ACWI: Bright End to 2023, Focus on Election Risks in Early 2024 (NASDAQ:ACWI)

never

It’s been quite a year for global stocks. Large Cap U.S. stocks were on the rise through July before a huge correction in the last two months of the third quarter and the start of the fourth quarter. Then, the stock price soared in an incredible rally. After hitting its lowest point on October 27th. Over the past eight weeks, the S&P 500 has indeed been on a steady rise, but the once-deadly US small and mid-cap sector has also been on the rise.

It may also be overseas stocks that reverse the upward trend. By total return, we saw the Vanguard FTSE All-Worl Ex-US ETF (VEU) close on Friday at its highest close since February 2022. Now that the vaunted Santa Claus Rally is underway, it’s all-skate (the last five trading days and first two sessions of the year) new year).

Let’s go global. I use the iShares MSCI ACWI ETF (NASDAQ:ACWI). I think the valuation is reasonable, but I’ll touch on the key risks for the upcoming first quarter later.

VEU International Stocks: New 22-Month High

stockcharts.com

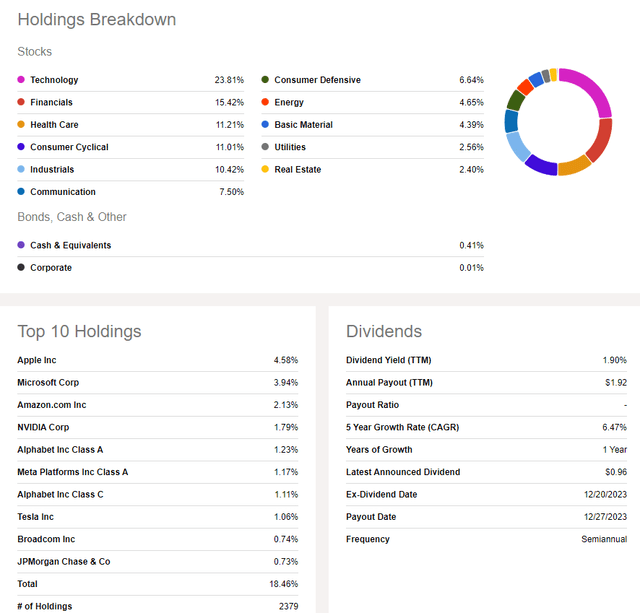

As background, ACWI aims to track the performance of the MSCI ACWI index, which includes large and mid-cap companies from developed and emerging markets. This fund is a large fund, with nearly $19 billion in assets under management. dividend yield 1.9% as of December 22, 2023. stock momentum It has an ACWI a B ETF rating via Seeking Alpha, and has yielded 0.32% per year, which is solid for now. cost ratio The price is reasonable, but you can find other broad index ETFs at lower costs. Still, it’s not really like that. dangerous ETF and liquidity According to , this is a very high figure considering that the average daily trading volume is more than 3.7 million shares and the 30-day average bid/ask spread is only 1 basis point. iShares.

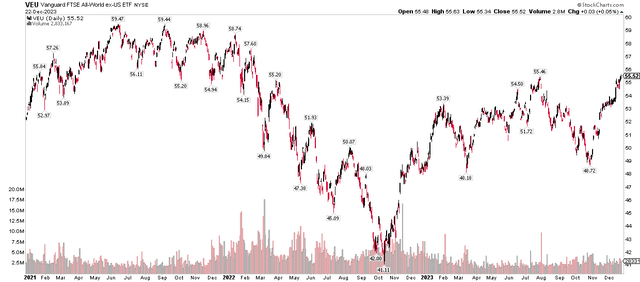

ACWI is currently selling for a paltry 16 times earnings estimates. This is roughly in line with the long-term average. Moreover, with interest rates now closer to the 25-year normal range, valuations appear fair, further underscoring the hold rating. Long-term investors should consider holding on to the fund, while active investors should be wary of price declines in the coming months. I will support this claim later in the article.

ACWI: 16.1x forward earnings near LTA

Goldman Sachs

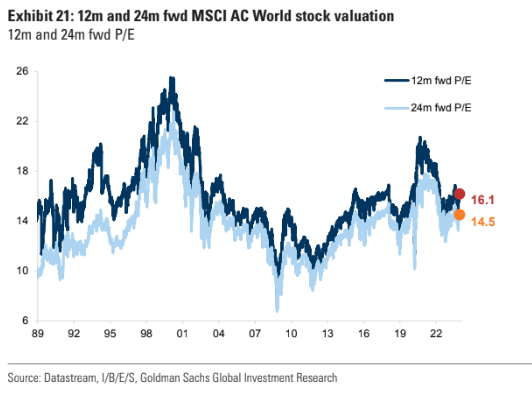

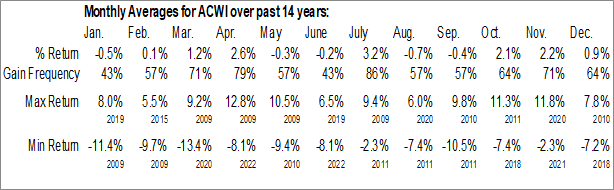

Consider that we are just wrapping up ACWI’s peak three-month period on the calendar, according to BofA’s seasonality chart below.

ACWI: An optimistic year-end trend has emerged.

BofA Global Research

ACWI: Holdings and Dividend Information

pursue alpha

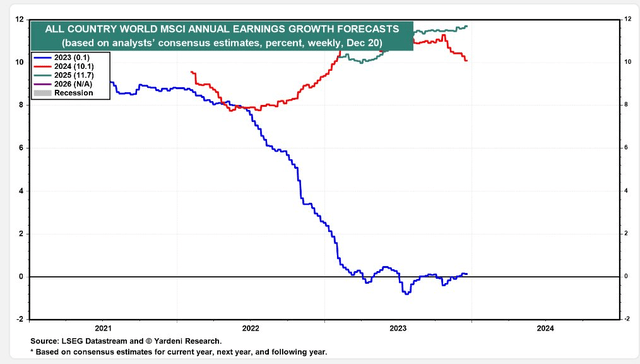

ACWI: EPS growth of 0% in 2023, +10% in 2024 (expected)

Jardeni

Seasonally, global stock markets tend to experience difficulties from mid-January to mid-March. stock clock. Recall that historically there has been some volatility in the first 10 weeks or so of the year (2009, 2020, 2022, 2023), with a selling peak occurring in mid-March. Will that happen in 2024? This is always a difficult thing to figure out, but after a steep uptick over the past two months, it may require some short-term digestion, especially as we enter an election year.

ACWI: Weak start-of-year positivity rate.

stock clock

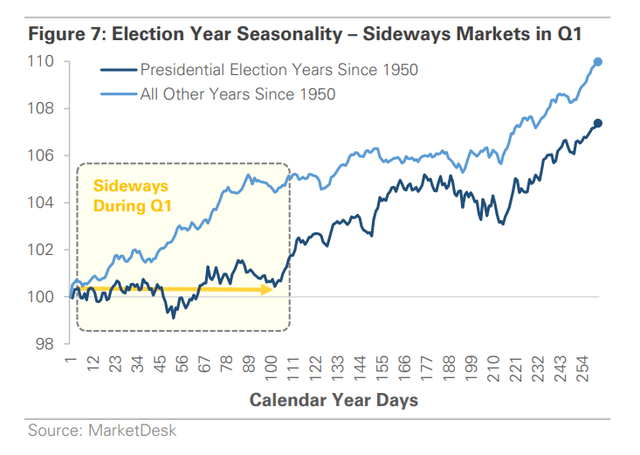

MarketDesk took the seasonal theme one step further, noting last week that volatility is common in the first few weeks of an election cycle. In fact, the first quarter was a rough patch for the S&P 500 bull market, which could undoubtedly have an impact on global stock markets and the ACWI ETF as well. This is just one trend to keep an eye on in a politically charged macro environment.

Is the first quarter dangerous? A rocky start to the election year.

Market Desk

technical take

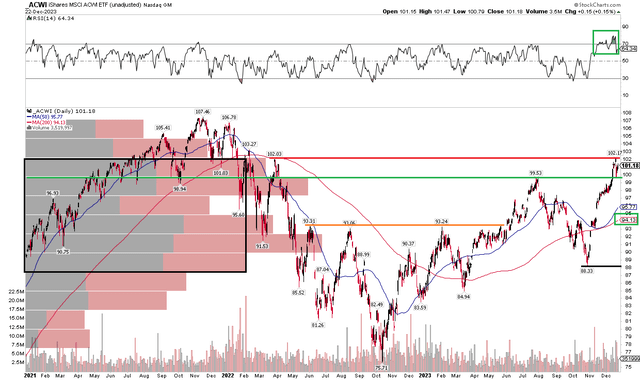

again summer, I noted that ACWI has major resistance at $102 and support at $93. In the chart below, the ETF actually stopped at $102 last week, but a new pivot area appears at $99.50. This was the highest reached last July and where the stock found short-term support a few sessions ago. The fund shed gains from its October lows, falling well below its 200-day moving average to $88.33. Nonetheless, the long-term trend indicator still maintains a solid upward trend, suggesting that the bullish trend is under control. Moreover, ACWI is addressing overbought conditions, as evidenced by the RSI momentum oscillator at the top of the graph. (The caveat is that we are in year-end distribution time, so the chart may look a little wonky due to major dividend payments.) ).

Nonetheless, we argue that there should be clear buying pressure on the downside as there is currently a lot of volume at each price compared to last week’s close of $101.18. Watch for a price gap near $94 (joined by a rise in the 50-day moving average). This could be a good entry point if we see typical first quarter volatility. Of course, $93 also remains a key support point. In terms of upside targets, we can expect moving price targets measured from the bottom formation from late last year to early 2023. $110 is a height extension of the $17 range ($76 to $93). We also identified the same target based on the decline and breakout of $99.53-$88.33.

Overall, the charts are generally constructive.

ACWI: Resistance $102, Support $93. Targeting $110 upside, eyeing a $94 downside gap.

stockcharts.com

conclusion

We reiterate our Hold rating on ACWI. I think today’s valuation is fair and the price action is encouraging. Nonetheless, we often see early-of-the-year volatility during election periods that can provide bulls with buying opportunities at better prices.