Adobe Q1: AI is an ally, not an enemy – Buy Weakness (Rank Upgrade) (ADBE)

Justin Sullivan

Adobe (NASDAQ:ADBE) When the company announced its Q1 FY24 results on March 15, the stock fell more than 13%.Day. I discussed my bullish view on Adobe in an article published in December 2023. Growth and price increases due to AI. Despite the second quarter outlook being lower than market expectations, I am quite optimistic about their AI growth potential. Considering the price decline, we upgrade Adobe stock to ‘Strong Buy’ with a fair value of $600 per share.

Strong Q1 growth and disappointing Q2 net ARR guidance

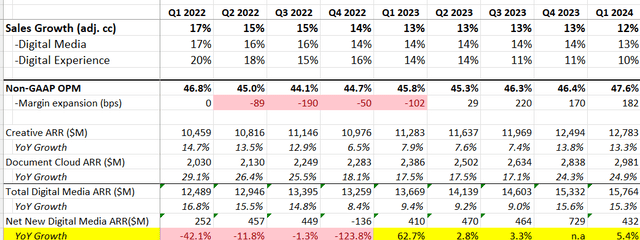

As summarized in the table below, we achieved revenue growth of 12% on a constant currency basis in Q1 FY24, with margins up 182 bps year-over-year. Annual recurring revenue (ARR) is a key leading indicator for Adobe, with Creative ARR up 13.3% year-over-year and Document Cloud ARR up 24.9%. Very solid results in the first quarter of course!

Adobe Quarterly Revenue

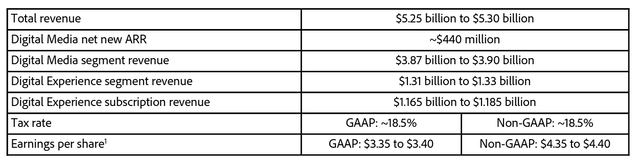

As described in the Q2 guidance table below, Adobe projects revenue growth of approximately 9% and digital media net new ARR of $440 million in Q2 FY24. The market was quite disappointed with the net new ARR guidance, which indicated a 6.4% year-over-year decline.

Adobe Q1 FY24 Earnings Release

The main reason for this weak ARR growth is the normalization of price increases.

Adobe began increasing product prices in FY22 and some pricing actions were rolled out in FY23. These price increases have contributed to further growth of the topline over the past two years. As discussed in a previous article, Adobe increased the prices of Creative Cloud subscriptions in FY23. Without further price adjustments, Adobe is expected to normalize price increases in FY24, which will create some growth headwinds due to higher comparables. Their weak ARR guidance is more likely to be a mathematical issue rather than due to any fundamental issues.

AI monetization is in its infancy

As mentioned in a previous article, Adobe has been investing heavily in AI-related projects. Adobe has integrated Firefly into both Creative Cloud and Adobe Express, and Firefly has been used to create 6.5 billion pieces of media, as revealed in an earnings call. Additionally, Adobe said the first quarter saw the highest adoption of Photoshop-based Firefly since its launch in May 2023. We are very impressed by the strong adoption of Firefly, a powerful tool that leverages AI to generate photos. Adobe plans to expand Firefly across all of its major products over time, and its high adoption rate lays the foundation for future monetization.

Adobe also launched AI Assistant in Acrobat to help users simplify tasks like searching and sharing documents. Management is confident that Adobe has tremendous revenue opportunities through its core Acrobat user base.

All these AI-related projects are still in their early stages and we do not expect these features/products to bring any significant growth to the company at this time. However, we acknowledge that these AI-based features will make it easier for users to create digital content. Adobe should be able to monetize these subscription-based products in the future, as they can add value to people looking to create digital content.

Is Sora a big threat?

Sora, OpenAI’s text-to-video model, has been receiving a lot of attention recently. Advances in AI technology have made digital content creation much easier than before. There are concerns that Sora could potentially disrupt Adobe’s Creative Cloud business. Is that a real threat?

Sora is still in closed beta, so it’s too early to evaluate its features. But basically, it allows users to generate videos based on inputs such as scenery, motion, and subjects.

Sora is not the first to apply AI to video content. Runway was founded in 2018 and focuses on AI models for video and image creation. Their video editing tools have been used in some movies such as “Everything Everywhere All at Once”. Runway has also launched AI tools for general users that provide image-to-video and text-to-video models.

We believe the overall threat to Adobe’s Creative Cloud business is fairly limited.

Adobe has been investing heavily in AI technology, leveraging notable competitive advantages such as data and large digital content repositories. These assets can potentially be leveraged for AI machine learning. On the earnings call, Adobe executives revealed that the company is working with OpenAI on Sora, and that both Adobe and OpenAI are developing their own models.

Even if in the future users will be able to create content from text or simple input, editing these videos will still require Adobe’s creative tools. In my opinion, AI-based video tools should be viewed as complementary to Adobe’s Creative Cloud solutions.

$25 billion worth of stock buybacks and outlook

Adobe announced a new stock buyback plan worth $25 billion, equivalent to about 11% of its total market capitalization. Assuming they complete share buybacks over the next four years, my calculations suggest that the total number of shares outstanding could decline by 3% per year. Quite an impressive capital allocation!

Another takeaway from Q1 FY24 is strong FCF growth. Excluding Figma’s $1 billion divestiture fee, operating cash flow increased 28% year-over-year. Management said strong deferred revenue and unbilled balances contributed to strong cash flow growth in the quarter.

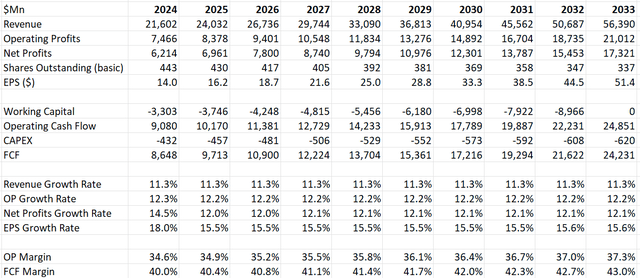

We expect to achieve 10% organic revenue growth in FY24. This is a slowdown from the 13% growth achieved in FY23. This deceleration reflects the benefit of price increases in FY23 and comparable headwinds in FY24. Adobe plans to enhance Express Mobile and AI Assistant in the second half of FY24, and expects these AI-related features to contribute to ARR growth starting in the second half of FY24. We do not assume any significant changes in the macro environment or corporate digital marketing spending in FY24. So, barring a 3% price increase in FY23, Adobe should be able to achieve 10% organic revenue growth without any contribution from AI capabilities.

Assessment updates

As previously discussed, Adobe expects to achieve 10% organic revenue growth in FY24. Assuming Adobe allocates 5% of group revenue to acquisitions, tuck-in deals could contribute 1.3% to revenue growth.

Adobe plans to repurchase $25 billion worth of stock over the next few years, so the number of shares outstanding could shrink by 3% per year, according to my calculations.

I expect their operating expenses to increase 10.7% year over year, resulting in margin expansion of 30 bps.

My estimates put Adobe’s total asset value at $266 billion after discounting all free cash flow. Therefore, the fair value in my model is estimated to be $600 per share. The stock currently trades at just 22x FY25 FCF. In my opinion, that’s a fairly cheap multiple for a double-digit growth company. Current stock prices appear to reflect many concerns about future AI disruption.

Adobe DCF – Author’s calculations

another pair of boots

Figma spin-off fee: Adobe paid $1 billion in spin-off fee after abandoning acquisition plans. I always thought it wasn’t a good idea for Adobe to pay a hefty price to acquire Figma, and it was lucky (or unlucky for Adobe) that regulators didn’t approve the deal.

Stock Options: Adobe spent 8.9% of total revenue on SBCs in FY23, up from 8.2% in FY22. My assumed margins in the DCF model require SBC as a percentage of revenue to decline to 6% by FY33. If Adobe continues to pay high SBC payments in the future, the fair value of my DCF model will be overstated.

conclusion

Adobe’s AI technology is still in its infancy, and I think the company has the potential to monetize its current AI investments in the near future. I continue to view Adobe as a high-quality growth company and upgrade Adobe to a ‘Strong Buy’ with a fair value of $600 per share.