing segments of active products in Europe. As of the third quarter, only two issuers, JP Morgan Asset Management (JPM) and PIMCO, account for more than 48% of total AUM held in active products.

Source: ETFBook, ETF Stream

However, with just over 100 active underlying products currently in operation in a world of over 1,800 UCITS ETFs, there is plenty of room for issuers to build more and more products.

At least part of this reorganization in Europe is due to a plethora of “passive” offerings that are not fully aligned with investor goals for efficient manager selection and performance. According to data from Jane Street, more than half of the 11,925 listed ETFs on the continent (i.e. not just UCITS certified) trade less than 10 times a day, while only 11% trade more than 100 times a day on average. This strongly suggests that European investors are looking for more than what can be achieved through a “passive” investment style.

Europe is particularly interesting for another reason. More than 80% of the European ETF market is driven by institutional investors. Successful support among a relatively small number of institutional investors, as opposed to the vast number of individual investors spread across countries, regions, and languages, tends to go a long way in driving adoption and AUM growth.

Many professional investors generally believe that European markets are five years behind the US in terms of demand changes. Given the tremendous success evident in the United States, the potential for increased investor interest and capital in Europe is increasingly being viewed by issuers as worthy of attention.

as a result

Asset managers have long struggled to raise capital and execute their strategies. used Active strategies required mutual fund structures and the resulting complexity. The alternative ETF structure had its own challenges. Industry precedent has largely favored “passive” index tracking models (of which there are many) that result in long delays in growing interest and AUM.

However, the recent trend of active issuances and tremendous success in the US and Europe, which are also attracting investment from Asia, is a positive sign that investors (both retail and institutional) are benefiting from the middle path of mutual funds. And traditional “passive” ETFs are available as active ETFs.

Given that market breadth will continue to suffer for at least two quarters of 2024 (as highlighted in our previous article), retail investors would do well to consider active products. Access to sophisticated strategies has never been easier or cheaper.

Although some instruments of interest are listed in the top 10 charts (such as JEPI and MINT), all investors are encouraged to carefully study the value propositions touted by a wide variety of issuers before making any investment decisions.